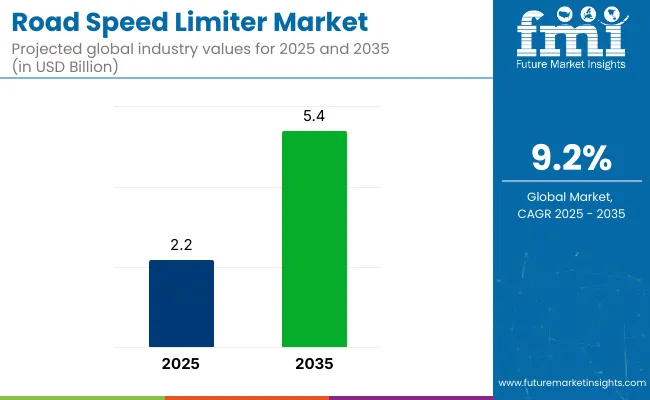

The global road speed limiter market is valued at USD 2.2 billion in 2025 and is slated to be worth USD 5.4 billion by 2035, reflecting a CAGR of 9.2%. Growth has been attributed to stricter speed-control regulations across major automotive regions, rising retrofit activities within commercial-fleet operators, and continuous technological upgrades particularly AI-enabled sign recognition, GPS geofencing, and over-the-air calibration, that enhanced compliance and reduced accident liability. Demand has further been supported by insurance incentives, national Vision-Zero road-safety programmes, and the broad integration of limiter modules into advanced driver-assistance system (ADAS) platforms at the OEM level.

| Metric | Value |

|---|---|

| Market Size (2025) | USD 2.2 Billion |

| Market Size (2035) | USD 5.4 Billion |

| CAGR (2025 to 2035) | 9.2% |

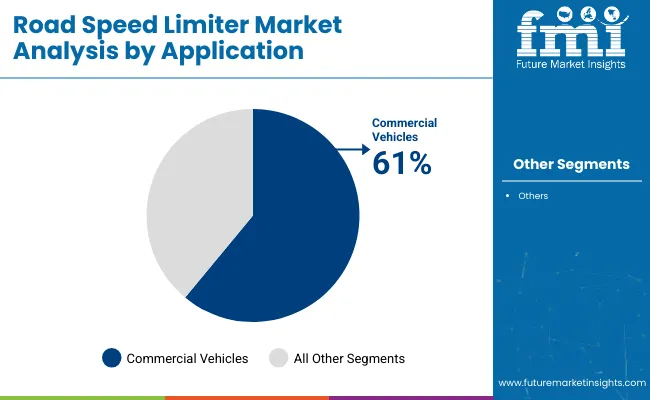

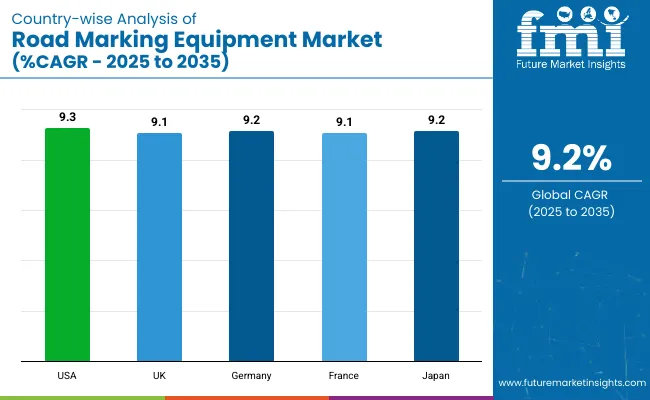

The USA is estimated to command the highest CAGR of 9.3%, underpinned by extensive trucking fleets and an early rollout of intelligent speed assistance regulations. The UK has been projected to expand at an estimated CAGR of approximately 9.1% over the 2025 to 2035 forecast period. Japanese market is set to grow at a 9.2% CAGR attributed to aggressive smart-mobility incentives. The commercial vehicles segment is estimated to command 61% of total installations in 2025.

AI-powered adaptive limiters that blend machine-learning analytics with IoT telemetry have been rolled out to predictively modulate speed in changing traffic and weather conditions. In addition, the ISA-FIT retrofit kit, combining camera-based sign recognition with a cloud-fed digital map layer, has been launched to upgrade legacy fleets cost-effectively to Intelligent Speed Assistance standards.

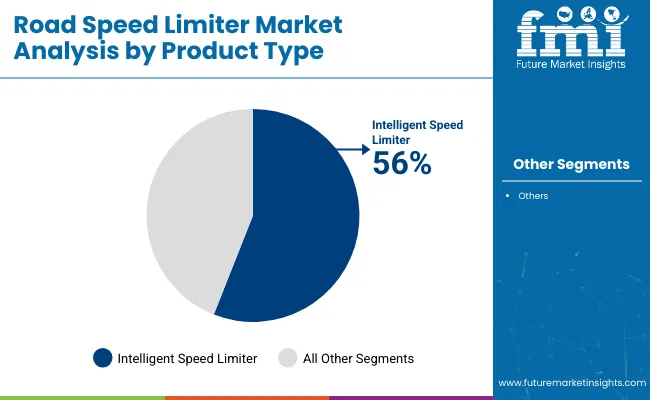

The road speed limiter market is segmented based on product type, application, sales channel, and region. By product type, the market is segmented into adjustable speed limiter and intelligent speed limiter. Based on application, the market is bifurcated into passenger vehicle (hatchback, sedan, SUV) and commercial vehicle (light commercial vehicle, heavy commercial vehicle, buses & coaches).

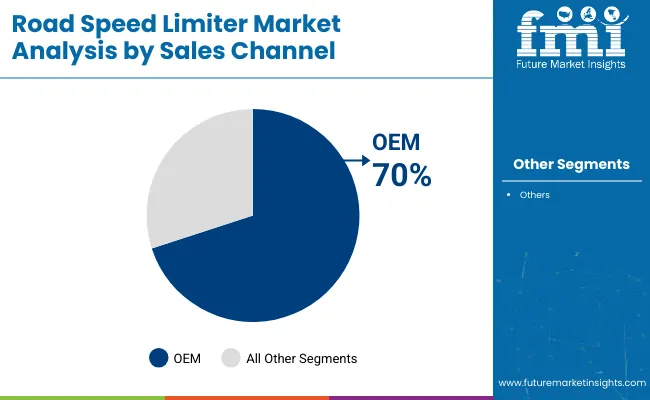

By sales channel, it is categorized into OEM and aftermarket. Regionally, the market is analyzed across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa.

Intelligent speed limiters have been projected to lead the product-type segment, accounting for 56% of global market share in 2025. Demand has been driven by regulations that have mandated intelligent speed assistance (ISA), by OEM integration with advanced driver-assistance systems, and by fleet operators’ preference for telematics-ready devices that enable real-time compliance monitoring and data analytics.

Commercial vehicles have been projected to dominate the application landscape, securing approximately 61% of global road-speed-limiter demand by 2025 and reinforcing their revenue leadership through 2035.

The OEM channel has been projected to secure about 70% of global revenue in 2025, because speed-limiter hardware is increasingly being embedded during vehicle assembly, ensuring immediate regulatory compliance and lowering lifecycle costs.

Steady growth has been witnessed in the road speed limiter market, driven by increasingly stringent speed-control regulations, heightened fleet-safety initiatives, and the rapid integration of AI-enabled limiter modules with telematics platforms, which together have enhanced compliance monitoring and reduced accident liability while supporting cost-effective vehicle operation.

Recent Trends in the Road Speed Limiter Market

Challenges in the Road Speed Limiter Market

The USA road speed limiter market is expected to grow at a CAGR of 9.3% during the forecast period. Fleet-wide safety mandates, pending federal speed-limiter rulings, and rapid telematics penetration have been considered major growth catalysts.

The UK road-speed-limiter revenues are projected to grow at a CAGR of 9.1% during 2025 to 2035. Post-Brexit regulatory alignment with EU ISA standards are being pursued and smart-city initiatives have been accelerated by local councils.

German road speed limiter market is poised to grow at a CAGR of 9.2% during 2025 to 2035. Federal Vision-Zero targets have been embedded within transport policy, and OEM headquarters in Bavaria and Baden-Württemberg have integrated intelligent limiters into forthcoming model years.

Sales of road speed limiter in France have been anticipated to grow at a CAGR of 9.1% during 2025 to 2035. National mobility orientation law provisions have mandated ISA adoption, and a broad school-zone speed-safety programme has been implemented. Public-transport operator RATP has commenced fleet-wide limiter retrofits, while regional agricultural cooperatives have embraced limiter technology to reduce accident-related downtime on rural distribution routes and bolster insurance cost-containment measures.

Japan road speed limiter industry has been estimated to grow at a CAGR of 9.2% during 2025 to 2035. Ageing-driver safety policies have spurred rapid adoption, and the Ministry of Land, Infrastructure, Transport and Tourism has issued guidance for ISA integration in new passenger vehicles.

The competitive landscape of the road speed limiter industry has been assessed as moderately fragmented, because no single vendor has been able to command more than a 15% revenue share, although tier-one electronics majors such as Continental A.G. and Vodafone Automotive have been positioned ahead of a broad field of regional specialists.

Across the tier-one cohort, cost-per-vehicle has been compressed through platform standardization, whereas differentiation has been pursued by embedding intelligent-speed-assistance (ISA) algorithms, cloud analytics, and over-the-air calibration services. Continental has prioritized regulatory-compliant ISA stacks for EU General Safety Regulation II vehicles, Vodafone Automotive has leveraged its cellular footprint to bundle connectivity and stolen-vehicle recovery with limiter hardware, and Autograde International has focused on government-approved kits for high-growth African and Asian markets.

Recent Road Speed Limiter Industry News

Road Speed Limiter Market Analysis by Top Investment Segments

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.2 billion |

| Projected Market Size (2035) | USD 5.4 billion |

| CAGR (2025 to 2035) | 9.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/Installations in million units |

| By Product Type Analyzed | Adjustable Speed Limiter, Intelligent Speed Limiter |

| By Application Analyzed | Passenger Vehicle, (Hatchback, Sedan, SUV), Commercial Vehicle, (Light Commercial Vehicle, Heavy Commercial Vehicle, Buses & Coaches) |

| By Sales Channel Analyzed | OEM, Aftermarket |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Continental A.G., Vodafone Automotive, Autokontrol, AVS LTD., Elson GmbH, Highway Digital, SABO Electronic Technology, Autograde International, IMPCO Technologies, Pricol Ltd. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

The market is valued at USD 2.2 billion in 2025.

The market has been projected to reach USD 5.4 billion by 2035.

A CAGR of 9.2% has been projected for the road speed limiter market over the 2025-2035 period.

The intelligent speed limiter segment has been expected to command 56% of the highest share.

Commercial vehicles have been forecast to contribute the largest installation base.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Road Marking Paints and Coatings Market Size and Share Forecast Outlook 2025 to 2035

Road Milling Machine Market Analysis and Opportunity Assessment in India Size and Share Forecast Outlook 2025 to 2035

Road Profile Laser Sensor Market Size and Share Forecast Outlook 2025 to 2035

Road Haulage Market Size and Share Forecast Outlook 2025 to 2035

Road Safety Market Size and Share Forecast Outlook 2025 to 2035

Road and Highway Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Road Marking Paint Market - Trends & Forecast 2025 to 2035

Road Marking Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Road Aggregates Market Growth - Trends & Forecast 2025 to 2035

Road Side Drug Testing Devices Market

Road-Rail Vehicles Market

Broadcast Switchers Market Size and Share Forecast Outlook 2025 to 2035

Broadband Network Gateway (BNG) Market by Component & Region Forecast till 2035

Broadcast Equipment Market Growth - Trends & Forecast 2025 to 2035

Railroad Market Size and Share Forecast Outlook 2025 to 2035

Off-road Tires Market Size and Share Forecast Outlook 2025 to 2035

Off Road Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Railroad Ties Market Growth - Trends & Forecast 2025 to 2035

Off-Road All Terrain E-Scooter Market Growth - Trends & Forecast 2024 to 2034

Off-road Motorcycle Market Growth – Trends & Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA