The safety box for syringe industry is experiencing substantial growth due to increasing demand from healthcare, pharmaceutical, and biomedical sectors. The market is driven by the need for safe disposal of used syringes, compliance with strict medical waste regulations, and growing awareness of infection control.

Companies focusing on sustainability, cost-effectiveness, and innovative safety box designs are gaining a competitive advantage in this evolving sector.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

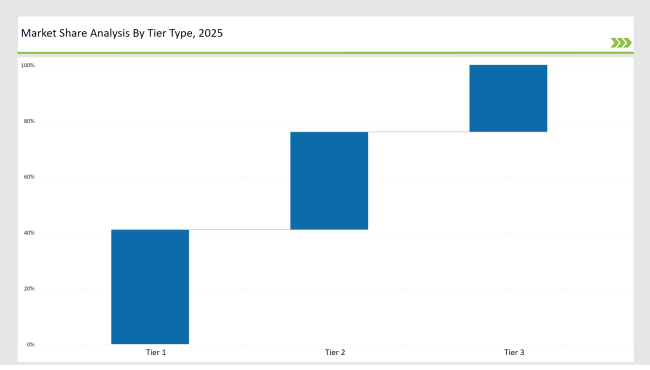

Tier 1: Leading companies, including BD (Becton, Dickinson and Company), Terumo Corporation, and Sharps Compliance, hold 41% of the market share. These firms leverage advanced safety technologies, regulatory compliance expertise, and global distribution networks.

Tier 2: Mid-sized players such as Cardinal Health, Medtronic, and Daniels Health account for 35% of the market. They specialize in cost-effective and customizable safety box solutions for healthcare institutions and waste management companies.

Tier 3: Regional and niche manufacturers hold 24% of the market, focusing on specialty safety boxes such as biodegradable options, high-capacity containers, and customized designs for specific medical applications.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (BD, Terumo, Sharps Compliance) | 17% |

| Rest of Top 5 (Cardinal Health, Medtronic) | 13% |

| Next 5 of Top 10 | 11% |

The demand for safety boxes for syringes is influenced by various industries

Manufacturers are innovating to offer specialized solutions

Leading manufacturers have driven innovation with sustainable materials, tamper-proof designs, and compliance-enhanced solutions.

Year-on-Year Leaders

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

To stay competitive in the safety box for syringe industry, suppliers should focus on sustainability, automation, and customization. Key strategic areas include:

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | BD, Terumo Corporation, Sharps Compliance |

| Tier 2 | Cardinal Health, Medtronic, Daniels Health |

| Tier 3 | Henry Schein, EnviroSafe, SafePoint |

Leading manufacturers continue to invest in sustainable materials, advanced processing technologies, and improved safety features.

| Manufacturer | Latest Developments |

|---|---|

| BD | Introduced next-gen durable and eco-friendly safety boxes (March 2024). |

| Terumo Corporation | Launched biodegradable syringe disposal solutions (August 2023). |

| Sharps Compliance | Developed high-capacity safety boxes for hospitals (May 2024). |

| Cardinal Health | Focused on cost-effective safety box production (November 2023). |

| Medtronic | Optimized designs for secure and easy handling (February 2024). |

Sustainability, durability, and efficiency are shaping the safety box for syringe industry. Leading brands are leveraging these factors to maintain market leadership:

The safety box for syringe industry is expected to progress towards more sustainable and technologically advanced solutions. Key focus areas include:

Safety boxes provide a secure, tamper-proof, and compliant disposal solution that minimizes infection risks.

Many manufacturers are incorporating biodegradable materials and developing recyclable safety boxes to reduce waste impact.

Advances include smart tracking, tamper-proof designs, and AI-driven quality control to ensure compliance and efficiency.

Explore Packaging Formats Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.