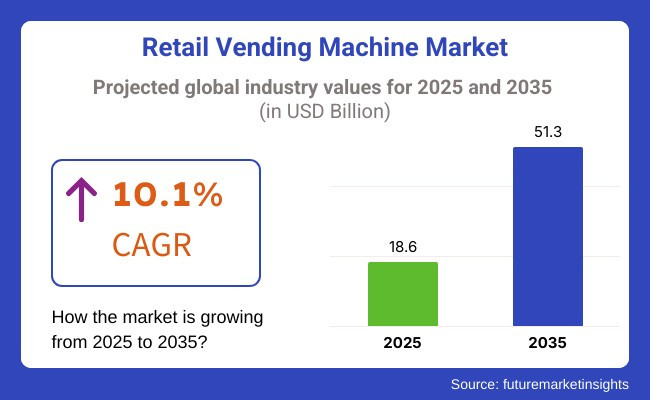

The retail vending machine industry is expected to see tremendous growth between 2025 and 2035 due to technological advancements in automation, rising demand for contactless shopping solutions, and the increasing use of AI-based vending systems. The industry is expected to grow from USD 18.6 billion in 2025 to USD 51.3 billion by 2035 at a CAGR of 10.1% during the forecast period.

The growth of this industry is powered by the rising consumer demand for convenient, on-the-go buying, smart payment integration, and product diversification beyond snacks and drinks. Brands are testing AI-driven vending machines that provide personalized product suggestions, real-time inventory monitoring, and frictionless mobile payments. Trends for sustainability are also powering the adoption of green vending machines with eco-friendly technologies and biodegradable packaging solutions.

Besides this, the adoption of cashless payment and IoT-driven vending machines is boosting operational efficiency and customer satisfaction. Data analytics is being used by companies to optimize restocking hours and offer location-based demand-specific products. Moreover, expansion of vending machines into non-conventional sectors like healthcare, electronics, and cosmetics is also driving industry growth.

Cashless payment, AI-driven inventory management, customer experience hyper-personalization are technologies shaping the industry at lightning speed. Retailers and vending machine operators worry about product range, local suitability, cost-effectiveness - getting the most bang for their buck and high levels of customer engagement.

Easy-to-use interface, convenience, and eco-friendliness are preferred by customers, and thus energy-saving and eco-friendly vending machines are being increasingly demanded. Manufacturers and distributors are focusing on technological innovation such as IoT connectivity, contactless payment, and remote monitoring to maximize operating efficiency.

The growing penetration of smart vending machines in malls, airports, offices, and public places is driving industry expansion. Besides that, the increasing growth of health food snacks and beverage vending machines follows consumer interest in healthy, organic foods and thus positions vending machines as central to today's retail industry.

Between 2020 and 2024, the industry expanded consistently due to increasing demand for contactless shopping, cashless payments, and product diversity. Intelligent vending machines with AI-based inventory management and real-time tracking enhanced operational effectiveness and customer satisfaction. Health-conscious consumers were at the forefront of fueling sales of organic snack foods, beverages, and fresh produce through vending machines.

Cashless and mobile payment technologies such as NFC technology and QR code became mainstream. As much as manufacturers were concerned with supply chain interruption and installation expense, they were concerned with energy-efficient design and line extension of their products so that they remained in tune with changing consumer preferences.

Between 2025 and 2035, AI-driven automation, personalized product suggestions, and eco-friendly designs will dominate the industry. Machine learning machines driven by AI will stock optimally based on consumer buying habits and recommend products through facial recognition and customer profiling. Self-service and self-replenishment will peak efficiency, while biodegradable components and environmentally friendly cooling technology will help implement sustainability efforts.

Vending machines will make inroads into non-traditional areas like airports, gyms, and co-working offices with location- and behavior-specific product offerings. Blockchain-enabled inventory tracking will enhance supply chain transparency and product quality assurance.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Companies launched cashless payment vending machines with inventory management based on AI. Facial recognition-enabled intelligent vending machines and personalized recommendations became fashionable. | AI-powered vending machines predict demand and automatically replenish stock. Product authenticity is enabled through blockchain, and drone-facilitated vending makes the products available at hand. |

| Green vending machines using power-efficient coolants and green packaging were trendy in business use. Recycling reverse vending machines were the rage. | Zero-waste vending machines are the norm, using reusable and refillable containers. AI streamlines vending supply chains to zero waste and sustainability. |

| IoT-based vending machines enabled real-time tracking, contactless payments, and remote diagnostics. AR-enabled and voice-activated vending experiences became a reality. | AI-driven vending joins forces with intelligent cities to deliver on-demand, hyper-personalized shopper purchasing. Blockchain provides secure payment and transparent supply chain. |

| Increased convenience and self-service need drove demand, and it drove growth. Office skyscrapers, airports, and city centers all experienced widespread adoption of the vending machine. | Growth is driven by emerging industries through localized, AI-enabled vending solutions. AI-powered consumer insights optimize inventory choices based on demographics and location. |

| More stringent hygiene standards after the pandemic resulted in touchless user interfaces and self-sanitizing vending machines. Food safety standards compliance was enhanced. | Governments regulate energy-efficient, sustainable vending technology. Blockchain-enabled regulatory monitoring confirms adherence to product safety and health regulations. |

| Smart vending machines with adjustable product mix and real-time pricing were introduced by brands. Subscription-based vending became mainstream. | AI-powered vending machines tailor recommendations using biometric information. On-demand vending using 3D-printed products facilitates hyper-personalized retailing. |

| Social media-led vending experiences, such as Instagrammable vending ideas and QR-code offers, picked up steam. TikTok and YouTube fueled viral vending machine trends. | Metaverse and virtual influencer vending machine activations transform the way brands engage. AR-based interactive vending maximizes consumer engagement and loyalty. |

| Consumers enjoyed contactless, 24/7 available vending machines. Vending of healthy food, organic food, and premium products saw increasing demand. | Biohacking-facilitated vending combines health-focused products like smart supplements and nootropic drinks. Consumers use AI-based vending for convenient on-the-go shopping. |

The industry has some vulnerabilities subject to technological, regulatory, operational, and consumer tastes peculiar risks. One of the major issues is related to cybersecurity, given that vending machines today are connected to the Internet of Things (IoT) and can both store payment and customer data of users. A data breach can lead to not only financial losses but also reputational damages.

The regulatory risks different from one region to another since they are about things like food safety, payment security, and ADA compliance. The fines or penalties faced under non-compliance can lead to the aforementioned machine shutdowns or some legal matters. Complying with the local health and business laws becomes the vendor's responsibility to make their operations go smoothly.

Still another issue lies with the operational and maintenance costs due to being high. The machines need regular stocking, servicing, and software updates to maintain their functionality and competitiveness, which are the primary reasons they are so high. Loss of sales due to machine downtimes is the result of technical problems, so the investment in predictive maintenance and remote monitoring systems is crucial.

The evolutionary shift of consumers to cashless transactions, healthy snacking selections, and smart vending has also been witnessed. The newer models that can't cope might have a problem due to the lack of recognition. An effective step that sellers can do is averting the problem by integrating the possibilities of paying through contactless, AI learning on products to be purchased, and a larger stock.

The industry is segmented based on the type of products offered by vending machines. In retail vending machines, The Beverage vending machines segment accounted for the maximum market share of the retail vending machine market. The beverage vending machine segment is witnessing increasing demand owing to the rising need for on-the-go beverages such as packaged bottled water, carbonated beverages, coffee, and energy drinks.

The likes of Coca-Cola, PepsiCo, and Selecta are at the vanguard of innovation with their introduction of, e.g., AI-powered personalization, cashless payment solutions, and contactless dispensing. For example, The Coca-Cola Freestyle machine has over 100 flavour combinations for consumers, which strengthens consumer engagement. Smart vending solutions have been progressively adopted in airports, malls, and places of work as a rise in the need for functional beverages, such as vitamin-enriched drinks and cold brew, continues to emerge in the industry.

The segment of snack vending machines is witnessing solid growth as consumers' inclination is increasing towards convenient, ready-to-eat snacks. Traditionally filled with chips, granola bars, and chocolates, modern vending solutions are responding to changing customer preferences by stocking organic, gluten-free, and protein-rich snacks.

To optimize operational efficiency, brands such as Fuji Electric and Seaga are also integrating AI-based inventory management, automated restocking, and remote monitoring. However, so-called healthy vending machines are increasingly located in corporate offices, hospitals, and universities, where the demand for healthy snacking options is growing. Moreover, smart sensor integration guarantees asset freshness while reducing waste, thus augmenting the sustainability of vending solutions.

As traditional transactions fade into the background due to the emergence of new technology such as the Internet of Things (IoT), Artificial Intelligence (AI), and cashless payments, the Beverage Vending Machines and Snack Vending Machines categories are a high-demand industry, especially in urban and high-traffic locations.

In regions with underdeveloped digital payment infrastructures, the Cash Payment Mode segment still retains a share in the industry. Basic vending machines for coins and bills are still common, especially in locations like transport hubs, schools, and public spaces, where consumers prefer fast, low-value transactions.

However, cash payment adoption is shrinking because of hygiene concerns, maintenance costs, and transaction inefficiencies. Vending machine manufacturers like Fuji Electric and Crane Merchandising Systems still produce cash-based machines but are adding hybrids to accept cash and digital payments.

The cashless payment mode segment is expected to garner attention owing to the proliferating contactless transactions, mobile wallets, and NFC-enabled smart cards. Industry leaders, including Selecta, Azkoyen, and USA Technologies, have introduced vending machines with Apple Pay, Google Pay, and RFID card compatibility, adding convenience to consumers.

Cashless vending is in demand at high-volume locations like corporate offices, airports, and universities, where quick and smooth payment integration is necessary. Furthermore, AI-powered vending machines have come a long way, offering not just a plethora of products but also personalized recommendations based on individual preferences and integration with loyalty programs.

As cashless payment methods become more widely used, the demand for cashless payment mode cash vending machines is expected to exceed the demand for cash-based machines, indicating the future of the automated retail industry.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 7.6% |

| UK | 7.3% |

| Germany | 7.4% |

| India | 8.0% |

| China | 8.5% |

The USA industry is experiencing tremendous growth due to technological advancement, shifting consumer trends, and increasing convenience requirements. Smart vending solutions, AI-driven inventory management, and cashless payments are transforming the industry. Industry giants such as Crane Merchandising Systems, Fuji Electric, and Seaga are leading the industry with next-generation solutions. FMI is of the opinion that the USA industry is slated to grow at 7.6% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Cashless and Touch-Free Payment Solutions | Increased use of digital wallets, mobile payment, and NFC cards has opened up demand for cashless machines. Retailers are installing them to offer greater user convenience and transactional security. |

| AI-Integrated and Smart Machines | driven by AI optimize stock, reduce stockouts, and enhance customer engagement through personalized suggestions. Coca-Cola's AI-driven vending machines have reported enhanced consumer retention. |

| Diversification Outside of Snacks and Drinks | Vending machines today are dispensing a broad spectrum of items such as electronics, drugs, and personal protection equipment (PPE). Public transit hubs and airport terminals diversified the stock found in machines to include crucial healthcare products and first-priority consumer goods. |

The UK industry is growing with increasing urbanization, the necessity of unmanned retail, and evolving consumer preferences towards healthy food. Westomatic, Azkoyen, and Selecta are spreading their wings in urban and corporate regions. FMI is of the opinion that the UK industry is slated to grow at 7.3% CAGR during the study period.

Growth Drivers in the UK

| Key Drivers | Details |

|---|---|

| Fresh and Organic Food Vending Machines | Consumers are going out of their way to seek healthier food, and that has led to more vending machines providing fresh salads, protein bars, and organic juices. Selecta was capable of delivering fresh food vending solutions for office buildings as well as hospitals. |

| AI and IoT-Based Inventory Management | Intellectually charged machines with IoT sensors track existing stock levels, waste is eliminated, and operational efficiency is increased. Artificial intelligence-based vending systems that were run within railway stations have streamlined inventory replenishment. |

| Expansion in Transport Hubs and Workplaces | Self-service retailing solutions are gaining acceptance in airports, railway stations, and office spaces. Heathrow Airport has equipped it with high-tech vending machines that carry travel-related goods, beauty goods, and specialty coffee. |

The German industry is expanding with increasing demand for high-tech solutions and eco-friendliness. Rheavendors, Sielaff, and EVOCA Group are leading the way in implementing energy-efficient machines and electronic payment. FMI is of the opinion that the German industry is slated to grow at 7.4% CAGR during the study period.

Drivers of Growth in Germany

| Key Drivers | Details |

|---|---|

| Energy-Efficient and Eco-Friendly Machines | Eco-friendly consumers are looking for machines that are energy-efficient and have recyclable packaging. Sielaff introduced eco-friendly vending machines based on renewable resources. |

| High-Tech and Cashless Payment Vending | Germany's growing fondness for online payments, contactless payment system and biometrics are becoming mainstream. Subway station cashless machines have reduced transaction time to a great extent. |

| Automatic Retail Kiosks for Non-Food Items | The industry selling cosmetics, electronics, and accessories is growing. Retailers such as Douglas have introduced beauty product vending kiosks in shopping malls with heavy footfalls. |

India's industry is expanding very rapidly due to urbanization, increasing disposable incomes, and the move towards self-service retailing. Players like Vendiman, Godrej Vending, and ATL Vending are leading the industry with AI-driven and cashless vending. FMI is of the opinion that the Indian industry is slated to grow at 8% CAGR during the study period.

India's Growth Drivers

| Key Drivers | Details |

|---|---|

| Beverage and Snack Vending Machines in Corporate Offices | Offices and technology parks are now employing vending machines to dispense snacks and beverages to employees. Major technology parks have also installed smart vending to cater to the working population by fitting them with the latest technology. |

| UPI-Based and Cashless Payments | Due to the rising popularity of UPI payments, vending machines at malls, airports, and metro stations now facilitate seamless digital payments. The government's push towards a cashless economy has also enhanced this trend. |

| AI-Fitted Public Vending Machines | AI-equipped public vending machines in cities and airports provide personalized suggestions and track consumer behavior. This has raised consumer engagement and improved sales. |

The Chinese industry is growing and is driven by automation, increasing consumer expenditure, and AI-equipped retail solution technology. Industry players TCN Vending, UBox, and SandenVendo are providing technology-driven vending solutions in various industries. FMI is of the opinion that the Chinese industry is slated to grow at 8.5% CAGR during the study period.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| AI-Powered and Fully Autonomous Machines | China is leading smart retail innovation through AI-powered machines that can read faces and shop through voice commands. Alibaba's intelligent vending machines have set a new standard in automated retail. |

| Diversification into Cosmetics, Fresh Food, and Electronics | machines now stock a range of products, from cosmetics to fresh produce and fruits and vegetables, to luxury electronics. Vending machines in Shanghai sell smartphones and accessories, another sign that there is a shift towards automated high-end sales. |

| Cashless and QR Code-Based Payments | With cashless wallets such as Alipay and WeChat Pay taking over payments, machines fully enable facial recognition and QR code payment. This eliminated the use of cash and was more convenient for customers to buy. |

The industry is rapidly growing due to increasing consumer requirements for convenience, innovations in payment technologies, and diversification of product offerings. Vending machines can now dispense items other than traditional snacks and drinks, such as electronics, personal care items, fresh food, and even pharmaceutical products, enhancing the appeal of such machines in the industry.

Major players in the industry that offer AI-based inventory management, touchless payment solutions, and smart vending technology comprise Fuji Electric, Crane Merchandising Systems, Azkoyen Group, and Westomatic. Startups and niche players are progressively coming up with innovative vending options, refrigerated units for fresh food, and knowledge-driven consumer insights.

The change in the industry dynamics is being created by cashless transactions, AI-driven automated restocking, and the boom of unmanned retail concepts. Sustainability trends, energy-efficient vending machines, and mobile app integration pave the way for imposing consumer engagement.

Factors influencing competition within the industry include technological innovation, machine durability, real-time inventory tracking, and positioning in high-footfall locations. Companies that invest in providing contactless interfaces, personalized product recommendations, and hybrid retailing models will create an increasing stronghold in this dynamically evolving industry.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Fuji Electric Co., Ltd. | 15% |

| Crane Co. | 12% |

| Azkoyen Group | 10% |

| Westomatic Vending Services Ltd. | 8% |

| Seaga Manufacturing, Inc. | 7% |

| Other Companies | 48% |

| Company Name | Key Offerings/Activities |

|---|---|

| Fuji Electric Co., Ltd. | Offers vending machines of all sorts and for all needs, such as beverage and food dispensers. Very recently, it has been working on the integration of IoT technology to improve machine efficiency and the overall experience. |

| Crane Co. | Offers vending solutions with an emphasis on cashless payments and interactive display screens. The company's line of products has expanded, with machines increasingly adaptable to meet the variety of needs different consumers have. |

| Azkoyen Group | Engaged in selling vending machines for hot beverages, snacks, and cigarettes. Recent activities involve the creation of energy-efficient models and the beautification of machines. |

| Westomatic Vending Services Ltd. | Provides tailor-made vending solutions, including options for green machines. The company has also kept itself busy launching machines with advanced telemetry systems for real-time monitoring. |

| Seaga Manufacturing, Inc. | Provides vending machines of various types with modular designs for easy customization. Recent activities include partnerships that expand their worldwide distribution network. |

Key Companies insights

Fuji Electric Co., Ltd. (15%)

Fuji Electric is maintaining a strong presence in the industry with its numerous vending machines. The company's current target is the integration of IoT technology, which is aimed mainly at operational efficiency and personalized consumer experience.

Crane Co. (12%)

Crane Co. has been innovating in payment systems and user interfaces. By way of cashless and mobile payment options, the company has been catering to the consumer preferences of the new-age, technologically savvy generation.

Azkoyen Group (10%)

Azkoyen Group diversified focus and energy consumption. The development of greener machines matches sustainable trends worldwide and would definitely appeal to environmentally conscious customers.

Westomatic Vending Services Ltd. (8%)

Customization and technological integration are other parameters on which Westomatic operates. Telemetry-enabled machines allow operators to monitor their inventory and performance remotely and manage their operations effectively.

Seaga Manufacturing, Inc. (7%)

Field-proven modular designs offer Seaga flexibility to meet the demands of varied types of products and consumers. Seaga's strategy relies on partnerships to gain industry presence as well as adapt to suit regional demands.

Other Key Players

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 18.6 billion |

| Projected Market Size (2035) | USD 51.3 billion |

| CAGR (2025 to 2035) | 10.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Product Types Analyzed (Segment 1) | Beverage Vending Machines, Snack Vending Machines, Personal Care Vending, Ticket Vending, Game & Amusement Vending, Food Vending |

| Payment Modes Analyzed (Segment 2) | Cash, Cashless (NFC, Mobile Wallets, QR Codes) |

| Applications Analyzed (Segment 3) | Offices, Commercial Spaces, Public Places, Educational Institutions, Transport Hubs |

| Technologies Assessed (Segment 4) | AI-based Inventory, IoT Connectivity, Real-time Monitoring, Contactless Payment, Smart Sensors |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia & Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, China, India, Japan, South Korea, Brazil, GCC Countries, South Africa |

| Key Players Influencing the Market | Fuji Electric Co., Ltd., Crane Co., Azkoyen Group, Westomatic, Seaga Manufacturing, Selecta Group, SandenVendo, Royal Vendors, Jofemar Corporation |

| Additional Attributes | Dollar sales by product type (beverage vs snack), penetration of AI-powered vending across high-traffic zones, mobile wallet and contactless payment trends, eco-friendly and energy-efficient vending designs, expansion into cosmetics and pharmaceutical retailing |

| Customization and Pricing | Customization and Pricing Available on Request |

By type, the industry is segmented into food retail, beverage retail, games/amusement retail, tobacco retail, candy & confectionery retail, beauty & personal care retail, and ticket retail.

By payment mode, the industry includes cash and cashless.

By application, the industry includes commercial places, offices, public places, and other applications.

The industry is slated to reach USD 18.6 billion in 2025.

The industry is predicted to reach a size of USD 51.3 billion by 2035.

Key companies include Royal Vendors, Inc., Bianchi Vending Group S.p.A., FAS International S.p.A., Jofemar Corporation, N&W Global Vending S.p.A., SandenVendo America, Inc., Selecta Group B.V., Hunan Kimma Intelligent Equipment Manufacture Co., Ltd., Fujian New Shiyu Group Co., Ltd., and Sielaff GmbH & Co. KG.

China, slated to grow at 8.5% CAGR during the forecast period, is poised for the fastest growth.

Food retail is among the most widely used retail vending machine segments.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA