The global screw conveyor market is projected to grow at a CAGR of 4.8%, reaching a market size of USD 1626.4 million by 2035. The market’s growth is fueled by the increasing demand for efficient bulk material handling solutions in industries such as mining, agriculture, food processing, and chemicals. Screw conveyors are widely used for their versatility, cost-efficiency, and ability to transport materials across varying inclines and distances.

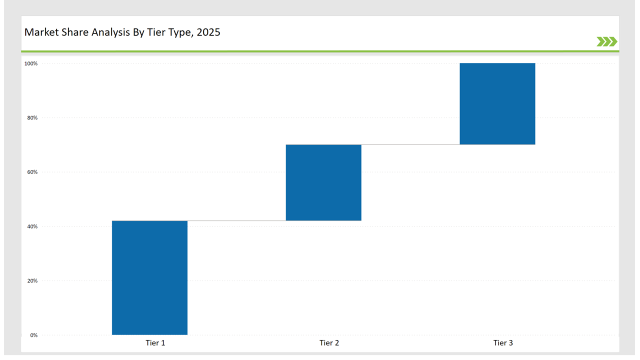

The market is moderately consolidated, with Tier 1 players (Screw Conveyor Corporation, Continental Conveyor Ltd., and Syntron Material Handling) collectively holding approximately 37% of the global market share. These companies dominate the market by offering highly durable and customizable solutions that cater to diverse industrial needs.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 1626.4 million |

| CAGR during the period 2025 to 2035 | 4.8% |

Among rotation capacities, 45-105 RPM screw conveyors lead with 40% of the market share, owing to their widespread adoption in food processing and agriculture. By end use, the mining and metallurgy sector accounts for 35% of the market share, reflecting the high demand for bulk material handling in large-scale operations.

As industries expand globally, the screw conveyor market is set to grow, with competition intensifying due to technological advancements and the rising demand for automated, energy-efficient solutions. Companies that prioritize innovation, sustainability, and customization to meet diverse industry needs will be well-positioned for success.

The shift toward automation and energy efficiency presents opportunities for manufacturers to deliver smarter, more cost-effective systems, driving growth. As demand for advanced material handling solutions increases, companies that can provide reliable, flexible, and environmentally-friendly products will continue to lead in this evolving and competitive market.

Explore FMI!

Book a free demo

| Category | Industry Share (%) |

|---|---|

| Top 3 Players (Screw Conveyor Corporation, Continental Conveyor Ltd., Syntron Material Handling) | 27% |

| Rest of Top 5 (Wamgroup Spa, DEMECH India, SPIRAC Engineering Pty Ltd, KWS Manufacturing Company Ltd, Martin Sprocket & Gear Inc) | 25% |

| Rest of the Market | 48% |

The Top 3 players (Screw Conveyor Corporation, Continental Conveyor Ltd., Syntron Material Handling) lead the market by offering advanced and durable screw conveyor systems for heavy-duty applications. Tier 2 players (WAMGROUP, Martin Sprocket & Gear) target niche markets and provide cost-effective solutions for small to medium-sized operations. Regional players address localized needs, focusing on affordability and tailored designs for specific applications.

The market is fragmented, with global players influencing innovation and product development, while regional players focus on addressing cost-sensitive demands.

The conveyor market is divided into three key rotation capacity segments. The 45-105 RPM range, holding a 40% market share, dominates due to its balance of efficiency and versatility, particularly in agriculture and food processing for handling moderately dense materials. Screw Conveyor Corporation leads this segment with customizable solutions. The 105-165 RPM segment caters to industries requiring rapid material transport, such as pharmaceuticals and chemicals, with Syntron Material Handling specializing in high-speed conveyor systems for precise material handling.

Finally, conveyors operating at less than 45 RPM are used for low-volume, delicate material transport in industries like food and beverage. WAMGROUP offers affordable, lightweight solutions for this niche market. Each segment is tailored to specific industrial needs, ensuring the right conveyor system for various applications.

The mining and metallurgy sector holds the largest market share at 35%, driven by the demand for efficient bulk material transport in ore processing and mineral handling. Continental Conveyor Ltd. and Screw Conveyor Corporation lead this segment with heavy-duty systems suited for harsh environments. In agriculture, screw conveyors are widely used for transporting grains, seeds, and fertilizers. WAMGROUP specializes in lightweight, customizable solutions tailored for small- to mid-sized farming operations.

The food and beverage industry also relies heavily on screw conveyors for hygienic, precise material handling. With the growing demand for food-grade systems, Syntron Material Handling provides conveyors made from food-safe materials, designed for easy cleaning and efficiency in food production. These tailored solutions across industries ensure effective and specialized material handling for diverse needs.

Screw Conveyor Corporation

Screw Conveyor Corporation has introduced advanced, heavy-duty screw conveyors specifically designed for mining and metallurgy applications. These robust systems are built to handle the challenging conditions of ore processing and mineral handling, ensuring reliable and efficient material transport. Additionally, the company has expanded its portfolio to include modular designs, offering greater flexibility for various industrial needs.

These modular systems allow for easy customization and adaptation to different environments, enhancing overall performance and scalability. With these innovations, Screw Conveyor Corporation continues to provide solutions that meet the demanding requirements of the mining and metallurgy sectors.

Continental Conveyor Ltd.

Continental has focused on developing high-capacity conveyors specifically tailored for mining and heavy industrial applications. These conveyors are designed to handle large volumes of bulk materials efficiently, ensuring reliable performance in demanding environments. In response to the increasing global demand, the company has strengthened its distribution network in key regions such as North America and Asia-Pacific.

This expansion enables Continental to better serve its customers, offering timely delivery and support for its advanced conveyor systems. With this strategic move, Continental is well-positioned to meet the growing needs of the mining and industrial sectors worldwide.

Syntron Material Handling

Syntron has launched lightweight, hygienic screw conveyors designed specifically for the food and beverage industry. These conveyors meet the industry's strict hygiene standards while offering efficient, precise material handling. In addition to their hygienic design, Syntron has emphasized product innovation by integrating automation and IoT capabilities, enabling real-time monitoring of the conveyor systems.

This technology allows operators to track performance, detect issues early, and optimize processes for maximum efficiency. By combining advanced design with cutting-edge automation, Syntron provides solutions that improve productivity and ensure the highest levels of safety and quality in food production.

WAMGROUP

WAMGROUP has developed lightweight, cost-effective screw conveyors specifically designed for agriculture and small industrial setups. These conveyors offer efficient material handling while being affordable and easy to implement for smaller operations. To further strengthen its market position, WAMGROUP has expanded its presence in Europe and the Middle East through strategic partnerships.

This expansion enables the company to cater to a broader customer base, providing tailored solutions and enhancing support in these key regions. With a focus on innovation and cost-efficiency, WAMGROUP continues to meet the unique needs of agriculture and small-scale industrial sectors globally.

| By Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Screw Conveyor Corporation, Syntron Material Handling, SPIRAC Engineering Pty Ltd |

| Tier 2 | WAMGROUP, KWS Manufacturing Company Ltd |

| Tier 3 | Regional players, start-ups |

Key performance indicators in the screw conveyor market include:

| Company | Initiative |

|---|---|

| Screw Conveyor Corporation | Introduced modular heavy-duty conveyors for mining applications, focusing on flexibility and durability. |

| Continental Conveyor Ltd. | Expanded high-capacity systems for heavy industrial use and strengthened its Asia-Pacific distribution. |

| Syntron Material Handling | Launched IoT-enabled hygienic conveyors targeting the food and beverage industry. |

| WAMGROUP | Focused on cost-effective and lightweight solutions for agriculture and small industrial setups. |

| Martin Sprocket & Gear | Invested in chemical-resistant conveyors for chemical and pharmaceutical industries. |

The screw conveyor market is poised for steady growth as industries increasingly prioritize efficient and durable material handling solutions. The 45-105 RPM systems and mining applications, which currently dominate the market, will remain key focal points for manufacturers. Companies should focus on innovating in these segments, ensuring robust performance and versatility for industries like agriculture, food processing, and mining.

Additionally, investing in smart technologies such as automation and IoT capabilities will be crucial for enhancing product performance and meeting the growing demand for real-time monitoring. Expanding into emerging markets and forming partnerships with regional distributors will further drive sustained growth.

The market will continue to evolve with advancements in automation, material science, and modular designs, offering new opportunities for customization and efficiency. This evolution presents a dynamic landscape for manufacturers to adapt and thrive in an increasingly competitive market.

The largest market share is held by key players such as Screw Conveyor Corporation, Syntron Material Handling, SPIRAC Engineering Pty Ltd, collectively controlling a significant portion of the global market.

Regional companies, like SPIRAC Engineering Pty Ltd, KWS Manufacturing Company Ltd, Martin Sprocket & Gear Inc, Plåt & Spiralteknik I Torsås Ab, hold a notable portion of the market, catering to specific regions and applications.

Startups and emerging players, focusing on innovations in sustainability and niche applications, hold a smaller yet growing share of the market, contributing to around 10-15%.

Private labels, primarily in niche markets or through distributors, account for a smaller portion, generally under 5% of the market.

The market concentration in 2025 is expected to be high for the top 5-6 global players controlling over 40% of the market, medium for the next tier of players, and low for smaller regional or specialized players.

Electrostatic Precipitator Market Growth - Trends & Forecast 2025 to 2035

EMC Shielding and Test Equipment Market Growth - Trends & Forecast 2025 to 2035

End Suction Pump Market Growth - Trends & Forecast 2025 to 2035

Electrostatic Coalescers Market Growth - Trends & Forecast 2025 to 2035

Electrical Enclosure Market Growth – Trends & Forecast 2025 to 2035

Dual Axis Solar Tracker Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.