The SCADA Alarm Management Market is estimated to be valued at USD 0.7 billion in 2025 and is projected to reach USD 2.1 billion by 2035, registering a compound annual growth rate (CAGR) of 12.1% over the forecast period.

| Metric | Value |

|---|---|

| SCADA Alarm Management Market Estimated Value in (2025 E) | USD 0.7 billion |

| SCADA Alarm Management Market Forecast Value in (2035 F) | USD 2.1 billion |

| Forecast CAGR (2025 to 2035) | 12.1% |

The SCADA alarm management market is experiencing consistent growth driven by the rising need for improved operational safety, regulatory compliance, and process efficiency across industrial sectors. Growing incidents of alarm flooding, operator fatigue, and increasing system complexities have highlighted the importance of advanced alarm management solutions.

Technological progress in automation, real time monitoring, and predictive analytics has further strengthened adoption. Organizations are investing in software tools that streamline alarm rationalization, improve situational awareness, and ensure timely decision making.

Moreover, strict regulatory frameworks across utilities, oil and gas, and manufacturing are reinforcing the need for structured alarm management systems. The outlook remains strong as industries increasingly prioritize safety, efficiency, and reduced downtime, positioning SCADA alarm management as a critical component of modern industrial automation strategies.

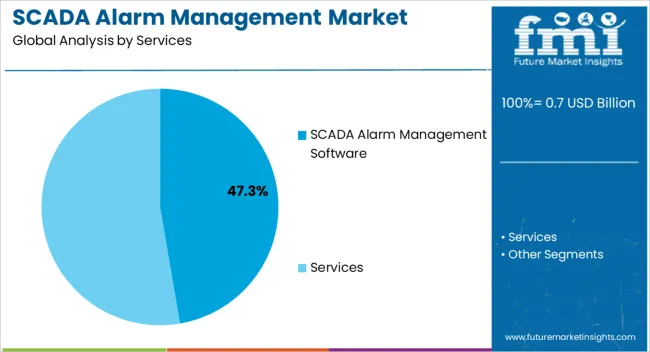

The SCADA alarm management software segment is projected to account for 47.30% of total market revenue by 2025, making it the leading services category. Growth in this segment is being propelled by the increasing demand for digital solutions that optimize alarm performance, eliminate nuisance alarms, and enhance operator effectiveness.

The ability of software platforms to integrate with existing SCADA systems while offering customizable reporting and predictive insights has supported their widespread adoption. Additionally, the rising focus on minimizing downtime and ensuring regulatory compliance has further boosted reliance on advanced software solutions.

With continuous innovation in data visualization and analytics, the software segment continues to lead the services category, reflecting its pivotal role in industrial alarm management strategies.

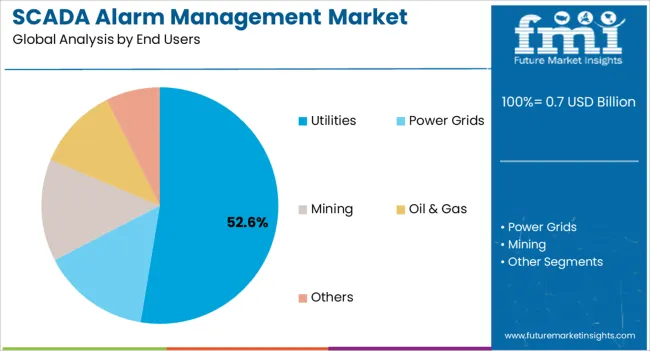

The utilities segment is expected to represent 52.60% of total revenue by 2025 within the end user category, positioning it as the dominant sector. This leadership is attributed to the critical role utilities play in public infrastructure and the necessity for uninterrupted service delivery.

The high volume of alarms in utility operations, combined with the need for compliance with stringent safety and reliability standards, has driven investment in advanced alarm management systems. SCADA alarm solutions have enabled utilities to achieve greater operational visibility, enhanced fault detection, and optimized resource allocation.

As demand for energy, water, and essential services continues to rise, utilities are expected to maintain their dominant share in the market, driven by their focus on reliability, safety, and regulatory adherence.

The modern pipelines and distribution systems have become more complex in nature. Today, the total length of pipelines amounts to 0.4 Million km in more than 120 countries. In 2020 alone, pipeline projects were completed for a total mileage of 7,830 km, which is about one-fifth of the earth’s circumference.

For operators, it has become a part of the daily work procedures to manage the alarm system quality in distribution plants, to ensure that the alarm system continues to be a useful resource for safe and efficient control room operation.

However, the major challenge with the alarm system is that when one thing goes wrong, lots of other things tend to go wrong, and the operator is get confused between all the alarms altering at the same time. There has to be a better way to manage and prioritize the alarms.

An effective SCADA alarm management system is critical to ensure that the process control rooms can safely and efficiently respond to activities in all operating conditions (normal, abnormal, and emergency).

With the increasing push for the adoption of the Industrial Internet of Things (IIoT) and Industry 4.0, intelligent alarm solution is giving plant operators an opportunity to gain efficiency and effectiveness with SCADA monitoring as well as enhance critical asset reliability for boilers, chillers, compressed air and other systems. The increasing need to effectively manage alarms in process plants is expected to drive the market growth.

Industrial organizations across every industry manage countless production processes and transactions every day. Integration of SCADA systems into oilfield help organizations to handle the complex processes required to operate in the new and existing oilfields. These control systems provide a stable and cost-effective solution to the needs of the oil and gas sector.

Accurate, real-time data is key to succeeding in the oil and gas industry. Management operators oversee operations, inspect equipment, gather enormous amounts of data, strive to minimize downtime and ensure that everything runs smoothly and seamlessly. Management operators make use of information analyzed by SCADA systems to calculate production values, generate trends for decision-making and project company profits. Performing these duties manually is a very critical and time-consuming task.

Thus, companies turn to SCADA to oversee operations, improve efficiency and minimize downtime. On top of that, companies also rely on the SCADA alarm management system for advanced warning and alerting mechanisms, helping management create deliberate and strategic actions to mitigate damage.

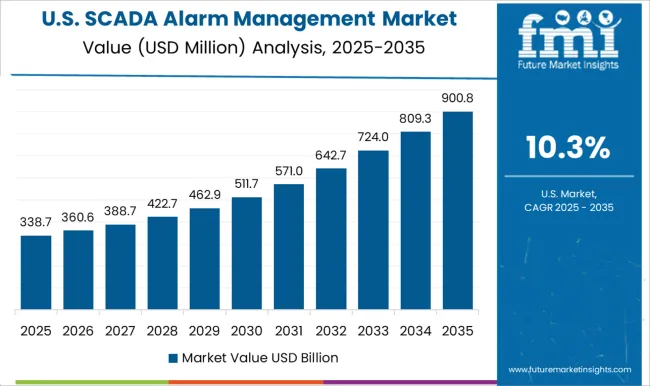

USA is expected to hold the largest share in the North America SCADA alarm management market. This is attributable to factors such as increased adoption of industrial automation systems across several industries, which is fueling the growth of SCADA alarm management solutions, in this region.

Several industrial and manufacturing organizations have deployed IoT enabled SCADA systems in their manufacturing plant to automate their industrial processes. The country has always been at the forefront in terms of technological advancements, and their adoption in the industrial sector is not an exception.

Moreover, USA has presence of multiple SCADA alarm management vendors, such as Schneider Electric, Emerson, Rockwell Automation, Siemens, Partita IVA, Honeywell, and Mitsubishi Electric. These companies are targeting higher revenue and business expansions due to high competition and demand prevailing across the region. Organizations in USA focus on innovations to keep pace with the latest advancements in the market.

China is among the major industrial areas in the world. The implementation of SCADA systems is vital as China looks to meet growing energy demand within huge geographical boundaries. The country is also set to be a huge market for smart grids, the development of which will impact on the implementation of SCADA systems in the future.

Moreover, enterprises in China are adopting the latest technologies to sustain in the global market competition. Government policies in China are also promoting the adoption of IoT solutions in manufacturing and industrial sectors. Along with this, several industrial organizations are also investing in these systems to meet the growing energy demand across the country.

Moreover, China is one of the world largest petrochemicals and petroleum production country and one of the largest markets for oil production, which creates higher demand for SCADA alarm management from oilfield companies in China.

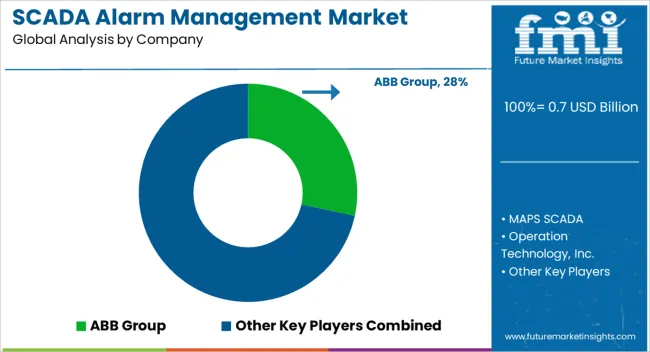

Some of the leading vendors offering SCADA alarm management products include

These vendors have adopted various key strategies, to increase their market shares locally as well as globally. The vendors are focusing on product innovation and strategic partnerships with the regional vendors to collaborate for offering advanced alarm management systems to effectively manage industrial control systems and plant operations.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global SCADA alarm management market is estimated to be valued at USD 0.7 billion in 2025.

The market size for the SCADA alarm management market is projected to reach USD 2.1 billion by 2035.

The SCADA alarm management market is expected to grow at a 12.1% CAGR between 2025 and 2035.

The key product types in SCADA alarm management market are SCADA alarm management software, services, _security consulting, _integration services and _support & maintenance.

In terms of end users, utilities segment to command 52.6% share in the SCADA alarm management market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Adoption Analysis of SCADA in Oil and Gas Industry Forecast and Outlook 2025 to 2035

Alarm Management System Market Analysis by Component, Industry and Region - Trends, Growth & Forecast 2025 to 2035

WiFi Alarm System Market Size and Share Forecast Outlook 2025 to 2035

Fire Alarm Systems Market by Solution by Application & Region Forecast till 2035

Smoke Alarm Market Trends- Growth & Industry Outlook 2025 to 2035

Burglar Alarm Systems Market Size and Share Forecast Outlook 2025 to 2035

Security Alarm Communicator Market Size and Share Forecast Outlook 2025 to 2035

The Clinical Alarm Management Market is segmented by component, deployment mode and end user from 2025 to 2035

Wind Speed Alarm Market

Plug-in Pump Alarm Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Smoke and Carbon Monoxide Alarm Market Size and Share Forecast Outlook 2025 to 2035

Vibration Fiber Optic Perimeter Alarm System Market Size and Share Forecast Outlook 2025 to 2035

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Risk Management Market Size and Share Forecast Outlook 2025 to 2035

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA