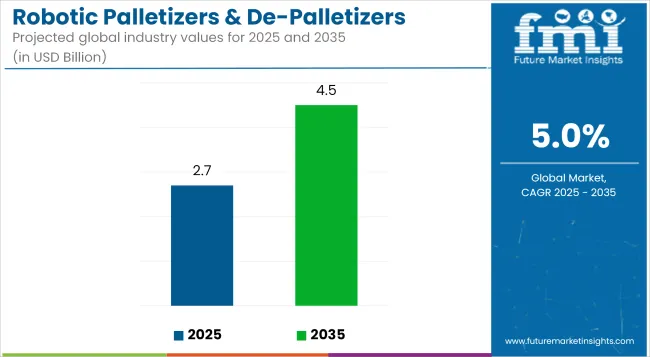

The robotic palletizers & de-palletizers market is projected to grow from USD 2.7 billion in 2025 to USD 4.5 billion by 2035, registering a CAGR of 5.0% during the forecast period. Sales in 2024 reached USD 2.5 billion. Growing labor costs and a rising emphasis on process automation in FMCG, warehouse, and food production industries have accelerated adoption.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.7 billion |

| Industry Value (2035F) | USD 4.5 billion |

| CAGR (2025 to 2035) | 5.0% |

Systems offering flexible configuration, reduced downtime, and increased throughput are preferred in industries seeking operational consistency. Robotic palletizing solutions are being deployed extensively to optimize stacking patterns, handle SKU variability, and minimize breakage. As manufacturers seek scalable and high-speed systems to streamline logistics operations, the demand for robotic palletizing technology is projected to strengthen over the next decade.

In January 2025, KUKA launched four new palletizing robots to its heavy-duty portfolio. These fast and powerful robots can perform a wide range of palletizing tasks with high efficiency. “The KR FORTEC PA is ideal for a wide range of palletizing tasks, from stacking small beverage cans to arranging 200-liter drums.

The high load-bearing capacity and low energy consumption contribute to a significant reduction in total operating costs (total cost of ownership). And, due to the modularization, identical spare parts from the KR FORTEC, KR QUANTEC and KR FORTEC ultra robot models can be used to save on storage costs” said Sandra Hirsch, Global Content Marketing Manager, KUKA.

Greater focus has been placed on sustainability, operational uptime, and workforce challenges, prompting increased interest in automated palletizing systems that reduce workplace injuries and improve energy efficiency. Deployments of robotic palletizers are increasingly viewed as eco-efficient alternatives, as they reduce rework, minimize product damage, and lower carbon emissions associated with logistics handling.

Several new-generation units are now equipped with energy-saving actuators, sensor-driven precision arms, and automated tooling heads. These advancements have allowed systems to optimize load stability while conserving electrical resources.

Between 2025 and 2035, the robotic palletizers and de-palletizers market is expected to unlock significant opportunities through modular platform offerings and software-integrated coordination. With manufacturers prioritizing scalability, investments are being channeled toward plug-and-play robotics and cloud-integrated fleet control systems. Demand will likely strengthen in e-commerce and logistics sectors as sorting complexity and packaging volumes surge.

Furthermore, real-time diagnostics, digital twin testing, and AI-driven pattern recognition are projected to play pivotal roles in performance upgrades. Competitive differentiation is expected to hinge on software-user experience, platform interoperability, and reduced integration costs, ensuring broad industrial applicability and favorable return on investment across medium- and high-volume applications.

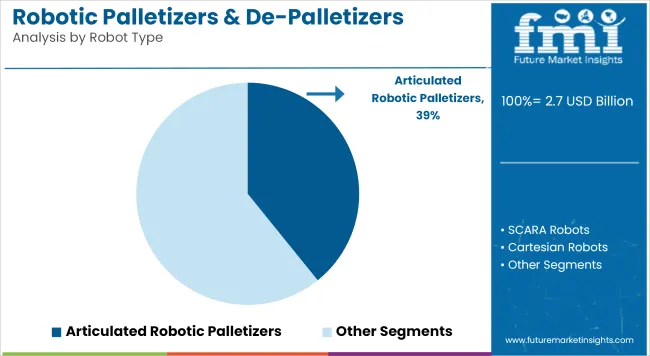

The market is segmented based on robot type, configuration, operation type, end-use industry, and region. By robot type, the market includes articulated robotic palletizers, SCARA robots, Cartesian robots, collaborative robots, and gantry robots. In terms of configuration, the market is categorized into inline palletizers, layer palletizers, mixed-case palletizers, depalletizing systems, and hybrid palletizer/depalletizer systems.

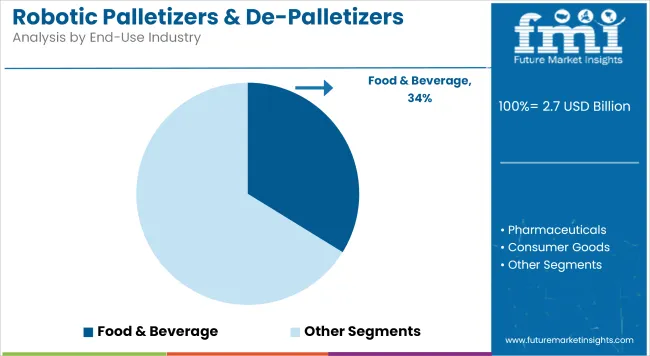

By operation type, the market comprises manual, semi-automatic, and fully automatic systems. In terms of end-use industry, the market includes food & beverage, pharmaceuticals, consumer goods, automotive components, chemicals, industrial manufacturing, and e-commerce & logistics. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

Articulated robotic palletizers are projected to account for 39.2% of the robotic palletizers & de-palletizers market in 2025, owing to their superior range of motion, multi-axis articulation, and adaptability across various packaging formats. These robots have been extensively applied in fast-moving production lines requiring high-speed, high-precision palletizing.

In industries where payload diversity and line complexity are common, articulated robots have enabled streamlined handling of boxes, crates, and shrink-wrapped units. The ability to operate in confined spaces and adapt to different stacking configurations has been a key advantage.

Enhanced with advanced vision systems and AI-based motion planning, these robotic arms have supported real-time decision-making and autonomous sorting. Their integration into Industry 4.0 frameworks has also improved throughput and minimized labor dependency. With increasing demand for automation across packaging, warehousing, and shipment operations, articulated robots are expected to maintain dominance due to their proven versatility, high uptime, and programmable accuracy.

The food and beverage industry is estimated to hold 33.8% of the robotic palletizers & de-palletizers market in 2025, propelled by automation trends in perishable goods handling, beverage bottling, and packaged food logistics. Robotic systems have been deployed to improve operational speed while maintaining hygiene standards in sensitive production environments.

Automated palletizers have enabled streamlined packaging of mixed SKU cases, temperature-sensitive cartons, and flexible pouches for beverage and dairy brands. Robotics has helped meet regulatory compliance while minimizing product damage during end-of-line handling.

In high-throughput environments such as beverage bottling plants and snack food distribution centers, robotic de-palletizers have enhanced efficiency and reduced manual strain. Their contribution to cold chain integrity and contamination control has been especially valued. With rising SKU complexity, expanding e-grocery, and growing demand for packaged convenience foods, robotic palletizers in this segment are expected to remain critical. The focus will remain on enhancing adaptability and cleanroom-grade automation in future installations.

High Initial Investment and Skilled Labour Requirement

Implementation of automation-driven palletizer and de-palletizer is a sunk capital solution, i.e., investment in hardware, software, and infrastructure. SMEs are generally discouraged by upfront gargantuan capital investment in automation.

Technically qualified personnel must also be available for operation, programming, and robot application maintenance. Training of staff needs to be carried out by the company so that optimum productivity of such automated technology is assured.

AI and Machine Learning developments

Artificial intelligence (AI) and machine learning application in robotic palletizers is among the largest growth drivers.AI robots are able to read patterns, stack correctly, and optimize processes with enhanced accuracy.

ABB and FANUC are investing in smart robots that can learn and reduce the use of manual programming and configuration. Widespread use of low-cost and modular robots is propagating automation to the third world. Robot producers are also using modular methods to make robots easy to integrate and customize.

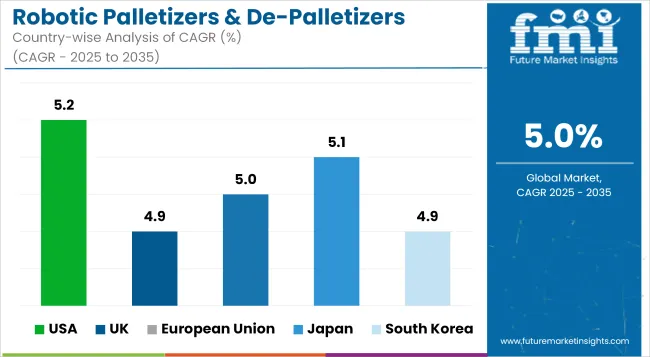

The market for USA robotic palletizers & de-palletizershas expanded steadily as automated warehousing has gained popularity and retail giants such as Walmart and Amazon have stepped up their demand for robotics. The shortage of labour and rising costs of labour have prompted investments in robotics automation, and firms are adopting AI-driven palletizing systems to boost efficiency.

Over the next few years, predictive analytics and machine learning will continue to extend robotic functionality, minimizing downtime while maximizing safety. Collaborative robots, or cobots, will gain acceptance in mid-sized warehouses, enabling automation at a cost to organizations outside large business. In addition, America's cold storage market is using robotic palletizers more and more to ensure efficiency and temperature-sensitive care.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

The UK robotic palletizer and de-palletizer market is growing, led by rising automation in manufacturing and logistics industries. Brexit-induced labour shortages have spurred the shift to robotic handling solutions. Large retailers and food processors are investing in AI-based robotic palletizing systems to enhance efficiency and minimize dependence on manual labour.

Meanwhile, regulatory environments like the UK Robotics Growth Partnership are promoting innovation in robotic automation. Intelligent robotic tools with the ability to handle variable product weights and dimensions will grow immensely, especially in grocery warehousing and pharma distribution.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.9% |

EU robotic palletizing market is defined by automation-friendly regulation and swift uptake in manufacturing and logistics. Germany, France, and Italy are at the forefront of adopting AI-based robotic palletizers in industries like the automotive, pharmaceutical, and food processing industries. The stringent labour laws in the EU and increasing demand for supply chain resilience have compelled dependence on robotics.

Green automation trends are propelling the adoption of energy-efficient robot solutions to support EU sustainability objectives. Adoption of AI-based palletizing solutions in food-grade and hazardous good handling is also improving operational efficiency in European warehouses.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.0% |

Japan's robotics industry for palletizers and de-palletizers is booming because of its highly developed automation culture. Gravely focused on precision engineering and integration with AI, Japanese suppliers are launching the newest palletizing robots with deep learning to make real-time adjustments.

Japan's indigenous growth in the semiconductor and logistics sectors is also generating demand for robotic palletizing systems. FANUC and Yaskawa are at the forefront of creating ultra-high-speed robotic palletizing systems that suit high-density storage warehouses.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

South Korea is witnessing quick expansion in robotic palletizing due to investments in intelligent logistics infrastructure. South Korea's strong e-commerce base, dominated by firms such as Coupang, is increasingly dependent on robotic automation to improve the efficiency of fulfilment.

Also, favourable AI and smart factory government policies are driving the take-up of robotic palletizers in manufacturing and distribution. South Korean manufacturers are applying digital twin technology to optimize robotic palletizing performance and improve warehouse productivity.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

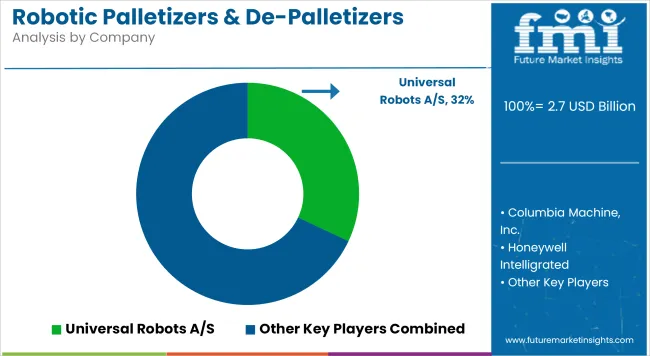

Robotic palletizers & de-palletizers are a rapidly developing field with improved international market participants and local manufacturers leading the process of material handling automation. Megacorporations dominate large market shares and are leading the charge on robot technologies, AI-powered automation, and accurate handling for food & beverages, pharma, logistics, and manufacturing industry applications. The industry has established producers and new participants, who collectively collaborate for efficiency, labour cost savings, and safety of operations.

Palletizers:

De-Palletizers:

The overall market size for robotic palletizers & de-palletizers market was USD 2.7 billion in 2025.

The robotic palletizers & de-palletizers market is expected to reach USD 4.5 billion in 2035.

The increasing adoption of automation in logistics and manufacturing industries, coupled with the rising need for efficiency, precision, and workplace safety, fuels the robotic palletizers & de-palletizers market during the forecast period.

The top 5 countries which drive the development of robotic palletizers & de-palletizers market are USA, Germany, China, Japan, and South Korea.

On the basis of application, the food & beverage industry is expected to command a significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Robotic Warfare Market Size and Share Forecast Outlook 2025 to 2035

Robotic Lawn Mower Market Size and Share Forecast Outlook 2025 to 2035

Robotics Welding Market Size and Share Forecast Outlook 2025 to 2035

Robotic Rehab Tools Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Robotics-Assisted Telesurgery Market Size and Share Forecast Outlook 2025 to 2035

Robotic Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Robotic Assisted Endovascular Systems Market Size and Share Forecast Outlook 2025 to 2035

Robotic Lung Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Robotics as a Service (RaaS) Market Size and Share Forecast Outlook 2025 to 2035

Robotic X-ray Scanner Market Size and Share Forecast Outlook 2025 to 2035

Robotic Catheterization Systems Market Growth – Innovations, Trends & Forecast 2025-2035

Robotic Aseptic Syringe Filler Capper Market Size and Share Forecast Outlook 2025 to 2035

Robotic Vision Market Size and Share Forecast Outlook 2025 to 2035

Robotics Actuators Market Size and Share Forecast Outlook 2025 to 2035

Robotic Biopsy Devices Market Insights - Trends & Forecast 2025 to 2035

Robotic Vacuum Cleaners Market Growth - Trends & Demand from 2025 to 2035

The Robotics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Robotics Prototyping Market Trends - Growth & Forecast 2025 to 2035

Robotic Process Automation Market by Component, Operation, Industry & Region Forecast till 2025 to 2035

Competitive Landscape of Robotic Vacuum Cleaner Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA