The Rx-to-OTC switches market is going through a significant growth phase because consumers now show a hike in the demand for self-medication, and due to regulatory approval that allows prescription drugs to enter OTC availability. Some of the key players in the market are GlaxoSmithKline plc., Sanofi, and Johnson & Johnson, which together accounts for around 46.60% of the total market share.

These companies are able to lead the market through significant R&D, brand value, and strategic collaborations. Other contributors include AstraZeneca and Merck KGaA, which hold another 25.0% share of the market, focusing on expansion in consumer health and innovative product formulation.

| Attribute | Details |

|---|---|

| CAGR (2025 to 2035) | 5.0% |

Emerging and middle-tier players, many of whom are regional pharmaceutical firms, gain market share based on the introduction of low-cost and alternative OTC solutions. Market growth is poised by increased healthcare awareness, consumer preference for over-the-counter medications, as well as improved access through e-commerce and retail pharmacy channels. Technological advances in digital health solutions and online medical consultations further fuel the demand.

To make the transition of Rx to OTC smooth, manufacturers are focusing on regulatory compliance, formulation safety, and education of the consumer. The government initiatives, encouraging increased access of drugs over the counter, in addition to an increase in self-medication, is expected to propel this industry into the future.

Explore FMI!

Book a free demo

| Global Market Share | Industry Share % |

|---|---|

| Top 3 (GlaxoSmithKline plc., Sanofi, Johnson & Johnson) | 46.6% |

| Top 5 (GlaxoSmithKline plc., Sanofi, Johnson & Johnson, AstraZeneca, Merck KGaA | 71.6% |

| Chinese Suppliers (Hansoh Pharmaceutical Group Company Ltd, Shanghai Fosun Pharmaceutical and others.) | 13.4% |

| Regional & Niche Players | 15.0% |

The Rx-to-OTC switches market exhibits a moderate level of concentration, with leading players collectively accounting for approximately 46.60% of the total market share. This dynamic reflects the dominance of a few key players who leverage their strong product portfolios, extensive distribution networks, and established brand reputations to maintain their competitive edge.

The base was provided by increased prevalence of seasonal allergies and preference of the consumers for quick relief administration rather than long-term treatments. Other classes include anti-smoking drugs and anti-allergen drugs. Increasing knowledge about the importance of allergy management, well-formulated antihistamines, superior decongestant combinations, and so on are factors which increase the demand for these drugs.

Gastrointestinal drugs are the ones that are growing steadily with increasing incidence of acid reflux, indigestion, and issues connected with the gut health. Smoking cessation products are also on the upswing due to strong public health promotion efforts, the use of nicotine replacement therapy, and the rising consumer's intent to quit smoking with readily available OTC options.

The presence of in-store consultations and guidance on OTC medications continues to drive sales through brick-and-mortar locations. Online pharmacies are rapidly expanding, capturing 21.4% of the market as consumers shift towards digital health solutions and convenient home deliveries.

The surge in e-commerce platforms offering detailed product descriptions, customer reviews, and subscription-based refills is making online sales a dominant trend. Hospital and drug stores also contribute significantly, serving as trusted locations for OTC purchases, particularly for chronic and post-prescription medication transitions.

GlaxoSmithKline (GSK)

GSK continues focusing on in-demand therapeutic categories through brands like Flonase-allergy relief, and Tums-digestive health. This will make GSK more competitive through direct marketing to the consumer, educating the consumer, and creating digital engagement and brand loyalty initiatives.

GSK invests in product innovation in order to improve the drug's formulation for enhanced bioavailability and to reduce side effects so that the consumer can adhere to the maximum level. The company is also enhancing the availability of its OTC portfolio in emerging markets through strategic collaborations with healthcare providers and regulatory bodies, thereby increasing accessibility and fostering sustained market growth.

Sanofi

Sanofi stands out in allergy relief and digestive health, with a focus on innovative drug formulations and strategic retail partnerships. The company is focused on developing OTC treatment options by introducing novel drug delivery systems, such as chewable tablets and liquid gels, that can enhance compliance in patients.

Sanofi thoroughly researches and tests its Rx-to-OTC switch products through extensive research and clinical trials to ensure efficacy and safety. Moreover, strong collaboration with pharmacies and healthcare providers helps Sanofi improve its channels of distribution and maximize consumer reach, thus it remains a dominant player in the OTC pharmaceutical market.

Johnson & Johnson

The company remains a leader in the OTC medication market by investing heavily into consumer health products and brand extensions. Its Rx-to-OTC transitions, especially in pain relief and allergy categories, guarantee sustained market share. The company emphasizes using vast R&D activities to improve the efficacy and safety of its products so that a patient transitioning from prescription to OTC would have no issues.

Johnson & Johnson also emphasizes worldwide access through effective distribution networks, thus making its self-care products more accessible. As they believes in innovation and development, so looking into more advanced formulations like extended-release analgesics and combination therapies to effectively meet the needs of changing consumers.

AstraZeneca

Prescription drugs that can be marketed over the counter because of the Rx-to-OTC switch process further improve access to the market and the capacity to generate revenues. Due to the rising cost of health care, today there is a high demand for self-medication by people.

Companies like AstraZeneca consider some or all products that have been established in safety profiles, but the process requires regulatory challenges and competition. AstraZeneca, being a prescription drug company for long, will try to find space in OTC market to be aligned with consumer empowerment movement and preventive health care, thus in line with strategic choices and market forces.

Merck

Merck KGaA was involved in Rx-to-OTC switches because it developed prescription drugs into over-the-counter products to become more accessible to the public. Though this comes with its benefits, such as better patient access, cost savings, and differentiation in the competitive market, hurdles include regulatory restrictions, effective marketing and education, and competition. The companies have to navigate these areas carefully to thrive in the emerging pharmaceutical landscape.

Growth in Online Pharmacies

E-commerce and digital health solutions are rapidly changing the sale of OTC drugs. Online is becoming a preferred choice among consumers because it is convenient, accessible, and offers personalized suggestions. AI health tools further refine the digital experience of pharmacies for consumers to use the right OTC products.

Retailers continue to increase subscriptions and loyalty programs to increase interaction, and approvals from regulatory authorities are opening more avenues for a wider range of medications to be sold online.

Growth of Self-Care Trends

Consumers increasingly seek OTC options to deal with minor health conditions independently. Growing awareness about preventive healthcare, combined with credible online medical information, has boosted demand for self-care solutions. Companies are reacting by developing clear-labeled, improved formulations, and digital companion tools to support consumers in managing medication adherence and symptom tracking.

Regulatory Approvals Driving Market Expansion

The government policies and streamlined regulatory procedures are fast-tracking the transition of Rx-to-OTC products. The health agencies are ensuring that a drug goes through the transition process with no compromise on safety and efficacy while it remains under prescription.

The streamlined approval procedures promote faster access to OTC products, thus widening consumer choices. Pharmaceutical companies are also engaging in public education campaigns to encourage responsible self-medication, thus supporting the growth of the market. Make your text human

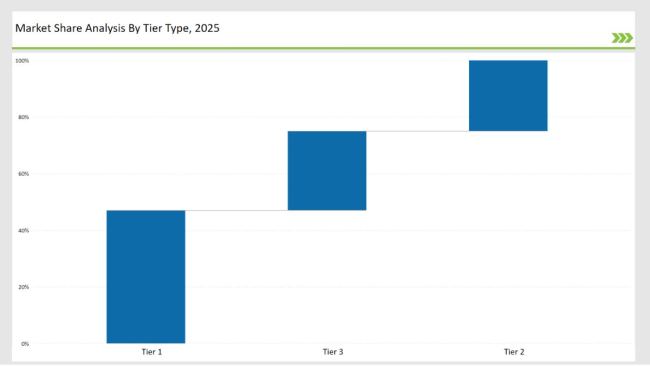

| Tier | Market Share (%) |

|---|---|

| Tier 1 (GlaxoSmithKline plc., Sanofi, Johnson & Johnson) | 46.6% |

| Tier 2 (AstraZeneca, Merck KGaA, Bayer AG) | 25.0% |

| Tier 3 (Regional & Emerging Players) | 28.4% |

| Company | Unique Initiative |

|---|---|

| GlaxoSmithKline | Leveraging advanced analytics to identify potential Rx-to-OTC candidates and enhance consumer education through digital platforms. |

| Sanofi | Prioritizing dual-action formulations to address multiple symptoms, driving innovation in OTC product development. |

| Johnson & Johnson | Expanding the portfolio of self-care solutions by focusing on natural and sustainable ingredient-based OTC products. |

| AstraZeneca | Strategically transitioning prescription-only medications like Nexium to OTC status while emphasizing global regulatory compliance. |

| Merck KGaA | Innovating within niche therapeutic areas to develop first-in-class OTC solutions and ensure regulatory adaptability. |

| Bayer AG | Investing in consumer health platforms and launching comprehensive wellness campaigns to drive OTC adoption. |

| Boehringer Ingelheim | Transforming animal health solutions into human-focused OTC opportunities while maintaining strong R&D investments. |

| Bausch and Lomb | Innovating ophthalmic products, introducing preservative-free OTC eye drops to cater to sensitive eyes. |

| Alcon | Expanding into OTC dry eye treatment markets with unique formulations like advanced artificial tear products. |

| Pfizer | Driving accessibility by converting key prescription medications into affordable OTC products through global collaborations. |

| Galderma SA | Introducing OTC dermatology treatments tailored to sensitive skin and supported by dermatologists for consumer trust. |

| Arbor Pharmaceuticals | Diversifying its portfolio with pediatric-focused OTC solutions, ensuring safety and efficacy for young patients. |

Investment in Digital Marketing & E-commerce

Digital marketing & e-commerce Suppliers need to invest more in online sales platforms and digital engagement to attract the ever-increasing online consumers. The increased use of e-commerce platforms, AI-driven recommendation engines, and mobile health applications is giving opportunities for a personal experience of a customer, making the consumer even more confident of OTC products. The investment in SEO, targeted advertising, and social media engagement would also help increase their reach and thereby sales.

Expansion into Emerging Markets

Penetration into Emerging Markets, increasing access in developing regions provides new growth prospects for the adoption of OTC drugs. Regulatory progress and government-sponsored health programs open self-care medications up to accessibility. Companies must partner with the healthcare community, adopt unique pricing plans, and also create marketing services that respond to the needs of an ever-diverse target audience of such regions.

Enhancing Consumer Education & Awareness

Thorough guidance on self-medication and safe OTC usage will strengthen consumer trust and drive demand. Educational campaigns, interactive packaging with QR codes that lead to educational videos, and pharmacist-led consultations can further improve consumer understanding. AI-powered chat bots and telehealth services can further bridge the gap, giving consumers an informed choice while adopting safe and effective self-care practices.

AI-Powered Consumer Health Platforms

AI-driven health tools will provide personalized OTC recommendations and virtual consultations, enhancing consumer confidence and decision-making. These tools leverage machine learning algorithms to analyze individual health profiles, past purchases, and symptoms, offering tailored suggestions. Additionally, AI-enabled chatbots and virtual pharmacists provide real-time assistance, ensuring informed self-care decisions.

Sustainable Packaging & Eco-Friendly Solutions

Most businesses are aligning with customer sustainability preferences, which include biodegradable products, minimum use of plastics, and recyclable packaging. innovations concerning sustainable processes in production lead to a minimum carbon footprint for the business and encourages responsible consumption of the product from consumers, which enhances demand from environmentally concerned customers who see their purchases as sustainable.

Innovative Drug Formulations & Delivery Systems

Innovative Drug Formulations and Delivery Systems will result from Over-the-Counter drug formulations with the expectation of increased use of dissolvable tablets, extended-release formulations, making it easier for patients to take their medicines. Newer delivery systems include transdermal patches and sublingual strips which increase faster absorption with better bioavailability.

Pharmaceutical companies will also continue to work on improvement in the areas of taste and easing the administration, child-resistant packaging which makes the product accessible and consumer-friendly to a wider range of consumers.

The global Rx-to-OTC switches industry is projected to witness CAGR of 5.0% between 2025 and 2035.

India is set to record the highest CAGR of 8.9% in the assessment period.

The key players operating in the global Rx-to-OTC switches industry include GlaxoSmithKline plc., Sanofi, Johnson & Johnson, Astrazeneca, Merck KGaA, Bayer AG, Boehringer Ingelheim, Bausch and Lomb, Alcon, Pfizer, Galderma SA, and Arbor Pharmaceuticals.

Dental Air Polishing Device Market by Product, Price Range, Application, Modality, End user and Region - A Forecast for 2025 to 2035

Submucosal Lifting Agent Market Segmentation based on Product Type, End Use, Application and Region: A Forecast for 2025 and 2035

Exophthalmos Treatment Market – Demand & Innovations 2025 to 2035

Filariasis Treatment Market - Demand, Innovations & Outlook 2025 to 2035

Eisenmenger Complex Management Market – Growth & Trends 2025 to 2035

Fecal Pancreatic Elastase Testing Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.