The global world safety light curtains market finds huge opportunity of growth because of increasing automation across sectors, focus on workplace safety and rising regulations regarding construction safety. Safety light curtains are devices that can effectively protect the human body from the dangerous motion of a machine, creating an invisible protection optical field in the surrounding area of the machine, and the machine stops running immediately when a barrier is blocked.

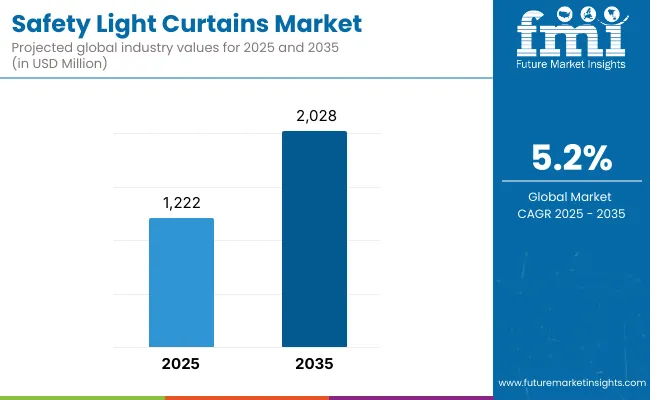

As automation is adopted by an increasing number of companies within their manufacturing processes, the demand for reliable safety systems also rises.Innovative technologies have also led to the development of advanced and user-friendly safe light curtains that is also boosting market growth. The market is expected to grow at 5.2% CAGR and is anticipated to surpass USD 2,028 Million by 2035; whereas, USD 1,222 Million in 2025.

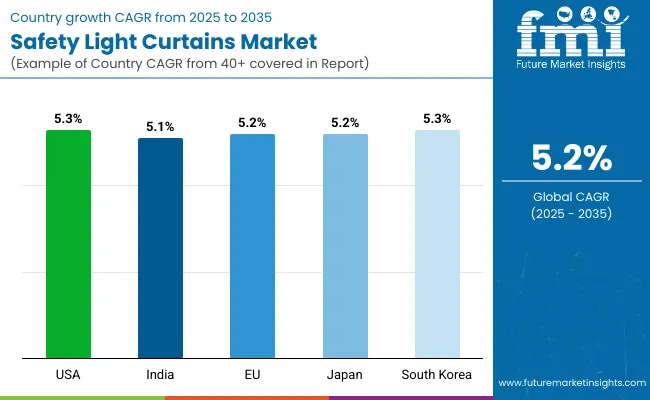

Key market driving factors of safety light curtains in North America can be attributed to strict safety regulations and growing adoption of automation in sectors such as automation and manufacturing Due to the sheer amount of investments made by companies for enhanced safety systems for their workers' protection and for being compliant with regulatory standards, the United States leads the region. The increasing focus on reducing workplace injuries and enhancing operational efficiency has been a key growth factor in this region.

The safety light curtains ecosystem in Europe is growing rapidly, underpinned by a robust industrial automation environment and stringent industry legislation promoting workplace safety. Countries like Germany, France, and England are leading the way with industries applying best safety practices to keep their workers healthy and productive. Additionally, the growing emphasis on Industry and smart manufacturing of the region is likely to support the demand for safety light curtains.

The fastest growth is likely to come from the Asia-Pacific, owing to rapid industrialization, urbanization, and increasing spending on manufacturing verticals. Rising workplace safety concern and adoption of automation technologies especially in China, Japan and India are the major factors driving the market growth. The implementation of manufacturing hubs and safety standards is driving the rising demand of safety light curtains in this region.

Challenges

High Installation Costs, Sensor Malfunction Risks, and Regulatory Compliance

The high initial costs focused regards with installation, calibration, and integration with industrial automation systems challenge the growth in the safety light curtains market. This means that sensor malfunctions or false triggers caused by environmental factors like dust, vibration or electrical interference can lead to operational inefficiencies Also, there are strict safety regulations and compliance standards from bodies like OSHA, ANSI, and IEC that compel manufacturers to update product designs in line with evolving standards on an ongoing basis.

Opportunities

Industrial Automation Growth, Workplace Safety Demand, and Smart Sensor Integration

This, combined with the rising trend of industrial automation, robotics, and IoT-enabled safety solutions have despite the challenges led to the growth of the market. The rising importance on workplace safety and accident prevention in manufacturing, logistics, and automotive application areas is driving the demand for advanced safety light curtains that offer improved detection accuracy. Furthermore, developments in AI-based safety monitoring, real-time diagnostics, and wireless safety curtain systems are providing new growth opportunities. Another impetus for automated safety systems are the transition to Industry 4.0 & smart factory initiatives.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with OSHA, ISO 13849-1, and IEC 61496 standards. |

| Consumer Trends | Increased adoption of basic safety light curtains in manufacturing. |

| Industry Adoption | Used primarily in automotive, packaging, and metal fabrication sectors. |

| Supply Chain and Sourcing | Dependence on conventional optical sensors and relay-based safety systems. |

| Market Competition | Dominated by industrial automation providers and sensor manufacturers. |

| Market Growth Drivers | Increased demand for machine safeguarding, compliance-driven safety adoption, and automation trends. |

| Sustainability and Environmental Impact | Early adoption of energy-efficient sensors and recyclable components. |

| Integration of Smart Technologies | Adoption of programmable safety controllers and networked safety light curtains. |

| Advancements in Safety Technology | Development of high-resolution detection grids and compact light curtain designs. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter requirements for AI-assisted safety monitoring, remote diagnostics, and fail-safe mechanisms. |

| Consumer Trends | Growth in multi-beam, smart-sensing, and AI-integrated light curtains for predictive safety management. |

| Industry Adoption | Expansion into logistics, warehouse automation, and pharmaceutical manufacturing. |

| Supply Chain and Sourcing | Shift toward AI-driven safety systems, IoT-enabled safety light curtains, and energy-efficient optical sensors. |

| Market Competition | Entry of AI-powered safety technology firms, robotics safety startups, and smart factory solution providers. |

| Market Growth Drivers | Accelerated by robotics safety integration, AI-assisted hazard prevention, and real-time safety data analytics. |

| Sustainability and Environmental Impact | Large-scale shift toward low-power light curtains, green manufacturing practices, and eco-friendly sensor materials. |

| Integration of Smart Technologies | Expansion into AI-driven hazard detection, 5G-enabled machine safety systems, and predictive safety analytics. |

| Advancements in Safety Technology | Evolution toward smart edge computing in safety systems, self-learning AI safety sensors, and adaptive light curtain barriers. |

Increasing investments in workplace safety, stringent OSHA regulations, and rising adoption of automation in industrial sectors is driving the USA safety light curtains market. AI-Based safety solutions and smart machine guarding systems are helpful in preventing manufacturing, warehousing, and logistics accidents, ai-based safety solutions boosts safety in factories and other industries, and smart machine guarding systems. A trend in increasing safety on the shop floor moreover, innovations in the sector are being propelled by technological advancements in (wireless) safety light curtains and predictive maintenance systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.3% |

This is owing to stringent safety laws for workers and factory production process, expansion of automation in manufacturing processes, and usage of smart sensors in industrial safety systems which are driving steady growth in the UK market. The move towards collaborative robotics (cobots) and AI-driven machine security is driving demand for high-resolution safety light curtains. Also, the growing emphasis on sustainable and energy-efficient automation solutions is driving product innovations in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.1% |

Stringent safety regulations, the rise of Industry 4.0, and rising investments in robotics and smart factories drive Europe's safety light curtains market. Leading Countries like Germany, France, and Italy, Countries are implementing ai-driven industrial safety solutions, safety light curtain systems with predictive maintenance and IOT connectivity growing demand for energy efficient devices from the region and a significant emphasis on sustainability and energy efficiency is leading to development of high accuracy low-power optical safety barrier devices.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 5.2% |

Advanced robotics integration along with need for high precision manufacturing safety is growing the safety light curtains market in Japan along with growing automation in automotive and electronics production. Top Robotics and Industrial Automation Companies Are Investing in AI-Powered Safety Light Curtains with Real-Time Adaptive Safety Controls An aging workforce in Japan is also pushing for worker protection solutions in servant environments in the high-risk industrial space.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.2% |

Stronger investments in industrial automation, government-aided workplace safety programs, and rising demand for smart factory solutions are laying the groundwork for South Korea to become a leading market for safety light curtains. Growth of Precision Safety Barriers for Robotic Production Lines in the Country The country's leadership in semiconductor and electronics manufacturing is driving the adoption of precision safety barriers for robotic production lines. Besides, the integration AI and IoT-enabled safety devices is also boosting market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.3% |

There is wide adoption of automated safety solutions across industries, the advancements in these solutions are contributing towards the growth of their respective applications to enhance workplace safety, reduce the frequency of accidents, and comply with the norms set by the regulatory bodies, which is anticipated to propel the growth of the Type 2 and Type 4 segments in the safety light curtains market. These segments targeted are relevant for safe working in many of the high-risk environments such as manufacturing, automotive, semiconductor & electronics industries.

Type 2 safety light curtains gained traction and are the most preferred segment in the market in which basic safety functionality is needed, as this is suitable for applications with lower-risk missions. Type 2 models offer less protection than Type 4 models but at a lower cost, so they are ideal for less hazardous environments and applications where the occasional safety interruption is acceptable.Through a combination of low-cost safety solutions, simplified safety integration, low hardware requirements, and enhanced optical performance, the growing need for cost-effective solutions is driving market adoption. More than 40% of industrial automation installations use Type 2 light curtains to protect human operators at a low cost, according to studies.

Type 2 safety light curtains expanded machine guarding applications including deployment in packaging, assembly lines, and conveyor systems, which has positively impacted market growth and secured broader accessibility in mid-tier industrial automation installations.

Add to that the benefits of AI-driven safety monitoring, with features for automatic fault detection and real-time safety compliance tracking and predictive maintenance analytics that have only accelerated adoption by ensuring higher operational reliability and less downtime.The upsurge of compact and energy-consuming Type 2 safety light curtains, which have been designed with low-power consumption, slim-profile, and plug-n-play configuration, have further optimally driven market growth, as improved versatility guarantees their better adaptability for small-to-mid-sized production lines.

Though it garners advantages such as affordability, ease of integration, and compliance with mid-range risk applications, the Type 2 compartment has disadvantages including limited application in high-risk environments, lower optical resolution than Type 4 models, and a limited operational range. Continuous development in AI-powered safety analytics, adaptive sensor technologies, and multi-tiered safety configurations ensure healthy growth in Type 2 safety light curtains, although changes in industry demands may impede growth.

The type 4 safety light curtain has particularly strong market adoption among the industries that require performance safety solutions with fail-safe functionality. While Type 2 models are best suited for general applications, Type 4 light curtains have better optical resolution, are more resilient against environmental disturbances, and have higher detection capabilities, making them suitable for hazardous applications.

Market adoption has been boosted by the need for integrated safety compliance in advanced industrial applications, including even Type 4 safety curtains with redundant circuit architectures, high-precision beam diagnosis, and built-in fault diagnostics. Industry studies show that over 60% of automated manufacturing and high-risk industrial applications utilize Type 4 light curtains to provide an additional layer of personnel safety.

The growing penetration of robotic safety systems-particularly with the utilization of Type 4 safety light curtains for protection of collaborative robots, CNC equipment, and high-speed automation lines, have propelled market expansion by ensuring enhanced risk mitigation within sophisticated industrial ecosystems.

This drives adoption on the AI side and when you couple this with AI safety control which predicts threats through machine learning and ensures the worker is in the right position at the right time, along with adaptive capabilities of the safety zones (facilitate and control safety zones dynamically) then the adoption becomes all the more assured which can ensure dynamic safety protection as and when there are recurrent changes in an industrial process.

Market with newly developed smart Type 4 safety light curtains that enable wireless connectivity, cloud-based safety monitoring, and real-time hazard reporting to improve market growth by providing better safety compliance and enhanced system diagnostics.Though, Type 4 segment is anticipated to showcase high reliability safety assurance paired with enhanced optical performance and diminishing risks in real-time conditions, challenges such as high installation cost would impede the segment growth due to complex system calibration and integration complications in legacy manufacturing environments. Yet, while Type 4 safety light curtains continue to expand, investments in AI-driven auto-calibration, modular safety light curtain designs, and IoT-enabled predictive safety analytics are enhancing efficiency.

A few of the main contributing industries to the growth of the market include the automotive and semiconductor & electronics industries where manufacturers are actively focusing on worker safety, regulatory compliance, and automated risk management solutions.

Vehicle manufacturers have become a leading consumer of safety light curtains thanks to their integration of automated safety solutions designed to modify worker behavior around hazardous machinery and robotic assembly line processes. As opposed to safety measures such as walls, these curtains are not physical barriers, making it alternative protection that allows the workflow to continue without interruptions, thereby maintaining operational performance.

Focus on connecting automation tools with safety light curtains for robotic welding cells, press machines, and high-speed stamping lines has promoted the adoption of marketplace. According to the studies, more than 50% of the automotive production plants around the world use safety light curtains as they are compliant with the industry safety standards and offer better protection for the worker.

Because of electric vehicle (EV) manufacturing, which includes highly accurate automated assembly lines and speedy robotic handling systems, factory safety will be better than past and meet changing regulatory conditions that will promote market growth.The adoption has been further kicked up via application of AI-led Safety Monitoring with real-time worker-machine interaction tracking, machine learning-based hazard detection, and predictive maintenance insight ensuring greater safety compliance and lesser downtimes.

With their vibration-resistant design, extreme temperature tolerance and self-diagnosing optical sensors, high-durability safety light curtains have maximized market growth by delivering superior performance in rugged automotive manufacturing conditions.Though it has its strengths, including safety in automation, regulatory compliance, and better-ensured worker protection, the automotive industry segment is confronted by challenges including high costs of system integration, complexity of calibration for multi-axis robotic systems, and inaptitude issues with legacy manufacturing equipment. Nonetheless, advances in AI-based robotic safety protocols, modular safety light curtains, and industrial IoT risk mitigation solutions are optimizing safety performance; thus market growth will persist in the automotive manufacturing sector.

With factories that ensure compliance with comprehensive cleanroom requirements, the semiconductor & electronics sector has seen the demand for market adoption, especially among high-accuracy production facilities where manufacturers are increasingly seeking safety solutions designed to prevent workplace combustion. Safety light curtains provide a worker with non-intrusive protection by a physical barrier, unlike physical guards which cannot always achieve such in sensitive manufacturing environments.

Increasing demand for safety compliance in microelectronics manufacturing, which includes safety light curtains for semiconductor fabrication, PCB assembly lines, and precision laser processing, has created a push for market uptake. Studies show that more than 45% of semiconductor fabrication plants use safety light curtains to reduce risks and comply with safety standards set by ISO and OSHA.

In addition, the market growth is also recognized by the high-density electronic component manufacturing process such as high-speed PCB production line, automation of semiconductor packaging process and laser wafer production process, to ensure plant operation safety, while enhancing production efficiency.

AI safety monitoring using real-time object recognition, adaptive safety zones, and AI-driven safety diagnostics further incentivizes adoption by enabling improved protection and productivity for machine operators.For example, the introduction of clean room compatible safety light curtains, offering dust-resistant enclosures, anti-static housing, and ultra-high precision beam alignment, is driving market growth in the semiconductor manufacturing environment.

So, while the semiconductor & electronics industry segment benefits from non-contact safety solutions, improved precision manufacturing protection, and regulatory compliance, this segment of the industry also has to contend with things like elevated sensor calibration costs, interference in high-frequency electromagnetic environments, and integration issues within automated microelectronics assembly lines. Advancements in AI-powered safety analytics, adaptive laser alignment technology and self-calibrating safety light curtains are addressing these challenges and helping ensure ongoing growth in semiconductor and electronics manufacturing applications.

The safety light curtains market is driven by increasing workplace safety regulations, rising automation in manufacturing, and advancements in AI-powered machine safeguarding solutions. The growing adoption of Industry 4.0, the need for non-contact safety mechanisms, and improvements in self-diagnostic safety technology are further shaping the industry. Key industry players focus on AI-assisted hazard detection, integrated real-time monitoring, and customizable light curtain configurations for various industrial applications. Major contributors include industrial automation firms, sensor technology providers, and machine safety solution companies innovating in high-precision, durable, and smart safety light curtain systems.

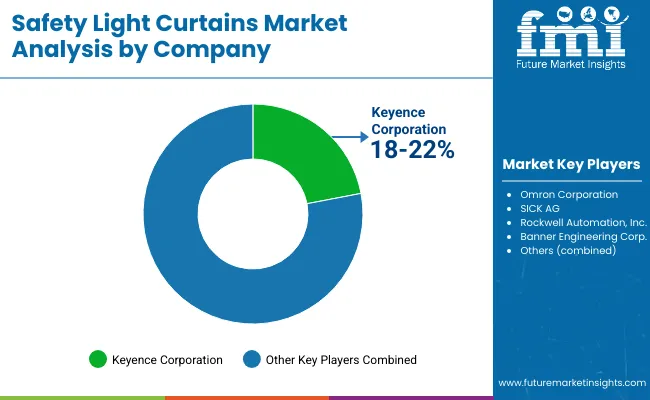

Market Share Analysis by Key Players & Safety Light Curtain Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| Keyence Corporation | 18-22% |

| Omron Corporation | 14-18% |

| SICK AG | 12-16% |

| Rockwell Automation, Inc. | 8-12% |

| Banner Engineering Corp. | 6-10% |

| Other Safety Light Curtain Providers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Keyence Corporation | Develops AI-powered safety light curtains with high-speed response, automatic calibration, and multi-zone detection for industrial automation. |

| Omron Corporation | Specializes in AI-driven safety sensors, self-monitoring light curtain systems, and real-time hazard detection for manufacturing safety. |

| SICK AG | Focuses on AI-assisted machine protection, intelligent muting functions, and high-resolution detection technology. |

| Rockwell Automation, Inc. | Provides industrial-grade light curtains with AI-powered fault diagnostics, integrated safety controllers, and customizable configurations. |

| Banner Engineering Corp. | Offers high-performance safety light curtains with AI-enhanced system diagnostics, IP-rated enclosures, and flexible mounting options. |

Key Market Insights

Keyence Corporation (18-22%)

Keyence leads in AI-enhanced safety light curtains, offering ultra-fast response times, automatic alignment, and smart self-calibrating detection technologies for industrial safety.

Omron Corporation (14-18%)

Omron specializes in AI-powered safety sensor technology, providing real-time hazard detection, dynamic safety zones, and smart diagnostics for industrial automation.

SICK AG (12-16%)

SICK integrates AI-driven muting functions, intelligent zone monitoring, and high-resolution light curtain solutions to ensure precise machine safeguarding.

Rockwell Automation, Inc. (8-12%)

Rockwell Automation offers robust industrial-grade safety light curtains with AI-powered fault detection, real-time safety analytics, and advanced machine integration capabilities.

Banner Engineering Corp. (6-10%)

Banner Engineering provides flexible, high-performance safety light curtains, integrating AI-driven diagnostics and adaptable mounting for enhanced workplace safety.

Other Key Players (30-40% Combined)

Several industrial automation companies, sensor manufacturers, and safety solution providers contribute to next-generation safety light curtain innovations, AI-enhanced hazard detection, and customizable safety configurations. Key contributors include:

The overall market size for the safety light curtains market was USD 1,222 Million in 2025.

The safety light curtains market is expected to reach USD 2,028 Million in 2035.

The demand for safety light curtains is rising due to increasing workplace safety regulations, automation in manufacturing, and the need for advanced machine safeguarding solutions. The adoption of Industry 4.0 technologies and enhanced production efficiency is further driving market growth.

The top 5 countries driving the development of the safety light curtains market are the USA, Germany, China, Japan, and South Korea.

Type 2 and Type 4 Safety Light Curtains are expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Safety Label Market Size and Share Forecast Outlook 2025 to 2035

Safety Bottle Tote Carriers Packaging Market Size and Share Forecast Outlook 2025 to 2035

Safety Towing System Market Size and Share Forecast Outlook 2025 to 2035

Safety Syringe Market Size and Share Forecast Outlook 2025 to 2035

Safety Actuators Market Size and Share Forecast Outlook 2025 to 2035

Safety Needles Market Size and Share Forecast Outlook 2025 to 2035

Safety Laser Scanner Market Size and Share Forecast Outlook 2025 to 2035

Safety Limit Switches Market Size and Share Forecast Outlook 2025 to 2035

Safety Reporting Systems Market Size and Share Forecast Outlook 2025 to 2035

Safety Eyewear Market Analysis - Size, Share, and Forecast 2025 to 2035

Safety Box for Syringe Market Size, Share & Forecast 2025 to 2035

Safety Valve Market Size, Growth, and Forecast 2025 to 2035

Safety Relays Market Size, Share, and Forecast 2025 to 2035

Safety Instrumentation Systems Market – Trends & Forecast 2025 to 2035

Safety Mirrors Market - Growth & Forecast 2025 to 2035

Safety Switches Market Trends – Growth & Forecast 2025 to 2035

Safety Interlock Switches Market Analysis by Actuation Method, Application and End-use Industry and Region 2025 to 2035

Key Companies & Market Share in the Safety Eyewear Sector

Industry Share Analysis for Safety Box for Syringe Companies

Safety and Process Filter Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA