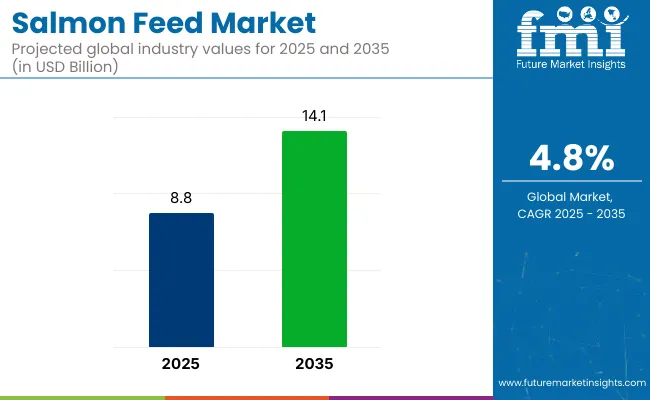

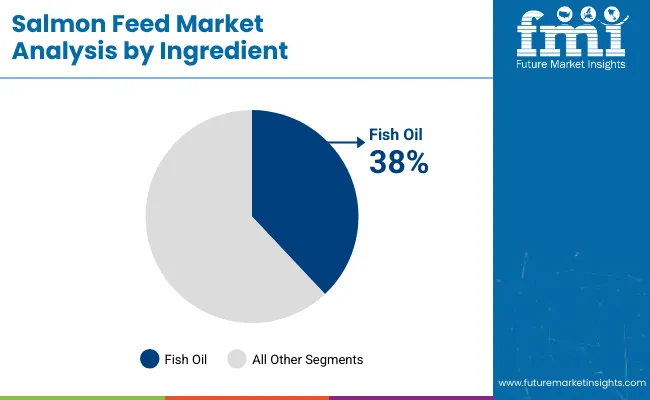

The salmon feed market will reach USD 14.1 billion by 2035, up from USD 8.8 billion in 2025, expanding at a CAGR of 4.8% during 2025 to 2035. Fish oil remains the most lucrative segment by ingredient, holding 38% share in 2025 whereas by feed type, grower feed accounts for 42% share.

Growth is being propelled by the relentless scaling-up of global aquaculture, especially intensive farming hubs in Asia-Pacific and North America, alongside evolving nutrition protocols that favour precision-balanced grower diets and fish-oil-rich blends. Adoption of land-based recirculating aquaculture systems (RAS) has intensified demand for high-performance feeds that maintain water quality and feed-conversion efficiency, while stricter livestock-nutrition standards worldwide have further reinforced consumption.

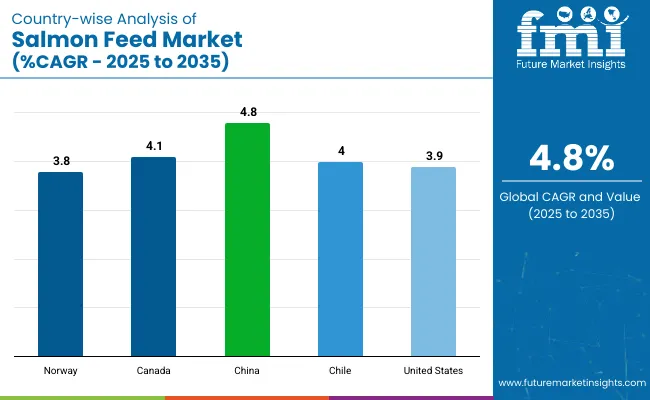

As per Future Market Insights analysis, Norway is expected to remain a lucrative market, accounting for roughly 25 percent of global salmon-feed sales through 2035. In contrast, China is projected to log the fastest expansion, advancing at an estimated 4.8 percent CAGR over 2025 to 2035 as land-based RAS capacity scales up.

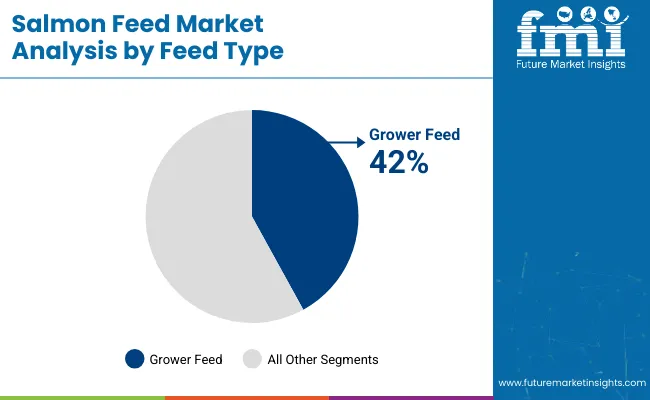

Grower feed will retain about 42 percent share in 2025, thanks to its balanced protein-energy profile that delivers optimal weight-gain efficiency during the high-consumption grow-out phase. Fish-oil-enriched formulations are set to capture the highest ingredient revenues, owing to their cost-effective omega-3 density and proven palatability.

