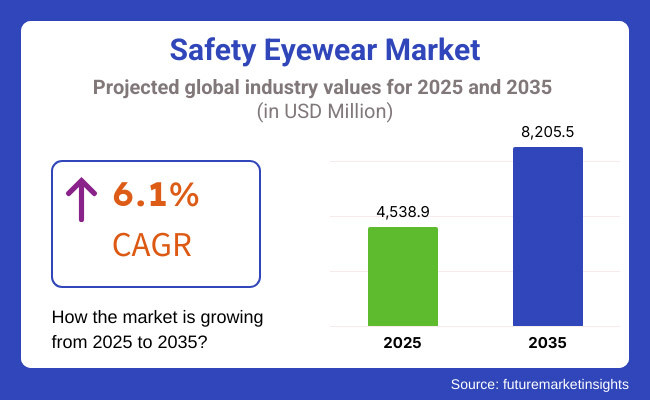

The global safety eyewear market is poised for substantial expansion, increasing from USD 4,538.9 million in 2025 to USD 8,205.5 million by 2035. The market is expected to grow at a CAGR of 6.1% from 2025 to 2035.

Over the past few decades, attitudes towards workplace safety have evolved from a more relaxed attitude to a strict adherence to compliance and standards within the eyewear industry. There has been more introspection amongst employers, employees, and regulatory bodies when it comes to protecting their personnel from occupational hazards.

Also, there are eye injuries that are common across many industries this shift comes about as a result of well-organized efforts such as educational campaigns, safety training programs, and media coverage that throw light on the consequences of ignoring eye protection.

Hence, with an increase in safety measures in the workplace. Industries are, after all, finding comfortable eyewear that will prevent accidents from occurring at the same time giving reassurance to themselves about their workers' welfare.

There have been an estimated 2.3 million occupational injuries or diseases that befall workers every year worldwide. The Bureau of Labor Statistics has recently reported that nearly 70% of eye injuries happen because of flying or falling objects. Those industries which require workers to operate under varying conditions include such fields as construction, manufacturing, and healthcare.

Flying debris, chemicals, infectious agents, and harmful radiation can greatly vary concerning eye safety. This has brought about safety eyewear to take care of these dangers and keep workers safe from harm. This necessitates safety eyewear to counteract these dangers and ensure workers' protection from potential harm.

There have been modifications made when it comes to eyewear, perfect colours, good quality materials, and new designs. Polycarbonate and Trivex are tough yet lightweight which should be used to help offer more eye protection than glass. Additionally, UV rays, glare, and blue light blockage have all progressed beyond expectations.

These improvements have made protective eyewear much more comfortable and enduring. They are now popular in more industries and among different workers. It shows that safety gear is getting better at keeping workers protected and comfy while they work.

Explore FMI!

Book a free demo

The below table presents the expected CAGR for the safety eyewear industry over semi-annual periods spanning from 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 6.7% (2024 to 2034) |

| H2 2024 | 5.7% (2024 to 2034) |

| H1 2025 | 6.9% (2025 to 2035) |

| H2 2025 | 5.2% (2025 to 2035) |

The CAGR exhibits a fluctuating trend, initially increasing by 67 BPS from H1 (2024 to 2034) to H2 (2024 to 2034), indicating stronger growth momentum in the latter half. Further, a slight increase of 69 BPS in H1 (2025 to 2035) suggests temporary market stabilization or external growth.

Growth declines in H2 (2025 to 2035) with a 52 BPS decrease, reflecting renewed demand or industry expansion. This pattern suggests cyclical variations, with stronger growth in the second half of each period, possibly driven by evolving market conditions and strategic investments.

Multifunctional Safety Eyewear is in High Demand

Multifunctional safety eyewear epitomizes the blend of technology and practicality, addressing the diverse requirements of modern workplaces. These glasses surpass conventional eye protection by integrating features. Like, built-in LED lighting provides enhanced visibility in low-light conditions, thus bolstering safety in industries like mining.

Moreover, embedded cameras facilitate photo and video capture. They are very useful in documentation, training and refer-a-friend programs, to promote special communication and information dissemination.

Moreover, Bluetooth connectivity facilitates integration into any device and promotes hands-free operation and improved productivity in areas like construction, and logistics. This convergence of advanced functionalities enhances safety and streamlines workflow processes, leading to more demand.

E-commerce and DIY Culture Rise are Leading to More Revenues

More people are getting involved in recreational activities. As such, manufacturers are providing products that satisfy safety concerns in Do-it-Yourself (DIY) projects. They are launching protective eyewear that is stylish and functional.

The e-commerce boom has made it simpler to buy these products online. With more products to compare and purchase, safety eyewear sales are rising. Review and comparisons help make informed purchasing decisions. Penetration in this industry has thus become easier for players. The ongoing digitalization wave is beneficial for safety eyewear manufacturers in the long run.

Offering Value-added Services and Solutions can be Opportunistic

Beyond merely selling safety eyewear, businesses can capitalize on opportunities by offering value-added services and solutions. These can range from conducting thorough safety assessments and providing training programs to offering maintenance and repair services.

Implementing subscription-based models for recurring purchases further enhances revenue streams. By providing comprehensive eyewear safety solutions tailored to individual customer needs, businesses can cultivate enduring relationships and ensure sustained revenue growth. This approach can expand reach and also enhance customer loyalty through ongoing support and value delivery.

The safety eyewear industry recorded ample sales between 2020 and 2024. Also, these industries record many instances of occupational hazards. Therefore, more stringent regulations are placed on occupational safety and health by the government and regulatory bodies. Consequently, compliance orders for eye protection have prompted a rise in their use.

Technological advances continue to be a driving force in the industry. Product design and utility patents are being filed. It is projected that the market for safety eyewear will rise at a 6.1% CAGR until 2035 due to increased product features and options becoming available.

Future industry growth will rest on environmental sustainability in the coming years. Therefore, concentrating on eco-friendly products may benefit the manufacturers. Supplying niche segments like sports and recreation, fashion, and military markets will increase sales in the years to come.

Tier 1: The leading players in the global safety eyewear market request cutting-edge technology, premium quality products, and strict adherence to safety regulations. They maintain their significant international presence through wide distribution networks, strategic partnerships, and collaborations with key industries such as construction, manufacturing, healthcare, and sports.

R&D is an area where Tier 1 companies daily invest significantly to put into functional protective eyewear advanced properties like anti-fog coatings, blue light filtration, impact resistance, and UV protection into work. Its standing also rests on having adequate adherence to the proposed standards, endorsements from industry insiders, and agency certifications. Tier 1 consists of 3M, Honeywell, Uvex, Bollé Safety, and Pyramex Safety.

Tier 2: Tier 2 players are established in safety eyewear, offering a full suite of reliable and economical eyewear products. Though Tier 1 manufacturers may dominate in global reach, Tier 2 has an appreciable following among varied customers: industrial workers, medical professionals, and outdoor sportspersons.

These companies are focused on cheaper alternatives, comfort, and durability by targeting prescription safety eyewear, tactical goggles, and lightweight protective glasses. They capitalize on online and regional distribution channels that help gain a foothold in the market. Prominent Tier 2 companies include Gateway Safety, Radians, Edge Eyewear, MCR Safety, and Kimberly-Clark Professional.

Tier 3: Tier 3 companies are new entrants who specialize in innovative approaches to customization and niche markets. Some of their specialities include fashion-style safety glasses, eco-compatible materials, and industry-unique safety equipment.

Although they must contend with bigger brands, they win customer loyalty over product quality, targeted marketing campaigns, and direct customer engagement. Many Tier 3 companies are also working with industrial safety specialists, sports teams, and small enterprises to strengthen their position in the market. These include companies like HexArmor, Jackson Safety, Encon Safety, Crossfire Safety Eyewear, and SafeVision.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 4.5 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 3.2 |

| Country | Germany |

|---|---|

| Population (millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 3.8 |

| Country | Japan |

|---|---|

| Population (millions) | 123.2 |

| Estimated Per Capita Spending (USD) | 3 |

| Country | Australia |

|---|---|

| Population (millions) | 26.3 |

| Estimated Per Capita Spending (USD) | 3.5 |

In the USA, the per capita spending on safety eyewear was USD 4.50 per year, which is due to a tightly knit workplace safety regulation and the strong awareness concerning eye protection. In addition, construction, manufacturing, and healthcare are essential sectors where demand for specialized eyewear is becoming a trend.

At USD 3.20 per capita spending, the UK safety eyewear market benefits from occupational safety standards and demand from industries like construction, healthcare, and sports. Increasing urbanization and technological advancements in lens protection boost market growth.

Germany's spending per capita at USD 3.80 is induced by firm support from the industrial sector, where there exists serious interest in workplace safety. Fueling this demand is also a robust durability feature further strengthened by toughened safety standards and innovations in the anti-fog and anti-scratch coatings.

In Japan, per capita spending equals USD 3.00; the items here are mostly qualitative and technologically designed protective eyewear. Rising UV protection, blue light filtering, and industrial safety needs are contributing to the growth of demand for safety eyewear products in these markets.

In Australia, per capita spending is at USD 3.50, largely benefiting from heightened safety awareness across industries such as the construction, mining, and healthcare sectors. Outfitters are responsible for the durable and stylish demand for safety eyewear with outdoor working environments and extreme weather as promoting factors.

| Countries | CAGR (2025 to 2035) |

|---|---|

| France | 9% |

| Italy | 6.9% |

| Spain | 6.7% |

| Germany | 4.3% |

| United States | 3.8% |

The demand for safety eyewear in France will rise at a 9% CAGR until 2034. Urban development projects offer opportunities for safety eyewear manufacturers, particularly wherein the construction and infrastructure sectors are involved.

French fashion culture drives the application of safety eyewear to be stylish, leading designers to work together to collect protection into aesthetics. Besides, demands fostered by the health care and biomedical research growing sectors facilitate development. This boosts market growth enhanced by a sustained rise in demand for specialized safety eyewear for certain professional groups.

Bollé Safety and Uvex Safety Group are prominent in France. These companies focus on advanced materials and designs to improve safety and comfort. They expand their presence in industrial sectors using targeted marketing and distribution.

In Italy, the growth of safety eyewear is forecasted to grow with a 6.9% CAGR until 2035. The evolution of Italian manufacturing towards becoming high-tech boosts the muscle behind the advanced safety glasses. The stylish designs meet fashion status for potential customers, complementing Italy's reputation regarding design excellence.

The focus on sustainability within the nation has propelled the use of eco-friendly materials, now tuned to take on environmentally conscious buyers. The implementation of digitization provides a substantial boost in production efficiency, with Italy positioned at the forefront of innovation in this field.

Luxottica is an old brand in Italy that sells safety eyewear under the paronym of Oakley. The company is very much focused on its quality and innovations to expand its network across the globe.

The sales of safety eyewear in Spain are set to amplify at a 6.7% CAGR till 2034. The focus on sustainability in Spain has increased the demand for eco-friendly safety eyewear. This also pushes manufacturers to go circular economy and join smart manufacturing technologies to increase efficiency and customization.

The growth of the healthcare and biomedical research sectors further fuels the need for specialized safety eyewear capable of protecting against specific hazards.

Remote work, which grew immensely due to the pandemic, also demands protective eyewear solutions. Spain's dream for innovation, sustainability, and adopting a new work setup makes Spain a key player in the market.

| Segment (Product Type) | CAGR (2025 to 2035) |

|---|---|

| Safety Glasses | 5.3% |

The safety glasses segment made its major share in the safety eyewear industry market in 2024, as the lenses are more usable across all industries. They give commendable protection against several threats, like impact and chemicals. These glasses steadily lend themselves to comfort in their fit and feel, promoting long-term use and compliance with safety regulations, therefore minimizing the chances of workplace injuries.

Advanced lens technologies ensure clear vision, which is important for safety and productivity. Stylish designs of safety glasses increase wearer acceptance and confidence, while the highest safety standards ensure dependability. Safety glasses may be had at a low but durable cost; hence they provide long-term value, which leads to high visibility in widespread acceptance of using safety glasses as a path toward eye protection in some industries.

| Segment (Lens Type) | CAGR (2025 to 2035) |

|---|---|

| Polycarbonate Lenses | 5.7% |

The polycarbonate lens segment has captured the largest share in 2024. Polycarbonate has a few advantages, which has a higher impact-resistant lens. With superior optical clarity and no distortion, polycarbonate allows greater safety and productivity under various illuminating conditions. The properties of polycarbonate lenses provide resistance against UV rays as well as scratches; they are strong and abrasive resistant.

These reduce the risk of prolonged skin exposure due to poor working conditions and very high workwear standards for construction fields and healthcare.

The safety eyewear segment is competitive with major established players like Honeywell, 3M, and UVEX Safety making use of their brand recognition and considerable problems concerning R&D. However, certain niche firms like Pyramex Safety Products and Gateway Safety started to take a certain vertical with a specific emphasis on customization and flexibility.

Competition is centred on pricing, differentiation, and regulatory compliance, with disruptive factors such as technology improvements and digitalization influencing the industry.

Recent Industry Developments

The market is expected to grow at ~6.1% CAGR between 2025 and 2035.

The industry stood at USD 4,538.9 million in 2025.

The market is projected to reach USD 8,205.5 million by 2035.

South Asia is expected to grow at an 8.5% CAGR during the forecast period.

Major players Honeywell, 3M, UVEX Safety, Bolle Safety, MSA Safety, and Kimberly-Clark Corporation among others.

Safety Glasses and Others are the key segments driving market growth.

The lens type segment is segregated into Polycarbonate Lenses and Others.

The market spans across North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and the Middle East & Africa.

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.