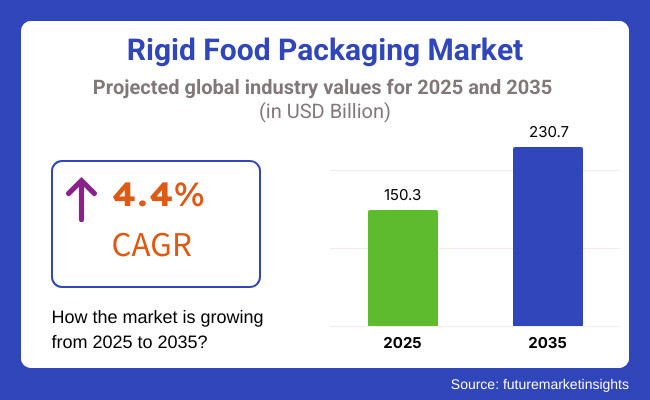

The rigid food packaging market is anticipated to achieve massive growth with projected market size of USD 150.3 billion in 2025 and the amount will reach USD 230.7 billion by 2035, at a CAGR of 4.4%. The market has experienced a remarkable jump in sales in 2024 which totalled USD 145.2 billion, showing its solid performance and the ongoing development.

Along with the above factors, rigid food packaging also provides food safety, longer shelf life, and enhanced product visibility.

According to the forecasters, the rigid food pack group will form more than 65.2% of the entire food packaging sector in 2035. One of the strong points that push the market upward is the need for tougher, leak-proof, and tamper-evident packing systems which is a result of the increase in demand for processed and convenience foods.

Nowadays, more and more people are raising the issue of packing not only that is able to increase the lifespan of the products but also is user-friendly, thus promoting the turning of the industry towards the new rigid-packaging methods.

The strong requirement for sustainable packaging is one of the basic arguments of the growth. Both consumers and manufacturers are interested in packing techniques that keep the size of the product longer, with fewer contamination problems, and that are more energy-saving in transport.

E-shops and online food delivery companies are leading to the higher request for durable packaging that can be send out on various transport conditions and still keep the product inside intact. Also, along with the increasing trend of sustainability, brands are searching for alternatives that are eco-friendly.

The development of government regulations concerning food safety and recycling has brought about a further effect, with the requirement for the packaging manufacturers to be forward-thinking and, therefore, comply with the laws.

The more severe laws on food contact materials and sustainability projects have given way to the common use of BPA-free plastics, completely recyclable glass bottles, and lightweights but flexible metal packaging. These frameworks of regulation are the ones leading to the industry’s improvement, and they are urging the companies to accede to the laws while still delivering quality products that the customers accept.

As sustainability issues increase in number, companies are bringing in modern materials and production techniques that will save the planet and at the same time give effective packaging. In spite of the fact that markets are wading through a global upswing, they still have to deal with the increase in the costs of raw materials and the challenge of recycling.

The oscillation in the prices of plastics, metals, and glass have imposed burdens on the manufacturers, thereby directly affecting the method of production and consequently firm profits. The more serious problem is the unending concern around plastic waste and limited recycling infrastructure that is hampering the growth in some regions.

Explore FMI!

Book a free demo

The table below presents the expected CAGR for the global rigid food packaging industry over several semi-annual periods spanning from 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| H1 | 4.6% (2024 to 2034) |

| H2 | 4.2% (2024 to 2034) |

| H1 | 4.0% (2025 to 2035) |

| H2 | 4.8% (2025 to 2035) |

In the first half (H1) of the decade from 2024 to 2034, the industry is predicted to grow at a CAGR of 4.6%, followed by a slightly lower growth rate of 4.2% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 4.0% in the first half and rise to 4.8% in the second half. The first half (H1) witnessed a decrease of 60 BPS, while in the second half (H2), the industry saw an increase of 80 BPS.

The global industry had a CAGR of 4.5% during the period 2020 to 2024, from USD 116.5 billion in 2020 to USD 145.2 billion in 2024. It was driven by increasing demand for tamper-resistant, light, and robust food packaging.