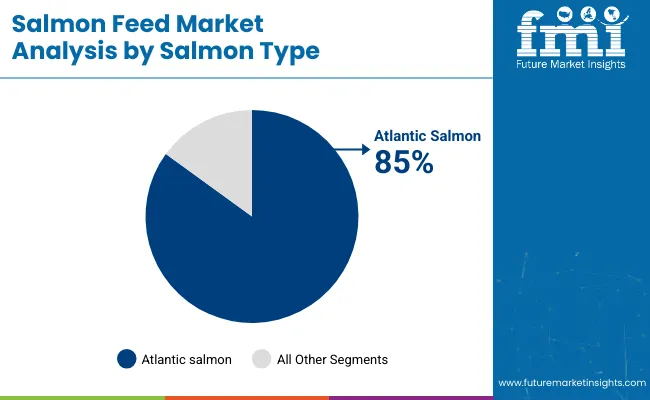

The global salmon feed market is segmented for the historical period 2020 to 2024 and the forecast period 2025 to 2035. By salmon type, the market is segmented into Atlantic Salmon and Pacific Salmon. By feed type, it is segmented into Starter Feed, Grower Feed, Medicated Feed, and Other Specialty Blends.

By ingredient type, the market is segmented into Fish Oil, Fish Meal, Corn, and Others (including plant and single-cell proteins). Regionally, the report covers North America, Latin America, Western Europe, Eastern Europe, the Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

FMI analysts estimate Atlantic salmon will account for roughly 85% of global feed consumption in 2025, reflecting its dominance in sea-cage production across Norway, Chile, Scotland, and eastern Canada. Pacific salmon species, chiefly coho and chinook, will collectively absorb the residual 15%, with output clustered in western Canada, Alaska, and select RAS facilities in East Asia.

FMI analysts anticipate grower feed will remain the top-selling feed type, securing roughly 42% of global revenue in 2025. Its dominance stems from the long mid-cycle feeding window (spanning most of the grow-out period) and its balanced protein-energy profile, which maximizes feed-conversion efficiency, crucial for intensive cage and land-based RAS operations targeting rapid biomass gains.

Demand for antibiotic-free and plant-protein-augmented formulations is accelerating in the EU and North America, reshaping R&D pipelines toward novel functional additives and fish-meal substitution strategies.

FMI analysts project fish oil will remain the cornerstone ingredient, accounting for roughly 38% of global formulation spend in 2025, owing to its unrivalled EPA- and DHA-rich profile that underpins feed-conversion efficiency and premium fillet quality.

Norway’s salmon feed demand is forecast to expand at a CAGR of 3.8% between 2025 and 2035. Although the market is mature, growth is fuelled by large‐scale offshore cage expansions, strong governmental backing for low-emission aquaculture, and rapid adoption of precision-feeding and circular-economy ingredients (insect meal, single-cell proteins). Key trends in Norway salmon feed market include,

Canada’s salmon feed market is projected to grow at a CAGR of 4.1% from 2025 to 2035. Growth centres on British Columbia’s sea-cage farms and Atlantic Canada’s land-based RAS projects, with feed buyers prioritising antibiotic-free and organic-certified formulations. Key trends in Canada salmon feed market include,

China salmon feed sales are set to register the fastest growth, at nearly 4.8% CAGR during 2025 to 2035, propelled by urban RAS facilities near Beijing, Shanghai, and Guangzhou that favour year-round fresh salmon supply. Domestic formulators are localising diets for Chinese-bred strains and sourcing region-specific raw materials. Key trends in China salmon feed market include,

Chile, the world’s second-largest salmon producer is likely to expand at 4% CAGR through 2035. Growth is moderated by environmental permitting caps yet reinforced by continued expansion in Patagonia sea-cages and Magallanes RAS pilots. Key trends in Chile salmon feed market include,

The USA salmon feed market is forecast to grow at nearly 3.9% CAGR between 2025 and 2035, anchored by large land-based RAS ventures in Maine, Florida, and Wisconsin targeting “locally raised” branding. Key trends in USA salmon feed market include,

The global salmon feed market is largely steered by vertically integrated aquaculture giants and specialized feed innovators. Leading players such as Skretting (part of Nutreco), BioMar Group, and Cargill’s EWOS division dominate the sector, accounting for the majority of feed production across Norway, Chile, and Scotland. These firms leverage advanced R&D infrastructure, proprietary formulations, and integrated value chains to maintain their edge.

Skretting, for example, continues to pioneer precision nutrition in salmon farming, using AI-driven feed optimization and fish health monitoring systems. Cargill EWOS has focused on high-digestibility ingredients to improve feed conversion ratios, while BioMar is scaling up its algae oil-based omega-3 feeds to replace wild-caught fish oil.

Tier-two players including Salmofood (Chile), Aller Aqua, and Ridley Aqua-Feed cater to regional or mid-sized producers. These firms often compete on formulation flexibility, localized raw materials, and cost-effective supply chains, especially in emerging aquaculture hubs like Vietnam and Canada’s Atlantic provinces.

However, barriers to entry remain high due to the capital-intensive nature of feed formulation, regulatory hurdles (e.g., ASC, BAP certifications), and the need for consistent pellet quality under varying water conditions.

Industry consolidation is underway, with larger feed groups acquiring niche biotech startups to bolster functional feed capabilities such as probiotics, immunostimulants, and mycotoxin binders. That said, niche segments remain fragmented, especially in organic-certified and insect-protein-based feeds. These segments are attracting investment from startups and research-backed ventures exploring circular economy models (e.g., using food waste or insect larvae).

Salmon Feed Industry News

| Attribute | Details |

|---|---|

| Market Size (2025) | USD 8.8 billion |

| Forecast Size (2035) | USD 14.1 billion |

| CAGR (2025 to 2035) | 4.8% |

| Base Year | 2024 |

| Historical Period | 2019 to 2024 |

| Forecast Period | 2025 to 2035 |

| Metrics | Revenue (USD billion) & Volume (kt) |

| Feed Types | Starter, Grower, Medicated, Others |

| Ingredient Types | Fish Oil, Fish Meal, Corn, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Key Countries | Norway, Canada, Chile, China, UK, USA, Japan, India, France, Germany, Italy, South Korea, and more |

| Key Players | Cargill, Skretting, Biomar, Nutreco, Mowi, Aller Aqua, Ridley Corp., Yadong, Tongwei, Grobest, Guangdong Haid |

By type industry has been categorised into Atlantic salmon and pacific salmon.

By feed type global business landscape categorised into Starter feed, grower feed, medicated feed and others.

Key Ingredient types which are Fish Oil, fish meal and Corn and others

Industry analysis has been carried out in key countries of North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, and Oceania

The market is valued at USD 8.8 billion in 2025 and projected to reach USD 14.1 billion by 2035, growing at a 4.8% CAGR over the decade.

Grower feed remains the top segment, accounting for roughly 42% of global revenue.

Fish oil leads with about 38% share, driven by its EPA/DHA profile and broad availability.

Norway continues to contribute the largest single-country share

China is expected to post the quickest expansion, at roughly 4.8% CAGR, on the back of rapid land-based RAS development.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Salmon Fish Market Size and Share Forecast Outlook 2025 to 2035

Canned Salmon Market Analysis by Source, Species, Form, and Sales Channel Through 2035

Frozen Smoked Salmon Market Insights – Trends & Forecast 2025 to 2035

Feed Grade Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Feed Electrolytes Market Size and Share Forecast Outlook 2025 to 2035

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Flavors Market Size and Share Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Mycotoxin Binders Market Size and Share Forecast Outlook 2025 to 2035

Feed Phytogenics Market Size and Share Forecast Outlook 2025 to 2035

Feed Carbohydrase Market Size and Share Forecast Outlook 2025 to 2035

Feed Grade Oils Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Packaging Market Size, Share & Forecast 2025 to 2035

Feed Mycotoxin Detoxifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Premix Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Feed Phytogenic Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Feed Attractants Market Analysis by Composition, Functionality, Livestock, Packaging Type and Sales Channel Through 2035

Feed Encapsulation Market Analysis- Size, Growth, and Forecast 2025 to 2035

Feed Grain Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA