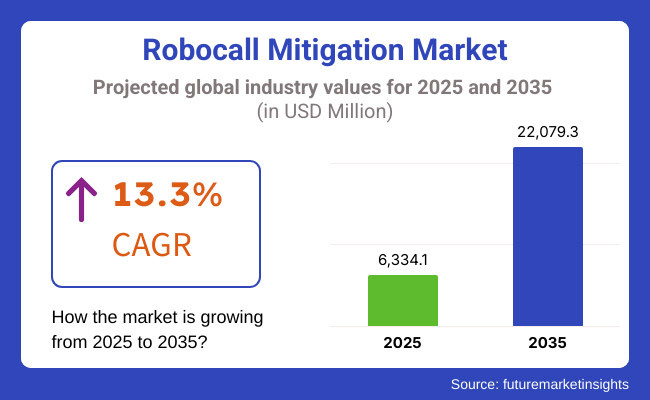

The global sales of Robocall Mitigation are estimated to be worth USD 6334.1 million in 2025 and are anticipated to reach a value of USD 22079.3 million by 2035. Sales are projected to rise at a CAGR of 13.3% over the forecast period between 2025 and 2035. The revenue generated by Robocall Mitigation in 2024 was USD 5,590.56 million. The market is anticipated to exhibit a Y-o-Y growth of 13.2% in 2025.

The market consists of solutions such as call authentication, AI-based call analytics, voice biometrics, and real-time call blocking. The main catalysts behind this evolving landscape are the increase in phone scams, regulatory approaches such as STIR/SHAKEN in the USA, and the increase in spam filters powered by artificial intelligence.

Key stakeholders in this ecosystem are telecommunication providers, enterprises, and regulatory bodies. Hosted and on-premise robocall mitigation solutions for businesses and consumers to keep voices secure and legitimate. The market is growing worldwide, propelled by rising mobile penetration along with AI development and the demand for better fraud prevention and improved calling authentication.

The Robocall Mitigation Market is revolutionizing the telecoms and customer service industry, as increasing regulatory enforcement and the rise of phone scams, alongside advancements in AI-driven fraud detection, fuel its growth. International governments, particularly those in the USA, Canada, as well as Europe, began enforcing STIR/SHAKEN and TRACED Act to fight against robocalls, which has driven telecom operators to deploy mitigation solutions. The market includes call authentication, AI-based spam filtering, voice biometrics, and real-time call blocking technologies. Cloud-based solutions are becoming popular owing to their scalability and ease of integration. Key participants include telecom operators, cybersecurity firms, and regulatory bodies.

North America leads the market, followed by Europe and Asia-Pacific, where the rise in mobile penetration is driving demand. The market is set to grow even further as enterprises look for strong caller authentication solutions and AI-preventive fraud. Rising synergy among telecom service providers and technology companies will enrich the offerings in the marketplace, leading to a safer and more streamlined voice communication ecosystem globally.

Explore FMI!

Book a free demo

| Company | FCC and Leading Telecom Providers |

|---|---|

| Contract/Release Details | The FCC mandated major telecom providers to enhance robocall mitigation efforts by integrating advanced AI-powered call authentication and blocking systems. |

| Date | February 14, 2025 |

| Contract Value (USD million) | Approximately USD 50 - USD 60 |

| Renewal Period | 3 - 5 years |

| Company | TNS (Transaction Network Services) |

|---|---|

| Contract/Release Details | TNS launched a new robocall mitigation solution leveraging STIR/SHAKEN and real-time analytics to improve call authentication for enterprises and carriers. |

| Date | December 10, 2024 |

| Contract Value (USD million) | Approximately USD 20 - USD 30 |

| Renewal Period | Not applicable |

| Company | Hiya and Global Tier-1 Carrier |

|---|---|

| Contract/Release Details | Hiya secured a contract with a major global carrier to implement AI-driven call protection solutions aimed at reducing fraudulent robocalls across millions of subscribers. |

| Date | September 8, 2024 |

| Contract Value (USD million) | Approximately USD 40 - USD 50 |

| Renewal Period | 3 - 4 years |

The robocall mitigation industry moved at a fast pace in 2024 and early 2025 due to set regulations and emerging technologies. The FCC's initiative, with an investment of about USD 50-USD 60 million, underscores the growing scrutiny. In turn, companies like TNS and Hiya have introduced AI-based call authentication & analytics solutions that have netted contracts ranging from USD 20-USD 50 million. Partnerships like YouMail’s expansion into enterprise security also show how demand is blooming for robocall mitigation services outside of consumer markets. These trends echo the continuing evolution of the industry toward AI-based, compliance-oriented call protection solutions.

Stringent Government Regulations and Compliance Mandates Boosting Adoption

Governments across the globe are enforcing stringent regulations to put a stop to robocalls, leading to increased demand for mitigation solutions. STIR/SHAKEN protocols are required by the USA Federal Communications Commission (FCC) for telecom providers to authenticate caller ID. So are Canada and the EU, enforcing new spam-call rules.

Telecom operators have to comply or pay penalties, which has since led to more investments in robocall mitigation technologies. Regulatory bodies work with AI-driven cybersecurity companies to improve fraud detection. In response to tightening regulations, telecom companies are adopting cloud-based call authentication, AI-powered spam filters, and voice biometrics to comply. A significant trigger is regulatory momentum, pushing businesses and services to adopt Tier-2378 solutions, broadening the market tremendously.

Rising Volume of Fraudulent Robocalls Leading to Increased Consumer Complaints

Spam robocalls, phishing, and scam calls are high on the list of motivators for robocall mitigation solutions. For consumers in America, 2023 was already shaping up to be a year full of frustration; they were slammed with over 50 billion robocalls, many of which were tied to fraudulent financial and identity theft.

Scammers take advantage of voice networks to trick users, which ultimately results in financial loss and affects telecom operator trust. As a result, consumer complaints have skyrocketed, leading telecom providers to implement AI-enabled call authentication and real-time spam blocking. As it strives to protect customers, industries are using caller ID verification and machine learning-based fraud prevention tools. The growing complexity of robocall scams calls for advanced mitigation strategies, thus boosting the growth of the robocall mitigation market across the globe.

Increasing AI and Machine Learning Integration, Enhancing Call Authentication and Filtering

Fraud detection and call authentication is transforming with AI and machine learning (ML) in robocall mitigation. AI-based solutions can analyze call patterns, detect anomalies, and identify potential spam calls in real time. Spam detection methods based on machine learning algorithms are always being improved to achieve the largest possible accuracy with the lowest rate of false positives and thus provide better services for the user.

Using advanced AI models, it can tell the difference between a legitimate automated call (like an appointment reminder) and a fraudulent robocall, allowing it to filter accurately. Major telecom companies and cybersecurity firms are sitting on cloud-based AI-driven call analytics to provide proactive battle detection. Robocall mitigation solutions are increasingly becoming more effective, scalable, and adaptable due to the advancements in AI and ML, propelling market adoption in multiple industries and different geographies.

Challenges in Cross-Border Robocall Mitigation Due to Varying International Regulations

However, there is one major restrain in the Robocall Mitigation Market, which is that international robocall mitigation is difficult as different countries have different regulations and enforcement mechanisms. Yet despite the fact that other countries like the USA, Canada, and the EU have introduced rigorous anti-robocall frameworks, in many parts of the world, there is no standardization in policy. These regulatory loopholes are exploited by cybercriminals who route fraudulent calls through chains of international networks, rendering detection and prevention near impossible.

Moreover, interoperability constraints among various telecom frameworks prevent smooth implementation of universal robocall prevention measures. Telecom providers are grappling with complex regulatory landscapes and diverse data privacy regulations that are slowing down adoption rates. To address such cross-border challenges, global cooperation, harmonized frameworks, and technology alignment are needed, and this remains an obstacle to fully mitigating robocalls globally.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Regulatory crackdowns began, with the USA FCC enforcing STIR/SHAKEN protocols to authenticate caller IDs and combat spoofing. Countries like Canada, the UK, and Australia introduced stricter telecom fraud regulations. |

| Technological Advancements | Telecom carriers deployed STIR/SHAKEN frameworks, call analytics, and voice traffic monitoring tools to flag and block spam calls. AI-based call classification systems started gaining traction. |

| Adoption of AI & ML | Machine learning models helped detect patterns in fraudulent calls, improving spam filtering. Early AI solutions enabled predictive blocking but struggled with false positives. |

| Enterprise & Consumer Demand | Businesses sought call authentication to maintain customer trust, while telecom providers implemented robocall filtering solutions. Consumers increasingly relied on third-party spam-blocking apps. |

| Evolving Scam Tactics | Fraudsters adapted by using neighbor spoofing and AI-generated voices to bypass detection. Social engineering scams increased, targeting vulnerable demographics. |

| Carrier & Network Security Enhancements | Leading telecom providers collaborated to share threat intelligence and block known fraudulent numbers. Call authentication became mandatory for major networks in North America and Europe. |

| Market Growth Drivers | Increased consumer complaints, regulatory action, and rising telecom fraud losses fueled demand for robocall mitigation solutions. Adoption of cloud-based call authentication tools surged. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Governments implement AI-driven enforcement mechanisms, requiring telecom providers to integrate advanced fraud detection systems. Global regulatory alignment ensures seamless cross-border robocall mitigation. Non-compliance penalties increase significantly. |

| Technological Advancements | AI-powered real-time voice authentication and behavioral biometrics have become standard for caller verification. Quantum encryption strengthens security, preventing spoofing and deepfake-generated scam calls. |

| Adoption of AI & ML | Next-gen AI models leverage deep learning and contextual analysis, achieving near-zero false positives. Self-learning systems dynamically adapt to new scam tactics. |

| Enterprise & Consumer Demand | Enterprises integrate robocall mitigation into customer engagement platforms, ensuring legitimate outreach. Consumers expect network-level protection, reducing reliance on standalone apps. |

| Evolving Scam Tactics | Sophisticated scam models use generative AI to create hyper-personalized fraudulent calls. Advanced botnet-driven robocalls exploit deepfake technology, demanding more robust countermeasures. |

| Carrier & Network Security Enhancements | 5G and cloud-native telecom security frameworks integrate AI-driven fraud detection at the core network level. Global threat intelligence sharing expands to emerging markets. |

| Market Growth Drivers | The proliferation of AI-driven fraud, stricter international regulations, and enterprise-grade call verification drive market growth. Telecom operators monetize robocall prevention services as a premium feature. |

The Tier 1 global providers, such as Transaction Network Services (TNS) and Neustar, a TransUnion company, provide comprehensive robocall mitigation solutions. By providing end-to-end services, including call authentication, caller ID management, and analytics, these organizations have built a strong market presence and trust.

MacroTik's strong infrastructure and regulatory compliance, such as STIR/SHAKEN protocols, allow them to serve major global telecommunications carriers and enterprises. Their solutions are designed to handle high call volumes and accurately identify and block fraudulent calls, improving overall call integrity and customer trust.

These are Tier 2 companies like First Orion, Hiya, and YouMail- sophisticated businesses that provide specialized robocall mitigation services. They specialize in delivering cutting-edge solutions like real-time spam call alerts for consumers, caller ID recognition, and customized call management for both individuals and enterprises.

Some mobile carriers partner with such companies to bundle their services into devices for better user experience. Although they do not possess the same scale of global reach as Tier 1 providers, they focus on certain offerings and innovations in technology that position them as important players in the world of robocall mitigation, successfully targeting particular problems and servicing niche markets.

Emerging robocall mitigation players that focus on niche elements of the robocall solution set would include tier 3 companies such as Nomorobo, RoboKiller, Truecaller, Caller ID Reputation, and Pindrop. These organizations provide consumers with applications and services designed to find and stop unwanted calls using community-oriented databases and sophisticated algorithms.

These firms offer app-based solutions that help people report and mitigate spam calls on their own terms. Although their market presence is limited relative to Tier 1 and Tier 2 companies, their agility and innovative strategies enable them to tackle specific user requirements, forming an integral part of the broad spectrum of robocall mitigation providers.

The section below covers the industry analysis for the Robocall Mitigation market for different countries. The market demand analysis on key countries in several countries of the globe, including the USA, France, UK, China, and India, is provided.

The United States is expected to remain at the forefront in North America, with a value share of 71.2% in 2025. In East Asia, China is projected to witness a CAGR of 14.9% during the forecasted period.

| Country | Value CAGR (2025 to 2035) |

|---|---|

| USA | 13.1% |

| France | 12.8% |

| UK | 13.4% |

| China | 14.5% |

| India | 14.9% |

Strict regulations and a high volume of spam calls govern the Robocall Mitigation Market in the United States. The STIR/SHAKEN framework developed by the FCC, as well as the TRACED Act, require telecom providers to authenticate user IDs, which has reduced the number of fraudulent calls. The USA telecom industry is quickly embracing these AI-powered call authentications and blocking solutions as Americans report receiving over 50 billion robocalls each year.

Furthermore, the big carriers - AT&T, Verizon and T-Mobile - spend heavily on robocall mitigation technologies, too. Additionally, the proliferation of internet-based communication apps, VoIP services, and cloud-based communication systems is also driving the growth of the market. With increasing regulatory compliance and consumer awareness, the USA leads the way in the innovation and adoption of robocall mitigation technology.

With the booming telecom industry and the growing numbers of call fraud, China’s robocall mitigation market is booming. China, which has about 1.6 billion mobile subscribers and the world’s largest telecom network, has been a target of scam calls and spamming messaging.

To tackle this rising menace, the government has put in place anti-fraud regulations and invested in AI-enabled call authentication and spam detection solutions. Top Chinese telecommunications companies, including China Mobile, China Unicom, and China Telecom, are leveraging advanced call analytics and machine learning for real-time fraud prevention. China’s expanded adoption of 5G and VoIP is also introducing new vulnerabilities, which further pushes demand for robocall mitigation solutions. Amid heightening worries about security, China is tightening telecom regulations and improving its technology to curb robocall fraud.

The robocall mitigation market in India is booming on the backdrop of fast-growing mobile penetration and digital transformation. India is a hotbed for spam calls, telemarketing fraud, and phishing attacks, with over 1.2 billion mobile users. Newer measures introduced by the Telecom Regulatory Authority of India (TRAI), such as caller ID verification and AI-enabled spam call detection, have been implemented to protect consumers from telemarketers. Telcos in India, including Reliance Jio, Bharti Airtel, and Vodafone Idea, are adopting robocall mitigation solutions with the help of artificial intelligence and big data analytics.

Moreover, the growth of digital banking and e-commerce has led to an increase in fraudulent call activities, and this has also led to additional adoption of fraud prevention tools. With the ongoing digitalization initiatives in India and regulatory developments, there is likely going to be a substantial increase in demand for robocall mitigation solutions.

The section contains information about the leading segments in the Robocall Mitigation industry. By Solution, the Call Authentication segment has held a share of 37.2% in 2025. By End Use, the IT & Telecommunication segment is estimated to grow at a CAGR of 13.8% during the forecasted period.

| Solution | Share (2025) |

|---|---|

| Call Authentication | 37.2% |

The call Authentication segment accounts for the largest share in the Overall Robocall Mitigation Market, which is primarily attributed to the rising adoption of STIR/SHAKEN protocols & regulatory frameworks globally. These solutions are able to verify whether the caller ID is legitimate or not, thereby preventing fraud and building trust in telecom networks. Major telecom providers and enterprise companies are implementing AI-powered authentication, digital signatures, and voice biometrics to recognize and block spam calls effectively.

As fraud incidents soar and compliance requirements tighten, authentication of calls is going to be key to successful robocall mitigation. Caller authentication is also critical in securing engagements in VoIP and cloud-based communication services, which is resulting in high demand in the global caller authentication market.

| End Use | CAGR (2025 to 2035) |

|---|---|

| IT & Telecommunication | 13.8% |

IT & Telecommunication Segment will Grow at the Highest CAGR in the Robocall Mitigation Market Due to the Growing Cyber Security Threats and Regulatory Requirements. Robocalls and call fraud are a significant threat to telecommunications operators and demand advanced mitigation solutions. As 5G networks, VoIP services, and cloud communication platforms grow, the demand for real-time call authentication, AI-based spam detection, and network security solutions is increasing. IT service providers are also building big data analytics and AI-driven fraud detection systems in order to bolster call protection.

The segment's sharp increase is additionally helped by government rules imposing more stringent telecom security requirements, which are pressuring telecom companies to apply scalable and automated robocall mitigation solutions across their networks.

The Robocall Mitigation Market includes several key players that focus on AI-based call authentication, real-time fraud detection, and compliance solutions. Dominant players such as Transaction Network Services (TNS), Neustar (a TransUnion company), and First Orion are well-established based on their wide range of call analytics and STIR/SHAKEN compliance solutions.

Hiya, YouMail, and RoboKiller specialize in consumer-oriented spam call blocking, while Truecaller is the king of the caller ID hill globally. New players are applying machine learning and cloud-based analytics to improve robocall detection. Innovation Reinforced: Telecom Providers and Cybersecurity Firms Form Strategic Partnerships As governments enact tighter regulations worldwide, competition increases as firms look to invest in AI, blockchain-based authentication, and cross-border fraud detection technologies to help them gain an edge in this fast-moving and innovate-driven market.

Recent Industry Developments in Rthe obocall Mitigation Market

The global Robocall Mitigation industry is projected to witness CAGR of 13.3% between 2025 and 2035.

The global Robocall Mitigation industry stood at USD 6334.1 million in 2025.

The global Robocall Mitigation industry is anticipated to reach USD 22079.3 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 13.7% in the assessment period.

The key players operating in the global Robocall Mitigation industry include Transaction Network Services (TNS), Neustar, a TransUnion company, First Orion, Hiya, YouMail and others.

In terms of Solution, the segment is categorized into Call Authentication, Robocall Prevention, and Robocall Analytics.

In terms of End Use, the segment is classified into IT & Telecommunication, Government, and Other Industries.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & pacific, Middle East and Africa (MEA) have been covered in the report.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.