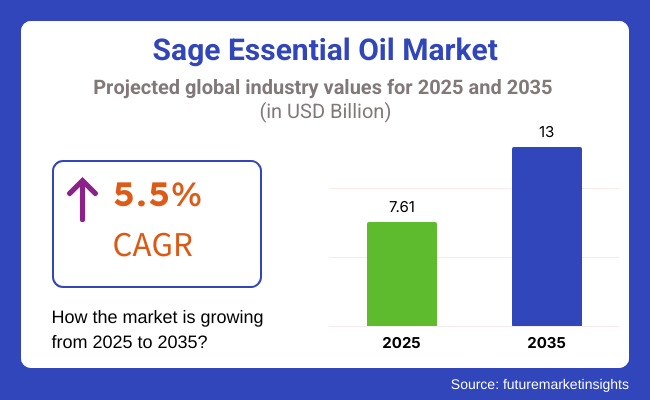

The sage essential oil market is estimated to be worth USD 7.61 billion in 2025 and is projected to reach USD 13 billion by 2035, expanding at a CAGR of 5.5% over the assessment period of 2025 to 2035.

The industry is steadily increasing due to consumers' growing interest in using natural and plant-based wellness items. This essential oil is obtained from the dried leaves of the sage plant and is widely esteemed for its many uses in treating different diseases, including the elimination of inflammation, the killing of microbes, and the relaxation from stress.

Furthermore, the rising consumption of aromatherapy, herbal medicine, and organic personal care products is the leading cause of the expansion of this sector. The industry's growth is mainly the result of the integration of sage essential oil into aromatherapy and holistic health practices.

People are more and more adding essential oils to their everyday wellness routines for relaxation, mental clarity, and emotional balance. The use of it in diffusers, massage blends, and herbal supplements is mostly because of the more and more people looking for natural solutions for anxiety, sleep disorders, and respiratory health.

The cosmetics and personal care industry is another strong support for the industry's growth. It is an ingredient that is greatly used in skin, hair, and fragrance products because of its antibacterial and antioxidant properties. Since consumers desire chemical-free and environmentally friendly beauty products, manufacturers have been adding it to their cleansers, serums, shampoos, and perfumes for the purpose of making them functional or simply appealing.

Technological innovations in extraction methods, such as steam distillation and supercritical CO2 extraction, are present in the industry and they help in producing cleaner and more potent sage essential oil. The increased concern with the production of crops without chemicals and sourcing from ethical sources is also imbedding the groove of industry trends, thereby, companies are vowing to use the environment-friendly methods and the right sourcing.

Nevertheless, the industry is encountering hardships like the fluctuation of raw materials, elevated production costs, and stipulations for the safety and labeling of essential oil. In addition to it, the competition from other essential oils that have similar therapeutic advantages like European lavender and rosemary might affect the growth of the industry.

Regardless of these barriers, the potential for the industry to expand is enormous. The fact that they are now being used in the treatment of wounds and pain management by the pharmaceutical sector is a great development. Moreover, the reach of herbs will be increased by the direct sales as the products will be more and more available online. Industry will grow further, because of the increasing demand for natural and healthy lifestyles, and it will also find its place in the future.

Explore FMI!

Book a free demo

The industry is expanding due to the factors such as increasing demand from consumers for natural wellness products, personal care, and therapeutic usage. The industry is being stimulated by aromatherapy, in which sage oil's stress-reducing and soothing attributes see it featured highly in diffusers, massage oil, and de-stressing mixes.

In the cosmetic industry, it is valued for its antimicrobial and anti-inflammatory actions, and is applied in hair care, skincare, and deodorants. The pharmaceutical sector also explores the utilization of sage oil for mental and hormonal balancing actions, primarily used in natural medicine for memory improvement and relief in menopause.

The food & beverage sector uses sage oil in flavor uses, particularly in herbal teas and functional foods, although it is used in limited amounts owing to regulatory limitations. Home cleaning brands are increasingly using sage oil for its antifungal and antibacterial effects, targeting environmentally friendly consumers. As the clean-label trend gains traction, brands emphasize organic certification, sustainable sourcing, and compliance with regulations to address consumer needs in this growing industry.

This table here showcases a relative comparison of CAGR shift from the Base Year (2024) and to the Current Year (2025) for the industry. It highlights the critical changes in the performance of the industry, conveying the progress in the realization of the revenues of the companies as well as of the industry which are usually portrayed in the growth of the industry more profoundly. H1 refers to the first half of the year which includes the months between January and June, while H2 refers to the second half that includes July to December.

The industry is expected to grow with an industry share of 5.2% CAGR during the first half (H1) of the decade between 2025 and 2035 and to 5.7% in the second half (H2). Later, from between H1 2025 to H2 2035, the CAGR is expected to fade to 6% for the first half and will prevail steady at 6.3% for the second half. In H1, the segment grew 30 BPS while in H2, the segment grew 40 BPS.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 5.2% |

| H2 (2024 to 2034) | 5.7% |

| H1 (2025 to 2035) | 6% |

| H2 (2025 to 2035) | 6.3% |

The industry grew steadily between the period 2020 and 2024, driven by increased demand for natural and organic personal care and wellness products, aromatherapy, and wellness. Growing consumer understanding of the medicinal effects of sage oil, such as its anti-inflammatory, antimicrobial, and stress-relieving properties, pushed the industry higher.

The cosmetic and skincare segment utilized sage oil for their formulations in soothing the skin and in age reversal, while the healthcare industry saw its use in analgesics and neurological disorders. Despite that, price variation in raw material, poor quality availability of high-quality sage crops, and over-regulation of essential oil challenged the development of the industry.

The industry will undergo renovation from 2025 to 2035 through breakthroughs in the technology for extracting it as well as more capital injection in eco-friendly procurement. Improved steam distillation and CO2 extraction methods will improve yield and quality, while AI-based supply chain management will maximize production efficiency.

Growing consumer demand for clean-label and transparent products will propel the manufacturing of organic and non-GMO sage oil blends. In increasing demand for it across the pharmaceutical, nutraceuticals, and functional food industries is due to antioxidant and antimicrobial activity.

Enhanced wellness tourism and awareness for mental well-being will continue to sustain demand for sage-based aromatherapy and spa therapies. Regulatory policy changes will be aimed at product safety, sustainable sourcing, and fair trade manufacturing, forcing companies to adopt cleaner processes and biodegradable packaging.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growth in usage of it in skin care, cosmetics, and aromatherapy application. | Pharmaceutical, nutraceutical, and functional food growth. |

| Growth in natural therapy and organic wellness products. | Growing trend towards non-GMO and clean-label product formulation. |

| Difficulty in managing regulatory compliance and supply chain disruption. | Supply chain management with artificial intelligence and enhanced manufacturing efficiency. |

| Promoting cleaner production and eco-friendly sources. | Incorporation of biodegradable packaging and carbon-neutral operations. |

| Regulated extraction procedures impacting yield and purity. | Technological innovations in CO2 and steam distillation extraction. |

The worldwide industry is witnessing growth due to the rising trend of natural wellness products, aromatherapy, and personal care usage. However, the essential oil safety, purity standards, and labelling requirements on which regulations are focused are the primary challenges of compliance.

It is a must for the companies to comply with international regulations and obtain the necessary certifications to show the consumers they are trustworthy and the industry is credible. Growing competition from other essential oils like lavender, tea tree, and eucalyptus threatens industry positioning.

Consumers are likely to choose multifunctional essential oils with performance as the most relevant attribute. The brands will have to sell exceptional qualities, scientific evidence, and new product development in order to dominate the industry, and this may include blends and infused skin products.

Public mistrust toward the genuineness of products and suspected adulteration is a risk factor for the industry credibility. The sourcing transparency, third-party quality tests, and labelling will be the ones for the company to maintain the trust and provide product differentiation in an industry that is full.

The industry dynamics are influenced by factors like economic uncertainties, the shift in consumer preferences to organic and clean-label products, and the fluctuating prices of raw materials. Fora long-standing success, businesses should pay attention to the innovation, practice sustainability, and implement targeted marketing strategies that will shape the it as a completely natural product.

Organic Sage Essential Oil Dominates Market Demand in Natural Products

| Segment | Value Share (2025) |

|---|---|

| Organic (By Source) | 60% |

The industry is best for the organic holding a 60% share and inorganic contributing 40.0% in 2025. The demand of the consumers for organic products is the reason people are preferring organic sage essential oil in comparison to the other products.

The organic segment is also expected to continue holding the largest share of revenue owing to the consumer preference for clean-label products and the lack of synthetic pesticides or fertilizers used in cultivation. Organic sage essential oil is extensively employed in therapeutic care (stress relief), skin care, and holistic healing.

Well-known brands such as doTERRA, Young Living, and Plant Therapy focus on the purity and effectiveness of their organic essential oils, responding to the increasing use of premium-quality, plant-based solutions. Moreover, rising regulatory backing for organic agricultural practices is propelling the growth of this segment.

The inorganic segment, which approaches a third of the industry share at 40.0% value, is difficult to compete with considering that it is generally cheaper and more widely available. It is commonly found in industrial formulations, such as perfumes, cleaning detergents, and synthetic perfume ingredients.

Brands like NOW Foods and Edens Garden also provide regular sage essential oil for those with green-thumbed noses seeking more affordable options to scent the air without sacrificing fragrance integrity. The sustainable and non-toxic personal care perspective is gaining wider recognition, leading to the anticipated growth of the organic segment, while the inorganic sage oil still holds appeal for a wide range of commercial uses.

Personal Care Sector Leads Sage Essential Oil Applications Growth

| Segment | Value Share (2025) |

|---|---|

| Personal Care (By Application) | 40% |

Personal care and cosmetics segments are the major drivers for the industry. With a 40% industry share, the personal care segment reigns, supported by the growing usage of herbal and natural skincare and haircare products. In addition, it is also valued for its anti-microbial, anti-inflammatory, and antioxidant properties, and is a common ingredient in shampoos, conditioners, soaps, and body lotions.

Aveda, L’Oréal, and The Body Shop are examples of brands that feature sage essential oil in scalp treatments, deodorants, and aromatherapy products respectively, as consumers increasingly demand clean-labeling and botanically-based personal care products.

The cosmetics segment has a 25% industry share and is encouraged by a movement towards organic and chemical-free beauty products. It is recommended to reduce skin irritation and to balance the production of sebum and is therefore used in facial serums, anti-aging creams, and some makeup types.

The premium skincare and cosmetic formulations from companies such as Estée Lauder, Kiehl’s, and Weleda incorporate it to boost skin rejuvenation and hydration at a cellular level. As more cosmetics incorporate aromatherapy benefits, sage oil is also more common in fragrance blends and wellness motives beauty products.

The demand for natural and plant-derived ingredients is steadily increasing among consumers, leading to an increasing innovation and product diversification in the personal care and cosmetics industries, further driving the growth of the industry.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.5% |

| UK | 5.5% |

| France | 5.3% |

| Germany | 5.2% |

| Italy | 5.0% |

| South Korea | 5.8% |

| Japan | 5.1% |

| China | 6.0% |

| Australia | 5.4% |

| New Zealand | 5.6% |

The USA industry will increase at 5.5% CAGR from 2025 to 2035. One of the most attractive drivers is the rising demand from consumers for natural wellness products, particularly for aromatherapy and personal care. Organic skincare and stress-reducing products are in high demand by consumers, thereby creating immense demand for it in cosmetics and therapy.

Large companies such as doTERRA and Young Living control the industry with ongoing innovation and superior production quality. Their environmentally friendly sourcing also appeals to nature-conscious consumers. In addition, the USA possesses a sophisticated distribution system in the form of web portals and physical stores, retailing it in mass quantities.

The growing use of sage essential oil in complementary medicine, coupled with experiential evidence of mental improvement, drives industry expansion. Growing social media presence and wellness influencer functions also drive public awareness and product uptake, placing the USA among the top markets.

The UK industry will grow at a 5.5% CAGR from 2025 to 2035. The industry is being spurred by increasing demand for natural and organic wellness products among health-conscious consumers. Aromatherapy and holistic healthcare are becoming increasingly popular, and companies such as Neal's Yard Remedies and Tisserand have started selling high-quality, ethically produced it.

The British market places tremendous importance on sustainability, and consumers enjoy eco-packaging and sustainably sourced ingredients. Moreover, the UK has a long history of herbal medicine, thus encouraging the use of it in therapy. Regulatory approval in the form of organically certified products solves the problem of product quality and aims at high-end consumers. Internet sales, especially via Amazon and Boots, are also essential to industry accessibility, and it is an easily accessible product across the country.

The French industry is expected to witness a CAGR of 5.3% during 2025 to 2035. The rich heritage of luxury perfumes and high-end cosmetics in France offers a favorable platform for essential oil consumption. French skincare brands like L'Occitane en Provence and Decléor use sage oil in anti-aging creams and skincare products, which are in favor of a industry seeking natural and effective products.

France also boasts a strong aromatherapy culture and many consumers incorporate essential oils into their daily routines. The government's strict regulation for the use of synthetic products also fuels natural alternatives such as sage essential oil. Locally established distilleries in provinces such as Provence also deal in hand-made and organic products, thus guaranteeing high quality that is acceptable to local and international consumers.

The German industry is anticipated to grow at a 5.2% CAGR between 2025 to 2035. Germans highly prefer therapeutic-grade essential oils since there is a cultural demand for natural German medicine. Taoasis and Primavera are a few of the major brands that are available in the industry, and they have certified organic sage oil that is highly strict according to European standards.

Furthermore, Germany's commitment to sustainable and responsible sourcing is a major driver of industry growth. Consumers love green purchases, which encourages companies to move towards open supply chain practices. Growing demand for DIY aromatherapy kits and the popularity of well-being workshops also support the consumers' dedication to essential oils with guaranteed future industry demand.

Italy is anticipated to develop at a CAGR of 5% in the industry for sage essential oil between 2025 and 2035. Italy's customary heritage of herbal health, dating back to the Romans, still prevails in the choice of consumers. Italian beauty and health companies like Erbario Toscano place immense significance on plant-based products, so it is an integral component in their skincare and aromatherapy products.

Also, Italy's vibrant tourism sector is an impetus for industry growth as tourists seek locally made basic oils as souvenirs. Uptake of sage oil in high-end spa treatment also boosts popularity, especially in the case of high-end well-being resorts in Tuscany and the Amalfi Coast. Expanding interest in holistic well-being fuels demand, making Italy an important industry.

The South Korean industry is expected to grow at a CAGR of 5.8% from 2025 to 2035. The industry is being fueled by the K-beauty product industry in South Korea, with industry leaders such as Innisfree and Sulwhasoo incorporating herbal extracts such as sage into their skincare products. Increased application of natural cosmetics and functional well-being products is also fueling the industry's growth.

In addition, the high rate of e-commerce penetration in South Korea makes essential oils easily accessible, with leaders in the industry, such as Coupang and Gmarket, having the largest shares of sales. The industry is also sustained by the increasing adoption of aromatherapy by younger consumers seeking remedies for the stress of the fast pace of city life. This increased demand for natural wellness products manifests in South Korea as a steadily expanding industry.

The Japanese industry will grow at 5.1% CAGR between 2025 and 2035. Traditional medicine and natural healing, driven by Japan's cultural importance, led to the use of sage oil in medical applications. Japanese cosmetic brands such as Muji and Shiseido combine modern skincare with the benefits of herbs with the help of essential oils in their products.

In addition, Japan's strict quality control process guarantees products are of better quality, and therefore, there is a need for locally produced sage essential oils. The increased popularity of essential oils among corporate wellness programs also fuels industry growth because companies are encouraging employees to use aromatherapy as a stress-reduction practice.

China's industry is expected to register a 6.0% CAGR over the forecast period from 2025 to 2035. The increasing use of traditional Chinese medicine (TCM) and wellness trends are creating a industry for the use of sage oil for integrative applications in health. Domestic firms Herborist and Baohetang offer sage as an added ingredient to herbal prescriptions, further solidifying its position even more in skin care applications and healing.

Online platforms such as Alibaba and JD.com are central to industry growth by providing vital oils for sale. Increased disposable incomes and higher awareness of natural health remedies among consumers drive the Chinese industry to expand and place the country in a global leadership position in the essential oil industry.

The Australian industry will grow at a 5.4% CAGR from 2025 to 2035. The country's established natural and organic well-being industry is an important driver-domestic Australian brands such as Perfect Potion and ECO. Modern Essentials emphasizes local sourcing and ethically sourced materials and resonates with environmentally aware shoppers.

In addition, Australia's robust wellness tourism sector, especially in spa resorts and natural treatment facilities, fuels the demand for high-quality essential oils. Increasing demand for homemade natural remedies also supports industry growth, making Australia one of the leading markets.

New Zealand's industry is anticipated to register a 5.6% CAGR between 2025 and 2035. Pure, organic, locally made, and ethically produced essential oils are favored by consumers due to New Zealand's reputation for the same. Sustainability and quality of production are concerns for companies such as Tui Balms and Absolute Essential.

New Zealand's thriving wellness tourism sector also promotes industry growth because visitors look for natural and organic products. Consumption of sage oil for stress reduction and skincare products at higher rates ensures consistent growth in the industry, making New Zealand a leader in the essential oil industry on a global level.

The industry is increasingly becoming one of the most significant segments of a growing plethora of markets worldwide. The increased awareness of therapeutic benefits, such as stress relief, skincare, and antimicrobial effects, has created an increasing demand for natural as well as organic wellness solutions by consumers in personal care, aromatherapy, and pharmaceuticals.

Some of the leading players in this industry are doTERRA, Young Living, Plant Therapy, Biolandes, and Edens Garden, which continue to implement strategies in sustainable sourcing and organic certifications while enhancing their aromatherapy products. Companies invest money to ensure that cold-pressed extraction techniques are employed and invest in purity testing to better the quality of their products while also maintaining consumer trust.

Lastly, the industry is moving towards an enhanced premium beauty and wellness entry with e-commerce increases in revenues and direct-to-consumer strategies. North America and Europe show greater growth in demand for clean-label essential oils. At the same time, the emerging opportunities in Asia-Pacific come from the rise in disposable income and holistic wellness trends.

Exclusive blends, transparent sourcing, and tie-ups with wellness brands define the major strategic drivers of competition. Companies are expected to invest in clinical research as well as expand distribution networks, guaranteeing that their offerings could benefit as broad a cross-section of society as possible with innovation in functional applications such as therapeutic massage oils, stress relief formulation, as well as holistic skincare solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| doTERRA International | 18-22% |

| Young Living Essential Oils | 16-20% |

| Plant Therapy Essential Oils | 10-14% |

| Biolandes | 8-12% |

| Edens Garden | 6-10% |

| Other Players (Combined) | 30-40% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| doTERRA International | Leading in therapeutic-grade essential oils, focusing on direct selling and certified pure products. |

| Young Living Essential Oils | Strong in aromatherapy and personal wellness, with vertically integrated farms for quality control. |

| Plant Therapy Essential Oils | Focuses on affordable, pure, and organic-certified oils, expanding its retail and online presence. |

| Biolandes | A major bulk supplier with expertise in natural extraction processes and sustainable sourcing. |

| Edens Garden | Specializes in small-batch, non-MLM essential oils, offering a wider variety of sage oil blends. |

Key Company Insights

doTERRA (18-22%)

Dominates the industry with certified therapeutic-grade oils, extensive global distribution, and proprietary testing protocols.

Young Living (16-20%)

Focused on seed-to-seal quality, controlling the entire production process to ensure high purity.

Plant Therapy (10-14%)

Competes with a cost-effective, organic-certified range, expanding in e-commerce and direct retail.

Biolandes (8-12%)

A key bulk supplier for the fragrance and cosmetic industries, emphasizing eco-friendly production.

Edens Garden (6-10%)

Stands out in non-MLM sales, targeting ethical sourcing and small-batch formulations.

The industry is expected to generate USD 7.61 billion in revenue by 2025.

The industry is projected to reach USD 13 billion by 2035, growing at a CAGR of 5.5%.

Key players include doTERRA International, Young Living Essential Oils, Plant Therapy Essential Oils, Biolandes, Edens Garden, NOW Foods, Florihana Distillerie, Mountain Rose Herbs, Givaudan, and Lebermuth Company.

North America and Europe, driven by the growing demand for natural personal care products, organic essential oils, and the expanding aromatherapy industry.

Clary sage essential oil dominates due to its strong demand in aromatherapy, skincare, and stress-relief applications, followed by common sage oil used in medicinal and herbal formulations.

By source, the industry is segmented into inorganic and organic sage essential oil based on production methods and purity levels.

By application, the industry is segmented into pharmaceutical, cosmetics, personal care, and household applications, with each segment catering to specific industry demands.

By distribution channel, the industry includes store-based retail, specialty stores, online retail, supermarkets, and hypermarkets, ensuring diverse market access.

The industry is analysed across North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and The Middle East & Africa.

Lecithin and Phospholipids Market Analysis by Product Type, Form, Nature, Function and Application Through 2035

Liqueurs Market Analysis by Type, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast from 2025 to 2035

Yeastless Dough Market Growth - Innovations & Consumer Preferences 2025 to 2035

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.