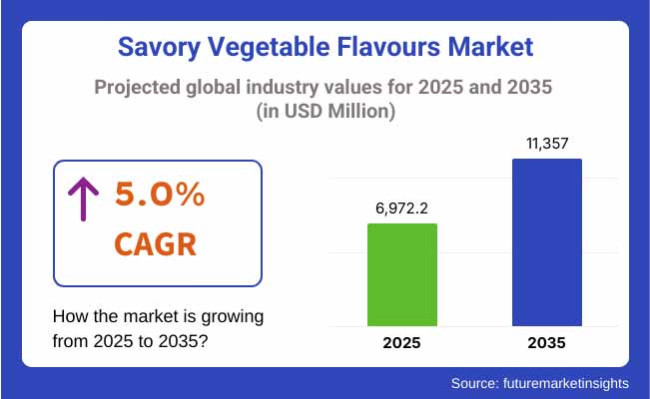

The savory vegetable flavours market was worth about USD 6,972.2 Million in 2025. It is expected to grow to over USD 11,357 Million by 2035. This means the market will rise by about 5.0% every year during this time. Many food items like snacks, soup, sauces, and ready-to-eat meals are using these flavours more and more.

People are looking for new and healthy foods, so the use of savory vegetable flavours will keep growing from 2025 to 2035. As more people learn about the dangers of fake additives, they want natural and simple ingredients in their food and drinks. This makes savory vegetable flavours perfect since they offer both health and taste.

North America is expected to remain dominant in the global savory vegetableflavours market and is expected to benefit from growing demand for convenience foods and a rise in the shift towards natural ingredients. Savory vegetable flavours are widely used as taste enhancers in the processed food industry, including soups, sauces, and plant-based meat substitutes, especially in North America (the USA and Canada) which is a major market for savory flavours.

The consumers in the region are more inclined towards clean-label and organic products, as they follow the global trend of health-oriented diet. The presence of prominent food manufacturers and flavor houses in North America also provides a supporting factor for market growth.

Europe is a key market, with Germany, France and the UK leading demand. While processed nutrition is seeing a rapid expansion, real source with authentic and natural flavor is dominant, so savory vegetable part is an important factor for market share among exotic flavours and gourmet food concepts.

The increasing shift towards healthy consumption behavior and regulatory support regarding clean-label food products act as the avenues for the clean-label food products market growth. A strong vegan and plant-based movement in the region further sustains demand for natural savoryflavours.

The Asia-Pacific market will grow fast due to more cities, more money, and new eating habits. Key reasons for growth around the world include high need for tasty veggie flavours in China, India, and Japan. These countries are eating more ready-to-eat veggie meals, snacks, and plant-based foods.

Trade and travel laws in Southeast Asia are more relaxed now, which makes starting restaurants easier there. A growing middle-class and interest in foods from other places also help the market in this region to grow.Moreover, local food manufacturers innovate flavours to suit different consumer’s taste, which drives the market growth further.

Challenge

High Production Costs and Limited Adoption in Emerging Markets

A big problem in the savory vegetableflavours market is the high cost of making natural and organic flavours. The process needs high-quality raw materials, advanced techniques, and strict checks, all of which increase costs. This makes natural flavours much pricier than fake ones, which is a problem for markets where price is a big deal.

In growing economies, people often care more about cost than clean-label goods, so they choose cheaper fake flavours that taste the same. Also, rules and supply chain issues add more to production costs, making it hard for small and mid-sized food makers to use natural vegetable flavours in their goods.

To solve these issues, new and cheap extraction methods, government help for natural goods, and teaching people about the health benefits of organic flavours will be key to growing the market.

Opportunity

Innovation in Product Development and Clean-Label Demand

The rising demand for clean-label products among consumers creates immense opportunities for innovation in the savoury vegetable flavours market. From taste to salt and sweet, makers are spending on research to give real and unique flavours that match what buyers want. Also, new flavor extraction tools make it possible to create high-quality, organic flavours. These meet the need for healthier foods.

The market for savory vegetable flavours is set to grow a lot as more people want healthy food. Natural ingredients are being used more in food and drinks. As innovations continue to emerge and clean-label products gain traction, the market is poised to cater to these changing dynamics of global consumers.

The savory vegetableflavours market saw strong growth from 2020 to 2024. More people wanted natural, plant-based foods and drinks. This push for clean labels made makers swap fake additives for veggie-based flavours. Also, umami-rich tastes in cooked foods, snacks, and plant-based meats became more liked, speeding up market growth.

Looking forward to 2025 to 2035, big changes are set to come. Health-conscious eating and finding sustainable ingredients will drive this market. As plant-based diets rise, folks are more aware of Earth-friendly choices. This will push makers to create new flavours that taste as good as old ones but stay natural and organic. Better ways to ferment and extract cleanly will make these flavours even more real, keeping the market growing.

Market Shifts: 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with food safety and clean-label regulations. |

| Technological Advancements | Enhanced extraction and fermentation methods. |

| Industry Applications | Used in soups, sauces, seasonings, and snacks. |

| Adoption of Natural Ingredients | Increasing shift from synthetic flavours. |

| Sustainability & Packaging | Standardized ingredient sourcing. |

| Data Analytics & Consumer Insights | Basic trend analysis. |

| Production & Supply Chain | Sourcing from traditional vegetable farms. |

| Market Growth Drivers | High demand for natural food ingredients. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter global regulations for organic, GMO-free, and natural flavours. |

| Technological Advancements | AI-driven flavor enhancement techniques and biotechnology applications. |

| Industry Applications | Expanding into alternative protein, plant-based dairy, and functional beverages. |

| Adoption of Natural Ingredients | Widespread use of fermented and umami-boosted vegetable extracts. |

| Sustainability & Packaging | Growth of regenerative agriculture and eco-friendly packaging. |

| Data Analytics & Consumer Insights | AI-powered personalized flavor development and predictive analytics. |

| Production & Supply Chain | Increased use of vertically integrated and sustainable farming. |

| Market Growth Drivers | Rising demand for clean-label and functional plant-based flavours. |

The savory vegetableflavours market in the US is growing. People want natural and plant flavours. They prefer clean and organic foods. They use vegetable flavours more in processed foods. The FDA and USDA watch food safety, labels, and natural flavor rules.

Key trends are more demand for umami-rich veggie flavours. More use of fermented and roasted veggie extracts in snacks and ready-to-eat meals. Folks are keen on health-boosting flavours too. Market players focus on sustainable sources for ingredients.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

The savory vegetableflavours market in the UK is growing. This is due to more people liking plant-based and vegan foods, using natural flavorings in meat-free meals, and wanting eco-friendly food ingredients. The UK's Food Safety group and Stores group check food safety, flavor rules, and eco-friendly standards.

Trends show more demand for smoky, grilled, and caramel veggie flavours. There is also more new ideas in mixing plant-based and regular flavours, and more work on creating plant-based snacks and ready-to-eat meals.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.8% |

The savory vegetableflavours market in the European Union is growing. This is thanks to strict EU rules on fake additives, more people wanting natural and organic flavours, and more use of veggie flavours in plant-based dairy and meat. The European Food Safety Authority (EFSA) and the European Commission (EC) make rules for flavor safety and labels.

Germany, France, and the Netherlands are leading. People there want clean food ingredients, are interested in fermented veggie flavours, and use more organic, local veggie extracts. Also, Mediterranean and Asian-inspired flavours are becoming popular in the European market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.0% |

The savory vegetableflavours market in Japan is expanding. People like umami flavours a lot. More are using veggie seasonings in both old and new dishes. The need for fermented and pickled vegetable flavours is up too. The Ministry of Health and the Consumer Agency handle food safety, flavoring, and organic tags.

Key trends show higher demand for seaweed and miso flavours. People are also using mushroom and fermented veggie seasonings more. There's a rise in using natural flavor boosts in processed foods.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

The savory vegetableflavours market in South Korea is growing. People there now like natural flavours and spices. More folks want plant-based seasonings in food. The need for veggie umami boosters is rising. The Korea Food and Drug Administration (KFDA) and the Ministry of Agriculture, Food, and Rural Affairs (MAFRA) keep food safe and check if natural flavours are okay.

Trends show more want for fermented veggies like kimchi and doenjang (soybean paste). New spicy and umami-rich seasonings are showing up. There is more use of plant ingredients that help the planet. This helps food makers in South Korea.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

The savory vegetableflavours market is growing quickly. People want foods and drinks with natural tastes, no added stuff, and plant-based parts. New ways to get these tastes, plus a want for organic and non-GMO food, help this market grow. These flavours are in foods like soups, snacks, and sauces.

Big companies make strong veggie extracts, special mixes, and find green ways to make food taste better, last longer, and have more good stuff.The market has top flavour makers, food factories, and ingredient suppliers, all working on new plant-based flavours.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Givaudan | 18-22% |

| Symrise AG | 14-18% |

| International Flavors & Fragrances Inc. (IFF) | 12-16% |

| Kerry Group | 10-14% |

| Firmenich SA | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Givaudan | In 2024, began selling new veggie extracts with richer taste. |

| Symrise AG | In 2025, added organic veggie flavours for plant foods with clear labels. |

| International Flavors & Fragrances Inc. (IFF) | In 2024, grew the collection with fermented veggie flavor boosters. |

| Kerry Group | In 2025, made special tasty mixes for plant protein foods. |

| Firmenich SA | In 2024, improved natural techniques for stronger veggie flavours. |

Key Company Insights

Givaudan (18-22%)

Givaudan leads the way with top vegetable extracts. They offer new umami and natural flavours.

Symrise AG (14-18%)

Symrise provides organic and non-GMO flavours. They meet the need for clean-label foods.

International Flavors & Fragrances Inc. (IFF) (12-16%)

IFF makes fermented vegetable tastes. They add depth to plant-based dishes.

Kerry Group (10-14%)

Kerry creates custom savory tastes. They help with protein and vegan foods.

Firmenich SA (6-10%)

Firmenich works on better extraction methods. They aim for stronger, eco-friendly vegetable flavours.

Other Key Players (30-40% Combined)

Many companies help improve natural tasty flavours, green extraction, and custom vegetable mixes, including:

The overall market size for the savory vegetable flavours market was USD 6,972.2 Million in 2025.

The savory vegetable flavours market is expected to reach USD 11,357 Million in 2035.

Increasing consumer preference for natural and plant-based flavours, growing demand for clean-label food products, rising adoption in processed and convenience foods, and advancements in food flavoring technologies will drive market growth.

The USA, China, Germany, France, and the UK are key contributors.

The sauces, dressings, and condiments segment is expected to lead due to the increasing demand for natural and authentic vegetable-based flavor profiles in food products.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Savory Snack Market Size and Share Forecast Outlook 2025 to 2035

Savory Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Savory Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Savory Flavor Blend Business

Examining Savory Ingredients Market Share & Industry Leaders

Analysis and Growth Projections for Savory Yogurt Market

Savory Extract Market

Savory Dairy Products Market

UK Savory Ingredients Market Analysis – Growth, Trends & Forecast 2025-2035

USA Savory Ingredients Market Growth – Demand, Trends & Forecast 2025-2035

Europe Savory Ingredients Market Growth – Trends, Demand & Forecast 2025-2035

Sweet and Savory Spread Market Growth - Industry Analysis

Asia Pacific Savory Ingredients Market Trends – Demand, Innovations & Forecast 2025-2035

Demand for Textured Pea for High Protein Savory in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Textured Wheat Systems for High-protein Savory in the EU Size and Share Forecast Outlook 2025 to 2035

Vegetable Glycerin Market Size and Share Forecast Outlook 2025 to 2035

Vegetable Seed Market Size and Share Forecast Outlook 2025 to 2035

Vegetable Sugar Market Size and Share Forecast Outlook 2025 to 2035

Vegetable Parchment Paper Market Size, Share & Forecast 2025 to 2035

Vegetable Dicing Machines Market Growth – Food Processing Efficiency 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA