The market for rotogravure printing machines is changing as packaging, publishing, and commercial print businesses need high-speed, high-quality, and low-cost printing technology. As industries focus on bright, long-lasting prints, producers are designing advanced gravure presses with higher automation, energy efficiency, and sustainability features.

Firms are spending on solvent-free inks, AI-powered quality control, and digitalization to enhance manufacturing efficiency while reducing environmental impact.

Producers are updating rotogravure equipment with intelligent web handling, servo-powered systems, and quick changeovers to boost productivity and functional adaptability. Demand is transforming in the direction of hybrid print platforms that make integration with digital innovations easier for the achievement of high-resolution variable-data printing of flexible packaging and specialty materials.

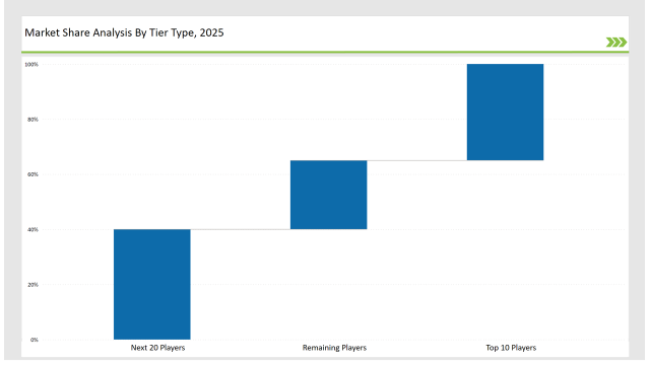

Tier 1 players like Bobst Group, Uteco Group, and Windmöller & Hölscher command 35% of the market with their expertise in high-performance gravure presses, robust R&D capabilities, and worldwide supply chains.

Tier 2 players such as Cerutti Group, Pelican Rotoflex, and Comexi hold 40% market share by offering low-cost and customized rotogravure machines tailored to local label and packaging applications.

Tier 3 are regional and niche players with specialization in small, modular, and green printing solutions, holding 25% market share. Tier 3 firms emphasize localized manufacturing, high-precision applications, and green printing technologies.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Bobst Group, Uteco Group, Windmöller & Hölscher) | 15% |

| Rest of Top 5 (Cerutti Group, Pelican Rotoflex) | 12% |

| Next 5 of Top 10 (Comexi, Kohli Industries, Shaanxi Beiren, Rotatek, Fuji Kikai) | 8% |

The rotogravure printing machine industry serves multiple sectors where high-speed and high-quality printing are essential. Companies are developing advanced presses to meet the growing demand for durable and visually appealing prints.

Manufacturers are optimizing rotogravure printing machines with enhanced automation, precision engineering, and eco-friendly features. They are integrating AI-powered real-time defect detection to improve print quality and minimize waste. Additionally, companies are developing solvent-free coatings to align with global sustainability standards.

Automation and sustainability are transforming the rotogravure printing sector. Businesses are applying AI-based defect detection, fast drying systems, and solventless ink formulations to make operations more efficient and emission-free. Organizations are implementing gravure presses with predictive maintenance and IoT-based monitoring to maximize performance. Manufacturers are adding hybrid gravure-digital machines to their portfolio to support variable-data and short-run print capabilities. Further, companies are adopting LED-UV curing technology for quicker drying and energy conservation.

Technology suppliers should focus on automation, digital integration, and eco-friendly innovations to support the evolving rotogravure printing market. Partnering with packaging, publishing, and decorative printing companies will accelerate adoption and market expansion.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Bobst Group, Uteco Group, Windmöller & Hölscher |

| Tier 2 | Cerutti Group, Pelican Rotoflex, Comexi |

| Tier 3 | Kohli Industries, Shaanxi Beiren, Rotatek, Fuji Kikai |

Leading manufacturers are advancing rotogravure printing technology with AI-powered quality control, sustainable ink solutions, and high-performance automation. They are developing high-speed presses with improved ink transfer efficiency to enhance print clarity. Additionally, manufacturers are incorporating low-energy curing systems to reduce operational costs and environmental impact.

| Manufacturer | Latest Developments |

|---|---|

| Bobst Group | Launched hybrid gravure presses with digital integration in March 2024. |

| Uteco Group | Developed solvent-free, high-speed gravure presses in April 2024. |

| Windmöller & Hölscher | Expanded intelligent web handling and defect detection systems in May 2024. |

| Cerutti Group | Innovated quick-changeover systems for enhanced productivity in June 2024. |

| Pelican Rotoflex | Strengthened high-precision, cost-efficient gravure printing solutions in July 2024. |

| Comexi | Introduced LED-UV drying systems for energy-efficient curing in August 2024. |

| Kohli Industries | Pioneered compact, modular rotogravure presses for flexible packaging in September 2024. |

The rotogravure printing machine market is evolving as companies invest in automation, hybrid printing technologies, and sustainable manufacturing practices. They are enhancing press efficiency by integrating AI-driven predictive maintenance systems. Additionally, manufacturers are optimizing energy consumption with high-speed drying and LED-UV curing solutions.

Manufacturers will continue integrating AI-driven quality control, solvent-free inks, and high-speed automation. Companies will refine hybrid gravure-digital printing solutions for enhanced customization. Businesses will develop ultra-thin, high-precision engraving rollers to improve print clarity while reducing material waste. Firms will expand predictive maintenance capabilities to minimize downtime. Smart packaging applications will drive the adoption of RFID-printed electronics within gravure technology. Additionally, manufacturers will focus on LED-UV curing to enhance print durability and reduce energy consumption.

Leading players include Bobst Group, Uteco Group, Windmöller & Hölscher, Cerutti Group, Pelican Rotoflex, Comexi, and Kohli Industries.

The top 3 players collectively control 15% of the global market.

The market shows medium concentration, with top players holding 35%.

Key drivers include sustainability, automation, hybrid printing technology, and high-speed efficiency.

BOPP Film Market Analysis by Thickness, Packaging Format, and End-use Industry Through 2025 to 2035

Korea Tape Dispenser Market Analysis by Material, Product Type, Technology, End Use, and Region through 2025 to 2035

Medical Transport Box Market Trend Analysis Based on Material, Capacity, End-User and Regions 2025 to 2035

Japan Heavy-duty Corrugated Packaging Market Analysis based on Product Type, Board type, Capacity, End use and City through 2025 to 2035

Corrugated Board Market Analysis by Material and Application Through 2035

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.