The rubber conveyor belt industry is expected to grow incrementally from 2025 through 2035 as demand grows across mining, manufacturing, and eCommerce industries. By 2025, the industry is expected to be valued at USD 3.62 billion, growing at a CAGR of 2.70% to reach USD 4.82 billion by 2035.

During 2024, the rubber conveyor belt market recorded steady growth owing to heightened demand from logistics industry. One of the trends was the growing use of automation and IoT-equipped conveyor systems in North America and Europe.

This growth will be fueled due to advances in material technology, automation, and an increased emphasis on cost-efficient material handling solutions. The mining industry remains a major contributor, with conveyor belts serving as the backbone for efficient raw material transport.

The lucrative eCommerce sector has also driven demand for warehouse automation. Technologies such as environmentally friendly and fire-safe rubber conveyor belts are also making waves as businesses focus on going green and ensuring a safe working environment.

Market Metrics

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 3.62 billion |

| Market Size (2035F) | USD 4.82 billion |

| CAGR (2025 to 2035) | 2.70% |

Explore FMI!

Book a free demo

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growth driven by mining, eCommerce, and manufacturing. | Expansion fueled by automation, AI, and smart logistics. |

| Adoption of lightweight, high-durability, and heat-resistant belts. | Shift to IoT-enabled, AI-driven predictive maintenance, and smart conveyor systems. |

| Focus on recyclable and energy-efficient materials. | Demand for biodegradable and low-carbon-footprint rubber belts. |

| Increased use in mining and warehousing. | Growth in automation, robotics, and self-adjusting conveyor belts. |

| Fire-resistant and oil-resistant belts gaining traction. | Stricter safety regulations, advanced compliance, and food-grade materials. |

| Strong demand in Asia-Pacific and North America. | Rapid industrialization in Asia-Pacific and Latin America. |

| Steady segment growth due to industrial expansion. | Increased adoption of smart and eco-friendly conveyor belts. |

Future Market Insights (FMI) conducted a survey among 500 key stakeholders in the rubber conveyor belt industry to assess growth drivers, technological advancements, regulatory challenges, and regional sector variances.

The survey targeted manufacturers, suppliers, logistics operators, and end-users from mining, metal processing, and industrial sectors, providing a comprehensive analysis of emerging trends and strategic priorities.

Primary Concerns

Regional Variance

High Variance in Adoption Rates

Convergent & Divergent Perspectives on ROI

Consensus

Regional Material Preferences

Shared Challenges

Regional Differences

Manufacturers

End-Users

Alignment Among Stakeholders

Regional Differences in Investment Focus

North America

Europe

Asia-Pacific

High Consensus Areas

Key Regional Variances

| Countries/Region | Key Regulations Impacting the Landscape |

|---|---|

| United States | OSHA (Occupational Safety and Health Administration) mandates fire-resistant conveyor belts in mining & industrial sectors; EPA regulations encourage eco-friendly materials. |

| European Union | REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) enforces strict environmental standards; CE marking required for conveyor belts sold in the EU. |

| China | China’s SAC (Standardization Administration of China), National Safety Standards for conveyor belt manufacturing, focusing on flame resistance and durability in heavy industries. |

| India | MoEFCC (Ministry of Environment, Forest and Climate Change), BIS (Bureau of Indian Standards) regulates conveyor belt safety, and CPCB (Central Pollution Control Board) pushes for reduced carbon emissions in production. |

| Australia | MSHA (Mine Safety and Health Administration) enforces flame-retardant belts in mining; strict workplace safety laws for conveyor belt systems. |

| Brazil | ANVISA (National Health Surveillance Agency) requires food-grade belts for the food processing industry; environmental policies promote sustainable rubber production. |

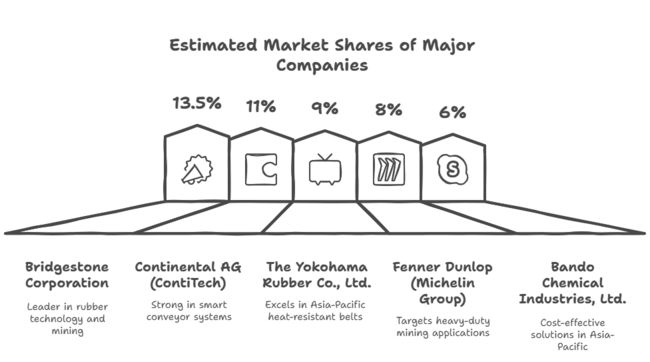

Segment leaders in the industry for rubber conveyor belts are engaging with a mix of price strategies, innovation in technology, strategic alliances, and international growth. Major players are emphasizing affordable production with excellent quality to get price-conscious consumers, especially from developing countries such as India, China, and Latin America.

Companies are diversifying their portfolios by investing in high-end materials, such as heat-resistant, oil-resistant, and eco-friendly rubber belts. The use of IoT-based smart conveyor belts with real-time monitoring features is another critical strategy to meet the increasing demand for automation across industries such as mining, logistics, and manufacturing.

Estimated Industry Share and Values for Top Companies

Bridgestone Corporation

Continental AG (ContiTech)

The Yokohama Rubber Co., Ltd.

Fenner Dunlop (Michelin Group)

Bando Chemical Industries, Ltd.

Fenner Dunlop Conveyor Belting Rebranding (January 2024)

ADNOC in Talks to Acquire Covestro A.G. for USD 12.9 Billion

Safety Incident and Legal Actions (March 2025)

The segment for rubber conveyor belts is a type of industrial equipment, and this segment is also closely related to material handling across industries such as mining, manufacturing, logistics, food processing, construction, and eCommerce. It drives demand based on industrial production, infrastructure growth, and global trade trends as a core part of automated material transport.

In shaping segment demand, the most important factor is the economic growth and expansion of the industry. Countries in the world that are undergoing rapid industrialization, like India, China, and Brazil, are accounting for the growing adoption of conveyor belts. Presently, factors like government-supported construction activities across regions, such as North America and the EU, are also driving the demand for highly efficient conveyor systems.

Some commodity price movements also impact the sector, especially in the rubber and mining sectors. Crude prices influence the costs of synthetic rubber production, while changes in steel prices influence the cost of reinforced conveyor belts. Moreover, increasing focus on sustainability and carbon footprint reduction is driving manufacturers to develop environmentally and energy-friendly conveyor belt solutions.

There are three main product types of rubber conveyor belts: heavy-duty, medium-duty, and light-duty belts. Heavy-duty conveyor belts are specifically engineered for industries that demand extreme durability, designed to endure high-impact loads. Medium-duty conveyor belts are commonly utilized in manufacturing and automotive applications but the operational requirements are not extreme.

Light-duty conveyor belts are commonly used in industries such as logistics and food processing where flexibility and handling are of utmost importance and the light-duty segment is expected to grow with a market share of 29% over the forecast period.

The mining segment is expected to grow with a market share of 23% over the forecast period. Mining is a key end-use industry, where the need for transporting bulk raw materials fuels demand for conveyor belts. Another big driver is the logistics sector, boosted by the rapid expansion of eCommerce and automated warehousing, where conveyor belts make sorting and distribution processes more efficient. Metal processing and manufacturing industries utilize conveyor belts for the transportation of hot metal and fabricated components alongside raw materials.

The USA segment for rubber conveyor belts is propelled by its flourishing mining, manufacturing, logistics and automotive sectors. Urbanization and population growth has fueled demand for more automation in warehouses and factories across the country.

The coal and mineral segment remains a key driver, utilising heavy-duty and fire-resistant conveyor belts. Furthermore, environmental regulations encourage the use of energy-efficient and recyclable rubber belts, which reduces carbon footprints.

FMI opines that the United States rubber conveyor belt sales will grow at nearly 2.6% CAGR through 2025 to 2035.

The logistics and automotive sectors have a great impact on the rubber conveyor belt landscape in the United Kingdom. The growing sustainability push around circular economy practices in the country has led to an increased demand for eco-friendly conveyor belts.

Trade policies and supply chain disruptions due to Brexit have made it difficult to procure raw materials. Material manufacturers are localizing production and setting up rubber processing units domestically. Moreover, demand for medium and light duty conveyor belts to increase production efficiency is also increased from process manufacturing and food processing sectors.

FMI projects that the United Kingdom's rubber conveyor belt sales will grow at nearly 2.5% CAGR through 2025 to 2035.

Automotive, metal processing and logistics industries are some of the major driving factors for the rubber conveyor belt segment in France. Renowned automotive companies, including Renault, Peugeot, and Citroën utilize automated assembly lines that depend on medium-duty conveyor belts.

Green industrial policies in the country have further propelled the use of energy-saving and low-carbon conveyor belt systems. Another major trend driving investments in sensor-equipped conveyor belts that is the increasing trend of smart factories. The segment is further bolstered by government incentives for industrial automation and energy efficiency.

FMI opines that the France rubber conveyor belt sales will grow at nearly 2.7% CAGR through 2025 to 2035.

Germany, Europe's largest industrial hub, has strong demand for heavy-duty conveyor belts, driven by its dominant metal processing, mining, and manufacturing industries. Advances in smart conveyor systems that utilize AI with predictive maintenance systems have been and will continue to be driven by the country’s leadership in engineering and automation. Automotive players include Volkswagen, BMW and Daimler and conveyor belts are heavily utilized in the manufacturing of vehicles and assembly of components.

FMI opines that the Germany rubber conveyor belt sales will grow at nearly 2.9% CAGR through 2025 to 2035.

Rubber conveyor belts are used in Italy's manufacturing and food processing sectors to facilitate materials movement. It has a high-quality machinery production and with many medium duty belts working in manufacturing.

The logistics and warehousing industry has experienced a heightened need for automated material handling solutions due to the rise of eCommerce. Workplace safety has been legislated in Italy, resulting in a rise in adoption of fire-resistant and anti-slip conveyor belts across industries.

FMI opines that the Italy rubber conveyor belt sales will grow at nearly 2.6% CAGR through 2025 to 2035.

The advanced manufacturing, electronics, and automotive industries in South Korea drives the rubber conveyor belt industry in the country. Big companies such as Hyundai, Samsung, and LG use conveyor belts as part of their automated assembly lines. As the world leader in robotics and floursihing smart factory technologies, the country also contributes to the advancement of AI-populated conveyor belt systems.

The government’s agenda of eco-friendly manufacturing has fostered innovations to produce conveyor belts. Demand for heavy-duty belts that can withstand harsh environments is also supported by South Korea's strong mining industry.

FMI opines that the South Korea rubber conveyor belt sales will grow at nearly 2.7% CAGR through 2025 to 2035.

Specialized rubber conveyor belts are needed for Japan's high-tech industries and precision manufacturing. Demand for medium and light-duty belts is driven by the country’s automotive and robotics industries, as well as assembly lines and logistics centers.

Japan’s emphasis on sustainability and energy efficiency has spawned durable, high-efficiency rubber materials. Mining, while less significant than other industries in Japan, still depends on heavy-duty conveyor belts to extract resources. Industry-IoT and AI systems for monitoring conveyers are widely implemented to boost operational efficacy.

FMI opines that the Japan rubber conveyor belt sales will grow at nearly 2.6% CAGR through 2025 to 2035.

China accounts for the highest production of rubber conveyor belts, a result of giant industrialization across the mining, manufacturing and logistics sectors. The country’s leadership in coal mining and heavy industries creates a high sector for heat and harsh resistance heavy duty conveyor belts.

Additionally, the thriving eCommerce industry has further stimulated investment in automated logistics centers, supporting light and medium-duty Belt demand. China’s commitment to sustainable practices and reduced emissions has led to use of environmentally friendly materials for conveyor belts.

FMI opines that the China rubber conveyor belt sales will grow at nearly 3.0% CAGR through 2025 to 2035.

The mining and agriculture industries are the leading drivers for the rubber conveyor belt sector in Australia and New Zealand. Australia, a major exporter of iron ore, minerals, and coal has had a robust demand for heavy-duty conveyor belts capable of withstanding extreme conditions. As a result, the country’s increased focus on mine safety regulations have continued to pave the way for the adoption of fire-resistant and self-extinguishing conveyor belt.

New Zealand’s agriculture and food processing industries also drive demand for light-duty belts used in sorting and packaging operations. Intelligent conveyor belt systems with real-time monitoring are being facilitated by automation and sustainability trends.

FMI opines that the Australia & New Zealand rubber conveyor belt sales will grow at nearly 2.8% CAGR through 2025 to 2035.

The rise of industrial automation, e-commerce logistics, and manufacturing will drive growth in the rubber conveyor belt market. The demand for automated material handling systems in warehouses and distribution centers to be a key growth opportunity.

Additionally, the mining and metal processing industries significantly contribute to demand for heavy-duty, heat-resistant, and durable conveyor belts Moreover, the growing demand for sustainable materials presents a lucrative opportunity for manufacturers to develop biodegradable, energy-efficient, and recyclable conveyor belts. Companies can leverage these opportunities by conducting R&D to develop smart conveyor belt solutions that utilize AI, real-time monitoring, and predictive analytics.

It is also vital to expand into high-growth regions, like China, India, and Southeast Asia, where industrialization in these economies is fueling demand. Additionally, the ability to keep pace and even surpass strict environmental policy mandates in regions like Europe and North America will provide companies with a competitive advantage.

Demand is being driven by the rising implementation of automation in several sectors such as mining, logistics, and manufacturing, as well as the requirement for sturdy and energy-efficient material handling systems. Growing eco-friendly and smart conveyor belts also drive the growth.

Mining, metal processing, logistics, automotive, and manufacturing are industries that depend heavily on these belts to transport materials. The growth of e-commerce has also created heightened demand in warehousing and distribution centers.

Emerging technologies like IoT-powered monitoring, AI-driven predictive maintenance, self-healing materials, and energy-efficient innovations will enhance the performance of the belt by minimizing downtime and improving operational efficiency.

To adhere to environmental regulations, manufacturers will see a transition toward recyclable rubber materials, low-carbon production processes, and biodegradable components.

Asia-Pacific is showing substantial growth owing to rapid industrialization, primarily in China and India. Moreover, the demand for automation and regulatory compliance driving growth in the North American and European sector is fueling steady adoption.

Automated Material Handling Systems Market - Market Outlook 2025 to 2035

Industrial Vacuum Evaporation Systems Market Analysis - Size & Industry Trends 2025 to 2035

Industrial Temperature Controller Market Analysis - Size & Industry Trends 2025 to 2035

Domestic Booster Pumps Market Growth - Trends, Demand & Innovations 2025 to 2035

Condition Monitoring Service Market Growth - Trends, Demand & Innovations 2025 to 2035

Industrial Robotic Motors Market Analysis - Size & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.