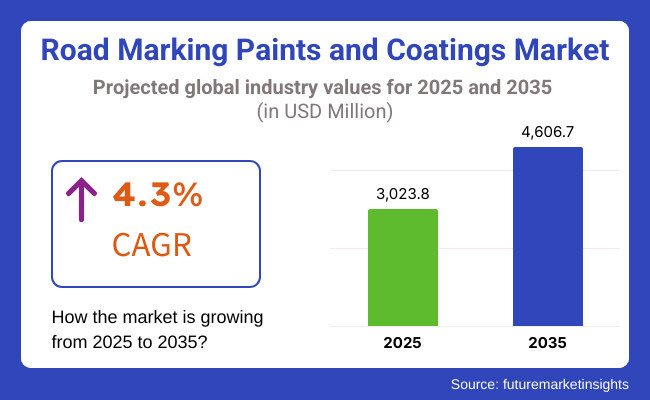

The global road marking paints and coatings market is expected to witness steady growth over the forecast period, driven by increasing urbanization, expanding road infrastructure projects, and rising emphasis on road safety. In 2025, the market is estimated to be valued at USD 3,023.8 million, and it is projected to reach USD 4,606.7 million by 2035, growing at a CAGR of 4.3%. Increased demand for high-performance marking solutions and innovations in thermoplastic and cold plastic coatings will propel this market.

The growing global focus on road safety and traffic management primarily drives the road marking paints and coatings market. To increase road visibility, decrease accidents and promote driving at night, some governments and authorities are making strict regulations about the type of light used. Urbanization and rise in the number of vehicles are creating the demand for durable and multi-purpose coatings. The market is anticipated to boost due to the increasing demand for coatings with reflective, glow-in-the-dark, and skid-resistant properties. Implementing smart road technology would unlock new growth avenues.

The growth of the advanced road marking paints and coatings market can also be attributed to a greater emphasis on the need to improve road safety by using clear long-lasting markings. A large government investment in infrastructure projects such as highways, urban roads, and runway airports worldwide will increase the consumption of reflective anti-skid and long-lasting coatings.

The introduction of eco-friendly or water-reduced paint with minimal VOC (volatile organic compounds), which is well-regulated, is one of the technological innovations expected to spur demand over the forecast period. Moreover, smart road technology, featuring luminous and temperature-sensitive coatings, is becoming increasingly implemented in contemporary urban planning.

Technological advancements in road marking materials are playing a crucial role in market expansion. A growing trend in the work of developing nanotechnology-based high-durability self-cleaning coatings. Smart coatings are also being embedded with sensors to monitor temperature and traffic, which has the potential to improve road management systems.

Building systems with bio-based and waterborne coatings are pushed by rising environmental concerns and regulatory requirements. In addition, increasing investments in infrastructure for autonomous vehicles are driving the rollout of high-contrast, machine-readable road markings, creating further demand on a global scale.

Explore FMI!

Book a free demo

North America is expected to be a key market for road marking paints & coatings owing to substantial investment in road infrastructure upkeep and safety programs. Existing regulations in the USA and Canada for high-performance coatings to improve visibility on roadways and help in reducing accidents. Reflective & Thermoplastic Coatings to grow durability and resistance to extreme weather conditions. Technology such as smart road markings that can integrate with autonomous vehicle systems are also beginning to come into play.

The US government’s Infrastructure Investment and Jobs Act (IIJA) has allocated substantial funds for road rehabilitation, which has further boosted the demand. Market trends are also being guided by eco-friendly solutions with more regulations being put in place pushing against road marking solutions with high VOCs, slowly converting to waterborne and bio-based road marking systems.

Europe’s road marking paints and coatings market is shaped by strict environmental regulations and a strong emphasis on sustainability. The directives of the European Union on cutting down VOC (volatile organic compound) emissions are fostering the demand for water-based, eco-friendly coatings. Countries like Germany, France, and the UK are investing in smart road infrastructure with photoluminescent and temperature-sensitive coatings for improved night-time visibility and road safety.

Moreover, the growth of electric vehicle (EV) charging networks and dedicated EV lanes is opening up new opportunities for specialized road markings. Interest in high-contrast markings designed to aid vehicle sensors is growing, driven by the adoption of automated driving technologies, further propelling regional market growth.

Asia-Pacific region is expected to grow at the fastest rate, owing to rapid urbanization, increasing vehicle ownership, and large-scale infrastructure development programs. Highway expansions, smart city initiatives, and expressway networks are widely under construction across the area of China and India, creating demand for durable and cost-effective thermoplastic coatings. Government regulations for road safety and better traffic management further drive market growth.

Japan and South Korea are introducing smart road technologies, such as AI-transmitted road markings that facilitate better navigation for autonomous cars. Growing manufacturing base and construction activities in the region are also contributing to the demand for warehouse and factory floor markings. The growing awareness about the environment is fueling the adoption of bio-based and water-based coatings.

The road marking paints and coatings market in the rest of the world, including Latin America, the Middle East, and Africa, is experiencing steady growth due to rising investments in road infrastructure and urban development. Latin America, Brazil and Mexico are at the forefront of the market, with projects to enhance highway networks and traffic safety. Smart city projects and highly visible road markings in the Middle East, especially in the UAE and Saudi Arabia, are helping manage the increased flow of vehicles into urban areas.

Africa’s market is growing and expanding, with governments enacting road expansion projects to boost economic development. The region has been seeing increasing demand for highly durable and weather-resistant coatings as the market faces challenges such as extreme weather conditions and maintenance costs.

Challenges

Fluctuating Raw Material Prices

Volatility in raw material prices is one of the major challenges in the road marking paints and coatings market. The main constituents, like resins, pigments, and additives, are still sourced from petrochemicals, exposing them heavily to increases in crude oil. Geopolitical tensions add to the complexity, while regulatory changes affect the availability and pricing of these input materials. Higher production costs can result in higher prices for end-users, especially in developing areas that have restrictions on spending.

Greener and bio-based replacements involve a major investment in research and development, which of these materials lack behind, which creates a costly challenge. Manufacturing also on their part need to manage and optimize their supply chain strategies, exploring and investing in a form that can be sustainable in most aspects of the production process to remain relevant in the market.

Stringent Environmental Regulations

Environmental regulations are one of the major challenges for the road marking paints and coatings market, especially related to the use of solvent-based paints having higher levels of volatile organic compounds (VOC). Governments around the world are tightening policies to combat air pollution and encourage sustainable alternatives. Water-based and bio-based coatings offer potential solutions, but their uptake involves performance compromises, including reduced durability and slower drying in adverse weather conditions.

Such regulations are expensive to implement, and manufacturers must also reformulate products to comply with environmental standards, further increasing production costs. Moreover, global players find it difficult to expand in the market thanks to differing regulatory frameworks in various regions. But companies need also to ensure that they are on continuous product innovation and eco-friendly formulations to keep up with changing policies and changing consumer needs for sustainable solutions.

Opportunities

Advancements in Smart Road Technologies

The increasing integration of smart road technologies has not widely penetrated but signifies a great opportunity for the growth of the road marking paints and coatings market. Systems garages develop an intelligent transportation system that combines highly descriptive, and there are embedded sensors, luminous properties, machine-readable markings, etc. Thermally responsive materials and photoluminescent coatings are being developed, allowing them to adapt to environmental changes used to improve visibility under low light conditions.

Moreover, the emergence of autonomous vehicles is propelling the requirement for high-contrast and reflective road marking,s which aid vehicle sensors in detecting and navigating through lanes. In summation, the rise in smart city projects and their implementation across the globe holds potential for manufacturers who can create and provide ingenious coatings aimed at driving forward the shift to both technologically responsive and safer road infrastructures.

Rising Demand for Sustainable and Eco-Friendly Coatings

Global sustainability efforts open new growth opportunities for bio-based and low-VOC road marking coatings. Due to strict environmental regulations on the use of solvent-based paints, manufacturers are developing waterborne and plant-based formulations with low impact on the environment while providing durability.

Especially in developed markets like Europe and North America, governments and regulators are encouraging eco-friendly alternatives. Demand for sustainable practices in transportation infrastructure is also encouraged by consumer awareness and corporate sustainability initiatives. Rapid urbanization and a boom in road construction in developing economies also present a huge market for sustainable coatings. Companies that focus on R&D for improvement of performance and durability in eco-friendly road marking will emerge as leaders in this changing paradigm.

The road marking paints and coatings market has been growing at a steady rate between 2020 and 2024, driven by rising infrastructure development, stringent requirements for road safety, better durability, and eco-friendly marking materials. The ongoing urbanization and development of road networks in underdeveloped regions have further stiffened the demand for high-performance coatings.

Looking forward to the period between 2025 and 2035, the market has significant growth due to new technologies, including smart road markings, anti-reflective coatings, and green solutions, which will likely transform the market landscape. Future product innovations will mirror this drive to reduce carbon footprints as well as the need for enhanced road visibility during extreme weather events.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments also imposed stricter road safety laws, which has resulted in the increased use of thermoplastic and waterborne road marking paints. |

| Technological Advancements | High-durability and fast-drying formulations are introduced to curb the need for estimates on road marking works. |

| Industry-Specific Demand | High demand from highway authorities, urban planners, and municipal bodies. |

| Sustainability & Circular Economy | Reduction in environmental impact through gradual adoption of water-based & lead-free paints |

| Production & Supply Chain | Pandemic-led restrictions; excessive reliance on petrochemicals-derived raw materials; supply chain hiccups |

| Market Growth Drivers | Urban developments, expanding highways, and surging vehicular flow boosted the demand for marking solutions. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Tighter sustainability regulation, with limits on Volatile Organic Compounds (VOCs) and requirements for bio-based and/or recyclable coatings, are also keys. |

| Technological Advancements | Smart coatings sensors traffic monitoring, solar-reflective paints, glow-in-the-dark road markings. |

| Industry-Specific Demand | Growth in smart city projects, road markings for autonomous vehicle-friendly road markings, and growing penetration of private road networks. |

| Sustainability & Circular Economy | Use of bio-based resins, recyclable thermoplastic coatings, and low-environmental-impact paints. |

| Production & Supply Chain | Localized manufacturing, AI-led supply chain optimization, and increased dependence on sustainable raw material sources. |

| Market Growth Drivers | Use of IoT-enabled road markings, global focus on climate-adaptive coatings, and increasing investments in smart infrastructure initiatives. |

The USA road marking paints and coatings market is projected to grow at a CAGR of 4.6% from 2025 to 2035. Increasing infrastructure investments, strict regulatory frameworks, and technological advancements in durable and reflective coatings drive growth. Federal and state initiatives to improve road safety fuel demand for high-performance thermoplastic and waterborne coatings. Expansion is fueled by rising infrastructure spending, stringent regulatory structures, and technological improvements in durable and reflective coatings.

The demand for high-performance thermoplastic and waterborne coatings is driven by federal and state projects aimed at enhancing road safety. Market forces are also driving demand for sustainable, VOC-compliant solutions. Smart coatings are also being innovated, such as buying retroreflective, wear override, etc. In addition, the emergence of autonomous vehicles calls for high-contrast road markings for accurate navigation, which is also augmenting demand. These trends collectively drive the market's steady expansion in the USA over the forecast period.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.6% |

The UK road marking paints and coatings market is set to expand at a CAGR of 4.2% from 2025 to 2035. Market growth is helped along by the rise of urban development, road safety campaigns, and strengthened environmental legislation which favors waterborne and bio-based paints. Government-funded transportation infrastructure smart highways, in addition to others, market demand for high-performance, durable, and highly reflective markings.

The industry is moving toward thermoplastic and cold plastic coatings in order to make our roads last longer and at the same time achieve sustainability goals. In addition, the trend towards eco-friendly and autonomous vehicles is driving the demand for advanced road markings that provide enhanced visibility and reflectivity. Over the forecasted period, the emphasis on carbon footprint reduction and enhanced traffic efficiency is expected to sustain market growth in the UK.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.2% |

The European Union’s road marking paints and coatings market is anticipated to grow at a CAGR of 4.3% from 2025 to 2035. The adoption of low-VOC and bio-based coatings is being driven by strict environmental policies such as REACH regulations. Rising infrastructure development projects across member states, notably in Germany, France, and Italy, support demand for the same.

The European Union (EU)’s green deal for smart mobility and connected roads is a driving factor for the faster adoption of thermoplastic and also high-contrast coatings, experts say. Green initiatives encourage more reflective and anti-skid coatings in the pursuit of greater road safety. The growth of electric and autonomous vehicles is also driving demand for advanced road markings. Collectively, these factors ensure stable market growth across the EU in the coming decade.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.3% |

Japan’s road marking paints and coatings market is expected to grow at a CAGR of 4.0% from 2025 to 2035. The country’s focus on road safety and aging infrastructure both fuel demand for high-performance coatings. Due to emerging technologies in autonomous driving, the smart road marking system is being increasingly adopted. To meet visibility standards in different climates, thermoplastic and retroreflective coatings are being increasingly adopted.

Moreover, Japan's strict environmental regulations are a growing preference toward waterborne and sustainable coatings sales. Additionally, investments on urban road maintenance & expansion projects further boost the market growth. The increase is mainly due to the continued adoption of smart cities and road traffic compact solutions, which drive the market for road marking coatings in Japan during the forecast period.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.0% |

South Korea’s road marking paints and coatings market is projected to grow at a CAGR of 4.1% from 2025 to 2035. The expansion of the market is driven by rapid urbanization, the development of smart infrastructure and enhanced road safety regulations. The government's emphasis on intelligent transportation systems (ITS) supports protective coatings that offer high visibility and durability. They prefer thermoplastic and cold plastic coatings for their durability and environmental compliance.

Furthermore, South Korea's investment in autonomous vehicle technologies increases the demand for high-contrast and reflective road markings. The increasing focus on sustainability has also led to waterborne and low-VOI coatings gaining traction. These trends, along with ongoing road maintenance and expansion projects, support steady market growth in South Korea over the next decade.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.1% |

Performance-based road marking paints and coatings lead the market due to their high durability, visibility, and resistance to wear and tear from heavy traffic and extreme weather conditions. Thermoplastic and cold plastic markings are examples of specialized road surface coatings, which offer exceptional adhesion and retro-reflectivity for lasting performance that requires little maintenance. They find wide application on high-traffic highways, urban roads, and airport runways, where visibility is vital. High-performance markings reinforce demand, driven by regulations, including EN 1436 (Europe) and MUTCD (USA).

North America and Europe dominate the global market as stringent safety regulations drive adoption, whereas the rapid growth in infrastructure development drives Asia-Pacific market. The rising focus on smart road infrastructure and autonomous vehicle integration further boosts market expansion.

Paint-based road markings, including water-based, solvent-based, and epoxy paints, are popular due to their cost-effectiveness and ease of application. Such coatings are extensively used on temporary markings, urban roads, and parking, where they can be easily repainted at a higher frequency. Although they are less durable than performance-based coatings, enhanced reflective and rapid curing formulations are extending their effective lifespan.

However, environmental legislation limiting the emissions of volatile organic compounds (VOCs) from solvent-based products has increased the use of waterborne acrylic paints. Demand also holds strong in developing parts of the world, where cost factors play a large role in decision-making. However, the increasing adoption of longer-lasting alternatives like thermoplastic and MMA-based coatings poses a challenge to the market share of paint-based markings in the long run.

The road and highway marking segment accounts for a crucial share of the road marking paints and coatings market due to an increasing expansion of transportation networks, road safety initiatives, and government regulations. As the density of vehicles is increasing, an essential feature of traffic management is the use of high-performance road markings that ensure police discipline, pedestrian safety, and hazard identification, among others.

Across the globe, smart highways are being built, utilizing retro-reflective and thermochromic coatings for increased visibility at night as well as weather-adaptive markings that are designed to change with the conditions. Government initiatives like the USA Infrastructure Investment and Jobs Act (IIJA) and European TEN-T projects are driving fast growth in durable road markings. Furthermore, the increasing adoption of autonomous vehicles is propelling demand for machine-readable road markings, which, in turn, is accelerating the growth of the market.

Parking lot marking is a key segment within the road marking paints and coatings market, driven by the growing number of commercial complexes, shopping malls, and urban parking facilities. Road markings help in the organization of parking spaces, the flow of traffic, and the safety of pedestrians. Despite being a cost-efficient and easily maintained solution, paint-based coatings, mainly waterborne acrylics, hold the majority market share in this segment.

Multi-level and underground parking structures are adding anti-skid and reflective coatings for enhanced visibility and accident prevention. This growth has also created a demand for particular markings to delineate charging spots or prohibited areas. As urban areas develop and the number of cars on the road increases, this segment is predicted to grow steadily around the world.

Infrastructure development & increasing focus on safety on roads & highways, which is extensively used for application in roadside are the key growth contributors of the market. Some of the key players in this market include The Sherwin-Williams Company, AkzoNobel N.V., Asian Paints PPG and several others. Because these companies have a wide variety of products and they have a presence in all over the world. The market is witnessing technological advancements like new eco-friendly and long-lasting marketing solutions and trends for people consolidating the market with mergers and acquisitions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| 3M Company | 12-16% |

| The Sherwin-Williams Company | 10-14% |

| Nippon Paint Holdings Co., Ltd. | 8-12% |

| Ennis-Flint, Inc. | 7-11% |

| Geveko Markings | 5-9% |

| Other Companies (Combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| 3M Company | Produces reflective and thermoplastic road markings of high performance while pursuing smart city connectivity. |

| The Sherwin-Williams Company | Offers strong waterborne and solvent-based road marking paints with an emphasis on environmental sustainability. |

| Nippon Paint Holdings | Expertise in highway and airport runway high-durability coatings, with a particular emphasis on Asia-Pacific markets. |

| Ennis-Flint, Inc. | Creates performed thermoplastics and next-gen solutions to road safety, such as bike lane coatings. |

| Geveko Markings | Specializes in budget-friendly and durable pavement marking goods, such as colored plastic and number two epoxy coatings. |

Key Company Insights

3M Company

3M is a global leader in road marking solutions, known for its high-performance reflective and thermoplastic materials. Significant investments have been made by the company in smart and connected roads and retroreflective technologies relevant to night-time visibility.

With a significant presence in North America, Europe, and APAC, 3M also focuses on widening its market reach through innovative solutions to cater to the ever-advancing road safety and autonomous vehicles domain. The Product line includes durability and guarantees that products remain functional for many years and the government favors for infrastructure contracts.

The Sherwin-Williams Company

Sherwin-Williams is a leading manufacturer of waterborne and solvent-based road marking paints, emphasizing low-VOC and eco-friendly solutions. The company is a prominent supplier of municipal road projects and airport infrastructure. The company continues to grow its presence in Latin America and Asian markets, spurred on by the growing government attention to sustainable transportation systems. This has made it a fierce competitor in the market. To maintain high regulatory standards, Sherwin-Williams consistently invests in R&D and presents innovative coatings.

Nippon Paint Holdings

Nippon Paint Holdings is a major maker of high-quality road marking paints, most notably in Japan and Southeast Asia. The company specializes in highly durable, wear-resistant coatings used on everything from highways and airports to urban development projects. Nippon Paint invests heavily in R&D projects primarily based on performance improvement by including better visibility, wear adjustment, and more support for racking. It partners with government agencies and private infrastructure developers to enhance road safety standards, establishing itself as a dominant market player in the Asia-Pacific region.

Ennis-Flint, Inc.

Ennis-Flint specializes in preformed thermoplastics and diesel for high-traffic areas, bike lanes, and pedestrian crossings. Some of the key attributes define the organization as an innovative player in providing integrated line marking solutions with a strong focus on safety and longevity. The company has created a presence in the market through acquisitions competently that have helped it develop its portfolio and global footprint. Ennis-Flint, in particular, is renowned for its durable roadway marking products and is a choice among municipalities and transport agencies seeking longer-lasting performance.

Geveko Markings

Geveko Markings specializes in economical and durable road markings, especially in Europe and North America its offerings include cold plastics, 2K epoxies, and thermoplastics markings, which guarantee impressive performance in diverse climate conditions. With a focus on sustainability and performance-driven innovation, Geveko has established itself as a serious player in the road marking sector. Its portfolio is still growing, with a particular focus of high-visibility and longer-lasting coatings with applications in both government infrastructure projects and private sector developments.

The global Road Marking Paints and Coatings market is projected to reach USD 3,023.8 million by the end of 2025.

The market is anticipated to grow at a CAGR of 4.3% over the forecast period.

By 2035, the Road Marking Paints and Coatings market is expected to reach USD 4,606.7 million.

The Performance-based segment is expected to dominate the market, due to its durability, superior adhesion, weather resistance, and reflective properties, ensuring long-lasting visibility and safety in high-traffic and extreme conditions.

Key players in the Road Marking Paints and Coatings market include 3M Company, The Sherwin-Williams Company, Nippon Paint Holdings Co., Ltd., Ennis-Flint, Inc., Geveko Markings.

In terms of Material Type, the industry is divided into Performance-based, Paint-Based Markings.

In terms of Application, the industry is divided into Road and Highway Marking, Pavement Marking, Parking Lot Marking, Factory Marking, Airport Marking, Field Marking, Other Applications

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

Anti-seize Compounds Market Size & Growth 2025 to 2035

Industrial Pipe Insulation Market Trends 2025 to 2035

Colloidal Silica Market Demand & Trends 2025 to 2035

Perfluoropolyether (PFPE) Market Size & Trends 2025 to 2035

Cold Rolling Oils/Lubricants Market Size & Growth 2025 to 2035

Basic Methacrylate Copolymer Market Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.