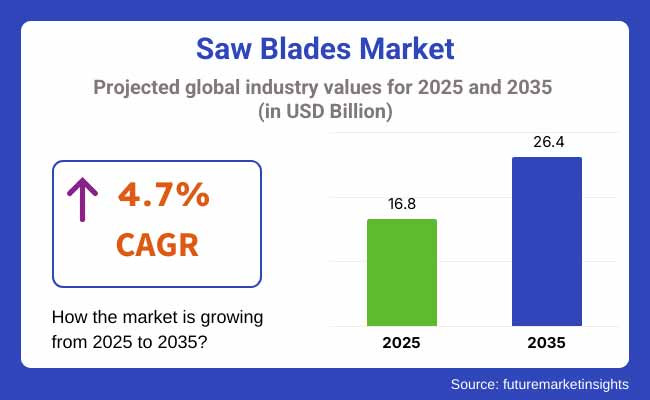

The global saw blades market is forecast to rise from USD 16.8 billion in 2025 to USD 26.4 billion by 2035, registering a CAGR of 4.7%. This growth is driven by the increasing demand across construction, woodworking, metal fabrication, and furniture manufacturing.

Asia Pacific remains the dominant regional market, fueled by expanding infrastructure projects and industrial manufacturing hubs, particularly in China and India. North America and Western Europe are seeing steady adoption of smart saw blades and high-efficiency cutting tools aligned with sustainability mandates.

Construction and woodworking industries remain the leading users of saw blades, with circular and band saw blades in high demand due to their cutting speed and versatility. Metal fabrication, driven by the automotive and machinery sectors, increasingly relies on carbide-tipped, bi-metal, and diamond-coated blades for precision, heat resistance, and longevity. The growing trend toward modular and prefabricated structures is also fueling demand for high-performance cutting tools that minimize material waste and increase throughput.

Technology is reshaping the market, with smart saw blades equipped with IoT sensors for wear detection, self-sharpening features, and automated adjustments gaining market share-particularly in the U.S., Germany, and South Korea. These innovations improve operational efficiency and reduce downtime, critical for large-scale industrial users. However, adoption varies: while North American and European players are prioritizing smart tools and eco-friendly materials, manufacturers in Japan and India still lean toward affordable, manually operated blades due to cost constraints.

Sustainability and regulatory pressure are shaping blade design and material choices. Stakeholders across Western Europe are shifting toward recyclable materials and hybrid composites to meet EU emission targets. At the same time, rising raw material costs-especially for carbide and high-speed steel-are prompting manufacturers to optimize supply chains and explore alternative sourcing strategies. Over the next decade, saw blade manufacturers that balance durability, cutting accuracy, and regulatory compliance with cost-efficiency will be best positioned to capture market share across diverse industrial applications.

Circular saw blades will retain their dominance in the market due to their broad application across wood, metal, and plastic cutting. Their speed, versatility, and ease of use make them ideal for both industrial and consumer-grade operations. As modular construction, DIY furniture, and prefabrication projects grow globally, the demand for circular saw blades will rise sharply.

Meanwhile, band saw blades are preferred in metal and woodworking for making long, continuous cuts with minimal waste. Chain saw blades find strong adoption in forestry and urban infrastructure maintenance, while hand saws continue to hold relevance in manual and small-scale applications. The “others” category-including jigsaw, diamond wire, and reciprocating blades-serves specialized roles in demolition, fine machining, and surgical tools.

| Saw Blade Type | CAGR (2025 to 2035) |

|---|---|

| Circular Blades | 4.9% |

Wood cutting remains the dominant application, powered by the furniture, housing, and remodeling industries. Circular and band saw blades are most widely used due to their precision and adaptability to various wood densities. Growth in residential construction, DIY trends, and smart furniture production will continue to support this segment’s expansion.

In contrast, metal cutting is increasingly relying on carbide and bimetal blades as demand rises from the automotive, aerospace, and industrial sectors. Stone cutting, requiring durable diamond-coated blades, will also grow steadily, especially in construction and mining. Other niche applications include composites, medical-grade materials, and precision electronics, where custom blade geometries are critical.

| Application Segment | CAGR (2025 to 2035) |

|---|---|

| Wood Cutting | 5.0% |

Regional Variance

High Variance Across Regions

ROI Perspectives

Global Consensus: Carbide-tipped saw blades were the most preferred (68%) due to their durability and ability to cut high-strength materials.

Regional Variance

Shared Concerns

Regional Differences

Manufacturers

Distributors

End-Users

Global Trends: 70% of manufacturers plan to increase R&D spending on wear-resistant coatings, automation, and eco-friendly materials.

Regional Focus Areas

High Consensus: There is a high consensus that cutting precision, durability, and automation remain universal priorities.

Key Variances

Strategic Insight

A one-size-fits-all approach won’t work-companies must adapt product portfolios to regional demands (e.g., carbide dominance in the USA, eco-friendly blades in Europe, compact hybrid designs in Asia).

| Countries | Regulation |

|---|---|

| United States | The Occupational Safety and Health Administration (OSHA) regulates saw blade safety standards, ensuring workplace safety. The Environmental Protection Agency (EPA) enforces emissions and sustainable manufacturing practices. |

| Canada | The CSA Group (Canadian Standards Association) mandates safety and performance standards for saw blades. The ENERGY STAR Canada program promotes energy-efficient manufacturing. |

| India | The Bureau of Indian Standards (BIS) regulates saw blades under IS 15283 to ensure quality and performance. Government initiatives encourage the use of sustainable materials in production. |

| European Union | The EU Machinery Directive (2006/42/EC) enforces safety compliance for saw blades. The Ecodesign Directive promotes sustainable and energy-efficient manufacturing. |

| China | The China Compulsory Certification (CCC) requires strict quality control on saw blade production. Environmental policies encourage the use of recyclable materials in manufacturing. |

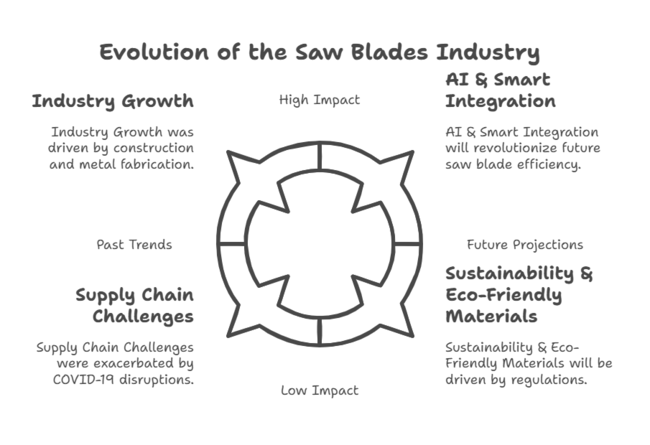

| 2020 to 2024 (Past Industry Trends) | 2025 to 2035 (Future Industry Projections) |

|---|---|

| Industry Growth: The saw blades industry grew steadily from USD 65.0 million in 2020 to USD 104.6 million in 2024, driven by demand in construction and metal fabrication. | Industry Expansion: The industry is projected to reach USD 26.4 billion by 2035, fueled by automation, sustainability, and high-precision cutting tools. |

| Technology & Material Advancements: Carbide-tipped and diamond-coated blades gained popularity for durability and efficiency. | AI & Smart Integration: AI-powered saw blades with self-adjusting cutting mechanisms and predictive maintenance will dominate. |

| Industrial Demand: Construction and furniture manufacturing were key drivers of saw blade sales. | Emerging Sectors: Electric vehicles (EVs), aerospace, and robotics industries will fuel future demand. |

| Automation Adoption: Slow adoption of IoT-enabled saw blades for predictive analytics and maintenance. | Automation Growth: Rapid integration of smart saw blades with real-time monitoring and AI-driven precision cutting. |

| Regional Demand: North America and Europe dominated sales, while Asia-Pacific saw increased industrial adoption. | Global Shift: Asia-Pacific, Latin America, and Africa will experience rising demand due to infrastructure growth. |

| Regulatory Influence: Governments introduced stricter workplace safety and emissions regulations for saw blade manufacturers. | Sustainability & Eco-Friendly Materials: Regulations will push for carbon-neutral production and recyclable materials in saw blade manufacturing. |

| Supply Chain Challenges: COVID-19 disruptions led to raw material shortages and increased prices. | Resilient Supply Chains: Manufacturers will shift to localized production and nearshoring to mitigate risks. |

| Retail & Distribution: Online sales of saw blades surged due to e-commerce growth. | Omnichannel Expansion: Hybrid distribution models will integrate direct-to-consumer, retail, and e-commerce for better accessibility. |

The United States saw blades sector is fueled by high demand from the construction, woodworking, and industrial manufacturing industries. Growth in infrastructure projects and home remodeling has boosted the usage of circular saws, band saws, and chain saws. The metal fabrication sector is also growing substantially, with increased demand for carbide-tipped and bimetal saw blades. The segment is also seeing the trend towards automation and intelligent saw blades with IoT-based monitoring and predictive maintenance functions.

The USA Occupational Safety and Health Administration (OSHA) is strict about implementing safety regulations, which affect saw blade design and production. Environmental sustainability initiatives are also on the rise, with companies concentrating on green materials and energy-efficient production.

FMI opines that the United States saw blades sales will grow at nearly 5.1% CAGR through 2025 to 2035.

The British saw blades landscape is influenced by the construction, furniture, and metalworking sectors' demand. The trend for green construction methods has raised the consumption of low-emission and energy-efficient saw blades. The woodworking industry is also positively impacted by increases in modular homes and prefabricated buildings, which result in increased sales of band and circular saw blades. Within the metals industry, advancements in cutting technology are driving demand for premium saw blades.

Supply chain complications brought on by Brexit have complicated raw material accessibility, forcing enterprises to seek nearby sourcing. The British government's focus on minimizing carbon footprints in production has incentivized saw blade manufacturers to adopt more environmentally friendly manufacturing processes.

FMI opines that the United Kingdom saw blades sales will grow at nearly 4.3% CAGR through 2025 to 2035.

The French saw blades landscape is dominated by the robust construction, automotive, and metal fabrication sectors in the country. The use of intelligent and automated cutting tools is on the rise, especially in industrial applications where precision and efficiency are key. The building industry's concentration on green building materials and energy-efficient structures has created a need for high-performance saw blades.

The furniture sector, renowned for its emphasis on craftsmanship, continues to drive demand for precise cutting tools. The government of France's rigid workplace safety and labor regulations have also influenced the segment, driving manufacturers to make saw blade designs safer and more long-lasting. Online sites are increasingly becoming popular places where businesses can buy industrial tools, and through them, have access to a wider range of saw blades.

FMI opines that the France saw blades sales will grow at nearly 4.5% CAGR through 2025 to 2035.

Germany, being an industrial manufacturing powerhouse of the world, has a well-established saw blades sector. Precision engineering and automation have been accorded high priority in the country, and this has resulted in growing use of CNC-compatible saw blades with special coatings for greater durability.

The metalworking and automobile sectors are large consumers, necessitating high-accuracy cutting tools adhering to very high quality standards. Germany's focus on sustainability has also hit the saw blades industry, with manufacturers investing in carbon-free manufacturing processes and recyclable materials. Woodworking is sustained by the robust home improvement and furniture manufacturing sector in the country.

FMI opines that the Germany saw blades sales will grow at nearly 4.9% CAGR through 2025 to 2035.

The saw blades landscape in Italy is dominated by its furniture, metalworking, and construction sectors. Italy hosts some of the best-known furniture manufacturers in the world, which has created great demand for precision woodworking saw blades. The building industry, especially in the restoration of historic buildings and new infrastructure development, calls for high-end cutting blades with precision and low material waste.

Italy's dominance in metal manufacturing and automotive sectors necessitates high-performance saw blades with advanced coatings. Incentives from the Italian government for the automation of industry have pushed manufacturers into investing in intelligent saw blades featuring IoT technology.

FMI opines that the Italy saw blades sales will grow at nearly 4.4% CAGR through 2025 to 2035.

South Korea's saw blades landscape is developing with the fast expansion of its construction, shipbuilding, and electronics sectors. The nation's emphasis on high-precision manufacturing has raised the need for cutting-edge saw blade technologies, especially in metal and composite material cutting.

South Korea is also shifting toward automation in industrial uses, resulting in increased use of IoT-capable saw blades with real-time monitoring. The government of the country has put in place stringent industrial safety standards, which have encouraged manufacturers to enhance saw blade designs to better protect operators.

FMI opines that the South Korea saw blades sales will grow at nearly 4.6% CAGR through 2025 to 2035.

Japan's saw blades sector is dominated by a high focus on precision, efficiency, and automation. The main driving forces for high-performance saw-blades are automotive and electronics -- the high-tech manufacturing industry of the nation. Japanese manufacturers also lead the way in green manufacturing, building a reputation for eco-friendly saw blade materials and manufacturing processes.

Although it is still a comparatively small player compared to other countries in the world, the construction sector in Japan, still provides a large part of the demand for precision cutting for new urban development’s projects. Premium saw blade technology with high costs, as well as aversion to costly replacements in favor of long-term, high-quality products, has slowed volume growth in the sector.

FMI opines that the Japan saw blades sales will grow at nearly 4.0% CAGR through 2025 to 2035.

China boasts one of the world's fastest-growing saw blades sectors, driven by fast industrialization, urbanization, and infrastructure expansion. The country's enormous manufacturing and construction industries are huge consumers of various saw blades of saw blades, such as circular, band, and chain saws.

China is also a leading exporter of saw blades, shipping products to the global segment at affordable prices. But the industry is also subject to issues like volatile raw material prices and eco-friendly regulations in an effort to curb carbon emissions. Sustainable manufacturing policies by governments have prompted companies to invest in energy-saving and environmentally friendly methods of producing saw blades.

FMI opines that the China saw blades sales will grow at nearly 5.5% CAGR through 2025 to 2035.

The Australian and New Zealand saw blades landscape is fueled by the construction, forestry, and DIY industries. Circular and chain saw blades are in high demand, considering the extensive use of wood in residential and commercial buildings in the region. The mining sector also feeds the sector, and it demands high-torque saw blades for stone and metal cutting.

Sustainability has, in the recent past, played a factor in the industry, with greater uptake of environmental-friendly saw blade materials and manufacturing. Online sales have also grown as web-based platforms improve access to specialized cutting equipment. Government policies governing workplace safety have motivated manufacturers to design safer saw blades with improved features such as anti-kickback mechanisms and greater durability.

FMI opines that the Australia and New Zealand saw blades sales will grow at nearly 4.2% CAGR through 2025 to 2035.

Leading players in the saw blades sectors are striving to gain a significant share through a combination of pricing strategies, product innovations, strategic partnerships, and regional expansion. These top manufacturers are price-competitive to increase industry share and remain profitable through economies of scale and operational efficiencies. Saw blade demand has seen increased segment demand for customized saw blades developed for particular industries such as construction, automotive, and metal fabrication.

These organizations pursue growth through mergers, acquisitions, and collaborations to enhance segment presence. Companies are partnering with suppliers of raw materials and distributors to streamline supply chains and shorten lead times. Furthermore, geographic expansion, with manufacturers opening production plants in emerging sectors such as China and India to take advantage of lower manufacturing costs and increased domestic demand, is a primary area of focus.

The global saw blades landscape is classified under the industrial equipment and tools industry that has a strong association with industries like construction, woodworking, metal fabrication, automotive, and manufacturing. Macroeconomic drivers such as international infrastructure spending, commodity prices, e-mobility for raw materials, robotics automation, and economic cycles directly impact the company's operations.

Geographically, improved sustainability practices in material sourcing and production and growing need for precision cutting tools in the metalworking and automotive industries promote the sector. Infrastructure development in emerging economies like China, India, and Southeast Asia is fueling the demand for high-performance saw blades. In emerging economies such as North America and Europe, cutting-edge technologies like IoT-enabled intelligent saw blades and laser-guided cutting machines have already brought about a change.

Innovation in cutting technology, automation, and sustainability initiatives provides considerable growth opportunities in the saw blades landscape. Construction, automotive, aerospace, and metal fabrication sectors have been demanding innovation more than ever. According to the report, companies that invest in smart saw blade technology, including IoT-enabled wear detection, self-sharpening mechanisms, and precision cutting technologies, can capitalize on these trends.

New players in the saw blades landscape are expected to offer product differentiation. Forming strategic alliances with construction companies, manufacturing units, and industrial suppliers can facilitate industry penetration. Furthermore, prioritizing cost-efficient manufacturing in economically favorable regions and possessing the capacity to meet international safety and environmental regulations can also bolster successful segment entry.

Circular, Band, Chain, Hand, and Others

Wood Cutting, Metal Cutting, Stone Cutting, and Others

North America, Latin America, Europe, East Asia, South Asia, Oceania, and Middle East & Africa

The industry is growing due to rising demand from the construction, woodworking, metal fabrication, and automotive sectors. Technological advances in cutting, automation, and green manufacturing are significant drivers as well.

North America, Europe, and Asia-Pacific are the demand leaders. Asia-Pacific is experiencing rapid growth due to industrial expansion industrial growth, whereas North America and Europe prioritize high-performance and eco-friendly cutting solutions.

Industries commonly use circular, band, chain, and reciprocating saw blades. Metalworking and construction precision cutting favor high-performance carbide-tipped, diamond-coated, and bi-metal blades.

The use of IoT-based smart blades, AI-based performance tracking, and self-sharpening features is improving efficiency and longevity. Saw blade manufacturers are also incorporating eco-friendly materials to comply with environmental standards.

Sustainability is becoming increasingly important, with companies using recycled materials, energy-efficient manufacturing processes, and environmentally friendly coatings.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hacksaw Blades Market Size and Share Forecast Outlook 2025 to 2035

Stone Cutting Saw Blades Market Analysis & Forecast by Blade Type, Blade Diameter, End User, and Region Forecast Through 2035

Woodworking Circular Saw Blades Market Size and Share Forecast Outlook 2025 to 2035

SAW Filter Market Size and Share Forecast Outlook 2025 to 2035

Sawing and Cutting Tools Market Growth, Trends and Forecast from 2025 to 2035

Saw Palmetto Market Analysis by Powder, Whole and others Forms Through 2035

TC-SAW Filter Market

Bandsaw Machines Market Growth - Trends & Forecast 2025 to 2035

Tile Saws Market Size and Share Forecast Outlook 2025 to 2035

Panel Saw Market Size and Share Forecast Outlook 2025 to 2035

Miter Saw Market Trend Analysis Based on Product, Mobility, Power Capacity, End-Use, Sales Channel, and Region 2025 to 2035

Concrete Saw Market Growth - Trends & Forecast 2025 to 2035

Circular Saw Blade Market Growth – Trends & Forecast 2024-2034

D-Handle Jigsaw Market Size and Share Forecast Outlook 2025 to 2035

Diamond Wall Saw Market Size and Share Forecast Outlook 2025 to 2035

Orbital Recip Saw Market Size and Share Forecast Outlook 2025 to 2035

Electric Meat Saw Market Size and Share Forecast Outlook 2025 to 2035

Portable Band Saws Market Size and Share Forecast Outlook 2025 to 2035

Concrete Chain Saw Market Size and Share Forecast Outlook 2025 to 2035

Stationary Band Saws Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA