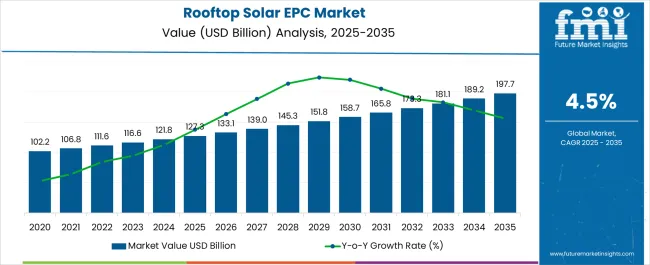

The Rooftop Solar EPC Market is estimated to be valued at USD 127.3 billion in 2025 and is projected to reach USD 197.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period. The market will generate an absolute increase of USD 70.4 billion and achieve a growth multiplier of 1.55x over the decade. This expansion, supported by a CAGR of 4.5%, reflects the steady adoption of solar photovoltaic systems across residential, commercial, and industrial segments. In the first five-year phase (2025–2030), the market will rise from USD 127.3 billion to USD 158.7 billion, adding USD 31.4 billion, or 44.6% of the total incremental growth, with a 5-year multiplier of 1.25x driven by policy incentives and rooftop installations in developed economies.

The second phase (2030–2035) contributes USD 39.0 billion, representing 55.4% of incremental growth, signaling consistent demand from emerging markets where distributed solar becomes a key energy solution. Annual increments increase gradually from USD 5.8 billion in early years to USD 8.5 billion by the end of the forecast period, indicating stable yet persistent growth. EPC companies focusing on integrated solar-plus-storage solutions, digital design tools, and cost-efficient installation models will be best positioned to capture value in this USD 70.4 billion opportunity, especially as decentralized energy adoption scales across Asia-Pacific and Latin America.

| Metric | Value |

|---|---|

| Rooftop Solar EPC Market Estimated Value in (2025 E) | USD 127.3 billion |

| Rooftop Solar EPC Market Forecast Value in (2035 F) | USD 197.7 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The rooftop solar EPC market holds a strong position across several renewable energy and distributed generation segments. In the solar energy market, its share is approximately 12–14%, as utility-scale projects dominate the larger portion of installed capacity. Within the renewable energy EPC market, it contributes around 8–10%, since this segment also includes wind and hydropower projects. In the distributed energy resources (DER) market, the share is about 15–18%, as rooftop solar represents a major component of decentralized energy systems.

For the residential and commercial solar solutions market, rooftop solar EPC accounts for nearly 35–40%, as these installations primarily rely on engineering, procurement, and construction services for execution. In the energy infrastructure and grid integration market, its share is smaller at 3–4%, given that grid modernization, substations, and large-scale transmission projects dominate. Growth is driven by rising electricity costs, government incentives for rooftop solar adoption, and increasing corporate sustainability initiatives. Additionally, technological innovations in solar panels, energy storage integration, and digital monitoring systems are further enhancing efficiency and reducing costs. With urbanization and net-metering policies gaining traction globally, the rooftop solar EPC market is expected to expand its influence within these parent markets, solidifying its role in the transition to distributed renewable energy systems.

Increased focus on distributed renewable energy solutions has placed rooftop solar at the forefront of clean energy adoption. This growth has been supported by favorable government policies, declining photovoltaic module prices, and improved financing options.

Urban centers are witnessing higher adoption rates due to space utilization efficiency and long-term cost savings for end users. EPC players are increasingly offering integrated solutions that combine design, procurement, installation, and maintenance, enhancing market value for residential, commercial, and industrial consumers.

Innovations in inverter technology, energy storage integration, and digital monitoring platforms are also elevating the reliability and scalability of rooftop solar systems. As demand for net-zero infrastructure intensifies across developed and developing economies, the rooftop solar EPC segment is poised to grow steadily, anchored by rising environmental awareness, supportive regulations, and increased private sector participation in renewable energy deployment.

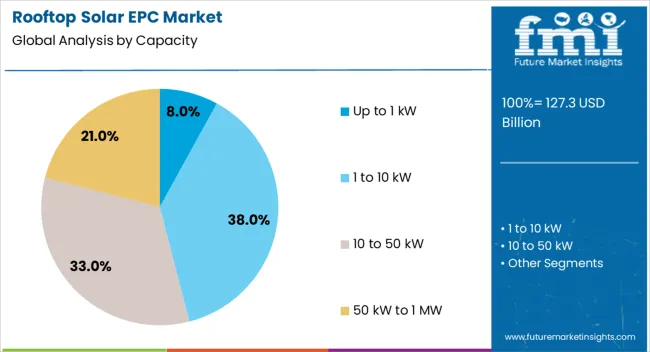

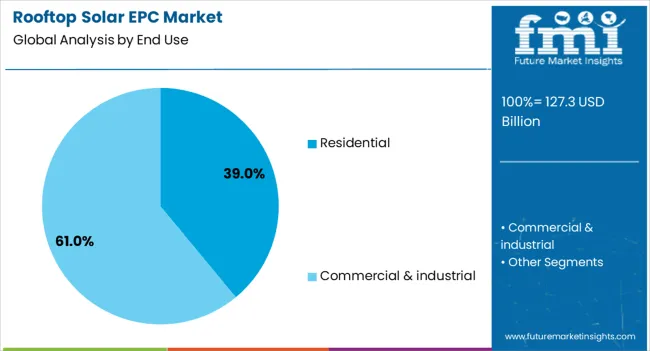

The rooftop solar EPC market is segmented by capacity, end use, and geographic regions. The capacity of the rooftop solar EPC market is divided into Up to 1 kW, 1 to 10 kW, 10 to 50 kW, and 50 kW to 1 MW. In terms of end use, the rooftop solar EPC market is classified into Residential and Commercial & industrial. Regionally, the rooftop solar EPC industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Up to 1 kW capacity segment is expected to contribute 8% of the Rooftop Solar EPC market revenue share in 2025. This segment has seen consistent uptake due to its suitability for individual households and small-scale users, particularly in urban and semi-urban areas with limited roof space. Adoption has been supported by government incentives and subsidies aimed at promoting residential solar usage for energy self-sufficiency and grid load reduction.

The segment has benefited from simplified permitting processes and lower capital investment requirements, which make it accessible to a larger consumer base. Technological improvements in panel efficiency and compact system designs have further strengthened its appeal.

Growth in this segment has also been driven by increased awareness of environmental benefits and long-term electricity cost savings. As rooftop solar adoption continues to expand across the residential sector, systems in the Up to 1 kW range are expected to play a key role in democratizing solar access and supporting the energy transition at the household level..

The residential segment is projected to lead the Rooftop Solar EPC market with a 39% revenue share in 2025. This dominance has been driven by increasing electricity costs, favorable net metering policies, and growing public awareness around sustainable living. Homeowners have increasingly adopted rooftop solar systems as a means to achieve energy independence while reducing monthly utility bills.

EPC contractors have responded to this demand with standardized, scalable offerings that simplify the installation process and enhance after-sales service. Residential installations have also been boosted by rising demand for energy resilience through storage-integrated systems, especially in regions facing frequent grid instability. Technological advancements in modular system design and smart energy management tools have improved system performance and usability.

Financial innovations such as solar leasing and pay-as-you-go models have further improved affordability, encouraging broader adoption. As sustainability becomes a core consideration in housing development and renovation, the residential sector is expected to maintain its leadership in rooftop solar EPC deployments..

The rooftop solar EPC market is expanding due to increased adoption of decentralized energy systems and favorable policy incentives. Growth is supported by rising installations in residential and commercial sectors, driven by reduced installation costs and energy independence goals. Opportunities are emerging in hybrid solar systems, storage integration, and industrial-scale rooftop projects. Key trends include digital project monitoring, modular mounting solutions, and performance-linked service contracts. However, restraints include high initial costs, policy uncertainties, and rooftop structural limitations. The overall outlook suggests sustained growth supported by government programs and consumer preference for low-cost energy solutions.

The primary growth driver is the implementation of supportive government policies and declining installation costs. In 2024 and 2025, net metering policies and tax incentives in regions like Asia-Pacific and North America accelerated rooftop solar deployment across residential and commercial segments. Competitive module pricing and standardized EPC packages have made rooftop systems more accessible to small businesses and households. Corporate energy buyers also initiated large-scale installations to secure cost savings and predictable energy expenses. These developments indicate that financial incentives and affordability improvements will continue to shape the market positively.

Significant opportunities have been identified in hybrid solar systems and energy storage integration for rooftops. In 2025, industrial facilities and warehouses adopted large-scale rooftop solar systems combined with battery solutions to enhance power reliability. EPC providers offering turnkey solutions for such hybrid projects attracted new contracts from manufacturing sectors seeking operational cost control. Growth was also observed in developing markets where grid reliability issues boosted demand for off-grid and backup-enabled rooftop installations. These opportunities underscore the strategic advantage for EPC firms specializing in customized, storage-ready solar solutions for energy-intensive industries.

Emerging trends point toward the growing adoption of digital monitoring platforms and modular rooftop mounting systems. In 2024, cloud-based analytics for performance tracking became a standard feature in EPC service portfolios, enabling predictive maintenance and optimized energy output. Modular designs that allow quick installations without heavy structural changes gained traction among commercial users with time-sensitive project schedules. Additionally, EPC players began offering financing-linked service contracts to attract cost-conscious customers. These trends demonstrate an industry shift toward technology-driven operations and user-focused flexibility, strengthening EPC competitiveness in a rapidly evolving energy landscape.

Market restraints are influenced by inconsistent regulatory frameworks, high upfront investment, and building structural challenges. In 2024 and 2025, uncertainty in net metering rules and tariff adjustments discouraged long-term investment in certain regions. Rooftop load limitations in older commercial buildings posed design challenges for EPC providers, leading to increased engineering costs. Complex permitting processes further delayed project execution, reducing profitability for installers. These constraints highlight the need for regulatory stability, simplified approval procedures, and innovative lightweight mounting systems to accelerate rooftop solar adoption across diverse infrastructure profiles.

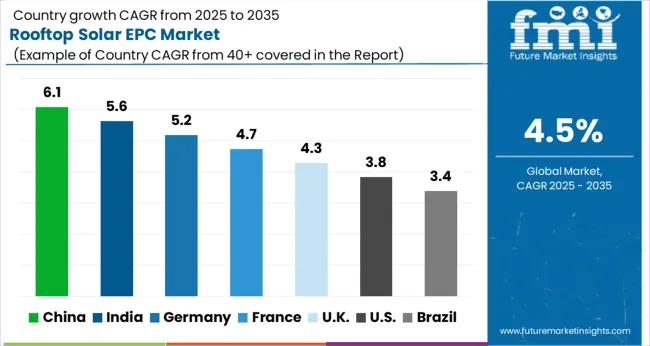

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

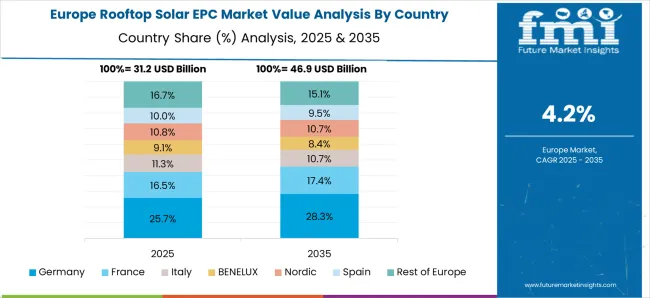

The global rooftop solar EPC market is projected to grow at 4.5% CAGR between 2025 and 2035. China leads with 6.1% CAGR, driven by aggressive renewable energy targets and government subsidies for decentralized solar installations. India follows at 5.6%, supported by rooftop solar programs and net-metering policies promoting self-consumption. Germany posts 5.2% CAGR, leveraging strong policy frameworks and residential energy storage integration. The UK records 4.3%, while the United States grows at 3.8%, reflecting moderate adoption in a mature solar market with emphasis on battery-paired rooftop solutions. Asia-Pacific dominates due to favorable economics and large-scale deployment, whereas Western markets focus on premium EPC services and smart energy systems.

China remains the global leader with an expected 6.1% CAGR, driven by extensive adoption of rooftop solar under national carbon neutrality goals. Residential and commercial building segments lead installations, aided by subsidies and low-interest financing for distributed solar projects. EPC firms focus on integrating high-efficiency modules with AI-based monitoring systems to enhance yield optimization. The rise of solar-plus-storage solutions is accelerating in urban and industrial hubs, providing energy security and reducing peak load dependency. Partnerships between EPC firms and real estate developers further expand penetration in new constructions.

The market in India is projected to grow at 5.6% CAGR, supported by rooftop solar mandates for commercial buildings and net-metering regulations. State-level programs and renewable purchase obligations encourage adoption across industries and educational institutions. EPC contractors focus on cost-effective design and modular installation solutions for small and mid-sized projects. The residential segment gains momentum due to decreasing panel costs and government-backed financing schemes. Integration of hybrid solar systems combining storage and grid connectivity offers growth potential for EPC players targeting reliability-focused users.

Germany records a 5.2% CAGR, supported by strong regulatory frameworks under the Renewable Energy Sources Act and incentives for rooftop PV integration. Growing adoption of solar-plus-storage solutions in residential and commercial properties drives demand for specialized EPC services. EPC providers increasingly leverage digital design tools and remote performance monitoring for system optimization. The country’s focus on energy independence and carbon neutrality accelerates investment in decentralized energy solutions. Expansion of community solar and shared rooftop projects opens new revenue streams for EPC firms.

The United Kingdom is forecasted to grow at 4.3% CAGR, supported by government programs promoting solar adoption and carbon-neutral building standards. EPC players target commercial real estate and public infrastructure projects requiring sustainable energy solutions. Growth in residential installations is driven by rising electricity costs and demand for smart home energy management systems. Premium EPC services featuring advanced monitoring platforms and predictive maintenance are gaining traction among large-scale commercial clients. Integration of rooftop solar with EV charging stations presents additional opportunities.

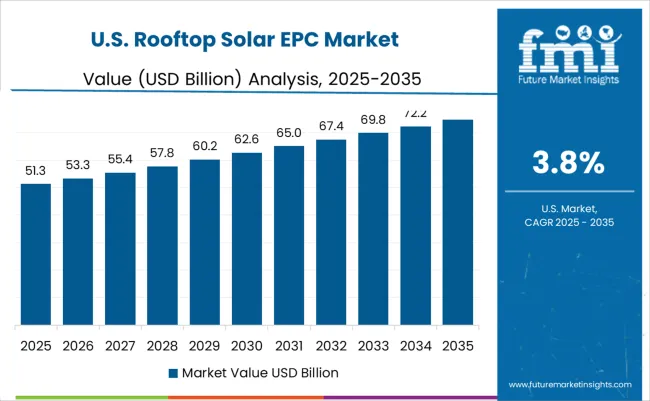

The United States market is expected to grow at 3.8% CAGR, reflecting moderate but steady demand. Growth is driven by solar tax credits, net-metering programs, and corporate sustainability commitments. EPC players emphasize turnkey solutions for commercial clients, integrating rooftop PV with energy storage and demand response systems. Residential adoption faces regional disparities due to policy variations but remains strong in states like California and New York. Technological innovations in module efficiency and IoT-based monitoring tools enhance the value proposition of EPC services in a competitive market.

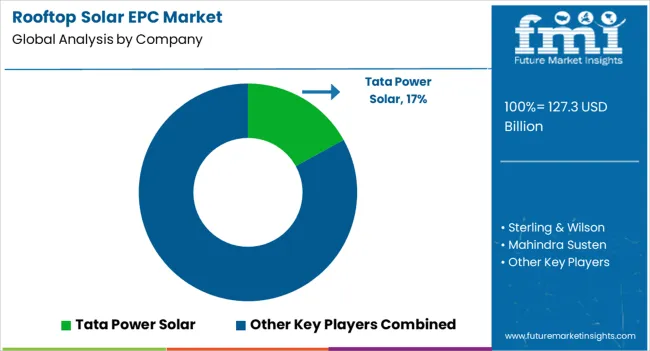

The rooftop solar EPC market in India is moderately consolidated, with Tata Power Solar recognized as a leading player due to its strong track record in residential, commercial, and industrial rooftop installations. The company’s expertise in engineering, procurement, and construction (EPC) services, combined with advanced solar solutions and strong after-sales support, reinforces its leadership in the sector. Key players include Sterling & Wilson, Mahindra Susten, Jakson Group, Vikram Solar, and Waaree Energies. These companies specialize in designing and implementing turnkey rooftop solar projects, offering services that encompass site assessment, customized system design, procurement of high-quality modules and inverters, installation, and maintenance.

Their focus is on optimizing energy output, reducing lifecycle costs, and ensuring regulatory compliance. Market growth is driven by increasing adoption of renewable energy, government incentives for distributed solar generation, and rising awareness among commercial and industrial consumers about reducing energy costs.

Leading EPC companies are investing in digital monitoring platforms, energy storage integration, and modular system designs for enhanced efficiency and scalability. Emerging trends include hybrid rooftop systems combining solar with battery storage, performance-based service models, and adoption of smart inverters for grid stability. India’s rooftop solar segment continues to expand rapidly, driven by supportive policies such as net metering and capital subsidies for residential consumers.

| Item | Value |

|---|---|

| Quantitative Units | USD 127.3 Billion |

| Capacity | Up to 1 kW, 1 to 10 kW, 10 to 50 kW, and 50 kW to 1 MW |

| End Use | Residential and Commercial & industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Tata Power Solar, Sterling & Wilson, Mahindra Susten, Jakson Group, Vikram Solar, and Waaree Energies |

| Additional Attributes | Dollar sales by mounting type (residential, commercial, industrial) and system size (≤10 kW, 10–50 kW, >50 kW). Market valued at ~USD 116.6 B in 2023, projected at ~USD 128.3 Billion in 2025 with ~5–6% CAGR to 2030. North America leads; Asia-Pacific fastest growth. Buyers seek turnkey EPC, storage-ready designs, IoT-enabled monitoring, smart roof integration, and streamlined permitting workflows. |

The global rooftop solar epc market is estimated to be valued at USD 127.3 billion in 2025.

The market size for the rooftop solar epc market is projected to reach USD 197.7 billion by 2035.

The rooftop solar epc market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in rooftop solar epc market are up to 1 kw, 1 to 10 kw, 10 to 50 kw and 50 kw to 1 mw.

In terms of end use, residential segment to command 39.0% share in the rooftop solar epc market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Rooftop Solar PV Module Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar PV EPC Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Ground Mounted Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Solar Module Recycling Service Market Size and Share Forecast Outlook 2025 to 2035

Solar Tracking Module Market Size and Share Forecast Outlook 2025 to 2035

Solar Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Solar Aluminum Alloy Frame Market Size and Share Forecast Outlook 2025 to 2035

Solar Grade Monocrystalline Silicon Rods Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Solar PV Module Market Size and Share Forecast Outlook 2025 to 2035

Solar Encapsulation Market Size and Share Forecast Outlook 2025 to 2035

Solar Pumps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Solar PV Recycling Market Size and Share Forecast Outlook 2025 to 2035

Solar Tracker for Power Generation Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Market Size and Share Forecast Outlook 2025 to 2035

Solar-Powered Active Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA