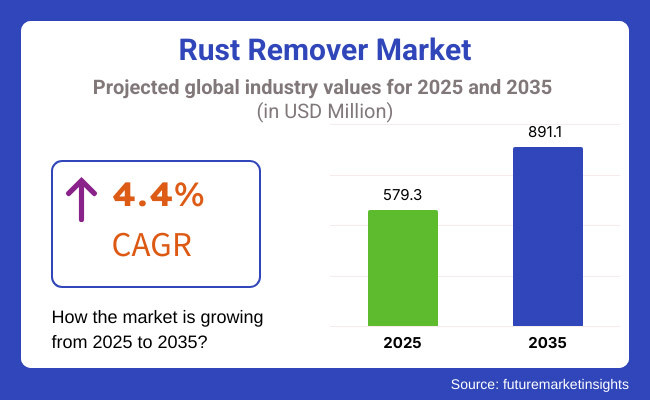

The rust remover market is projected to grow steadily over the next decade, driven by increasing industrial applications, infrastructure maintenance, and advancements in eco-friendly formulations. The market size is expected to reach USD 579.3 million in 2025 and expand to USD 891.1 million by 2035, reflecting a CAGR of 4.4% over the forecast period.

The rising demand from industries such as automotive, construction, marine, and manufacturing is expected to propel market growth. Stringent environmental regulations are encouraging the development of biodegradable and non-toxic rust removal solutions, further shaping the industry landscape.

The growing awareness of the economic effects of rust and corrosion is another factor that encourages the expansion of the market since enterprises demand budget-friendly maintenance techniques to reduce the delay of the machine, vehicle, and building life span. The rapid increase of research and development projects is also leading to ground-breaking rust removal techniques that are not only faster but also much safer. Besides the very fact that the requirement for DIY rust removers is mostly on the increase, the home appliances sector is also developing the market further.

The trend of the rust remover market is towards a more ecological and energy-efficient option. Acid-based rust removers traditionally used are now being replaced by bio-based and water-based formulas that are not only cost-effective but also are the best for environmental safety. Further, the automotive sector, in which rust removal and maintenance are critical factors in vehicle life, is another factor to the market for rust removers. The effect of partial refurbishment and maintenance of old infrastructures, particularly in high humidity and saline regions, is the need for effective rust treatment solutions.

The stride in nanotechnology has also gotten a seat in the game, and the market spaced out is in on the birth of high-class rust removers that will extend the protection effects even more. The tightening of workplace safety regulations is an additional reason that is pushing the shift to eco-friendly means as industries are forced to replace the rust removers with one that has less toxic smartness.

Explore FMI!

Book a free demo

The maintenance of strong industrial and infrastructure facilities propels the North American rust remover market. The USA takes the lead in the region, where the automotive, aerospace, and construction sectors are driving the demand. The stringent environmental regulations enforced by the Environmental Protection Agency (EPA) are encouraging manufacturers to opt for the eco-friendly and non-toxic routes. The maritime sector is also seeing the growing application of rust removers, especially in the coastal regions, which is a significant driving factor behind it.

The rising consumer consciousness regarding vehicle' care and DIY rust remover products is elevated in the retail segment. Investments in new nanotechnology-based solutions for corrosion protection and surface treatment are also contributing to the changing market trends. Prominent industry players and ongoing technological improvements in corrosion control are additional drivers for market growth.

The European rust remover market is witnessing vigorous growth owing to its dynamic manufacturing and automotive sectors. Countries such as Germany, France, and the United Kingdom hold the top position in the fight against industrial corrosion, with an increasing transition to sustainable and biodegradable rust removers. Imposing restrictions under the European Chemicals Agency (ECHA) to prevent environmental damages from hazardous chemicals are endorsing the water-based and bio-based solutions.

The infrastructural maintenance sector is a major force in the region's industrial development, as it focuses on the rehabilitation of decayed railway lines and bridges. Besides, the increasing burst demand for circular economy principles also plays a vital role in promoting long-term protective rust removers that feature recyclability. An expansion in the marine and offshore industries, particularly in Nordic countries, is another element that affects the market with progress.

The Asia-Pacific rust remover market is experiencing the fastest growth, fueled by rapid industrialization and infrastructure development. In the spotlight are countries like China, India, and Japan, which are leading the way with growing demand from the automotive, construction, and shipbuilding sectors. With the region's manufacturing sector growing, the need for rust prevention and removal solutions has increased dramatically, especially in industries such as metal fabrication and machinery production.

Government infrastructures undergo modernization due to the person's Smart Cities Mission of India and the Belt and Road Initiative of China, adding fuel to the causes. The developing initiatives on sustainability are bound to generate the invention of eco-friendly rust removers. The other edge of the coin is that the market is growing with the increase of foreign manufacturers while the do-it-yourself consumer-grade rust removal products are becoming more widely available.

The rust remover market in the rest of the world, including Latin America, the Middle East, and Africa, is steadily growing due to rising industrial and construction activities. The automotive and oil & gas sectors are the main drivers of demand, with Mexico and Brazil being the leading contributors in Latin America. The Middle East is facing high demands for advanced rust protection solutions in marine, construction, and energy sectors as the climate is harsh and causes corrosion at a higher rate.

The African market is also expanding due to the construction of more infrastructure projects and the need for industries to obtain more cost-efficient solutions, which in turn increases equipment longevity. As long as the introduction of eco-friendly rust removers rolls out gradually along the regulatory frameworks developers and industrial safety standards strictness, people will get more acquainted with the idea of applying it.

Challenges

Environmental and Regulatory Constraints

The increasing regulatory restrictions on chemical-based rust removers due to their environmental and health risks are the biggest problem in the rust remover market. Many of the old rust removers include strong acids, phosphates, and volatile organic compounds (VOCs) that pose hazards to the users and environment both. The Environmental Protection Agency (EPA) of the USA and the European Chemicals Agency (ECHA) are two of the regulatory bodies that are laying down stringent guidelines on substance usage and disposal.

Consequently, manufacturers are left with the only option of investing in the development of biodegradable, non-toxic alternatives which on the other hand may increase their production costs. Again, the need to comply with different rules and regulations in different regions makes it difficult for the companies to expand. As a result, certain formulations are not available in some regions.

High Raw Material Costs and Supply Chain Disruptions

The continuing battle for the rust remover market is caused by the price fluctuations of vital raw materials such as acids, chelating agents, and specialty chemicals. Fluctuations in the cost of raw materials are tied to the condition of the global market, including supply chains, trade policies, and political stability, and lead to price variations that are hard to foresee. Also, supply chain routing issues such as those due to pandemics, bottlenecks in transportation, or trade restrictions can cause shortages and lead to higher production costs, too.

For the most part, small and medium-sized manufacturers are the most affected as they have difficulty keeping their profit margins stable. Such manufacturers are seeking other options and formulating plans to switch to raw materials from local suppliers along with implementing modern production practices, which, if useful, will lower the use of such raw materials.

Opportunities

Growing Demand for Eco-Friendly and Biodegradable Rust Removers

The trend of sustainability and environment-friendly practices has driven the development of eco-friendly rust removers significantly. Both the industry and the consumers are moving away from acid-based and solvent-based formulations due to the dangers of health and environmental hazards; this is the main reason for the switch. Thus, manufacturers are now ventilating the need for biodegradable, water-based, and bio-derived rust removers, which extremely effectively remove corrosion while ensuring that both the user and the environment stay safe.

The governments and environmental NGOs are also promoting the innovations of green chemistry and are providing incentives to companies engaged in sustainable product development. So, businesses will seek to stand in line with their CSR goals, and the use of non-toxic, VOC-free rust removers will be taken across many sectors, such as automotive, marine, and industrial maintenance.

Rising Industrialization and Infrastructure Development in Emerging Markets

Rapid industrialization and infrastructure expansion in emerging economies, particularly in Asia-Pacific, Latin America, and Africa, are driving demand for rust removal solutions. Countries like India, China, and Brazil are investing heavily in the construction, transportation, and manufacturing sectors, increasing the need for corrosion control products. The expansion of rail networks, highways, and bridges in these regions is boosting the market for rust removers used in maintenance and restoration.

The growth of industries such as shipbuilding, metal fabrication, and automotive manufacturing presents lucrative opportunities for rust remover manufacturers. As more businesses and government agencies focus on cost-effective maintenance to extend the lifespan of assets, the demand for efficient rust removal and prevention solutions is expected to surge.

The rust remover market has seen significant growth from 2020 to 2024, driven by increasing industrial applications, infrastructure maintenance, and rising consumer awareness regarding corrosion prevention. The adoption of eco-friendly and biodegradable rust removers has gained traction due to stringent environmental regulations.

