The salon service market is currently experiencing dynamic growth due to growing consumer demand in the areas of beauty, wellness, and self-care. From personalized treatments, eco-conscious beauty products, to digital appointment booking systems, innovation is transforming this industry at lightning speed. Today, consumers expect premium salon experiences that are convenient, hygienic, and customized, driving innovation as the key driver of market leaders.

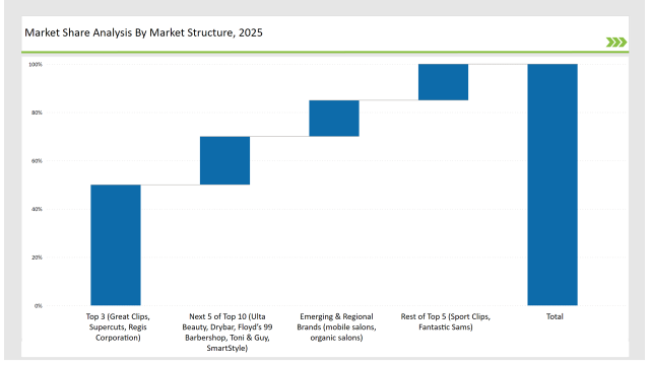

Top companies like Great Clips, Supercuts, and Regis Corporation together hold 50% of the market share due to franchise expansion, value for money, and brand loyalty. Independent salons and boutique spas comprise 30%, due to specialist services mainly targeting customers willing to spend money on premium and niche treatments. Lastly, start-ups that focus on mobile salon operations, eco-friendly beauty products, and AI-based hair and skincare consultations make up 20% of the market.

Explore FMI!

Book a free demo

| Market Segment | Industry Share (%) |

|---|---|

| Top 3 (Great Clips, Supercuts, Regis Corporation) | 50% |

| Rest of Top 5 (Sport Clips, Fantastic Sams) | 15% |

| Next 5 of Top 10 (Ulta Beauty, Drybar, Floyd’s 99 Barbershop, Toni & Guy, SmartStyle) | 20% |

| Emerging & Regional Brands (mobile salons, organic salons) | 15% |

The salon services market in 2025 is highly fragmented, with the top players accounting for 40% to 55% of the total market share. Leading chains such as Regis Corporation, Great Clips, and Supercuts dominate the segment, while independent stylists and personalized beauty services add competitive diversity. This market structure reflects strong brand influence while allowing space for organic hair treatments and digital booking system enhancements.

Franchise & Chain Salons lead the market with 55% of sales, as large salon networks offer consistent services and nationwide accessibility. Boutique & Independent Salons comprise 30%, offering luxury and niche treatments for clientele seeking a personalized experience. Mobile & Home-Service Salons account for 10%, gaining popularity due to convenience and on-demand beauty services. Online Beauty Platforms & Subscription-Based Models represent 5%, catering to digitally savvy consumers who prefer membership-based or virtual consultations.

Hair Care & Styling dominates with 45%, since cuts, color treatments, and styles are considered primary salon services. Skincare & Facial Treatments contribute to 25%, driven by anti-aging and specific skin treatments. Nail Care & Manicures/Pedicures account for 20%, with gel polish and nail art being some of the trendy additions. Lastly, Wellness & Spa Services constitute 10%, as salons include holistic treatments like massages and aromatherapy.

As the preferences of customers changed, market leaders and new entrants made strategic decisions that transformed the salon service industry.

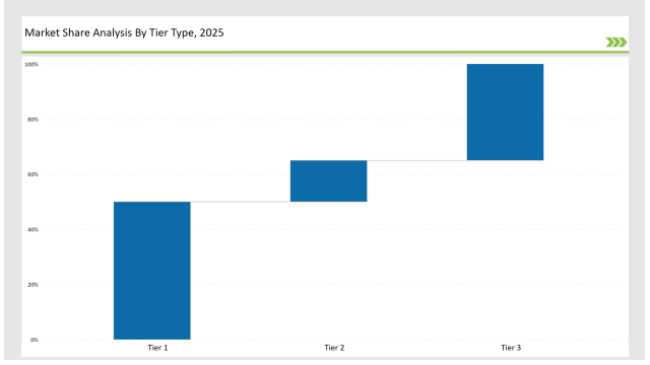

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | Great Clips, Supercuts, Regis Corporation |

| Key Drivers | 50% |

| Tier Type | Tier 2 |

|---|---|

| Example of Key Players | Sport Clips, Fantastic Sams |

| Key Drivers | 15% |

| Tier Type | Tier 3 |

|---|---|

| Example of Key Players | Ulta Beauty, Drybar, Floyd’s 99 Barbershop, Toni & Guy, SmartStyle |

| Key Drivers | 35% |

| Brand | Key Focus Areas |

|---|---|

| Great Clips | AI-powered stylist matching & digital booking |

| Supercuts | Express services & affordability |

| Regis Corporation | Premium service expansion & hygiene enhancements |

| Ulta Beauty | Beauty retail & salon service integration |

| Emerging Brands | Mobile & on-demand beauty services |

Salon service markets will see ongoing growth because of the increase in digitization, environment-conscious beauty, and enhanced expectations for superior services among customers. Companies will gain their space within this business based on the development of smart technologies, tailored solutions in beauty care, and responsible eco-friendliness in all activities. Future Salon Service trends will be high-tech, customer-focused, and sustainable.

Leading players such as Great Clips, Supercuts, and Regis Corporation collectively hold around 50% of the market

Independent salons and luxury spas contribute approximately 30% of the market, focusing on high-end services.

Startups specializing in home-service beauty and mobile salons hold about 10% of the market.

Subscription-based salon services and virtual beauty platforms represent around 5% of the market.

High for companies controlling 50%+, medium for 30-50%, and low for those under 30%.

Korea Men’s Skincare Market Analysis - Size, Share & Trends 2025 to 2035

Japan Men’s Skincare Market Analysis - Size, Share & Trends 2025 to 2035

Japan Wall Décor Market Analysis by Base Material, End Use, Product Type, Sales Channel, and Region through 2025 to 2035

Korea Mobile Phone Accessory Market Analysis - Size, Share & Trends 2025 to 2035

Japan Mobile Phone Accessory Market Analysis by Packaging Type, Price Range, Product Type, Sales Category, Sales Channel, and Region through 2025 to 2035

Japan Portable Dishwasher Market Analysis by Application, Capacity, Distribution Channel, Price Range, and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.