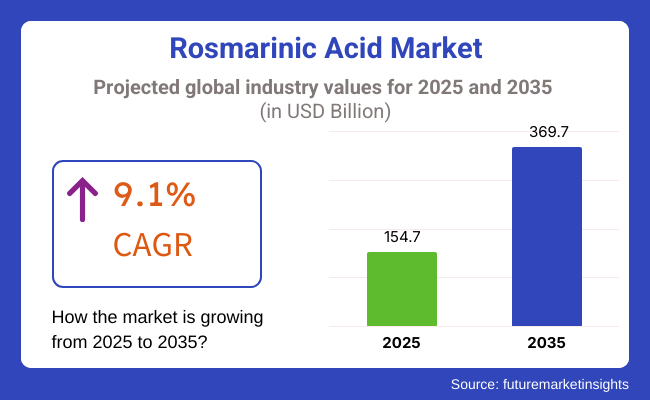

The rosmarinic acid market is set to increase significantly, with a forecast value of USD 154.7 million in 2025. The total industry is predicted to present a growth rate of 9.1% during the period from 2025 to 2035. The industry's value as a whole will attain USD 369.7 million by 2035.

The rise in demand is mainly powered by the fast-moving consumption of plant-based and pure-label ingredients. People are on the lookout for natural components as substitutes for synthetic preservatives, which in turn results in the boosted usage of it in processed foods, drinks, and dietary supplements. Likewise, a demanding rise in the range of herbal skincare and anti-aging products that are pervaded with it in the cosmetics industry, is another key driver of innovation in this sector.

Obligatory for the function of the pharmaceutical sector is the boosting of sales of r-shannon acid. The presumed advantages of this plant for lessening inflammatory symptoms, cognitive development, and immune support have turned it into the main active element of nutraceutical products.

There is a potential for the product being used in the treatment of neurodegenerative diseases and oxidative stress-related disorders as shown by the standing research which suggests that it will yield new businesses opportunities.

Although, the industry also has its obstacles, such as the elevated expenditure incurred in the purifying and extraction process. The lack of knowledge of the benefits of it by consumers and the complex rules about herbal extracts might impede the growth of the sector. However, the production of raw materials might be affected due to climate conditions, which in turn could have an impact on the price level.

Nonetheless, despite these hurdles, there are still ample avenues for the industry to develop. The demand for natural antioxidants in functional foods and beverages has been growing, while the innovations in extraction technologies help with the increase in demand. The growth of e-commerce due to direct-to-consumer sales is another gain for the industry making the products easier to be obtained all over the world.

Explore FMI!

Book a free demo

The industry is growing due to its rising use as a natural anti-inflammatory and antioxidant compound across different industries. It is mostly produced from rosemary, basil, and other plants in the Lamiaceae family. It finds extensive use in food preservation, cosmetics, dietary supplements, and pharmaceuticals.

In the food & beverage industry, it is used as a natural preservative, improving shelf life and replacing synthetic antioxidants. In the pharmaceutical industry, anti-inflammatory and neuroprotective drugs utilize it, primarily for Alzheimer's and arthritis diseases. Personal care businesses incorporate it in anti-aging and UV-protecting skincare, which aligns with the trend of clean-label cosmetics.

Besides, food supplement producers sell it for its cognitive, cardiovascular, and immune-stimulating benefits. Nevertheless, personal care and industrial applications' price sensitivity is an issue. As consumers move towards plant-based, functional ingredients, it has a huge scope for growth in the next few years.

The industry witnessed slow but steady growth during the period from 2020 to 2024 due to the increased demand for natural and plant-derived ingredients in the food, beverage, cosmetic, and pharmaceutical industries.

The antioxidant, anti-inflammatory, and antimicrobial activities saw widespread usage as a natural preservative and functional ingredient. In the food and beverages industry, the trend towards clean-label products drove the utilization of it in natural flavorings and preservatives.

In the cosmetics industry, the rising use of it in skin care products due to its protective and anti-aging characteristics also happened. However, the supply of limited raw materials and production at a high cost constrained wider industry expansion during this period.

From 2025 to 2035, the industry is expected to boom tremendously as a result of technological innovation in extraction and formulation methods, increasing the effectiveness of the products and reducing the costs. Health benefit awareness among consumers will be driving higher acceptance within dietary supplements and functional food, while natural personal care products and cosmetics growing demand will add more fuel for demand for it as a natural anti-inflammatory and antioxidant ingredient.

In the pharma sector, more research into it's therapeutic use in chronic diseases such as cardiovascular and neurodegenerative disorders will create new industry opportunities. Trends towards sustainability will drive manufacturers toward green extraction processes and open supply chains, which will enable long-term industry growth.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Sustained growth due to natural preservative and functional ingredient demand. | Quicker expansion due to technology breakthrough and rising uses. |

| Higher demands for plant-based and natural ingredients. | More focus on clean-label products, sustainability, and health benefits. |

| Largely in cosmetics, foods, and beverages. | Expansion to pharmaceuticals, functional foods, and dietary supplements. |

| Little new technology innovation in extraction and processing. | Development in green extraction and high-yield processing technology. |

| Compliance with food safety and natural ingredient regulation. | Severe regulation to facilitate openness and green production. |

| Dominant players retaining industry share with current lines of products. | More competition with new players introducing innovative and sustainable products. |

The industry is witnessing growth due to the rising use in food preservation, pharmaceuticals, and cosmetics. But the strict regulatory requirements regarding natural preservatives and dietary supplements are the compliance challenges. The companies have to not only follow the global safety standards but also have the required certifications to ensure industry credibility and gain consumer trust.

Supply chain disruption, including the limited availability of rosemary and other botanical sources, might affect the consistency, and also the pricing of production. Climate change, agriculture challenges, and regional sourcing limitations are the sources of supply volatility.

Businesses ought to take a step in the right direction such as investing in diversified sourcing strategies, adding sustainable cultivation practices, and extracting methods that are different from the common ones to fight this kind of risks.

There is an increase in the desire for natural antioxidants and plant-based ingredients among consumers, but the competition is fierce from synthetic alternatives and other plant-based compounds like quercetin and flavonoids which create industry pressure. The companies have to make the difference by presenting the products with high purity, the studies' backing on health benefits, and new ideas of use in different industries.

Variations in the cost of raw materials and the geopolitical elements that affect trade regulations could shape the industry stability. The businesses have to be the ones that implement cost-effective manufacturing processes, better the supply chain logistics, and search for local sources to make sure that the company will be sustainable and profitable no matter the dynamics in the industry.

The economic difficulties and adjusting customer choices can also impact the demand for products that contain rosmarinic acid. To maintain the company's long-term effectiveness, the businesses need to get into the markets that are emerging, allocate resources to the research and development of the new applications, and employ the marketing strategies that will highlight the health, preservative, and anti-inflammatory benefits.

In terms of purity, the industry is segmented as >96% purity and ≤97% purity and finds application across various industrial and commercial sectors. It (>96% purity) is extensively used in the pharmaceutical, cosmetic, and dietary supplements industry owing to its prominent antioxidant, anti-inflammatory, and antimicrobial activity. With increasing demand for natural health products, this segment is anticipated to hold an industry share of about 60% by 2025.

HSRG's high-purity rosmarinic acid is used for functional foods, anti-aging skincare, and chronic disease management by companies such as Sabinsa Corporation and Naturex (Givaudan). As this natural preservative trend continues to grow, this high-purity variant is also finding its way into organic food formulations in the food and beverage industry.

It (≤97%) constitutes the 40% industry share, with major applications in: food preservations, animal feeds, and industrial applications. It is low-cost and offers reasonable antioxidant action, making it useful for processed foods, seasoning blends, and the preservation of meat.

Major producers partnering to provide this form in bulk applications of herbal extracts and functional ingredients include Layn Natural Ingredients and Martin Bauer Group. Increasing application in feed additives and beverages is expected to zoom the steady growth for this segment. In 2025, the high-purity rosmarinic acid and other natural preservatives will drive industry growth as well as industrial rosmarinic acid and botanical extract growth.

Depending on their solubility, application convenience, and stability, the industry is further divided into powder and liquid forms to offer commodities to various industries. The powder form of milk is the most dominant and is predicted to retain around 65% industry share by 2025.

Such form of Vitamin E is extensively used in pharmaceutical, dietary supplements, and food applications as it provides a long shelf life is stable and is easy to transport. Powdered form is added to capsules, tablets, and dry formulations for its antioxidant and anti-inflammatory properties.

High-purity powdered form for functional food, herbal extract, and nutraceuticals are produced by companies such as Sabinsa Corporation and Layn Natural Ingredients. Moreover, its naturally occurring antimicrobial properties make it a preferred ingredient in spice blends, spice seasonings, and preservative formulations for the food and beverage industry.

Liquid form is expected to occupy 35% of the industry share by 2025 as a result of its growing presence in the cosmetics, personal care, and beverage industries, owing to its high solubility and faster absorption. It is being extensively used in skin care serums, anti-aging creams, and natural flavoring agents.

It has been produced in solutions containing rosmarinic acid in companies such as Givaudan (Naturex) and Martin Bauer Group for its use in botanical extracts, essential oils, and cosmetic formulations. With its ease of incorporation into water-based solutions, it is perfect for functional beverages, herbal teas, and liquid dietary supplements. As the demand for plant-based antioxidants rises, the powder and the liquid forms will experience healthy growth across all industries until 2025.

| Countries | CAGR |

|---|---|

| USA | 6.2% |

| UK | 5.8% |

| France | 5.5% |

| Germany | 5.9% |

| Italy | 5.3% |

| South Korea | 6.5% |

| Japan | 6% |

| China | 7.1% |

| Australia | 5.2% |

| New Zealand | 4.9% |

The USA industry is expected to reach a 6.2% CAGR between 2025 and 2035. Increasing demand for natural antioxidants by the nutraceuticals and pharmaceutical sectors drives the growth. Companies are influenced by the trend towards natural supplements instead of synthetics to stimulate innovation. Industry leaders like NOW Foods and Nature's Way use it in dietary supplements, functional drinks, and cosmetic products.

The nation's large R&D infrastructure facilitates product development. Food is also playing a key role as clean-label trends gain momentum. Increased use of preservative-free foods and vegetable meats is a profitable industry. Regulatory sanctions of botanical extracts further increase prospects by enabling brands to promote it as a natural, safe ingredient.

The UK will likely register a CAGR of 5.8% in the period from 2025 to 2035. A historical trend towards using herbal supplements and an increasing consumer preference for organic skin care drive demand. Holland & Barrett heavily promotes it in their herbal supplement brand.

Besides this, increasing demand for vegan and plant-based foods supports industry growth. The strict regulations against synthetic additives in the UK support food companies to adopt natural preservatives such as rosmarinic acid. With rising investment in sustainable and plant-based ingredients, industry players are poised to see steady growth.

The French industry is anticipated to expand at a CAGR of 5.5% during 2025 to 2035. The country's rich tradition for herbal medicine and botanical extracts plays a major role. French multinational corporations such as L'Oréal and Yves Rocher incorporate it in skincare products, emphasizing anti-inflammatory and antioxidant activities.

Clean-label food preservative demand drives growth. Growth in organic and natural food products, especially dairy substitutes and drinks, moved the adoption of it. Furthermore, government efforts to enhance plant-based solutions for pharma and cosmetics also boost industry potential.

Germany is likely to have a CAGR of 5.9% during 2025 to 2035. German drug and nutraceutical firms focus on natural products, and it is a very popular component. It is used by companies like Weleda and Dr. Hauschka in organic cosmetics and medicines.

Apart from that, German leadership in food science and preservation creates a high demand for natural antioxidants. The increase in the trend for functional foods, especially for bakery and dairy applications, drives long-term expansion. With the consumer becoming more interested in the risks of artificial additives, manufacturers look to plant-based alternatives.

The industry in Italy is anticipated to register a CAGR of 5.3% from 2025 to 2035. Italy's cultural diversity and Mediterranean food inclination drive demand for natural food preservatives. It is becoming more and more integrated into sauces, dressings, and processed foods by Italian food companies.

Also, Italy's beauty industry enjoys increased demand for herbal skincare products. Bottega Verde capitalizes on the antioxidant potential of it in anti-aging. Consumers giving the highest priority to plant-based ingredients mean that Italy's industry is ready for consistent growth.

South Korea stands on the brink of monumental growth with a forecasted CAGR of 6.5% during 2025 to 2035. South Korea's highly advanced beauty and skincare industry incorporates it into K-beauty products. Industry giants such as Innisfree and Laneige incorporate the compound into antioxidant serums and creams.

The beverage and food sector is also a growth driver with functional beverages and herbal teas like rosmarinic acid. The liberalizing trend of South Korea towards natural additives also increases opportunities in the industry, and it has become a central hub for growth in Asia.

Japan's industry is expected to expand at 6.0% CAGR between 2025 and 2035. The nation's traditional culture of functional foods and herbal medicine is a key driver of industry growth. Shiseido and FANCL, both Japanese companies, employ it in cosmetics and food supplements.

Further, Japan's rapidly aging population boosts demand for products with antioxidant capabilities, mainly within functional foods and beverages. Encouragement by the government for a plant-based diet aligns with the increasing demand for natural preservatives, further fueling persistent industry growth.

China will have the highest CAGR of 7.1% from 2025 to 2035. Exponential development is founded on the fast industrialization of the functional food and herbal medicine industries. Industry leaders in China, like BYHEALTH, use it in immunity and anti-aging nutraceuticals.

Moreover, China's expanding middle class requires clean-label foods and cosmetics, and therefore natural antioxidants have to be used by manufacturers. Government incentives towards the herb supplement industry increase market growth even further, and thus the industry in China is a lucrative business.

The industry in Australia is expected to expand at a rate of 5.2% CAGR from 2025 to 2035. Natural health in Australia is a major sector, and companies like Blackmores are adding botanical antioxidants to supplements.

In addition, the industry for organic and preservative-free food keeps expanding. As consumers increasingly adopt a plant-based diet, food manufacturers take advantage of it based on its clean-label status. Strong regulatory support from the country for natural health products facilitates further industry growth.

New Zealand is also forecast to grow at a CAGR of 4.9% during the 2025 to 2035 period. Natural health products and organics are priorities in the country, and that fuels demand for rosmarinic acid both as a nutraceutical and as a cosmetic ingredient. Luxury brands such as Comvita feature botanical extracts in their products.

Apart from this, New Zealand's plant-based and dairy-free food industry experiences an increasing demand for natural antioxidants. The trend towards green and sustainable food solutions ensures constant industry growth, backed by local health-conscious consumers.

The industry shows considerable growth due to the increasing demand for natural antioxidants, preservatives, and anti-inflammatory products in food, pharmaceuticals, and cosmetics. The increased movement toward clean-label plant-derived compounds also poses healthy competition.

Major companies include Naturex (Givaudan), Sabinsa Corporation, Danisco (IFF), Kemin Industries, and Martin Bauer Group. They all produce high-purity rosmarinic acid extracted either from rosemary, lemon balm, or perilla leaves. New startups and niche firms entering the industry are focusing on organic and sustainably sourced variants that could target functional foods and nutraceuticals.

As the applications widen to include dietary supplements, skincare applications, and natural food preservation, the industry continues to develop. A case in point is Kemin's rosemary extract-based preservatives, which are now widely applied in meat and bakery products. In cosmetics, it draws attention because of its said UV protective as well as anti-aging qualities, with brands spotlighting it as part of anti-pollution skin care.

Good growth is seen in North America and Europe, which have the advantage of consumers who prefer botanical antioxidants instead of synthetic ones. In contrast, Asia-Pacific's growth potential is seen to lie in increasing demand for use in traditional medicine and herbal formulations.

The key competitive factors include sustainability, extraction efficiency, and compliance with regulatory requirements. Companies have launched green extraction techniques like that of supercritical CO₂ and sunk e-commerce channels for health-conscious consumers and clean-label manufacturers.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Naturex (Givaudan) | 18-22% |

| Sabinsa Corporation | 14-18% |

| Danisco (IFF) | 10-14% |

| Kemin Industries | 8-12% |

| Martin Bauer Group | 6-10% |

| Other Players (Combined) | 25-35% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Naturex (Givaudan) | Supplies high purity rosmarinic acid extracts, mainly applied in food preservation, functional foods, and dietary supplements. |

| Sabinsa Corporation | Emphasizes botanical extracts for pharmaceutical and nutraceutical purposes, utilizing innovative extraction methods. |

| Danisco (IFF) | It supplies natural antioxidant solutions for use in food, beverages, and personal care products. |

| Kemin Industries | Develops natural plant-based preservatives with a focus on sustainable and organic-certified ingredients. |

| Martin Bauer Group | Expertise in herbal extracts for food, beverage, as well as health uses, with a focus on clean-label solutions. |

Key Company Insights

Naturex (Givaudan) (18-22%)

A pioneer in the regional industry for plant-based extracts, offering it with high purity for natural food preservation processes and functional health products.

Sabinsa Corporation (14-18%)

The company strongly concentrates on developing botanicals-based nutraceuticals, investing mostly in scientific research and proprietary extraction technologies.

Danisco (IFF) (10-14%)

Strong presence in food-grade antioxidants focusing on shelf-life extension in clean-label formulations.

Kemin Industries (8-12%)

Development of plant-based preservatives, making use of sustainability and traceability in reaching health-centric consumers.

Martin Bauer Group (6-10%)

A major player in herbal ingredient solutions, catering to functional beverages, cosmetics, as well as nutraceutical industries.

The industry is expected to generate USD 154.7 million in revenue by 2025.

The industry is projected to reach USD 369.7 million by 2035, growing at a CAGR of 9.1%.

Key players include Naturex (Givaudan), Sabinsa Corporation, Danisco (IFF), Kemin Industries, Martin Bauer Group, Cayman Chemical, Shaanxi NHK Technology, Hunan NutraMax, Geneham Pharmaceutical, and Monteloeder.

North America and Europe, driven by rising consumer preference for natural preservatives, increasing application in functional foods, and the growing herbal supplement industry.

Plant-extracted rosmarinic acid dominates due to its strong antioxidant properties, anti-inflammatory benefits, and extensive use in dietary supplements, skincare, and pharmaceuticals.

By product type, the industry is classified as >96% purity and ≤97% purity.

By form, the industry is classified as powder and liquid.

By application, the industry is classified as food and beverage, pharmaceuticals, nutraceuticals, cosmetics & personal care, and animal feed.

By region, the industry is segmented as North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

Natural Dog Treat Market Product Type, Age, Distribution Channel, Application and Protein Type Through 2035

Buttermilk Powder Market Analysis by Product Type, Sale Channel, and Region Through 2035

Oat-based Beverage Market Analysis by Source, Product Type, Speciality and Distribution channel Through 2035

Multivitamin Melt Market Analysis by Ingredient Type, Claim, Sales Channel and Flavours Through 2035

Nuts Market Analysis by Nut Type, Product Type, Distribution channels, End-use Industry, and Region through 2025 to 2035

Korea Fusion Beverage Market Analysis by Beverage Type, Ingredient Profile, Distribution Channels, and Country Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.