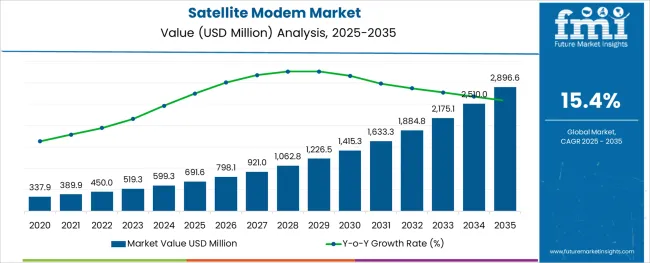

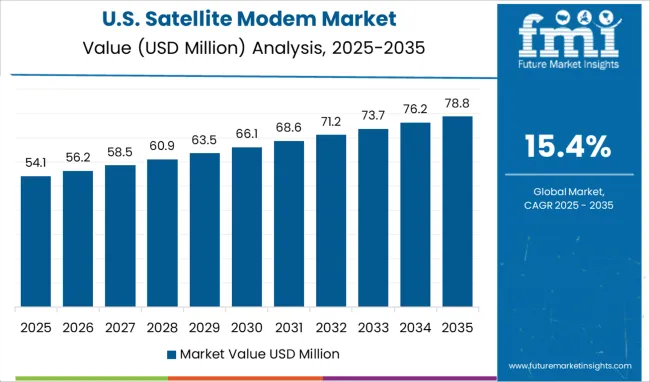

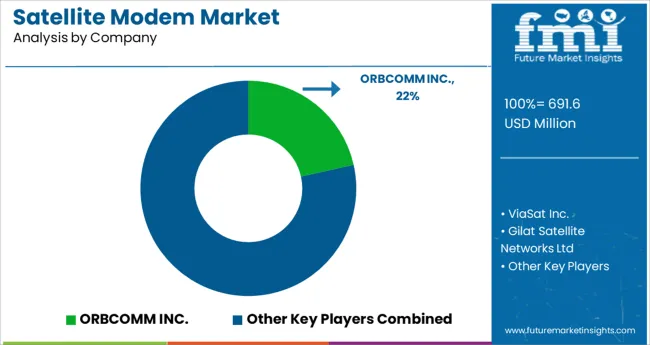

The Satellite Modem Market is estimated to be valued at USD 691.6 million in 2025 and is projected to reach USD 2,896.6 million by 2035, registering a compound annual growth rate (CAGR) of 15.4% over the forecast period.

The satellite modem market is experiencing strong expansion, driven by the global surge in data demand and the evolution of satellite communication infrastructures. Advancements in high throughput satellites, low earth orbit constellations, and beamforming technologies are enabling faster, more reliable connections for commercial, government, and defense applications. Organizations are prioritizing modems that support dynamic bandwidth allocation, network redundancy, and encrypted transmissions for secure and high-capacity communication.

Integration of satellite modems into hybrid networks that combine terrestrial and non-terrestrial links is gaining traction across remote connectivity, disaster recovery, and mobile command systems. The market is also benefiting from increased investments in space infrastructure and satellite internet programs.

As next-generation satellites are deployed with enhanced coverage and frequency flexibility, modem technology is expected to play a central role in bridging the digital divide, supporting connected mobility, and meeting the growing need for resilient global communications.

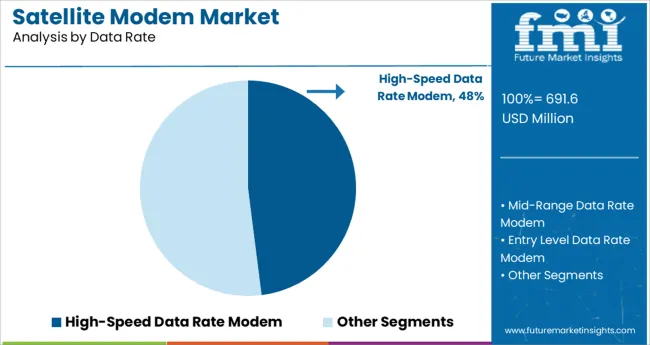

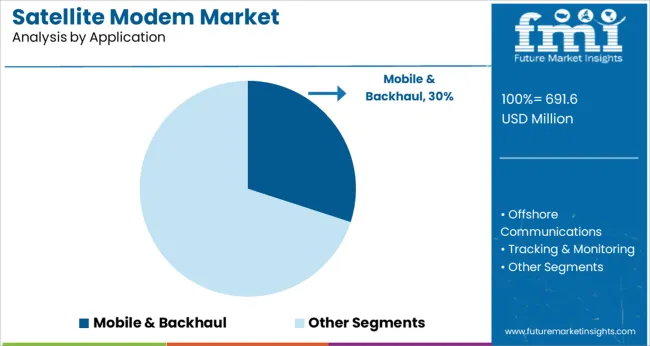

The market is segmented by Data Rate, Application, and End User and region. By Data Rate, the market is divided into High-Speed Data Rate Modem, Mid-Range Data Rate Modem, and Entry Level Data Rate Modem. In terms of Application, the market is classified into Mobile & Backhaul, Offshore Communications, Tracking & Monitoring, and IP Trunking.

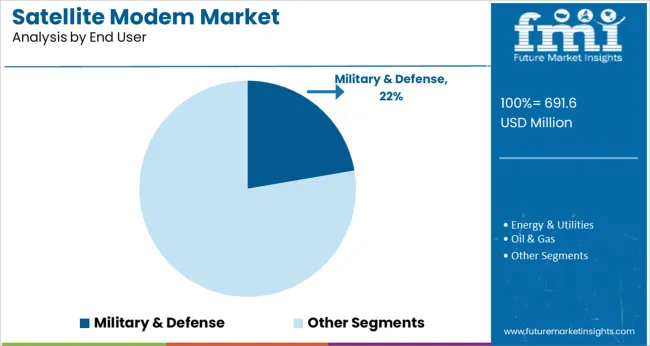

Based on End User, the market is segmented into Military & Defense, Energy & Utilities, Oil & Gas, Transportation & Logistics, Marine, Mining, and Telecommunication. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Making it the leading category by data rate. This dominance is being driven by the increasing need for real-time data transfer, video streaming, and cloud-based applications across industries that rely on satellite communications.

These modems are being adopted to support bandwidth-intensive activities such as surveillance, broadcasting, and remote sensing in sectors with limited terrestrial connectivity. The rise of high throughput satellites and dynamic spectrum access technologies has enabled the deployment of modems capable of supporting gigabit-level speeds.

Integration with software-defined networking and compatibility with both geostationary and non-geostationary satellite systems have further strengthened the value proposition of high-speed modems. As enterprise and government networks demand greater data throughput and low latency, the adoption of high-speed satellite modems is expected to accelerate.

Positioning them as the most prominent category. The rise in mobile network expansion into rural and underserved regions has led to increased deployment of satellite-based backhaul solutions.

Satellite modems are being used to support cellular connectivity where terrestrial infrastructure is either limited or economically unfeasible. Telecom providers are relying on these systems for temporary network extensions, emergency response, and mobility support in areas impacted by natural disasters or infrastructure outages.

The ability of modems to offer rapid deployment, scalable bandwidth, and seamless integration with core network elements has made them ideal for mobile backhaul operations. Furthermore, demand from mobile fleet operations and aviation connectivity has reinforced the growth of this segment as continuous and reliable mobile access becomes a critical service requirement.

making it a significant end user of satellite modems. This share is being driven by the sector’s critical need for secure, resilient, and high-capacity communication channels for command, surveillance, and tactical operations.

Satellite modems are being utilized for real-time data exchange across combat zones, mobile command units, and surveillance drones. The preference for advanced modems that offer anti-jamming features, frequency hopping, and encryption has grown as modern warfare increasingly depends on uninterrupted information flow.

Integration with advanced satellite networks and compatibility with both legacy and next-generation military platforms have enhanced operational flexibility. Additionally, ongoing investments in defense modernization and space-based communication strategies are expected to further support the expansion of satellite modem usage in military applications globally.

There is an increasing requirement from various verticals for high-speed data communication and solutions for vehicle tracking, asset monitoring, and fleet management. This is likely to expand the market size.

High-speed network communication solutions across military, defense, enterprise, and government sectors are expected to promote market growth. In addition, the sales of satellite modems are expected to surge owing to the growing popularity of the internet, digital communication, high-speed data transfer, and global transfer. The satellite modem has widespread usage in the telecommunication industry for a secured high-speed connection. Mobile and telecom operators further deploy satellite modems owing to their efficiency despite uncertain weather conditions.

Network outages along the infrastructure due to terrestrial networks, such as cable or DSL, can be avoided by adopting a satellite modem. A complete satellite network works independently of terrestrial infrastructure and maintains prolonged connectivity. The cost efficiency of satellite modems is favorable during the lack of terrestrial connectivity. Likewise, the deployment and installation of satellite antennas require minimal duration.

The rise in demand for high bandwidth applications is unable to be met by enterprises. This is expected to hinder the sales of satellite modems. Furthermore, ambiguity in the regulatory framework governing satellite communications techniques and standards poses a major challenge for satellite operators.

Small satellite operators unfamiliar with the L, S, C, Ku, and Ka bands associated with satellite internet, face difficulties in manufacturing satellite modems for different countries or regions, incorporated with all the standards and communication protocols. Moreover, national authorities fail to provide a harmonized approach to licensing and frequency authorizations, further curbing the market growth.

The lack of international regulations on communication standards and common protocols for satellite internet is likely to hamper the demand for satellite modems. Additionally, cybersecurity breaches have increased across the globe due to the advent of technology and the implementation of 5G networks. This negatively impacts the market.

Key market players implementing plans to build satellite constellations using smaller satellites present a productive opportunity for the satellite modem market share. Further growth opportunities in the satellite modem market are attributed to the rising demand for connected healthcare devices, home devices, and connected automobiles.

The market is expected to witness significant growth through mobile technologies being paired with satellites, as well as the advent of the Internet of Things (IoT) in satellite communications. Moreover, mergers and acquisitions amongst key players further contribute to market growth.

MCPC's modern technology significantly contributes to the market growth owing to its ability to deliver finer broadband internet services and high data rate capacity. Likewise, SOTM terminals deployed in business applications additionally expand the market size.

North America is the leading satellite modem market, with a significant revenue of 34.3%. This is due to video and voice communications in military applications requiring critical decisions, which is increasing the demand for satellite communication.

Other major industries, such as oil & gas, military & defense, marine, etc., requiring voice, video, and data communication for critical and effective decision-making surge the market growth. In addition to this, the technological developments of major satellite launching enterprises, such as SpaceX and NASA, further contribute to market progress.

The Asia Pacific is expected to showcase significant growth in the satellite modem market. This is on account of developing telecom connectivity, satellite-based backhauling, and 4G rollout in this region.

With the growth of Long-Term Evolution (LTE) technology in various Asian countries, along with the growth of broadband services in rural areas, satellite services to increase customer base are increasing in demand.

High-speed network communication is a growing requirement in every sector. There are a lot of criteria regarding the features of satellite modems that manufacturers have to keep in mind to cater to every consumer need. This includes better streaming services, capabilities for multiple device usage, the ability to withstand extreme weather conditions, etc.

By virtue of technological developments, these attributes can gradually be met. Naturally, start-up companies are implementing existing features of satellite internet with newer innovations to stand out in the market and improve the credibility of satellite modems.

Several start-up companies such as Gravity Internet, Numerisat, GalaxySpace, Swarm Engineers, Orbitare, LeoLabs, Akash Systems, Cesium Astro, etc. are administering various strategies such as 4x high-speed satellite internet, eco-friendly satellite internet, satellite constellation, IoT satellite connectivity, nanosatellites, etc. These will contribute significantly to the satellite modem market growth.

The satellites are deployed in various industries, including agri-tech, maritime, energy, and ground transportation. These industries require faster upload speeds and seamless file sharing and backups. The ability to resist the change in weather patterns is also significantly in demand. Hence, several key players in the satellite modem market share are conducting research and development activities to initiate continuous innovations and meet these requirements.

Key market players of the satellite modem market:

Some of the recent developments in the satellite modem market are:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 15.4% from 2025 to 2035 |

| The base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments Covered | Data Rate, Application, End User, and Region. |

| Regional scope | North America; Western Europe, Eastern Europe, Middle East, Africa, ASEAN, South Asia, Rest of Asia, Australia, and New Zealand |

| Country scope | United States of America, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | ORBCOMM INC.; ViaSat Inc.; Gilat Satellite Networks Ltd.; Newtec Cy N.V.; Teledyne Paradise Datacom; Comtech EF Data Corporation; WORK Microwave GmbH; ST Engineering; Teledyne Technologies; NOVELSAT; Hughes Network Systems; ND SATCOM; SatixFy; Ayecka Communication Systems Ltd.; Amplus Communication Pvt. Ltd.; Iridium Communications Inc.; C-DOT; Thuraya Telecommunications Company; VT iDirect Inc; Singapore Technologies Engineering Ltd.; Newtec CY N.V.; Advantech Wireless; Rohde & Schwarz Inradios Gmbh; Satcom Resources; Satexpander; Datum Systems Inc. |

| Customization scope | Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global satellite modem market is estimated to be valued at USD 691.6 million in 2025.

It is projected to reach USD 2,896.6 million by 2035.

The market is expected to grow at a 15.4% CAGR between 2025 and 2035.

The key product types are high-speed data rate modem, mid-range data rate modem and entry level data rate modem.

mobile & backhaul segment is expected to dominate with a 30.0% industry share in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA