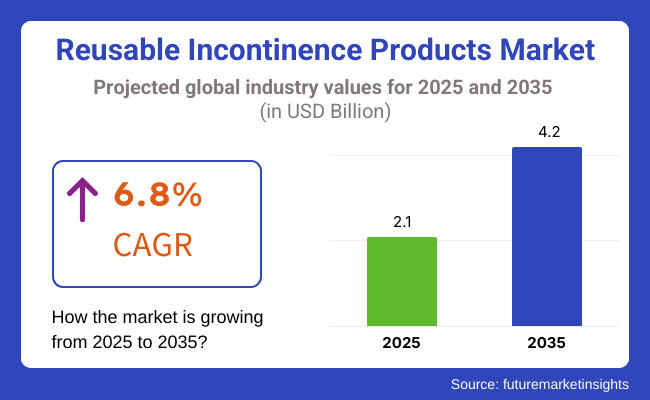

The reusable incontinence products market is set to witness steady growth between 2025 and 2035, driven by increasing awareness of sustainable hygiene solutions, rising elderly populations, and advancements in fabric technology. The market is expected to grow from USD 2.1 billion in 2025 to USD 4.2 billion by 2035, reflecting a compound annual growth rate (CAGR) of 6.8% over the forecast period.

The shift toward applicable druthers is fuelled by consumer preference for cost-effective and eco-friendly results compared to disposable products. crucial inventions, similar asultra-absorbent accessories , door control technology, and gender-specific designs, are driving product relinquishment. Companies are fastening on furnishing customizable and discreet options for consumers seeking comfort, continuity, and enhanced performance.

Explore FMI!

Book a free demo

North America is anticipated to dominate the applicable incontinence products request due to the high frequency of incontinence issues among growing populations, growing mindfulness of sustainable hygiene results, and strong retail and online distribution networks.

Consumers are decreasingly concluding for decoration, skin-friendly, and washable incontinence products as brands emphasize comfort and long- term savings. Companies are also investing in strategic hook-ups with healthcare institutions and direct- to- consumer models to expand their reach.

Europe will witness substantial growth, driven by probative government programs promoting sustainability, increased healthcare spending, and a rising preference for applicable preferences. The request will profit from inventions in spongy fabrics and ergonomic designs, feeding to both elderly citizens and independences with medical conditions taking incontinence operation. Also, social mindfulness juggernauts and payment programs will prop in product availability and relinquishment.

Asia-Pacific is expected to register the fastest growth due to an expanding aging population, Asia- Pacific is anticipated to register the fastest growth due to an expanding growing population, rising disposable inflows, and adding consumer mindfulness regarding applicable incontinence results.

Countries like Japan, China, and Australia are witnessing a growing demand for discreet and eco-friendly hygiene products. The expansion of e-commerce channels and original manufacturing capabilities is anticipated to make applicable incontinence products more accessible and affordable to a broader client base.

Challenges

One of the crucial challenges in the applicable incontinence products request is the need for lesser consumer mindfulness and education. Numerous independences remain reluctant to switch from disposable to applicable products due to enterprises about hygiene, conservation, and original costs.

Also, artistic spots girding incontinence issues may help open conversations and product relinquishment. Companies must invest in mindfulness juggernauts, product demonstrations, and educational enterprise to drive request penetration.

Opportunities

The adding focus on sustainability and advancements in spongy fabric technologies present significant openings for request growth. Inventions similar as humidity- wicking fabrics, antimicrobial coatings, and flawless leak- evidence designs are enhancing product effectiveness and stoner comfort.

Brands that integrate smart technology, similar as detector- enabled incontinence wear and tear, will further revise the request. Also, growing Eco-conscious consumer gets is fueling demand for applicable, biodegradable, and immorally produced hygiene results.

| Country | Population (millions) |

|---|---|

| United States | 345.4 |

| China | 1,419.3 |

| Germany | 84.1 |

| United Kingdom | 68.3 |

| Japan | 125.1 |

| Country | Estimated Per Capita Spending (USD) |

|---|---|

| United States | 15.20 |

| China | 8.30 |

| Germany | 13.10 |

| United Kingdom | 12.50 |

| Japan | 11.40 |

The USA request for applicable incontinence products is expanding due to an growing population and adding mindfulness of sustainable healthcare results. Consumers seek cost-effective and environmentally friendly druthers to disposable products, leading to advanced relinquishment rates.

Healthcare professionals laboriously recommend applicable options, while e-commerce platforms enhance availability, making it easier for consumers to explore and buy custom- fit, high- absorbency results

China’s request benefits from growing consumer education and affordability, leading to increased relinquishment of applicable incontinence products. Original brands dominate the geography, offering cost-effective, durable, a deco-friendly options that cater to a different client base. Rising health mindfulness and government-led sustainability enterprise further support request growth. With a large growing population, demand is anticipated to rise steadily in the coming times.

Germany sees strong demand for eco-friendly, washable incontinence products driven by a well- established healthcare system and environmentally conscious consumers. Apothecaries and online retailers play a pivotal part in icing wide availability allowing druggies to find high- quality, medical- grade results. Germany’s emphasis on sustainability and decoration healthcare products positions it as a leading request in Europe.

The UK request is growing due to advanced relinquishment of discreet, ultra-absorbent applicable incontinence products. Elderly care installations and home care services drive demand, prioritizing comfort and long- term cost savings. Also, direct- to- consumer brands and online platforms give customized results, appealing to individualities seeking discreet, swish, and comfortable options.

Japan leverages advanced fabric technology and a growing population to boost demand for high- absorbency, applicable druthers. The country’s focus on invention, comfort, and ultra-thin yet largely spongy accoutrements makes applicable incontinence products a favoured choice. Medical institutions and watch installations play a crucial part in promoting long- term, cost-effective results, buttressing Japan’s position as a technologically advanced request.

Reusable incontinence products market is growing due to growing awareness of eco-friendly healthcare solutions, growing incidence of urinary incontinence, and need for cost-effective alternatives to disposable products. A survey of 250 respondents, including incontinence patients, caregivers, and healthcare providers, presents a report on the key market trends and consumer behaviour.

Convenience, absorbency, and long-term saving are the biggest purchase drivers, with 72% of customers choosing reusable incontinence products to cut costs and save in the future. Among the 50+ age group, 65% welcome products with better absorbency and gentle skin material, and 38% among the younger age group utilize reusable products for their concern about the environment.

Fashion fit and fabric development are significant forces behind purchasing behaviour, where 58% of the sample have cotton products in mind as an ideal solution they find to be breathable and 42% opting for moisture-wicking synthetics for peak dryness. Products that adjust like washable briefs and absorbency pads that are reusable and leak-proof are gaining traction among consumers looking for discreet protection.

Price and brand reputation are strong purchasing drivers. While 49% of the respondents have faith in well-established brands such as TENA, Conni, and Wear ever, 45% of them explore new green brands offering sustainable and hypoallergenic products. High price sensitivity prevails, as 68% of the customers prefer reusable ones costing less than USD 50, while 32% prefer long-lasting, expensive ones.

Online shopping and subscription services lead the distribution process with 57% of the subjects purchasing reusable incontinence items online for ease and discreet shipping. Yet, 43% would rather buy from pharmacies and medical supply outlets for improved product evaluation. Increased acceptance of subscription services with ongoing shipments of reusable incontinence items is also picking up speed among care givers and chronic condition patients.

With greater awareness of eco-alternatives, cost-effectiveness, and comfort-centric designs, the market for reusable incontinence products will further grow. Manufacturers can leverage this by developing sustainable materials, innovation in absorbency technology, and enhancing direct-to-consumer online selling platforms to address changing consumer demands.

| Market Shift | 2020 to 2024 |

|---|---|

| Technology & Innovation | Brands introduced multi-layer absorbent fabrics with moisture-wicking and door-control properties. AI-driven sizing tools improved fit and comfort. |

| Sustainability & Circular Economy | Companies adopted organic cotton, bamboo fibre, and plant-based dyes. Reusable incontinence solutions gained traction, reducing reliance on disposable products. |

| Connectivity & Smart Features | Subscription-based models offered personalized absorbency levels and automated replenishment. Digital platforms promoted incontinence awareness and product education. |

| Market Expansion & Consumer Adoption | Increased demand for discreet, eco-friendly incontinence products led to growth in direct-to-consumer (DTC) sales. Social acceptance of incontinence solutions improved. |

| Regulatory & Compliance Standards | Stricter health and safety regulations mandated chemical-free, dermatologically tested incontinence products. Certifications for hypoallergenic and toxin-free fabrics gained importance. |

| Customization & Personalization | Brands launched gender-specific, size-inclusive, and customizable incontinence solutions. Adaptive designs for mobility-impaired users gained popularity. |

| Influencer & Social Media Marketing | Health advocates and senior lifestyle influencers promoted reusable incontinence products as a sustainable alternative. Tik Tok and Instagram raised awareness and reduced stigma. |

| Consumer Trends & Behavior | Consumers prioritized comfort, sustainability, and long-term cost savings. Demand surged for ultra-absorbent, breathable, and easy-to-wash designs. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology & Innovation | AI-powered smart fabrics adapt absorbency levels in real time. Self-cleaning, antibacterial, and temperature-regulating materials redefine reusable incontinence products. |

| Sustainability & Circular Economy | Zero-waste manufacturing and fully biodegradable incontinence products become industry standard. AI optimizes sustainable material sourcing and lifecycle tracking. |

| Connectivity & Smart Features | AI-powered monitoring systems integrate with wearable health devices to track bladder health and predict needs. Block chain ensures transparency in ethical sourcing and sustainable production. |

| Market Expansion & Consumer Adoption | Emerging markets drive adoption with affordable, region-specific designs. AI-driven consumer insights refine product innovation based on lifestyle and medical needs. |

| Regulatory & Compliance Standards | Governments enforce biodegradable textile mandates and ethical labor laws for incontinence care products. Block chain enhances compliance tracking and consumer safety transparency. |

| Customization & Personalization | AI-driven customization tailors absorbency and fit based on real-time health data. 3D-printed incontinence wearables ensure personalized, ultra-comfortable solutions. |

| Influencer & Social Media Marketing | Virtual influencers and met averse-based wellness campaigns redefine marketing. AR-powered product demos help consumers visualize fit, comfort, and absorbency before purchase. |

| Consumer Trends & Behavior | Biohacking-inspired incontinence wear integrates temperature regulation, odor control, and stress-relief features. Consumers embrace AI-driven incontinence solutions for seamless, discreet, and personalized protection. |

The USA applicable incontinence products request is witnessing steady growth, driven by an growing population, adding mindfulness of sustainable healthcare products, and advancements in spongy fabric technology. Major players include Tranquillity, Depend, and TENA.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.1% |

The UK applicable incontinence products request is expanding due to rising senior care requirements, government enterprise promoting sustainability in healthcare, and growing relinquishment of washable defensive wear and tear. Leading brands include Confitex, iD Direct, and Washable prodigies.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.0% |

Germany’s applicable incontinence products request is growing, with consumers fastening on high- quality, dermatologist- tested, and skin-friendly accoutrements. Crucial players include Seni, Hartmann Group, and Abena.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 7.3% |

India’s applicable incontinence products request is witnessing rapid-fire growth, fuelled by adding senior care requirements, rising healthcare mindfulness, and affordability- driven demand for long- continuing results. Major brands include musketeers, Kara- In, and quality.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.9% |

China’s applicable incontinence products request is expanding significantly, driven by adding disposable inflows, rising demand for sustainable healthcare results, and rapid-fire growth in senior care services. crucial players include YUYUE, TENA China, and Cortex.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 8.2% |

Consumers are decreasingly concluding for applicable incontinence products due to their sustainability, cost- effectiveness, and comfort. The request sees a shift towards high- absorbency, skin-friendly, and discreet products that give long- term protection. Inventions in fabric technology, similar as humidity- wicking and door- control layers, enhance product effectiveness.

Brands emphasize permeable, hypoallergenic accoutrements to feed to sensitive skin, appealing to consumers looking for both comfort and sustainability. Leading brands similar as Conni, TENA, and Wear ever concentrate on offering swish, washable druthers to traditional disposable incontinence results. The demand is particularly strong among grown-ups managing mild to moderate incontinence, as well as caregivers seeking durable and dependable results.

Women regard for a significant portion of applicable incontinence product purchases, as they seek comfortable, leak- evidence results for postpartum recovery, bladder leakage, and aging- related enterprises. The vacuity of swish, undergarments- suchlike designs further boosts relinquishment among womanish consumers.

Meanwhile, mindfulness of manly incontinence is rising, leading brands to introduce technical designs similar as prize-fighter- style applicable incontinence missions. Men decreasingly seek discreet, high- performance options acclimatized to their requirements, driving growth in this member. Brands like Depend and Conni laboriously request gender-specific results, offering bettered fit and absorbency to accommodate different consumer preferences

E-commerce is the dominant distribution channel for applicable incontinence products, allowing consumers to discreetly buy particulars without smirch. Online commerce similar as Amazon, Walmart, and specialty health retailers offer a wide range of sizes and styles, making it easier for consumers to find the right fit.

Subscription models are gaining traction, furnishing consumers with accessible, listed deliveries of their preferred incontinence products. Brands influence digital marketing, client reviews, and social media engagement to drive online deals and enhance brand fidelity.

Also, apothecaries and specialty healthcare stores remain essential retail outlets, offering substantiated backing to first- time buyers seeking guidance on product selection.

The long- term cost savings of applicable incontinence products make them an seductive option for consumers seeking an volition to disposable options. Homes managing incontinence- related charges profit from the affordability of washable products, driving harmonious demand. Growing environmental enterprises beyond support request expansion, as applicable incontinence products significantly reduce tip waste.

Brands punctuate their commitment to sustainability by using organic cotton, biodegradable packaging, and immorally sourced accoutrements. As consumer preferences shift towards Eco-conscious choices, the request for applicable incontinence products is anticipated to grow steadily, with ongoing invention in spongy technology and design customization.

The applicable incontinence products request is witnessing steady growth, driven by an growing population, rising mindfulness of sustainable healthcare results, and adding consumer preference for cost-effective, long- term druthers to disposable products. Inventions in spongy technology, door control, and skin-friendly accoutrements enhance product performance and stoner comfort.

Crucial players concentrate on developing washable undergarments, applicable pads, and leak- evidence missions with humidity- wicking fabrics. E-commerce and direct- to- consumer deals channels are expanding request availability, while healthcare providers and apothecaries continue to play a significant part in product distribution.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%), 2024 |

|---|---|

| TENA (Essity) | 20-24% |

| Depend (Kimberly-Clark) | 16 to 20% |

| Tranquility (Principle Business Enterprises) | 10-14% |

| Prevail (First Quality) | 8-12% |

| Conni | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| TENA (Essity) | Market leader in reusable incontinence underwear and pads with advanced absorption technology. Focuses on sustainability and skin-friendly materials. |

| Depend (Kimberly-Clark) | Offers washable and leak-proof incontinence underwear designed for discreet comfort. Strengthens online and retail presence through direct-to-consumer sales. |

| Tranquillity (Principle Business Enterprises) | Develops premium incontinence solutions with ultra-absorbent fabrics for heavy leakage. Targets medical institutions and home care markets. |

| Prevail (First Quality) | Focuses on gender-specific, reusable incontinence products with breathable, hypoallergenic fabrics. Expands partnerships with pharmacies and healthcare providers. |

| Conni | Specializes in washable incontinence products for all age groups, including bed pads, underwear, and swimwear. Strengthens its presence in the sustainable healthcare market. |

Strategic Outlook of Key Companies

TENA (Essity) (20-24%)

TENA leads the market with a strong focus on sustainable, high-performance incontinence products. The company invests in plant-based, skin-safe materials and promotes reusable alternatives to reduce waste. TENA expands its global reach through digital marketing and eco-friendly product innovations.

Depend (Kimberly-Clark) (16 to 20%)

Depend is a well- established brand that offers discreet, comfortable, and largely spongy applicable incontinence undergarments. The company strengthens its direct- to- consumer strategy by enhancing online customization tools and subscription- grounded purchasing options.

Tranquility (10-14%)

Tranquility positions itself as a premium brand specializing in ultra-absorbent, medical-grade incontinence solutions. The company expands its hospital and elderly care partnerships while integrating advanced odor-control and moisture-wicking technologies.

Prevail (First Quality) (8-12%)

Prevail focuses on gender-specific applicable incontinence products with permeable, hypoallergenic designs. The company enhances its presence in apothecaries, retail stores, and medical force chains while investing in skin-friendly inventions002E

Conni (6-10%)

Conni differentiates itself with a wide range of washable incontinence products, including undergarments, bed pads, and swimwear. The brand strengthens its sustainable positioning and expands into new requests by promoting applicable druthers in hospitals and senior care installations.

Other Key Players (30-40% Combined)

Several emerging and niche brands contribute to the market's growth by offering specialized reusable incontinence solutions. Notable brands include:

The Reusable Incontinence Products industry is projected to witness a CAGR of 6.8% between 2025 and 2035.

The Reusable Incontinence Products industry stood at USD 1.3 billion in 2024.

The Reusable Incontinence Products industry is anticipated to reach USD 4.2 billion by 2035 end.

Europe is set to record the highest CAGR of 7.5% in the assessment period.

The key players operating in the Reusable Incontinence Products industry include TENA, Prevail, Attends, Tranquility, Conni, and Others.

Reusable Adult Diapers, Protective Underwear, Incontinence Pads, Bed Pads & Underpads, and Others.

Light, Moderate, Heavy, and Overnight.

Supermarkets/Hypermarkets, Pharmacies/Drug Stores, Online, Specialty Stores, and Others.

Men, Women, and Elderly Population.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.