The business of rolling machines is growing fast. Manufacturers are all in the hunt for speedy cost-efficient and accurate metal shaping machinery options. These machines are critical for high-speed and fully automated production in industries like automotive, construction, aerospace, and appliances. Cold has called in customized high-precision roll forming machines into demand, as many companies think up new ways of increasing productivity and minimizing wastage.

Companies are leveraging smart automation, AI-based controls, and high-strength materials in their roll forming machines to boost durability and efficiency. Such innovations are driven by green initiatives as manufacturers converge into the development of energy-efficient and recyclable materials-friendly roll forming systems. The industry is shifting towards flexible, modular, and digitally interconnected roll forming solutions to meet the dynamic requirements of a wide range of industrial applications.

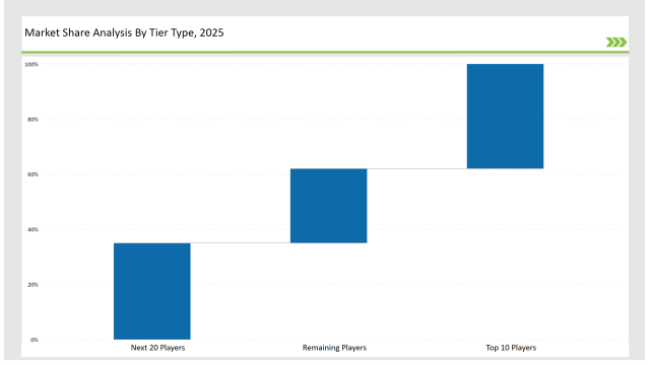

Tier 1 players, for example, Bradbury Group, Samco Machinery, and Formtek, hold 38% of the share in the market with their leadership in precision engineering, their wide global presence, and their investments in automation.

Innovative, cost-effective, and industry-specific roll forming solutions capture around 35% of the market share from Tier 2 companies, such as Dallan S.p.A, Gasparini Industries, and Dreistern.

Tier 3 is made up of local and niche players dealing with custom-made roll-forming machines, high-speed production systems, and compact roll-forming units, with a total of 27% market share. The companies majorly focus on localized production along with technological innovations and customizations specific to the industry.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Bradbury Group, Samco Machinery, Formtek) | 18% |

| Rest of Top 5 (Dallan S.p.A, Gasparini Industries) | 12% |

| Next 5 of Top 10 (Dreistern, ArcelorMittal, BMS Metal Tech, Zeman Bauelemente, STAM S.p.A) | 8% |

The roll forming machine industry serves multiple sectors where precision, automation, and cost-efficiency are essential. Companies are developing innovative roll forming solutions to optimize production across various applications.

Manufacturers are optimizing roll forming machines with smart automation, modular configurations, and sustainability-driven innovations.

Revolutionizing roll forming machinery: automation and digital transformation. Organizations are implementing intelligent process optimization, robotic integration, and real-time quality control for improved production efficiency. Companies are investing in roll formers that consume less energy for sustainable manufacturing. Such firms are also providing modular and flexible roll forming systems for small-batch or customized production. They are also transitioning to cloud analytics tools for condition-monitoring machine performance and maintenance needs.

Year-on-Year Leaders

Technology suppliers should focus on automation, sustainability, and digital integration to support the evolving roll forming machine market. Partnering with automotive, aerospace, and construction firms will accelerate adoption.

| Tier Type |

Example of Key Players |

|---|---|

| Tier 1 | Bradbury Group, Samco Machinery, Formtek |

| Tier 2 | Dallan S.p.A, Gasparini Industries, Dreistern |

| Tier 3 | ArcelorMittal, BMS Metal Tech, Zeman Bauelemente, STAM S.p.A |

Leading manufacturers are advancing roll forming machine technology with automation, smart monitoring, and modular configurations.

| Manufacturer | Latest Developments |

|---|---|

| Bradbury Group | Launched AI-integrated defect detection roll forming in March 2024. |

| Samco Machinery | Developed fully automated high-speed roll forming lines in April 2024. |

| Formtek | Expanded servo-driven roll forming solutions in May 2024. |

| Dallan S.p.A | Released compact roll forming machines for lightweight structures in June 2024. |

| Gasparini Industries | Strengthened modular roll forming system production in July 2024. |

| Dreistern | Introduced energy-efficient roll forming technology in August 2024. |

| ArcelorMittal | Pioneered recyclable roll forming systems in September 2024. |

The roll forming machine market is evolving as companies invest in automation, sustainability, and smart manufacturing technologies.

The industry will keep integrating Ai-based quality control; cloud-based predictive maintenance; and highly efficient modular designs. This refinement will allow manufacturers to redefining roll forming machines in terms of being recyclable to adopt green manufacturing goals. They will use digital twin technology to boost production efficiency in businesses.

Companies will incorporate smart analytics to improve machine diagnostics and reduce downtimes. Energy-efficient roll forming systems will be the norm. Moreover, companies will add automation capabilities for highly precise roll forming applications.

Leading players include Bradbury Group, Samco Machinery, Formtek, Dallan S.p.A, Gasparini Industries, Dreistern, and ArcelorMittal.

The top 3 players collectively control 18% of the global market.

The market shows medium concentration, with top players holding 38%.

Key drivers include automation, sustainability, modularity, and precision engineering.

The roll-forming machine market includes pre-punch, mid-line punch, and post-punch process types.

The segment is trifurcated into steel, aluminum (30-60 meters/minute), and copper (20-40 meters/minute) operating speed.

Steel is further classified into light gauge steel (20-50 meters/minute), medium gauge steel (10-20 meters/minute), and heavy gauge steel (5-10 meters/minute).

Portable and non-portable roll-forming machines are included in this category.

The segment includes channels, angles, tubes, beams, panels, and other customized shapes.

The category includes automotive, construction, defense and aerospace, electrical and electronics, and other manufacturing end uses.

Information is given about the leading countries of North America, Latin America, Western Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

BOPP Film Market Analysis by Thickness, Packaging Format, and End-use Industry Through 2025 to 2035

Korea Tape Dispenser Market Analysis by Material, Product Type, Technology, End Use, and Region through 2025 to 2035

Medical Transport Box Market Trend Analysis Based on Material, Capacity, End-User and Regions 2025 to 2035

Japan Heavy-duty Corrugated Packaging Market Analysis based on Product Type, Board type, Capacity, End use and City through 2025 to 2035

Corrugated Board Market Analysis by Material and Application Through 2035

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.