Technological breakthroughs in barrier coatings, high-performance polymers, and increased consumption of ready-to-eat and packaged food drove industry growth. Sustainability concerns and regulatory changes regarding the use of plastic were some of the challenges.

| 2020 to 2024 (Past Trends) | 2025 to 2035 (Future Projections) |

|---|---|

| Steady growth (~4.5% CAGR) due to increasing demand for convenience foods. | Sustainability trends and material innovations have triggered this growth rate which stands at ~6.0% CAGR. |

| Initial moves toward making packaging recyclable and biodegradable. | Totally compostable and recyclable packaging-the rigid materials. |

| If possible, mainly using PET, HDPE, PP, and aluminum. | Increasing use of bio-based plastics, molded fiber, and biodegradable alternatives. |

| Moderate mechanization, depending on traditional methods of manufacture. | Fully automated AI-driven quality control and predictive maintenance. |

| Simple rigid packaging, with barriers slightly improved. | Smart packaging involves oxygen scavengers, freshness indicators, and antimicrobial coatings. |

| Raw material price fluctuations affect profit margins. | Cost cuts will be realized through lightweighting, material innovations, and automation techniques. |

| Mainly used in dairy, bakery, frozen foods, and beverages. | Wider uptake by premium confections, plant-based food product lines, and meal kits. |

| Few colors and branding options. | Superior digital printing and interactive packaging quality feature elements of customization. |

| Adherence to food safety regulations and rudimentary sustainability. | Stringent regulations require ensuring a high level of recyclability and transparency both in materials and processes. |

| Increase in the demand for sturdy packaging for food deliveries. | Advanced protective rigid packaging promises well in catering to direct-to-consumer food services. |

| The early beginnings of an initiative to improve recyclability and reuse models. | High integration of recycled content and closed-loop packaging systems is inevitable. |

The rigid packaging industry is under pressure from intense environmental regulations, including the EU’s Single-Use Plastics Directive, which aims to phase out the use of disposable plastics, accelerating the shift to recyclable or biodegradable alternatives.

Adapting carries a price, and non-adaptation carries a risk of fines or bans. Food-safety laws make packaging innovations even more of a challenge, as designs for new materials must be stringently approved. Rigid packaging relies on raw materials such as plastic resins, metals and glass, all vulnerable to price swings. Production is affected by disruptions like resin shortages or trade curbs.

That underscores the complexity of supply chains that span the world, from additives to coatings, where the risk of delays and escalating costs is growing. Demand is affected by consumer trends, as the growing shift to e-commerce and meal delivery has benefited rigid formats while competition with flexible packaging is threatening the industry share. Manufacturers face uncertainty due to economic downturns or raw material shortages.

Rigid packaging pricing is based on a cost plus system that price is followed by the raw material price. Prices drift when the resin and metal prices change, and the manufacturer is obliged to adjust. Competitive bidding results in pricing pressure for many of the contracts. Major food brands negotiate price cuts making cost optimization centric.

Other companies use penetration pricing - in which price points are lowered to gain industry share before raising them. Premium rigid packaging formats, such as high-barrier trays or compostable containers, have higher value and demand, being a better choice, for instance, by offering greater shelf life. Whereas, those for budget packaging are volume and efficiency oriented, addressing cost-sensitive markets.

Margins are preserved through packaging of rigid packaging with complementary products, design consultation, and tier pricing. With long-term contracts and volume-based pricing, there is stability. Barriers to entry for the sustainability-intensive, eco-conscious segments (ex. recycled content mandates) that would raise costs but also provide value.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| The USA | 5.9% |

| India | 7.3% |

| Germany | 4.2% |

| China | 6.0% |

| Brazil | 3.8% |

| The UK | 4.5% |

| Canada | 4.2% |

FMI is of the opinion that the USA rigid food packaging market is slated to grow at 5.9% CAGR during the study period. The market growth drivers include the rising need for convenience and ready-to-eat food and an increasing focus on sustainability. With consumers turning eco-friendlier, choosing green packaging, there is a sharp inclination towards recyclable, biodegradable, and compostable packaging materials.

Packaging technology advancements, including tamper-evident packaging and light-weight packaging systems, are improving safety and convenience, which is supporting market growth. Furthermore, the USA government policies aimed at minimizing plastic waste have compelled the food sector to shift to more sustainable packaging solutions.

Growth factors in the USA

| Key Drivers | Details |

|---|---|

| Convenience & Convenience Food Demand | Consumers are increasingly preferring packaged and ready-to-eat foods, thereby demand is increasing. |

| Theme: Sustainability | Environmentally friendly packaging is on the rise, with recyclable and biodegradable packaging. |

| Technological Innovation | Lightweight and tamper-evident packaging developments ensure safety and ease of use. |

| Regulatory Drive for Sustainability | Government policy on plastic reduction is encouraging sustainable packaging. |

As per research conducted by FMIs, India’s competitive food packaging market will grow at a high CAGR of 7.3% from 2025 to 2035. This is primarily because of India's fast-expanding urban population, which is driving demand for convenience and packaged food. Moreover, increasing disposable incomes and changing lifestyles are driving demand for premium packaged food and beverages.

India's thriving e-commerce industry also significantly contributes to demand for sustainable and secure packaging solutions. With the consumer market in India becoming even more progressive, there is an increased focus on green packaging, where industry players look for alternatives to conventional plastic packaging.

Growth factors in India

| Key Drivers | Details |

|---|---|

| Urbanization & Changing Lifestyles |

Growing urban population and per capita expenditure in India are accelerating demand for packaged foods. |

| E-commerce Growth | Rising e-commerce channels call for efficient packaging of food delivery. |

| Growing Demand for Convenience Foods | Growing demand for ready-to-consume foods is driving packaged food consumption. |

| Environmental Awareness | Rising pressure due to plastic waste is promoting the shift towards environmentally friendly packaging material. |

Germany's rigid food package market will expand at a 2025 to 2035 CAGR of 4.2%. Germany, being a front-runner in the European Union, is witnessing skyrocketing demand for premium and quality packaged foods. The growth is fueled by consumer demand for longer shelf life and better food safety.

Additionally, Germany's solid emphasis on the environment and sustainability is driving sustainable packaging innovation. Companies are moving more towards the use of recyclable, biodegradable, and renewable material to satisfy customer demand and regulatory requirements to decrease plastic waste.

Growth factors in Germany

| Key Drivers | Details |

|---|---|

| Premium Food Demand | Market growth is being driven by the demand for high-value packaged foods by consumers. |

| Regulatory Emphasis on Sustainability | Tough environmental regulations are encouraging the use of recyclable and biodegradable packaging. |

| Technology Innovation | Advanced packaging technology provides food safety, extended shelf life, and product preservation. |

| Conscious Consumerism | Growing consumer demand for sustainable packaging solutions. |

China's highly regulated food packaging market is likely to register a CAGR of 6.0% during the period 2025 to 2035. Urbanization and growth of the middle class in China are key drivers for packaged and processed foods. In addition to this, increasing demand for sustainability in China is also driving the demand for more green packaging products such as biodegradable and recyclable packaging products.

Food convenient meals and snacks are also increasing the demand for strong packaging materials. The government actions in China to mitigate plastic waste are also persuading individuals to consume more environmentally friendly solutions in the context of food packaging.

Growth factors in China

| Key Drivers | Details |

|---|---|

| Urbanization & Middle-Class Expansion | Growing urban population means growing demand for packaged convenience foods. |

| Government Drive Towards Sustainability | Plastic waste minimization regulations are driving the transition towards sustainable packaging materials. |

| Increased Convenience Food Consumption | Increased consumption of ready-to-eat food fuels demand for strong, protective packaging. |

| Packaging Innovation | The industry is supported by ongoing innovation in packaging technologies and materials. |

Brazil's rigid food packaging industry is projected to grow at a CAGR of 3.8% during 2025 to 2035. The tropical climate of Brazil is one of the primary drivers for the demand for packaging resistant to environmental conditions such as heat and humidity.

The increasing middle class in the country is also fueling demand for premium packaged food products like snacks and ready-to-eat meals. There is also an increased emphasis on sustainability, as consumers look for packaging solutions that are sustainable but functional. Additional demand for safe and trustworthy food packaging also comes from Brazil's growing e-commerce market.

Growth factors in Brazil

| Key Drivers | Details |

|---|---|

| Food Safety Demand | The warm climate requires packaging to maintain food quality and shelf life. |

| Growing Middle Class | The growth in disposable income in Brazil is causing higher demand for packaged premium foods. |

| Growing E-commerce | More food bought online demands safe, long-lasting, and easy-to-store packaging. |

| Focus on Sustainable Packaging | Greater need for recyclable and biodegradable packaging due to environmental reasons. |

FMI is of the opinion that the UK hard food packaging industry is slated to grow at 4.5% CAGR during the study period. This is attributed to heightened demand for packaged food for convenience as standards of living are increasingly hectic and health-conscious and wellness-conscious consumers' increasing desire. UK consumers are also likely to prioritize environmental sustainability, and this will translate into the utilization of sustainable packaging materials like biodegradable plastic and recyclable packaging.

Government policy efforts at reducing plastic waste and encouraging recycling also contribute towards this trend towards sustainable packaging. Innovation in smart packaging solutions improving food safety and traceability is also a significant driver for market growth.

Growth factors in The UK

| Key Drivers | Details |

|---|---|

| Convenience Food Demand | Consumers' busy lifestyles are propelling demand for convenient-to-consume, packaged foods. |

| Government Regulations | Recycling and plastic waste reduction initiatives are impacting packaging decisions. |

| Consumer Concern for Sustainability | Growing environmental footprint concern is resulting in a shift towards green packaging. |

| Technological Advances | Development of intelligent packaging technologies is driving market growth. |

Canada's rigid food packaging market is anticipated to reach a CAGR of 4.2% during 2025 to 2035. The increase in the market is driven by increased demand for packaged foods and drinks and increased consumer interest in organic and healthy food items.

Canadians are increasingly becoming concerned with the sustainability of the materials used to pack foods that they consume, therefore pushing towards sustainable solutions. Also, the fact that the country has a wide, dense consumer base along with increased e-commerce consumption is increasing demand for safe and efficient food packaging solutions even more.

Growth factors in Canada

| Key Drivers | Details |

|---|---|

| Health & Wellness Focus | Increasing demand for organic and healthy food products fuels packaging protection demand. |

| Environmental Sustainability | Consumers are increasingly asking for recyclable, biodegradable, and eco-friendly packaging solutions. |

| E-commerce Growth | Food product e-commerce is growing, which improves the demand for long-lasting and safe packaging. |

| Technological Development | Packaging technology advancements used for improving shelf life and preserving food are spearheading market expansion. |

This section contains information about the leading segments in the industry. In terms of material type, plastic rigid food packaging is estimated to account for a share of 53.4% by 2035. By packaging type, trays & containers are projected to dominate by holding a share of 42.7% by the end of 2035.

| Material Type | Share (2025) |

|---|---|

| Plastic Rigid Packaging | 53.4% |

These characteristics make plastic the most widely used material in food packaging: it is cheap, durable, and pliable. However, the advances made in recyclable, bio-based, or even compostable plastics have once again fueled the demand for plastics vis-a-vis sustainability and environment.

Meat, dairy, ready-to-eat foods, and snacks are a few of the key applications where barrier functionality and long shelf life are imperative. There can be a paradigm shift towards post-consumer recycled (PCR) plastics and mono-material packaging as brands rapidly move towards circular economy compliance.

| Packaging Type | Share (2025) |

|---|---|

| Trays & Containers | 42.7% |

Trays and containers are most sought-after choices in the rigid packaging format on account of their versatility among various food categories ranging from fresh produce, meat, and poultry to seafood and baked goods. They provide structural strength, leak-proof sealing, and other parameters of portion control; hence, they are preferred in foodservice, retail, and delivery.

With more online food delivery and takeaway services in vogue, the need for microwave-safe, reusable, and biodegradable tray solutions is ever increasing. Companies are already focusing their efforts on lightweight and green materials that comply with strict food safety and sustainability regulations.

Tier 1 companies are the industry leaders with strong industry presence and high global share. They have enormous production capacities and a large product portfolio. They are highly technical companies and work on a global scale with a large customer base. They continue to invest in cutting-edge technology, green solutions, and regulation affairs to provide quality products. Its key participants include Amcor Plc, Berry Global Inc., Sealed Air Corporation, Sonoco Products Company, and DS Smith Plc.

Tier 2 companies are medium-sized companies with regional leadership. They have good technology strength and comply with regulation but do not have global reach and new technologies such as tier 1 companies. They typically provide specialized or customized solutions to local requirements in a specific industry. Silgan Holdings Inc., Huhtamaki Oyj, Genpak LLC, Pactiv LLC, and ALPLA Group are good examples of tier 2 companies.

Tier 3 is composed of low-scale businesses operating in business at the regional level for addressing specific regional needs. Their concern is more with addressing regional industry needs rather than being part of an unorganized sector vis-à-vis the organized manner of working practiced by tier 1 and tier 2 units.

Competitive food packaging industry is a space that has forced a lot of major players into acquisitions, sustainability projects, and product innovations. In this regard, Amcor Plc is also widening its scope globally by undertaking various mergers and acquisitions, including that of Bemis Company, to improve its packaging capabilities.

The company has begun investing in developing sustainable packaging solutions out of recyclable and biodegradable raw materials in response to increasing environmental concerns. The other key player in this area is Sealed Air Corporation, which is working on technological advancements in food packaging. The most relevant kind of technological advancement is vacuum sealing and other modified atmosphere packaging processes that extend shelf life and reduce food waste.

Manufacturer Priorities for Rigid Food Packaging (2019 to 2035)

| Manufacturer | Past Priorities (2019 to 2024) & Future Priorities (2025 to 2035) |

|---|---|

| Amcor Plc | New sustainable rigid plastic packaging offerings. Innovations in fully recyclable and compostable rigid packaging. |

| Berry Global Group | Reinforced the use of PCR plastics and innovative formats of lightweight rigid packages. Large-scale replication of mono-materials for improved recyclability. |

| Sonoco Products Company | Augmented fiber-based rigid food packaging with increased barrier attributes. Investment in coated paperboard substitutes for plastics. |

| Huhtamaki Oyj | Manufactured recyclable trays and molded fiber rigid food containers. For frozen and chilled foods, developing fiber-based solutions in Visit. |

| Sealed Air Corporation | Concentrating on high-performance rigid trays for fresh food. Improving vacuum skin packaging with long shelf life gains. |

| Silgan Holdings Inc. | Strengthened metal food can business for processed and canned foods. Exploring lightweight aluminum and hybrid rigid packaging solutions. |

| Mondi Group | Expansions in rigid paper-based food packaging solutions. Improving recyclable high-barrier fiber-based packaging solutions. |

| DS Smith Plc | Rigid corrugated food packaging for e-commerce and delivery has developed. Increasing emphasis on sustainable rigid packaging for fresh food logistics. |

| Tetra Pak | Invested in aseptic rigid cartons for dairy and beverage. Fully published renewable rigid food packaging formats. |

| ALPLA Group | Dedicated to dairy and sauces, focusing on PET rigid containers. Closed-loop PET food-grade packaging advancement to application. |

| Winpak Ltd. | High barrier offers rigid trays for ready-to-eat meals. Developing bio-based right rigid food packing solutions. |

| Greif, Inc. | Strengthened industrial rigid packaging for bulk food storage. Explores smart packaging with QR-enabled traceability features. |

| Placon Corporation | Customized rigid food packaging for fresh-cut produce. Post-consumer recycled plastic packaging expansion. |

| Coveris Holdings S.A. | Launched advanced rigid packaging for dairy and protein sectors. Make thermoformed packaging solutions greener. |

| Faerch Group | Recyclable rigid food trays have been designed for food service and retail. Closed loop food grade PET tray recycling capability expansion. |

| Chuo Kagaku Co., Ltd. | Specialized in microwave-safe and temperature-resistant rigid packaging. Invested in high-barrier rigid solutions for extended shelf life. |

| Pactiv Evergreen Inc. | Expanded compostable and fiber-based rigid food packaging. Scale up biodegradable packaging innovations for food containers. |

| Eco-Products, Inc. | Focused on sugarcane and molded fiber rigid packaging for foodservice. Plastic-free, fully compostable rigid packaging solutions. |

| Genpak LLC | Dual compartment and multi-purpose rigid trays strengthened. Focused on lightweight yet durable and grease-resistant rigid food packaging. |

Key Developments in the Rigid Food Packaging Market

| Company Strategy | Development |

|---|---|

| Product Launch | Amcor launched a new series of thin-wall, recyclable PET containers into the dairy and ready-to-eat meal markets, adding strength but not sustainability. |

| Partnership | Berry Global partnered with Nestlé to develop a reusable and recyclable rigid food packaging technology for dairy and confections systems. |

| Acquisition | Sonoco has upgraded itself in the business of its metal and plastic food packaging portfolios across Europe by acquiring Eviosys Packaging for an amount of USD 1.1 billion. |

| Certification | The company has been awarded the ISCC PLUS certification for its advanced recycled content food trays putting a seal on its commitment to the green economy initiatives. |

| Acquisition | Huhtamaki acquired Hilex Poly to step up its activity in the rigid packaging segment, especially with molded fiber trays and containers. |

| Manufacturer | Vendor Insights |

|---|---|

| Amcor | Consistently maintaining leadership with their PET rigid packaging solutions, focusing on sustainability. |

| Berry Global | They have incorporated recycled content in their food packaging to promote a circular economy. |

| Sonoco | Grew its metal and plastic food packaging portfolio through strategic acquisitions. |

| Sealed Air | Enhanced its high-barrier food tray offer with advanced recycling technology. |

| Huhtamaki | The molded fiber trays for fresh and frozen foods market share have grown. |

| Pactiv Evergreen | Kept a steady demand by investing in compostable and recyclable rigid food containers. |

| Placon Corporation | There has been an upward increase in the company growth through their post-consumer recycled PET packaging solutions. |

| Silgan Holdings | On the other hand, there is no stopping in aluminum food cans and plastic closures in the food industry. |

| DS Smith | So, our rigid paper-based food packaging segment now contains sustainable innovations. |

| Genpak LLC | Conquered the market for lightweight plastic and fiber rigid containers in foodservice packaging. |

| Greiner Packaging | Emphasis on mono-material solutions will improve recyclability. |

| Winpak Ltd. | Increased investment in modified-atmosphere, high-barrier packaging for fresh food. |

| Mondi Group | Innovative hybrid paper-plastic container solutions were introduced into rigid food packaging. |

The market is developing at a rapid pace with rising demand for sustainable, long-lasting, and high-barrier packaging materials. Key strategies for industry players include:

The market is projected to witness a CAGR of 4.4% between 2025 and 2035.

The global rigid food packaging industry stood at USD 150.3 billion in 2024.

The market is anticipated to reach USD 230.7 billion by 2035.

Asia-Pacific is expected to record the highest CAGR due to rising urbanization and demand for packaged food.

The key players include Amcor, Berry Global, Sonoco, and Sealed Air.

The market is segmented based on material type into Plastic (PET, PP, HDPE, PS), Metal (Aluminium, Tinplate), Glass and Paperboard.

The product type segmentation includes Trays, Containers & Clamshells, Bottles & Jars, Cans & Tubs, Caps & Closures

The market is segmented Dairy Products, Bakery & Confectionery Meat, Poultry & Seafood, Fruits & Vegetables, Ready-to-Eat Meals, Sauces & Dressings.

By end-uses the segmentation is as Food Processing Companies, Foodservice & QSRs, Retail & Supermarkets.

The market is segmented based on region type into North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa.

Sustainable Packaging Market Trends – Innovations & Growth 2025 to 2035

Specialty Pulp and Paper Chemicals Market Analysis – Growth & Forecast 2025 to 2035

Sublimation Paper Market Analysis – Growth & Demand 2025 to 2035

Wire Cage Pallet Collar Market Growth & Insights 2025 to 2035

Kraft Paper Machine - Market Outlook 2025 to 2035

Retail Paper Bag Market Analysis by Material, Product Type, Thickness and End Use Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.