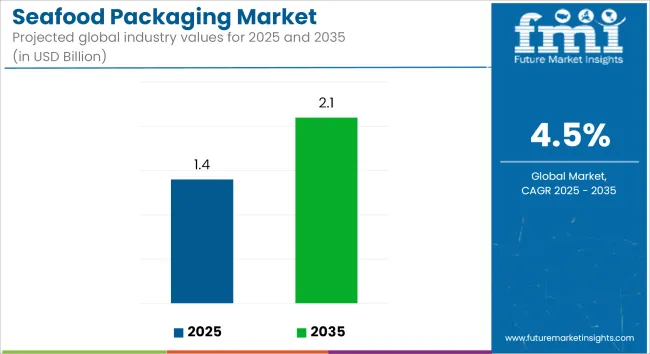

The sea food packaging market is projected to grow from USD 1.4 billion in 2025 to USD 2.1 billion by 2035, registering a CAGR of 4.5% during the forecast period. Sales in 2024 reached USD 1.3 billion, indicating a steady demand trajectory.

| Attributes | Description |

|---|---|

| Estimated Seafood Packaging Market Size (2025E) | USD 1.4 billion |

| Projected Seafood Packaging Market Value (2035F) | USD 2.1 billion |

| Value-based CAGR (2025 to 2035) | 4.5% |

This growth has been attributed to the increasing demand for fresh and frozen seafood products, driven by rising health consciousness and the expansion of global aquaculture. The need for packaging solutions that ensure product safety, extend shelf life, and meet sustainability goals has further propelled the adoption of innovative seafood packaging.

Additionally, advancements in packaging technologies, such as vacuum sealing and modified atmosphere packaging, have enhanced product appeal and safety, aligning with the evolving needs of manufacturers and consumers alike.

DS Smith DryPack Solution Benefits Seafood Industry. We are helping seafood processors reduce costs and CO2 emissions through our DryPack seafood box. “DS Smith is changing how the seafood industry delivers seafood, salmon and other fish from catch to customers with DryPack, a proven, 100% recyclable, fiber-based box that meets uncompromising standards and stands up to the rigor of processing and transportation,” said Cheryl Holliday, Director, Marketing for DS Smith, North America.

We are now manufacturing DryPack boxes at its USA specialty packaging plants using its patented and proven Greencoat® technology, a food-safe, moisture-resistant, recyclable coated box solution that has USDA, CFIA, FDA and FBA certifications.

The seafood packaging sales has been significantly influenced by the increasing demand for sustainable and environmentally friendly packaging solutions. Manufacturers have been transitioning towards recyclable and biodegradable materials to align with environmental sustainability goals and meet consumer preferences for eco-conscious products.

Innovations in material science have led to the development of packaging that not only provides superior protection but also minimizes environmental impact. Additionally, advancements in manufacturing technologies have enabled the production of customizable and efficient packaging, catering to a wide range of applications across different seafood products.

Seafood Packaging demand is poised for continued growth, driven by the ongoing expansion of various seafood industries and the increasing emphasis on sustainable packaging solutions. The market's trajectory suggests a steady rise in demand for innovative, eco-friendly packaging that caters to both consumer preferences and regulatory requirements.

Companies investing in research and development to create durable, cost-effective, and environmentally friendly packaging are expected to gain a competitive edge. The integration of advanced materials and ergonomic designs will likely play a crucial role in shaping the future of the Seafood Packaging Market.

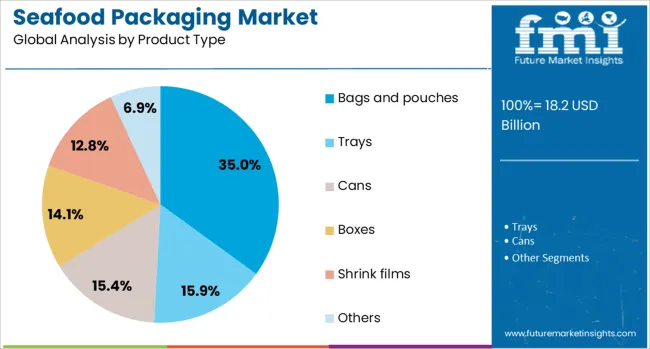

The market is segmented based on product type, seafood type, material, packaging technology, and region. By product type, the market includes films, pouches, bags, trays, and wraps. In terms of seafood type, the market is categorized into fish, molluscs, crustaceans, and others. By material, the market comprises plastic, paper, metal, glass, and others.

Based on packaging technology, the market is segmented into modified atmosphere, vacuum skin, vacuum thermoformed, and other technologies. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

Pouches have been projected to account for 47% of the seafood packaging market in 2025, favored for their lightweight structure, efficient barrier properties, and cost-effective production. These flexible formats have been adopted widely across fresh, frozen, and ready-to-cook seafood product lines.

Modified atmosphere and vacuum-sealed pouch technologies have been utilized to extend shelf life and minimize spoilage. High oxygen and moisture barrier films have been applied to ensure product safety during transport and storage.

Stand-up, gusseted, and resalable pouch styles have been implemented by both premium and bulk seafood brands. Clear windows and full-color flexographic printing have been employed for visual branding and transparency in packaging. Microwave- and boil-ready pouches have been introduced to enhance consumer convenience and cater to ready-meal preferences.

Sustainable pouch options made from recyclable or compostable laminates have been promoted as alternatives to traditional plastic films. Multi-layer structures with reduced plastic content have been designed to meet eco-label requirements and corporate sustainability targets.

Seafood exporters have utilized pouches to meet space-saving goals and reduce shipping costs. Pouches have also enabled localization of labeling and QR tracking for compliance across international markets.

Automation-compatible pouch designs have supported high-speed filling lines, reducing labor and boosting packaging throughput in processing plants. Brand-specific pouch shapes and textures have been developed to enhance differentiation on refrigerated retail shelves. Tamper-evident seals and date-labeling systems have been incorporated for regulatory and safety assurance.

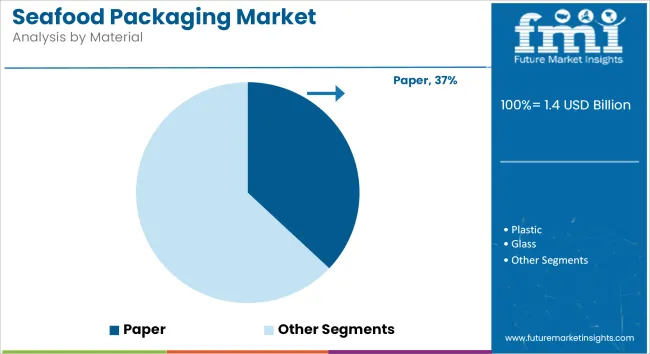

Paper-based packaging has been estimated to hold 37.5% of the seafood packaging market share in 2025, supported by the growing demand for sustainable, recyclable, and plastic-free alternatives. Paper has been selected especially for secondary packaging and dry seafood applications where moisture barriers are less critical.

Coated kraft paper and laminated paperboard variants have been used to improve strength and shelf appeal. Certified paper sources like FSC and PEFC have been prioritized to meet regulatory compliance and buyer preferences.

Food-grade inks and coatings have been applied to ensure safety and clarity in labelling for wrapped and boxed seafood. Seafood meal kits, takeaway containers, and promotional multipacks have frequently employed paper for its tactile, natural presentation.

Custom embossing, digital printing, and branded sleeves have been enabled by paper's superior print compatibility. Compostable paper trays and boxes have been promoted in retail seafood counters and specialty stores.

Insulated paper wraps combined with starch-based films have been used for fresh or chilled fillets, enabling partial barrier performance without synthetic layers. Frozen seafood suppliers have begun trialing hybrid paper-polymer formats to achieve both performance and sustainability goals. Rigid paperboard containers have been preferred for institutional catering and bulk orders. Single-use packaging bans and consumer preferences have influenced a rapid shift from plastic toward fiber-based options.

Retailers and processors have aligned paper packaging with corporate ESG targets, promoting biodegradable and renewable formats across seafood SKUs. Lifecycle assessments and carbon footprint tracking have validated the environmental benefits of switching to paper-based formats. Automation solutions have been adapted to handle paperboard trays and sleeves without compromising speed or integrity.

Growing Demand for Seafood

As more people focus on their health, the demand for seafood is increasing. Seafood is full of protein and omega-3 fatty acids, which makes it a popular choice for many. This growing interest in seafood creates a need for packaging that keeps it fresh and maintains its quality.

Innovations in Packaging Technology

New materials and methods such as biodegradable packaging and vacuum sealing, help keep seafood fresh for a longer time. These improvements not only make the products better but also cater to the growing demand for packaging benefiting the environment.

Growth of E-commerce

The rise in online shopping for groceries has had a big impact on the seafood packaging market. As more people buy seafood online, packaging must make sure the products stay fresh during delivery. Because of this change, more investment is going into creating packaging that can handle the challenges of transport while keeping the seafood in good condition.

Environmental Concerns

One of the major challenges faced by the seafood packaging market is the environmental impact of packaging materials. Many traditional packaging options, particularly plastics, contribute to pollution and waste. As consumers become more eco-conscious, there is pressure on companies to adopt sustainable practices, which can be costly and complex.

Regulatory Challenges

The seafood packaging industry has to follow many rules about food safety and packaging materials. Following these rules can be tough for companies, especially smaller ones. Tighter rules can also lead to higher costs and make operations more complicated, which can slow down market growth.

Awareness about environmental issues is increasing and consumers are choosing products that are eco-friendly. Such packaging is made from recyclable, biodegradable, or compostable materials.

Consumers are also looking for more transparency. They want to know the source of their seafood and the packaging stages involved. In fact, the population prefers brands that share clear information about where the seafood is sourced and what materials are used in packaging.

Convenience is another key factor. With a busy lifestyle, many consumers want ready-to-eat or easy-to-prepare seafood. Packaging that is easy to open, resealable, or in single-serving portions is popular. Overall, consumers are focusing more on sustainability, transparency, and convenience, pushing brands to adapt and improve.

Sustainable packaging is becoming more important in the seafood market. Consumers are more aware of environmental issues and prefer packaging made from recyclable or biodegradable materials. Due to this, companies are creating eco-friendly solutions that help reduce waste and pollution. This change not only helps protect the environment but also attracts customers focusing on sustainability. As a result, many businesses are investing in new materials that lower their environmental footprint.

Another significant trend is the rise of smart packaging. This technology helps monitor the freshness and quality of seafood products, providing valuable information to consumers. Smart packaging includes features such as temperature indicators or freshness sensors, ensuring that customers receive safe and high-quality products.

Additionally, customization is gaining traction, with brands offering personalized packaging solutions. This approach enhances the consumer experience and builds brand loyalty by making products feel unique and tailored to individual preferences. Together, these trends reflect a market that is evolving to meet the demands of modern consumers while focusing on quality and sustainability.

| Countries | CAGR |

|---|---|

| USA | 4.2% |

| China | 5.1% |

| India | 5.3% |

| UK | 3.5% |

| Germany | 4.8% |

In the USA, the seafood packaging market is expected to grow at a CAGR of 4.2%. This growth is driven by more people becoming aware of healthy eating and the rising demand for fresh and frozen seafood. The USA government has policies to support sustainable fishing, encouraging companies to invest in eco-friendly packaging.

Also, with more people shopping for groceries online, seafood is becoming easier to access, which is boosting sales. As consumers look for packaging that is convenient and safe, companies are expected to innovate and offer more options, helping the market grow.

China is expected to grow at a CAGR of 5.1% in the seafood packaging market. The country has a large population with a growing middle class that is increasingly interested in seafood as a healthy food choice. The Government of China promotes food safety regulations, demanding better packaging to ensure quality and freshness.

This focus on safety is pushing companies to adopt advanced packaging technologies. There is a rise in e-commerce and delivery services, because of which, the demand for packaged seafood is increasing. Consumers are becoming more conscious about their health and are buying high-quality seafood. This will further help in market growth

India's seafood packaging market is expected to grow at a CAGR of 5.3% over the forecast period. The country has a long history of eating seafood, and as incomes rise, more people are choosing seafood for its health benefits. Government efforts to improve the aquaculture industry are also helping.

Policies that focus on better food processing and packaging are encouraging companies to invest in better packaging. As more people live in cities, there is also a growing demand for easy-to-prepare and ready-to-eat seafood. All these factors are helping the seafood packaging market in India grow.

In the UK, the seafood packaging market is expected to grow at a CAGR of 3.5% during the forecast period. The demand for sustainable and environmentally friendly packaging is rising as consumers become more aware of environmental issues. The UK government supports this trend through policies aimed at reducing plastic waste and promoting recycling.

This encourages companies to explore alternative packaging materials. Additionally, the popularity of seafood as a healthy meal option is increasing, especially among younger consumers. As more people seek convenient and sustainable seafood products, the market for seafood packaging in the UK is expected to expand.

Germany's seafood packaging market is expected to grow at a CAGR of 4.8%. This growth comes from people who like fresh and high-quality seafood, along with a strong focus on being environmentally friendly. The Government of Germany has put in place rules to reduce plastic waste and encourage the use of eco-friendly packaging.

These rules push companies to find new packaging materials that can be recycled or are biodegradable. More consumers are also choosing seafood as a healthy food option. With the rise of online grocery shopping, there is a greater need for safe and attractive packaging. Because of these factors, the seafood packaging market in Germany is likely to grow significantly in the coming years.

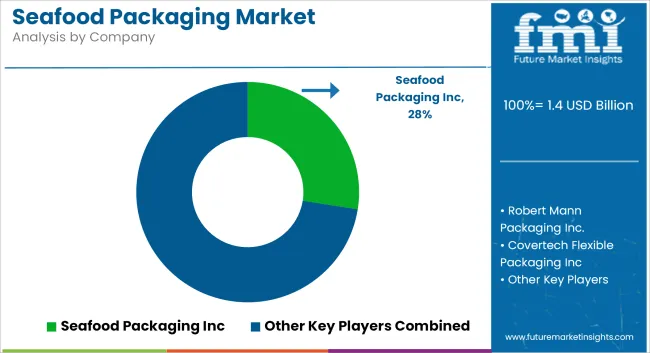

The seafood packaging industry is competitive, and many companies want to stand out. Major players include both large corporations and smaller, businesses. These companies focus on developing innovative packaging solutions that meet consumer needs for freshness, safety, and sustainability.

As more consumers demand eco-friendly options, companies are spending money on research and development to create packaging that is both effective and environmentally friendly. This competition encourages constant improvement and adaptation to changing market trends.

Along with new ideas, working together is becoming more common in the seafood packaging industry. Companies often team up with suppliers, tech companies, and even retailers to improve their products. These partnerships can lead to new packaging methods and materials that keep seafood fresh longer and reduce waste. Branding is also very important.

Companies are creating strong brand identities with special packaging designs that catch the eye of consumers. Overall, the market is competitive, with businesses focusing on being sustainable, coming up with new ideas, and working together to meet the needs of a growing market.

In the seafood packaging market, companies are using eco-friendly materials to meet the growing demand for sustainability. Many are switching to biodegradable and recyclable packaging, such as plant-based plastics or compostable options. The change is good for the environment and matches consumer expectations. At the same time, new packaging technologies like vacuum sealing and modified atmosphere packaging (MAP) are being used to keep seafood fresh longer.

These innovations help maintain quality and reduce waste, which is significant for the development of seafood industry.

To stay competitive, companies are also working more closely with seafood producers and distributors. By teaming up, they create packaging that fits the needs of different seafood products. Additionally, packaging companies are expanding into new markets, such as Asia and Africa, where seafood is becoming more popular. These strategies help companies grow and reach new customers around the world.

By product type, the market is sub-divided into containers, boxes, pouches, bags, cans, bottles, trays, and others

By application, the market is sub-divided into frozen seafood, fresh seafood, dried seafood, and others

By material, the market is sub-divided into plastic, glass, paper, metal, and others

By region, the market is sub-divided into North America, Latin America, Western Europe, South Asia and Pacific, East Asia, and Middle East and Africa

The market was valued at USD 1.4 billion in 2025.

The market is predicted to reach a size of USD 2.1 billion by 2035.

Some of the key companies manufacturing seafood packaging include Seafood Packaging Inc, Robert Mann Packaging Inc., Covertech Flexible Packaging Inc, International Packaging, and others.

India is likely to be a prominent hub for seafood packaging manufacturers.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Seafood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Seafood Packaging Market Share & Provider Insights

Meat, Poultry, and Seafood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Meat, Poultry, and Seafood Packaging Manufacturers

Seafood Farming Chillers Market Forecast and Outlook 2025 to 2035

Seafood Takeout Market Size and Share Forecast Outlook 2025 to 2035

Seafood Flavors Market Growth - Innovations & Industry Demand 2025 to 2035

Seafood Market Analysis - Size, Share, and Forecast 2024 to 2034

Live Seafood Market Size and Share Forecast Outlook 2025 to 2035

Canned Seafood Market Size, Growth, and Forecast for 2025 to 2035

Frozen Seafood Market Analysis by Nature, Form, End Use, Distribution Channel and Other Products Type Through 2035

Functional Seafood Market Size and Share Forecast Outlook 2025 to 2035

Ready To Eat Seafood Snacks Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA