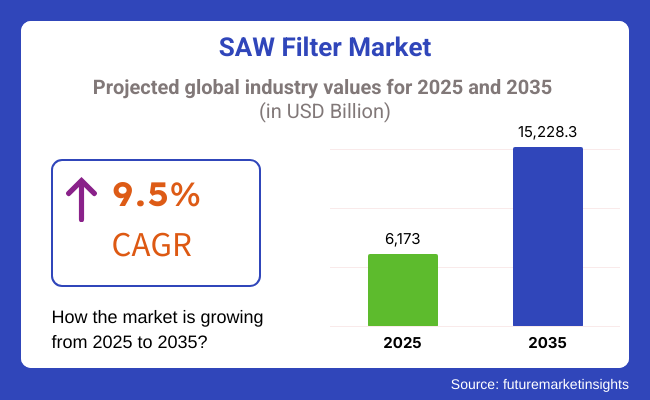

The global sales of SAW filter are estimated to be worth USD 6,173.0 million in 2025 and are anticipated to reach a value of USD 15,228.3 million by 2035. Sales are projected to rise at a CAGR of 9.5% over the forecast period between 2025 and 2035. The revenue generated by SAW Filter in 2024 was USD 5640.0 million. The market is anticipated to exhibit a Y-o-Y growth of 9.5% in 2025.

The Surface Acoustic Wave (SAW) Filter Market refers to the industry focused on the development, production, and sales of these essential components in radio frequency (RF) signal processing. They use acoustic wave propagation along a substrate surface to selectively filter certain frequencies, making them crucial for wireless communication systems like 4G, 5G, Wi-Fi, GPS, and IoT applications. With benefits such as compact size, high performance, and cost-effectiveness, they are widely used in consumer electronics, automotive, aerospace, and industrial applications.

Market growth is fueled by demand for advanced telecom infrastructure, the spread of connected devices, and military and aerospace application growth. Sustained R&D activity leading to constant evolution in technology, such as temperature-compensated and high-frequency variants, makes them increasingly valuable to the market.

The expansion of 5G, Wi-Fi 6/7, and IoT ecosystems is driving demand for RF filtering solutions in telecom, automotive, and smart devices. Vehicle-to-everything (V2X) and ADAS technologies further boost adoption in automobiles. Growing IoT applications in industrial automation and healthcare enhance market prospects. However, competition from Bulk Acoustic Wave (BAW) filters in high-frequency applications poses a challenge, particularly in 5G and satellite communications.

Explore FMI!

Book a free demo

The SAW (Surface Acoustic Wave) filter market is experiencing tremendous growth due to the increasing demand for high-frequency components in telecommunication, consumer electronics, automotive, and industrial applications.

Frequency range, miniaturization, and power efficiency are the focus areas of telecom and networking industries to provide hassle-free wireless communication in 5G infrastructure, IoT devices, and RF front-end modules.

Miniaturization and cost-effectiveness are the most critical issues for consumer electronics manufacturers, as they are essential technology for smartphones, tablets, and wearables. Automotive applications are more focused on hardness and reliability, especially in V2X communication and ADAS.

Industrial and military applications require customized, high-performance filters with enhanced robustness to function in harsh environments. Their market demand continues, pushing innovations of miniaturized, low-consumption, and high-performance filters, and these are becoming a key technology in wireless communication and modern electronic systems.

During the 2020 to 2024 period, the Surface Acoustic Wave (SAW) filter market grew steadily due to growing demand for high-frequency signal processing in smartphones, 5G networks, and IoT solutions. The deployment of 5G networks triggered demand for SAW filters to reduce signal interference and increase mobility and connectivity in wireless and mobile communication networks.

Smart household devices and smartwatches employ filters to provide improved signal quality and device performance. Although some limitations, such as the high cost of production and poor performance at a higher frequency, have been overcome, microfabrication and materials science advancements have enhanced SAW filter efficiency and miniaturization.

Between 2025 and 2035, the market development will be fueled by AI-optimized design optimization, upcoming 6G networks, and hybrid acoustic-electronic devices. Artificial intelligence-based simulation and material design will boost filters with a wider frequency range and reduce signal loss.

Commercialization of 6G networks and new wireless technologies will increase demand for high-frequency filters in satellite communications and wireless applications. Acoustic-electronic hybrid filters will increase signal processing capacity for automotive radar, defense, and medical devices. Green manufacturing processes and recyclable materials will address environmental standards and industrial regulations.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Greater government regulation on RF spectrum efficiency, particularly on 5G network deployment. Greater needs for military and aerospace applications. | Stringent policies of spectrum management require high-performance filters. Energy conservation and lead-free policies are specified in environmental regulations. |

| Temperature-compensated SAW (TC-SAW) filter development enhanced performance in high-frequency applications. Growing adoption in smartphones, automotive radar, and IoT devices. | Fourth-generation filters incorporate AI-based frequency tuning. Ultra-wideband (UWB) filters improve satellite communications and defense. Quantum computing and 6G integration redefine filtering technology. |

| SAW filters were the facilitators for 4G-to-5G migration, boosting signal processing. Increasing need for high-frequency filters in Wi-Fi 6E and mmWave technology. | Ultra-high-frequency filters experience demand driven by 6G deployments. AI networks and smart city networks present new opportunities. Increased use in satellite internet and high-bandwidth applications. |

| Greater use of SAW filters in vehicle-to-everything (V2X) communication and Advanced Driver Assistance Systems (ADAS). Increased adoption of electric vehicles (EVs) driving demand for SAW-based RF modules. | Complete autonomy and EV growth drive high-frequency SAW demand. LiDAR, radar, and next-generation automotive sensor integration have become the norm. Edge computing and real-time processing of data propel SAW innovations. |

| Enormous growth in wearables, smart home devices, and connected appliances. Filters designed for compact and energy-efficient IoT modules. | Ubiquitous connectivity generates more high-performance and miniature filters. Edge AI and cloud-based intelligent devices need more precise signal filtering. |

| Increased use in military communications, radar systems, and navigation devices. High-reliability filters are suitable for hostile conditions. | Hypersonic and space defense systems need highly sophisticated SAW filtering. Quantum radar and future surveillance systems need ultra-low-noise SAW devices. |

| Development of other piezoelectric materials to reduce environmental impact at an early stage. Low-energy and low-price manufacturing methods are increasingly in the limelight. | Recyclable and biodegradable SAW materials come into view. The AI-optimized design achieves maximum utilization of material, limiting the amount of waste produced in manufacturing. |

| Disruptions in the supply chain from semiconductor shortages had affected the supply of SAW filters. Stepped-up local production in high-volume markets to cushion risks. | AI-driven predictive analytics optimize supply chain resilience. Strategic partnerships and regional production hubs reduce dependence on raw material volatility. |

| 5G deployment, IoT penetration, and vehicle connectivity were the main drivers of growth. Emerging markets saw greater uptake in telecommunications. | 6G, AI-powered IoT, and intelligent infrastructure drive demand faster. Defense and high-frequency communication network growth define new market opportunities. |

The market of SAW (Surface Acoustic Wave) filter is exposed to many risk factors that potentially affect its expansion and assimilation. Among these, one of the most important is technology aging, with new filter alternatives like BAW (Bulk Acoustic Wave) filters bringing the possibility of disposing of the traditional SAW filters in their use for high-frequency applications.

Some other critical risk factors are the disruptions in the supply chain as SAW filters depend on some particular materials such as quartz and lithium niobate. Development of geopolitical tensions, shortages of semiconductors, or fluctuations in raw material prices could eventually lead to an increased production cost and delay deliveries, thus further impacting the expected profit-making and market stability.

Quality control and manufacturing complexity remain as the major ones. Acoustically connected to the reality of physical laws, SAW filters must be subject to rigorous design specifications. Even minute deviations in wave propagation could lead to poor performance. Therefore, mass production turns out not to be viable, which in itself ends up in higher prices as well as in product recalls.

The market economy is changing with the market competition getting fiercer, companies are focusing more on R&D to achieve better efficiency and lower costs for filter solutions. Staying behind on innovation, these companies are likely to fall behind either due to the arrival of new technologies or the existence of other companies better equipped to compete with them.

Besides, the legal issues surrounding the regulations on wireless communication standards and the allocation of frequencies may add to additional risks. The introduction of stricter rules may lead to the doubling of testing and certification costs which would then further slowdown market expansion.

Tier 1 companies are characterized by their significant global presence, extensive product portfolios, and substantial market shares. These industry leaders have established themselves through continuous innovation, robust supply chains, and strong customer relationships. They cater to a wide range of applications, including consumer electronics, automotive, telecommunications, and industrial sectors.

Their advanced research and development capabilities enable them to stay ahead in technological advancements, ensuring high-performance and reliable SAW filters that meet the evolving demands of modern electronic devices. Their extensive distribution networks and strategic partnerships further solidify their positions as market leaders.

Tier 2 companies are well-established manufacturers with specialized product offerings and strong regional influence. While they may not have the same global reach as Tier 1 companies, they play a crucial role in the industry by focusing on niche applications and catering to specific customer requirements.

These companies often excel in providing customized solutions, leveraging their expertise to address unique challenges in various industries. Their agility allows them to respond quickly to market changes and emerging trends, making them valuable partners for clients seeking tailored solutions. Their regional dominance and specialized knowledge contribute significantly to diversity and competitiveness.

Tier 3 companies are emerging manufacturers that focus on niche markets or specific applications within the industry. These companies often operate on a smaller scale but demonstrate significant growth potential due to their innovative approaches and ability to address underserved segments.

They may concentrate on developing cost-effective solutions, targeting local markets, or pioneering new technologies that cater to emerging applications. Their flexibility and willingness to explore unconventional strategies position them as potential disruptors in the market. As they continue to expand their capabilities and establish themselves, these companies contribute to the overall dynamism and innovation within the industry.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 8.6% |

| France | 7.9% |

| UK | 8.2% |

| China | 10.4% |

| India | 11.2% |

United States is a major contributor to the industry, which is gaining remarkable progress in wireless communication; for example, updating wireless communication systems to support multiple spectrum bands can be anticipated for the 5G systems, Internet of Things (IoT) functions, and inter-satellite communication. The 5G infrastructure is growing and leading to high-performance RF filters that major telecom providers want to help expand their new 5G services.

Market growth is also being driven by leading semiconductor manufacturers, defense contractors, and consumer electronics firms. The use of SAW filters and other products in aerospace, defense, and military sectors for secure communication networks and efficient communication systems greatly expands the market.

Government efforts to promote the domestic production of semiconductors also offer an extra tailwind to the industry. Furthermore, advanced smart devices demand robust RF filtering solutions, automotive connectivity solutions, and AI-driven applications, creating high demand, which in turn is expected to make the USA a leading contributor to the global industrial scenario.

Reliable RF communication is becoming an increasing focus as the demand for electric and autonomous vehicles rises. The USA industry is expected to expand at a 8.6% CAGR during the forecast period, according to FMI.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| More rollout of 5G infrastructure | There is an intense need for high-performance bulk wave-based filters owing to large investments of telecom companies in the 5G network. |

| Strong Aerospace and Defense Adoption | In military applications, surface acoustic wave (SAW) filters are critical parts in communications, radar, and navigation systems. |

The demand for SAW filters is high in countries like France, where RF technologies are developing, and there is a significant increase in consumer electronics production. They are critical for secure communication systems in the country's aerospace and defense sectors. Additionally, the continuous proliferation of 5G architecture systems and the rapid adoption of IoT in verticals like industrial automation and healthcare are aiding growth in the market.

The increasing emphasis on in-car connectivity, autonomous driving, and V2X communication is also accelerating their adoption in the automotive industry. France acts as the stronghold for the European industry, further backed by government-driven initiatives toward promoting semiconductor innovations and wireless communication development. The France industry will grow at a 7.9% CAGR during the forecast period, according to FMI.

Growth Factors in France

| Key Drivers | Details |

|---|---|

| Expansion of 5G Networks | Telecom providers upgrade their infrastructure, boosting SAW filter utilization. |

| Increased Demand for Consumer Electronics | Smartphones, tablets and introduction of wireless devices is expected to boost the market. |

The growing presence of global market players and exponentially increasing 5G implementation in the UK leads to market expansion in the UK Telecom companies in the country are expanding their network infrastructure, further generating demand for advanced filters. Market growth is also driven by the increasing adoption of IoT applications across smart homes, healthcare, and industrial automation.

Growing demand for wireless communication devices, mostly smartphones, tablets, and wearables, in the consumer electronics space, is contributing significantly to the high adoption of filters. Similarly, the homepage offers insight into the company's next-generation low-power voice recognition technology. The UK industry will grow at a 8.2% CAGR during the forecast period, according to FMI.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Huge Investment in 5G Infrastructure | Better technology employed by transport operators results in better connectivity. |

| Growing IoT Adoption | RF agility is needed for smart homes, industrial automation, and healthcare devices. |

With its strong manufacturing ecosystem, extensive semiconductor supply chain, and high domestic demand for consumer electronics, China dominates the market. The country's top position in 5G infrastructure spurs demand for filters in base stations, smartphones, and connected devices.

In addition, major international manufacturers have established factories in China so that high-quality components can be produced at cost-effective prices. The adoption of these filters is also being boosted by the rapid growth of the automotive market in China, especially that of electric and connected vehicles.

The increasing development of industrial automation and smart city projects further spurs market expansion. China is one of the fastest-growing markets for these filters in the world, with major investments in semiconductor self-sufficiency and advanced RF technologies. FMI anticipates China's industry to grow at a 10.4% CAGR during the study period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Leadership in 5G and Telecom | The launch of 5G services substantially increases the requirement for filters in base stations and smartphones. |

India is one of the fastest-growing SAW filter markets, supported by its growing telecom market, increase in the number of smartphones, and the adoption of Internet of Things (IoT) applications. The government is pushing for the deployment of 5G, and initiatives like the program "Make in India" encourage semiconductor and RF component manufacturing here. India's fast-growing consumer electronics market further drives the demand for filters for smartphones, wearables, and wireless devices.

The growth of the market is led by the automotive industry, particularly electric and connected cars. High-performance filters are required for ADAS, V2X communication, and infotainment systems. Despite these challenges, the semiconductor and electronics manufacturing sectors in India are gaining momentum as a preferred destination for making significant investments from foreign players, leading the country to become prominent in the global industry. The Indian industry is expected to expand at 11.2% CAGR during the forecast period, according to FMI.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| 5G and Digital Transformation Growth | Telecom is seeing increasing demand due to government initiatives driving telecom expansion. |

| The Demand for Smart Devices is Increasing | An increase in Smartphones, Wearables, & Other Connected Devices is Driving Demand for Advanced RF Filtering Solutions |

| Type | Share (2025) |

|---|---|

| RF SAW Filters | 52.3% |

RF-SAW filters accounted for 52.3% of the total market share in 2025, capturing a larger share of the whole industry since RF-SAW filters are generally utilized in different wireless communication systems like 4G, 5G, Wi-Fi, GPS, and Bluetooth applications. RF SAW filter is a key component of smartphones, telecom infrastructure, and IoT devices.

The industry giants like Murata, Qualcomm, and Broadcom never rest on their laurels and keep pushing the boundaries, especially in terms of Temperature-Compensated SAW (TC-SAW) technology, where they improve frequency stability and signal integrity for faster networks.

With the increasing adoption of BAW (Bulk Acoustic Wave) filters in high-frequency applications, at low-to-mid frequency bands below 3.5 GHz, Cost-effective and compact RF SAW filters still dominate the industry along with low insertion loss. In addition, their growing utility in IoT communication for automotive devices (V2X), medical devices, and industrial IoT applications is geared to catapult its market growth, thus cementing its 52.3% share in the global industry.

Frequency in between (IF) accounted for 47.7% of the market in 2025. SAW filters are essential for radar systems, satellite communication, and broadcasting because they enhance signal selectivity and lower interference.

The increasing use of IF SAW filters in aerospace and defense is due to the increased need for precise and safe communication. Companies like TDK Corporation and Kyocera are developing IF SAW technology that is capable of enabling upcoming satellite-based connectivity, avionics, and defense communication systems.

| Bandwidth | Share (2025) |

|---|---|

| 5MHz to 100MHz | 64.2% |

The highest market share of 64.2% in 2025 was in the 5 MHz to 100 MHz bandwidth range for 5G infrastructure, Wi-Fi 6/6E, and radar and satellite communication. As 5G (which, by some estimates, will have more than 4.8 billion connections globally by 2030) networks continue to be deployed, the market for high-frequency surface acoustic wave (SAW) filters in smartphones, base stations, and IoT devices is set to expand.

Product analysis, such as temperature-compensated SAW (TC-SAW), filters product portfolios and key manufacturers, and store analysis provides a comprehensive analysis of the market. In addition, the boom in autonomous vehicles and V2X communications also contributes to the growth of this bandwidth segment.

In 2025, the 2 kHz to 50 kHz bandwidth segment is anticipated to hold a market share of 35.8%, owing to its application in low-frequency devices, such as industrial sensors, medical devices, and precision audio processing. This segment is important for hearing aids, ultrasonic sensors, and military-grade communication systems that require signals with minimum interference.

SAW filters in industries, within this bandwidth window, are embedded into industrial ultrasonic flow meters to improve precision in industrial automation implementations. While this segment has low growth upon high-bandwidth filters, continuous demand will keep it important within the hospital, protection, and commercial automation sectors.

The SAW (Surface Acoustic Wave) Filter Market is expanding widely because of increasing demand for high-frequency, low-power RF components in 5G, IoT, and the automotive field. Temperature-compensated SAW (TC-SAW) and high-frequency SAW filters show increasing trends in market growth as industries crave potent signal processing and interference deflection.

Major players include Murata Manufacturing, Qorvo, Skyworks Solutions, TDK Corporation, and Taiyo Yuden, which continue to spend heavily on R&D and maintain global distribution networks with a diversified product portfolio. In addition, the increasing number of new entrants, such as startups and niche players, mostly from China and other Asian markets, has increased competition through low-cost solutions and regional market penetration strategies.

Market evolution is characterized by trends toward miniaturization, integration with advanced semiconductor technologies, and increasing applications in high-speed wireless communication. The developments toward higher bandwidth and low-latency RF front-end modules energize innovation in filter design.

Strategic drivers of competition include technological development, cost optimization, efficiency of three-way suppliers, and strategic mergers & acquisitions. Companies expanding into next-generation filter technologies, powering superior efficiency, and using high-performance RF solutions will retain an edge in this dynamic market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Murata Manufacturing Co., Ltd. | 25-30% |

| Qorvo, Inc. | 18-22% |

| Skyworks Solutions, Inc. | 12-16% |

| TDK Corporation | 10-14% |

| TAIYO YUDEN Co., Ltd. | 5-8% |

| Other Companies (Combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Murata Manufacturing Co., Ltd. | Global leader in SAW and TC-SAW filters, specializing in compact, high-frequency RF solutions for 5G and IoT applications. |

| Qorvo, Inc. | Develop high-performance RF SAW filters with a focus on wireless infrastructure, defense, and mobile communication. |

| Skyworks Solutions, Inc. | Offers miniaturized filters for smartphones, wearables, and automotive connectivity solutions. |

| TDK Corporation | Manufactures high-stability SAW filters, catering to telecommunications, industrial automation, and connected devices. |

| TAIYO YUDEN Co., Ltd. | Specializes in temperature-compensated SAW filters with applications in 5G base stations and satellite communications. |

Key Company Insights

Murata Manufacturing Co., Ltd. (25-30%)

Murata is a market leader in the sector with a stout foothold in 5G and IoT applications, adding tiny and less power-consuming RF components.

Qorvo, Inc. (18-22%)

Innovator of next-generation RF components, Qorvo works to satisfy mobile, defense, and infrastructure applications by putting the latest technology low-loss filters that it helps create into action.

Skyworks Solutions, Inc. (12-16%)

Skyworks is a key supplier of RF front-end solutions and implements filters in smart devices, smartphones, and automotive connectivity.

TDK Corporation (10-14%)

Among those recognized for design excellence, TDK's high-precision designs serve the industrial, automotive, and telecommunications arenas.

TAIYO YUDEN Co., Ltd. (5-8%)

It specializes in temperature-controlled QA filters with high-performance stability for 5G as well as IoT applications in extreme environments.

Other Key Players (20-30% Combined)

The industry is slated to reach USD 6,173.0 million in 2025.

The industry is predicted to reach a size of USD 15,228.3 million by 2035.

Key companies include Murata Manufacturing Co., Ltd., Qorvo, Inc., Skyworks Solutions, Inc., TDK Corporation, TAIYO YUDEN Co., Ltd., WISOL, Kyocera Corporation, TST, SHOULDER Electronics Limited, and CETC Deqing Huaying Electronics Co., Ltd.

India, slated to grow at 11.2% CAGR during the forecast period, is poised for the fastest growth.

RF SAW filters are among the most widely used SAW filter segments.

The market is segmented by type into RF SAW Filters and IF SAW Filters.

By bandwidth, the market includes 2kHz to 50kHz, 100kHz to 2MHz, and 5MHz to 100MHz.

In terms of frequency range, the market is categorized into 10 MHz to 50 MHz, 50 MHz to 1 GHz, and 1 GHz and above.

By industry vertical, the market includes consumer electronics, automotive, aerospace & defense, telecommunications, and others.

In terms of region, the market spans North America, Latin America, Europe, Asia Pacific, and the Middle East and Africa.

Human Augmentation Technology Market Growth - Trends & Forecast 2025 to 2035

Micromobility Platform Market by Vehicle Type, Platform Type, End User, and Region through 2035

Mobile Virtual Network Operator (MVNO) Market by Operational Model, Subscriber Type, Organization Size, and Region Forecast till 2035

Endpoint Protection Platform Market Growth – Trends & Forecast 2025-2035

Application Control Software Market Insights – Growth & Forecast 2025-2035

Outage Management System Market Insights – Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.