The global reverse osmosis (RO) pump market is projected to grow at a CAGR of 5.3%, reaching a market size of USD 15,352.9 million by 2035. The growing demand for clean and potable water, driven by increasing urbanization, population growth, and heightened awareness of water quality, fuels the expansion of the RO pump market. The rising adoption of reverse osmosis technology in industrial, residential, and commercial applications further accelerates market growth.

The market is moderately fragmented, with leading players like Grundfos, Xylem Inc., Pentair, and Danfoss collectively holding approximately 45% of the market share. These companies focus on technological advancements, energy-efficient pump solutions, and strategic partnerships to sustain their competitive advantage.

Centrifugal pumps, particularly multi-stage designs, dominate the market, accounting for over 40% of the revenue share due to their versatility and efficiency in handling high-pressure applications. Booster pumps lead in the pump type segment, reflecting their critical role in ensuring optimal water flow and system performance.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 15,352.9 million |

| CAGR during the period 2025 to 2035 | 5.3% |

Explore FMI!

Book a free demo

| Category | Industry Share (%) |

|---|---|

| Top 3 Players (Grundfos, Xylem Inc., Pentair) | 30% |

| Rest of Top 5 (Danfoss and CAT Pumps) | 15% |

| Rest of Top 10 | 55% |

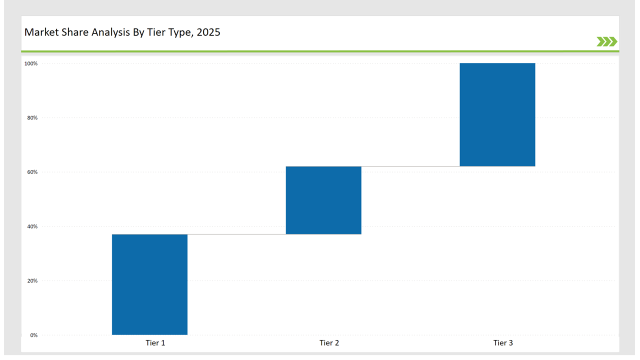

The Top 3 players (Grundfos, Xylem Inc., Pentair) dominate the market through innovations in energy-efficient pump designs and strong distribution networks. The Next 2 of 5 players (Danfoss and CAT Pumps) contribute significantly by focusing on niche applications, particularly industrial and high-pressure reverse osmosis systems. Smaller, regional players account for the remaining 55% and focus on providing cost-effective solutions tailored to local needs.

The market is fragmented, with global players influencing technological advancements and standardization while regional players compete on price and application-specific products.

In the market for reverse osmosis pump, centrifugal pump comprise 65% of the total. Efficiency, durability, and capability to pump high volumes of water at low operating costs are the key advantages of centrifugal pump. Such pumps operate through rotational energy that produces consistent and stable water flow, which is suitable for industrial-scale desalination, municipal water treatment, and large commercial RO systems.

They can operate at high pressure with less maintenance and are thus more economical in applications where a constant water flow is needed, compared to positive displacement pumps.

Apart from this, being scalable, centrifugal pumps are useful to modify according to pressure and flow requirements in different RO systems. Another aspect of their high usage is improved efficiency in recovering energies that reduce the amount of power consumed. Centrifugal pumps are the prominent choice for large-scale operations compared to other pump types because of their long life, low maintenance requirements, and ability to withstand fluctuating water conditions, cementing their status at the top in the RO pump market.

Industrial RO application made up the significant part of the market, with 52% of sales. The Industrial RO application will dominate the Reverse Osmosis (RO) Pump Market since it is mainly used in power generation, pharmaceuticals, food & beverage, and chemical processing industries, as these industries have high water requirement and need a high-purity water supply to operate.

For this purpose, RO systems prove to be highly efficient and economical for removing dissolved solids, contaminants, and impurities. The increasing industrial demand for desalination and wastewater recycling enhances the use of RO pumps since companies are interested in sustainability and regulatory compliance.

In addition, strict environmental norms for water release and reusing have compelled the industries to seek advanced RO technologies for water savings. Industries under water scarcity or stress conditions are oil & gas, mining, and semiconductor manufacturing, which utilize RO technology highly for efficient treatment of water. Industrial RO technology is preferred as it can manage large volumes with high pressure in comparison to residential and commercial use, thus sustaining its market supremacy.

Grundfos

Grundfos introduced multi-stage centrifugal pumps optimized for high-capacity desalination plants and industrial RO systems. The company also expanded its product portfolio with energy-efficient booster pumps tailored for residential applications, securing its position as a market leader.

Xylem Inc.

Xylem focused on compact single-stage centrifugal pumps for residential and small commercial RO systems. The company’s innovative designs, featuring noise reduction and low energy consumption, gained traction across urban markets.

Pentair

Pentair launched next-generation booster pumps designed to improve water flow and reduce energy consumption in large-scale commercial applications. The company also partnered with water treatment companies to enhance its reach in emerging markets.

Danfoss

Danfoss focused on diaphragm pumps for niche applications such as brackish water treatment and small industrial RO systems. The company’s emphasis on durability and low maintenance appealed to cost-conscious buyers.

| Tier | Examples |

|---|---|

| Tier 1 | Grundfos, Xylem Inc., Pentair |

| Tier 2 | Danfoss, CAT Pumps |

| Tier 3 | Regional and niche players |

| Companies | Key Focus |

|---|---|

| Grundfos | Launched multi-stage centrifugal pumps optimized for high-capacity desalination projects. |

| Xylem Inc. | Focused on compact single-stage centrifugal pumps for residential and small-scale applications. |

| Pentair | Introduced energy-efficient booster pumps for large-scale commercial applications. |

| Danfoss | Expanded its diaphragm pump portfolio, targeting brackish water treatment systems. |

| CAT Pumps | Developed high-pressure delivery pumps tailored for industrial and municipal applications. |

| Ebara Corporation | Strengthened its presence in Asia with energy-efficient single-stage pumps for RO systems. |

| Shurflo (Pentair) | Enhanced its booster pump offerings for residential markets, emphasizing affordability and reliability. |

Grundfos, Xylem Inc., Pentair command a significant share in the overall reverse osmosis pump market, with these companies holding a combined market share of approximately 30%.

Centrifugal pump comprise nearly 65% of the overall market.

Regional and domestic companies hold approximately 45% of the overall market. These companies typically focus on serving local needs, offering more affordable and accessible reverse osmosis pump compared to global players.

The market is moderately concentrated, with the top 10 players commanding a significant share. While global brands dominate the market, there is also space for regional players and smaller manufacturers who cater to niche markets or offer specialized reverse osmosis pump.

Industrial RO application offering significant growth prospects to market players.

Automated Material Handling Systems Market - Market Outlook 2025 to 2035

Industrial Vacuum Evaporation Systems Market Analysis - Size & Industry Trends 2025 to 2035

Industrial Temperature Controller Market Analysis - Size & Industry Trends 2025 to 2035

Condition Monitoring Service Market Growth - Trends, Demand & Innovations 2025 to 2035

Ice Cream Processing Equipment Market Growth - Trends, Demand & Innovations 2025 to 2035

Power System Simulator Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.