Industries such as automotive, construction, and marine have contributed to the steady demand for rust removal solutions. Looking ahead to the period of 2025 to 2035, advancements in nanotechnology, the rise of sustainable formulations, and enhanced automation in rust removal processes are expected to redefine the market dynamics.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Framework | The impact of global warming has triggered the need for the use of eco-friendly products in rust removers. Regulations like REACH and the guidelines of the EPA were the motivation for the shift to the use of less toxic solutions. |

| Tech Innovations | CEO of the company stated that science was responsible for the creation of acid-free and biodegradable rust removers, together with gel-based solutions for better adhesion. |

| Sector-Specific Demand | Automotive, marine, and industrial maintenance were the main drivers of the rust removers market. |

| Sustainability & Circular Economy | The first initiatives of the company are the promotion of green chemistry and the use of sustainable packaging in rust removal products. |

| Market Growth Factors | High urbanization rate, growing industries, and the surge in maintenance of existing infrastructure were the main factors growing the market. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Framework | Enforcement of stricter environmental policies will lead to the phenomenal obsolescence of conventional solvent-based rust removers. Legislative structure will probably cover the ban of old-style acidic rust removers. |

| Tech Innovations | New technologies involving nanotechnology and AI-based applications will permit the most efficient and selected removal of rust. Smart materials that repair themselves will less often require reapplication. |

| Sector-Specific Demand | Implementation in aerospace, renewable energy infrastructure, and precision engineering industries would be the trigger that will deliver more rust removers into the market. |

| Sustainability & Circular Economy | Broader adoption of zero-VOC (Volatile Organic Compounds) emitters and recyclable packaging. Circular economy will introduce the practices of reusability and waste reduction. |

| Market Growth Factors | Smart manufacturing, the transition of cleaning programs to robots, and the use of green alternatives will be the top drivers of the market. |

The rust remover sector in the USA is projecting a normal promoting year with the backing of industrial progress, infrastructure care, and new rules on the management of corrosion. The sectors of automotive, aerospace, and construction are major players, needing efficient solutions to extend the lifetime of the devices. The switch to ecological and biodegradable rust removers is gaining ground, thanks to the increasing concern for the environment and the stricter laws that have to be followed.

Furthermore, the industrial needs for rust removers are particularly met in the manufacturing and marine sectors, which is additional proof of the market's durability. The governmental conditions for the USA to ensure structural upgradient and infrastructure digital copies through investment in various minor restoration projects also grow the manufacturer's capacity. Meanwhile, the development of new formulas in chemical production causes the industry to turn to high-gain, non-toxic products.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.7% |

The United Kingdom's rust remover market is experiencing moderate but steady growth, driven by demand from industrial maintenance, maritime, and construction sectors. With an aging infrastructure, rust removal solutions are essential for maintaining buildings, bridges, and transport systems. The UK’s severe environmental regulations work as a catalyst for the switch to low-VOC and biodegradable rust removers being adopted. With the cooperation of the automotive industry, where the producers and service providers call for effective rust treatment options, it is the performance of the manufacturers that is, indeed, at the forefront of the market.

The restoration of historic buildings is, furthermore, the boost in the market since these preservation projects usually involve particular rust removers. The challenges caused by the economic uncertainties are countered with the achievements made by corrosion-resistant technology, and the market growth for the long term is expected to be aided by the demand for solutions that are environmentally friendly.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.2% |

The European Union's rust remover market is shaped by stringent REACH regulations promoting eco-friendly corrosion control solutions. The primary sectors of automotive and heavy machinery are the driving forces behind the need for high-performance rust removers used in maintenance and manufacturing processes. The water-based and biodegradable formulations from the development of sustainability-centered products are indicative of the EU green initiatives. Industrial and marine applications are other market contributors, especially in countries with dense manufacturing bases.

The application of automation in rust removal processes is an additional factor stimulating the market's growth. Short-term demand may face challenges due to economic uncertainty, while infrastructure projects and advancements in green chemistry drive long-term development.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.3% |

Japan’s rust remover market is a unique mix of cutting-edge techniques, high maintenance standards, and inherent industrial demand. Within the automotive and electronics sectors, the main consumers need precise rust removal for their components. Furthermore, Japan’s broad maritime and shipbuilding industries depend on rust prevention and treatment systems for longevity. The pursuit of non-toxic, high-performance rust removers is the main reason for both the growing non-toxic trend and the ongoing issue of strict environmental policies.

Industrial automation and robotics are also integrating rust removal technologies, improving efficiency and reducing labour costs. Even though Japan’s aging population may affect commodity availability in a number of sectors workforce, the innovative and sustainable solutions drive the market for the whole period of the forecast.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.0% |

The South Korean rust remover market is on an upswing, propelled by the vigorous industrial sector, which includes shipbuilding, automotive manufacturing, and heavy industries. The constant influx of high-quality equipment and machinery that is exported from the nation has increased the demand for efficient rust removal methods. Changes in the environmental regulations are directing the use of eco-friendly, water-based rust removers and inspiring new developments in this sector.

The shipbuilding sector, a major player, seeks to improve the lifespan of the vessels by using rust-resistant solutions. Meanwhile, the commuters' investments in the fixing of infrastructure and the creation of new streets reinforce the regular rust removal and corrosion prevention requirement.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.5% |

Acid Rust Removers Dominate the Market Due to Their High Efficacy

Acid rust removers, mainly phosphoric and hydrochloric acid-based formulations, are at the forefront of the market due to their unparalleled capacity to quickly remove major corrosion damage. They are commonly utilized in different sectors of industries, such as metal fabrication, automotive restoration, and construction. They are the number one option in the treatment of iron and steel surfaces, which is why these are the most often used in different maintenance and repair operations.

Nevertheless, the severe safety regulations on hazardous chemicals and environmental impact issues constitute the main threat to their market advancement. The development of green formulations, which also have inhibitors, is a beneficial approach to deal with the questions of the safety of workers and, at the same time, to hold the market demand.

Neutral Rust Removers Gain Traction for Safer Applications

Neutral remove rusts based on chelating agents or organic compounds, which are trending thanks to the fact that they are user-friendly and safe for the environment. Unlike acid-based counterparts, they do not undermine metals or emit vapours therefore they are suitable for consumers or even in delicate applications like car restoration and maintenance of machinery. They are more and more used in aviation, marine, and electronic as safety-oriented industries.

Regulatory factors setting sustainability issues, such as non-toxic, biodegradable solutions, are also vital in their demand. The flying adoption of the neutral rust removers is done in North America and Europe but the awareness and the start of the shift to the safest chemical distribution in the manufacturing and maintenance industries spring the seeds of growth concerning sales in Asia-Pacific.

Automotive Industry Drives Significant Demand for Rust Removers

The major outlet for rust removers is the automotive industry, which implements them in the maintenance, restoration, and manufacturing of vehicles. Rust removal is important for the protection of vehicle frames, undercarriages, and engine parts that are, time after time, left in a moist environment or with road salts. Acid and neutral rust removers are the most common products used at car repair facilities and detailing companies to protect the life of the cars.

The growing trend of classic car restoration, along with the increasing number of vehicles on the road, are the major contributors to the market rise. North America and Europe have a strong automotive repair culture, where vehicles are regularly maintained, while the Asia-Pacific region, and especially China and India, are experiencing the automotive market boom with the production and awareness of vehicles. The transition from traditional rust removers to eco-friendly ones is in line with the ruling emission and waste disposal laws of developed markets.

Oil and Gas/Petrochemical Industry Relies on Rust Removers for Infrastructure Maintenance

The oil and gas sector benefits immensely from the rust removers in pipelines, drilling machines, and storage containers, which are greatly affected by environmental damage from moisture and chemicals. Acid and alkaline rust removers are widely used for structural integrity and to extend the life of equipment. The industry's high-level safety regulations, as well as costs related to injuries from corrosion, create a strong need for effective solutions for rust disposal.

The keys in the sector include the Middle East, North America, and Russia, which have built a strong oil and gas base. Innovations like corrosion inhibitor flushers that provide the target of minimum waste and prolong the usage of equipment down the line assure the sustained market increment.

The Rust Remover Market is a niche in terms of rapid growth; it is linked to the overall demand for different industries (Buyers) such as automotive, construction, marine, and industrial manufacturing. Technological innovations in eco-friendly and biodegradable rust solutions, alongside a rising emphasis on corrosion inhibition and sustenance effects, are the primary forces driving the market.

Sustainability, new formulations, and cost-effective solutions are some of the areas that key players are focusing on to grab a competitive advantage. Mergers and acquisitions, as well as geographical areas the company's leaders are entering, are the central forms of the market that are also consolidating.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Henkel AG & Co. KGaA | 12-17% |

| The 3M Company | 10-14% |

| WD-40 Company | 8-12% |

| Evapo-Rust | 5-9% |

| Corrosion Technologies | 3-7% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Henkel AG & Co. KGaA | Offers industrial rust removers with biodegradable and eco-friendly solutions. Focuses on high-performance coatings and automotive applications. |

| The 3M Company | Provides rust removal sprays, abrasives, and corrosion-resistant coatings. Invests in sustainability and industrial maintenance solutions. |

| WD-40 Company | It is well-known for its multi-use lubricant and rust prevention products. It focuses on the household, automotive, and industrial segments. |

| Evapo-Rust | Specializes in non-toxic, water-based rust removers. Targets environmentally friendly applications in automotive restoration and industrial maintenance. |

| Corrosion Technologies | Develops specialized corrosion protection solutions for marine, aviation, and military applications. |

Key Company Insights

Henkel AG & Co. KGaA

Henkel AG & Co. KGaA is an industry giant known globally, and it is the leader in the industrial sector, especially in the automotive, aerospace, and metalworking industries. The company is a strong proponent of green and biodegradable rust removal solutions parallel to earth environmental projects. Henkel increasingly grows a line of products through research, development (R&D), and acquisition of companies.

By having the main concern on innovation, they created cutting-edge coatings, which are resistant to deterioration, and also they use fewer resources. The company covers all parts of the world with a reliable supply chain network, thus assuring customers of the product's availability and satisfaction. The promotion of environmentally friendly practices and performance-driven products is what keeps Henkel atop the rust remover market.

The 3M Company

The 3M Company operates as a diversified manufacturer and has a strong market position in rust removal and corrosion protection systems. The company has a wide range of rust-removing products, including industrial-grade solutions, sprays, and coatings that resist corrosion. 3M is dedicating a lot to research and development in order to create new technologies for surface protectio,n such as nanotechnology-based corrosion inhibitors.

The company's plan for growth includes working with industrial maintenance firms to implement its products in larger corrosion prevention systems. 3M is also doing its part for the environment by designing new rust removers that are less harmful to the environment but still efficient. By implementing avant-garde technology and high-level expertise, 3M holds a firm grip on the rust removal market.

WD-40 Company

WD-40 Company is a company known globally for its multi-purpose lubrication and rust removal solutions. The company is already a strong player in the automotive, manufacturing, and marine sectors, where rust prevention and maintenance are of utmost importance. WD-40 has broadened its palette to include specialized rust removers made for heavy-duty and industrial applications.

The company does not simply focus on product diversification and brand expansion but rather on ensuring that the offered solutions fit both the commercial and household markets. Through a robust retail and distribution network, WD-40 globally ensures the availability of its products. Through the process of continuous improvement of the product lines and the development of long-lasting rust protection solutions, WD-40 firmly establishes itself in the harsh market as a responsible, trusted, and innovative brand.

Evapo-Rust

Evapo-Rust is a creator of innovative, non-toxic, and eco-friendly rust remediation solutions. The brand of this company, which consists of water-based and biodegradable rust removers, is very popular in the markets of household equipment, DIY, and professionals. Evapo-Rust introduces secure but effective substitutes of traditional chemical rust removers, which is the reason it is a good choice for automotive restoration, industrial maintenance, and heavy machinery upkeep.

The company is targeting global markets by promoting environmentally friendly products. Evapo-Rust has also been collaborating with enterprises in the manufacturing and automotive sectors to supply large amounts for major rust removal projects. Adhering to a green chemistry approach and sustainable innovation, they have been consistently achieving growth as an ingrained market player.

Corrosion Technologies

Corrosion Technologies is a company that offers high-performance corrosion inhibitors and reliable rust prevention systems. The company is mostly involved in military, marine, and aviation industries, where rust and corrosion may have a serious effect on operation. It is worth noting that the company is the only one that provides rust removers that work well and protect for a long time, which are considered industrial-grade ones.

Corrosion Technologies focuses on the development of new formulas with extended durability and resistance to extreme conditions. The company is also in touch with the government and military agencies by providing products adapted to aerospace and naval applications. With continuous innovations in high-performance rust prevention, Corrosion Technologies remains a prominent player in the niche of specialized rust removers.

The global Rust Remover market is projected to reach USD 579.3 million by the end of 2025.

The market is anticipated to grow at a CAGR of 4.4% over the forecast period.

By 2035, the Rust Remover market is expected to reach USD 891.1 million.

The Acid Rust Removers segment is expected to dominate the market, due to its high effectiveness, fast action, and widespread use in industrial and automotive applications for removing tough rust and corrosion efficiently.

Key players in the Rust Remover market include Henkel AG & Co. KGaA, The 3M Company, WD-40 Company, Evapo-Rust, Corrosion Technologies.

In terms of Product Type, the industry is divided into Acid Rust Removers, Neutral Rust Removers, Alkaline Rust Removers.

In terms of End use industry, the industry is divided into Automotive, Aviation and Aerospace, Oil and Gas/Petrochemical, Marine, Construction & Infrastructure, Metal Machining, Others.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Asia Pacific Waterproofing Chemicals Market Growth - Trends & Forecast 2025 to 2035

Diamond Wire Market Size & Outlook 2025 to 2035

Thioesters Market Growth & Trends 2025 to 2035

The Self-Healing Materials Market is segmented by product, technology, and application from 2025 to 2035.

Polyurethane Foam Market Size & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.