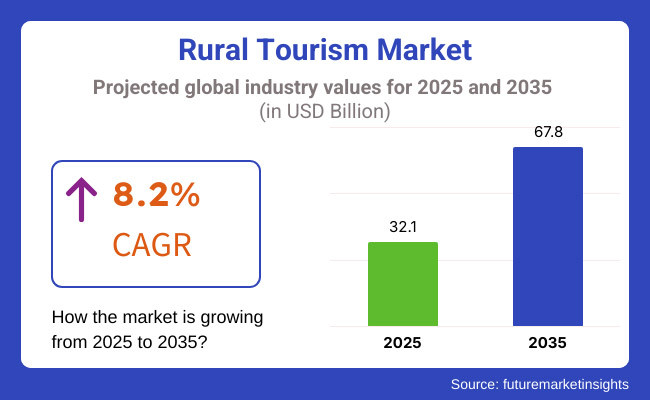

The international rural tourism industry is expected to grow to USD 32.1 billion by 2025 and reach USD 67.8 billion by 2035. At an estimated CAGR of 8.2% between 2025 and 2035, growth results from the rising need for rural experiences, growing awareness of sustainable travel, and government-supported initiatives of driving rural economies through tourism.

Rural tourism providers are expanding their services to include farm stays, hands-on agrotourism experiences, and eco-lodges with minimal environmental impact. Leading companies such as Responsible Travel, Farm Stay UK, and EcoRetreats are creating tailored rural travel packages, offering tourists activities such as organic farming workshops, countryside hiking expeditions, and heritage village immersions.

Travelers are actively seeking remote destinations where they can engage with local communities, learn traditional crafts, and participate in farm-to-table dining experiences. Whether it’s tending olive groves in Spain, experiencing nomadic herding life in Mongolia, or learning indigenous fishing techniques in the Amazon, rural tourism provides an escape from urban life while supporting local livelihoods.

Technology is also transforming the sector. Digital booking platforms make rural tourism more accessible, while AI-powered travel guides offer personalized itineraries based on traveler preferences. Virtual reality (VR) farm tours and online rural heritage experiences allow urban dwellers to explore countryside destinations before booking their trips.

Explore FMI!

Book a free demo

| Rural Tourism | Adventure Tourism |

|---|---|

| 2020: USD 24.1 Billion (Growing preference for nature-based getaways) | 2020: USD 19.5 Billion (Rise in outdoor recreational activities) |

| 2024: USD 29.4 Billion (Expansion of agritourism projects) | 2024: USD 23.8 Billion (Increase in extreme adventure tourism) |

| 2025: USD 32.1 Billion (Surging demand for sustainable farm stays) | 2025: USD 26.7 Billion (Growth in guided expedition tourism) |

| 2035: USD 67.8 Billion (Widespread adoption of eco-friendly tourism) | 2035: USD 54.3 Billion (Technological integration in adventure activities) |

Travelers today prioritize immersive rural experiences that allow them to participate in traditional farming, artisanal crafts, and sustainable agriculture. Visitors can engage in olive harvesting in Tuscany, experience alpaca farming in Peru, or join community-led conservation efforts in South Africa. Digital transformation plays a key role in making rural destinations accessible, with AI-powered platforms offering itinerary recommendations and online farm stay bookings.

Farm stays have become a central rural tourism segment offering tourists authentic rural experiences and complementing local economies. Travelers in Tuscany, Italy, get immersed in olive picking and wine production and live in family-operated agritourism estates. New Zealand also offers sheep farm stays where tourists get involved in sheep herding, shearing, and wool processing and get a glimpse of rural life.

Governments actively encourage farm stays to enhance rural tourism. Japan's Furusato Nozei Program offers tax relief to local tourists who choose countryside lodging, raising the profile of rural areas. There has been a growth in Harvest Hosts in the United States, where RV travelers overnight at farms and wineries, directly benefiting producers.

In France's Provence province, lavender plantations welcome tourists wanting to discover essential oil harvesting and traditional farming techniques. In Argentina, the gaucho ranch stays provide tourists with an opportunity to horseback ride alongside experienced cattle herders and experience the energetic culture of the Pampas. These are but a few examples of how farm stays are designed for experiential tourists seeking sustainable types of tourism.

Green tourists are having a notable impact on countryside tourism, making low-impact accommodation, carbon-free travel, and conservation-minded experiences more sought after. Such tourists want their destinations to support sustainable principles in the form of organic cultivation, use of renewable energy, and ethical wildlife encounter.

In Costa Rica, Monteverde Cloud Forest eco-lodges combine solar power, rainwater collection, and biodegradable facilities, setting a standard for rural sustainable tourism. Likewise, in Norway's fjord villages, tourists contribute to rewilding initiatives, restoring indigenous vegetation and preserving biodiversity.

Bhutan's eco-tourism experiences focus on high-value, low-impact tourism. Gross National Happiness (GNH) tourism policy of the country ensures that tourists' spending is directly channelized into conservation and well-being of the local population. Tourists visit customary agriculture practices, engage in meditation retreats conducted by monasteries, and patronize local craftspeople by buying handloom textiles.

Technology also contributes to the development of environmentally friendly rural tourism. Online platforms such as Regenerative Travel bring travelers together with sustainable accommodations and activities, ensuring their visit leaves a positive footprint. In Iceland, tour companies provide carbon-neutral rural tours, where tourists get to see geothermal energy farms and glacier preservation projects up close.

The need for vegetarian rural getaways is also increasing. In Thailand's Chiang Mai province, tourists engage in permaculture courses, discovering how to grow food sustainably and farm ethically. In Spain's Andalusian countryside, regenerative agriculture initiatives invite volunteers to assist in replenishing depleted soils through environmentally friendly farming methods.

With increasing awareness of climate change and sustainability, environmentally friendly travelers will continue to mold rural tourism. Those destinations focusing on responsible tourism, the integration of renewable energy, and conservation will be prominent in the new era of rural travel.

India’s Rural Tourism Industry is booming as travelers seek cultural immersion and sustainable travel options. Government initiatives such as the Rural Tourism Scheme and Swadesh Darshan Yojana promote agrotourism, eco-tourism, and heritage village stays. In Rajasthan, travelers participate in camel safaris, pottery workshops, and traditional Rajasthani folk music performances. Kerala’s backwaters offer homestays where visitors experience organic farming, canoe fishing, and Ayurvedic wellness treatments.

In Himachal Pradesh, apple orchards provide farm-to-table experiences, where travelers engage in fruit harvesting and cider-making. Private enterprises like Grassroutes Journeys facilitate rural community-based tourism, allowing visitors to interact with local artisans, farmers, and tribal communities.

Japan actively integrates rural tourism into its national tourism framework, focusing on preserving countryside traditions. The Satoyama Initiative promotes sustainable agriculture and forest conservation, drawing tourists to rural villages like Shirakawa-go, where they stay in centuries-old thatched-roof houses.

The Kumano Kodo Pilgrimage Trail offers rural homestays in traditional ryokans, where visitors experience Japanese hospitality, organic tea farming, and Zen meditation. Additionally, Nagano’s Snow Monkey Park attracts eco-conscious tourists interested in wildlife conservation and thermal hot spring experiences.

Italy’s Agriturismo Program has positioned the country as a top rural tourism destination. In Tuscany, visitors stay on vineyard estates, participate in winemaking, and learn to cook regional specialties. In Sicily, travelers engage in olive oil pressing and citrus farming, connecting with Italy’s agricultural heritage.

The Piedmont area is famous for truffle-hunting excursions, during which tourists hike through forests with dogs trained to detect truffles and indulge in true farm-to-table cuisine. Italy's focus on slow travel and sustainable farming ensures it is a favorite among countryside travelers.

Costa Rica leads in eco-tourism, attracting visitors to its rural landscapes and conservation projects. The Monteverde Cloud Forest offers eco-lodges that use renewable energy, while coffee plantations in Tarrazú allow tourists to participate in harvesting and roasting processes.

At Tortuguero National Park, tourists participate in sea turtle conservation activities, learning about nesting cycles and protecting habitats. Costa Rica's focus on sustainability means rural tourism works to the advantage of local communities as well as the environment.

Norway’s rural tourism sector focuses on outdoor adventures and sustainable living. The Lofoten Islands offer fishing village stays, where visitors learn traditional cod drying techniques and explore Arctic marine ecosystems. In Sognefjord, eco-conscious travelers enjoy off-grid cabins, powered by solar energy, while participating in glacier hiking and rewilding programs.

Norway also promotes indigenous Sámi culture through reindeer herding experiences in Finnmark, providing travelers with insights into Arctic traditions and sustainable livestock practices. The government’s investment in green tourism makes Norway a preferred choice for nature-focused rural travelers.

The Rural Tourism Industry remains highly fragmented, with competition between government tourism boards, private eco-tourism operators, and rural hospitality providers. Regional development initiatives such as the European Network for Rural Development (ENRD) and UNWTO’s Rural Tourism Program support sustainable rural tourism by integrating local communities into tourism planning and infrastructure development.

Governments actively collaborate with private enterprises to improve rural tourism experiences. In India, the Ministry of Tourism partners with eco-lodge developers to expand rural homestays. In Japan, government-backed Satoyama conservation projects ensure that rural tourism benefits both travelers and local farmers. Similarly, Italy’s Agriturismo Program incentivizes small farm owners to host tourists while preserving traditional farming methods.

Digital platforms further intensify competition. Companies like Airbnb Rural Retreats and GetYourGuide provide direct booking access to rural stays and experiences, challenging traditional travel agencies. Specialized rural tourism operators such as G Adventures and Intrepid Travel offer curated itineraries focusing on cultural immersion, adventure, and sustainability.

Additionally, global hotel chains are expanding into rural tourism by developing eco-conscious lodges and retreats. Marriott’s “Rustic Retreats” and Hilton’s “Eco-Stay” programs are entering the rural hospitality space, competing with locally-owned farm stays and boutique accommodations.

With sustainability at the core of rural tourism growth, organizations such as the Global Sustainable Tourism Council (GSTC) and WWF’s Conservation Tourism Initiative are influencing industry standards. Market players focusing on carbon neutrality, regenerative tourism, and community engagement will emerge as leaders in this evolving sector.

Recent Developments in the Rural Tourism Industry

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data | 2020 to 2024 |

| Market Analysis | USD Billion (Value) |

| Key Regions | North America, Latin America, Europe, East Asia, South Asia, Oceania, MEA |

| Key Segments | Experience Type, End User, Tourist Type, Booking Channel |

| Key Players | G Adventures, Intrepid Travel, Airbnb Rural Retreats, Responsible Travel, EcoRetreats, Farm Stay UK, Marriott Rustic Retreats, Hilton Eco-Stay, GetYourGuide, Italy’s Agriturismo Program |

The global Rural Tourism Industry stands at USD 29.4 billion in 2024. Analysts project it to reach USD 32.1 billion by 2025 and expand to approximately USD 67.8 billion by 2035, growing at a CAGR of 8.2%.

Increasing demand for authentic cultural experiences, government initiatives supporting rural economies, and advancements in digital travel platforms drive the industry’s growth.

Leading companies include G Adventures, Intrepid Travel, Airbnb Rural Retreats, Responsible Travel, EcoRetreats, Farm Stay UK, Marriott Rustic Retreats, Hilton Eco-Stay, GetYourGuide, and Italy’s Agriturismo Program.

AI-powered travel guides, virtual reality (VR) farm tours, and online booking platforms enhance accessibility and personalization for travelers.

Certifications like the Global Sustainable Tourism Council (GSTC) accreditation and WWF-backed conservation tourism initiatives promote responsible rural tourism practices.

Travelers increasingly seek eco-conscious accommodations, farm stays, and off-grid retreats that support environmental conservation and local economies.

Tourists prioritize immersive experiences such as agrotourism, hands-on farm stays, and community-based cultural exchanges, shaping the future of rural tourism.

Winning Strategies in Social Media and Destination Market Share Analysis: A Competitive Review

Winning Strategies in the Global Tourism Industry Loyalty Program Sector: A Competitive Review

Winning Strategies in the Global Spa Resorts Industry: A Competitive Review

Surrogacy Tourism Industry – Competitive Analysis and Market Share Outlook

China Destination Wedding Market Insights – Growth & Forecast 2025-2035

Tourism Industry Loyalty Programs Sector Analysis by Program Type by Traveler Profile by Region - Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.