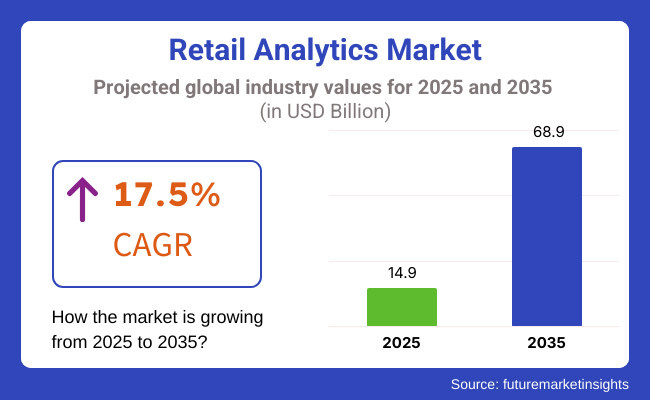

The global retail analytics market is set to experience USD 14.9 billion in 2025. The industry is expected to observe 17.5% CAGR from 2025 to 2035, reaching USD 68.9 billion by 2035.

The market growth is fueled by the rising demand for real-time data analysis, AI-based recommendation engines, and machine learning-based insights. There’s Intelligent analytics solutions are leveraged by retailers to fulfil demand accurately, bouncing off optimal pricing, personalized shopping and other in-depth customer interaction.

Supply chain operators are also using predictive analytics systems to optimize logistics, remove operating inefficiencies, and reduce losses due to overstocking or under-stocking.

The industry uses data analytics, AI, and predictive insights to optimize retail operations, enhance customer experience and drive business decision-making. Retailers, e-commerce business, and supply chain stalwarts use analytics for monitoring consumer activity, browsing, inventory management, and pushing personalized marketing strategies.

As digital transformation gains pace, organizations are increasingly turning to AI-driven data processing, real-time customer tracking, and cloud-based analytical channels to gain advantage and optimize service capabilities.

Cutting-edge technologies like big data analytics, IoT based data collection, and automated analytics dashboards are changing the landscape of The industry, allowing firms to harness vast amounts of consumer and operational data. By analysing customer feedback systematically using AI, retailers can refine their loyalty programs and marketing strategies according to data-driven insights gleaned through sentiment analysis and Omni channel analytics.

Cloud analytics platforms also enable retailers to analyse real-time data from multiple sites making it easy to integrate data from your point of sale (POS) system, customer relationship management (CRM) applications and enterprise resource planning (ERP) systems.

The need of the hour is scalable and inexpensive analytics investments as businesses are recognizing the importance of personalization, demand planning, and operational excellence. AI-based merchandising is helping retailers customize their product mix based on shifts in consumer behaviour, while sentiment tracking apps provide a deeper understanding of customer reviews and satisfaction rates.

Due to increasing competition in retail, organizations rely on data-driven decisions to improve profitability, customer retention, and performance.

The industry shall follow suit with technological advancements in AI, cloud computing, and machine learning. Companies will hold the key to successful retail world by empowering themselves with analysis of consumer data on real-time basis, early prediction of industry trends and streamlining retail operations.

As the technology becomes even more advanced, the future of retail will be focused on smart analytics solutions that provides the best customer experience and a more successful business strategy.

Explore FMI!

Book a free demo

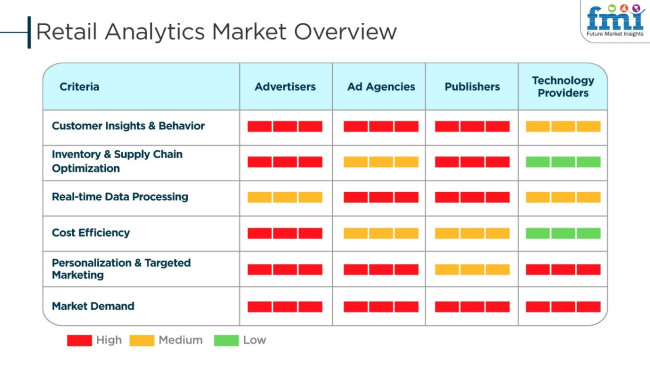

The industry in terms of growth and development, is driven by the increasing digitization and data-centric decision-making. To support, and enhance existing products and services, the retailers focus on customer behaviour insights, demand forecasting, and inventory optimization to increase operational efficiency and improving customer experience.

E-commerce platforms employ advanced analytics for personalized marketing, dynamic pricing, and fraud detection attaining higher rates of engagement and conversion. Data analytics providers, through AI-powered solvers for predictive analytics, real-time analytics, and automated reporting B2B product offering, support the business transformation processes.

In return, the end-users get personalized recommendations, targeted promotions, and better shopping experiences indirectly. The main criteria for purchasing consist of the AI-powered analytics capabilities, Omni channel data integration, cost efficiency, scalability, and real-time processing.

The increase in Omni channel retailing and predictive analytics results in significant business investments into cloud-based analytics platforms, customer sentiment analysis, and automation tools to ensure competitiveness in the changing retail industry.

| Company | SAP SE |

|---|---|

| Contract/Development Details | SAP SE secured a contract to provide its retail solutions to a leading global supermarket chain. The partnership aims to enhance inventory management and customer personalization through advanced data analytics. |

| Date | February 2024 |

| Contract Value (USD Mn) | Approximately USD 80 - USD 100 |

| Estimated Renewal Period | 3 - 5 years |

| Company | Oracle Corporation |

|---|---|

| Contract/Development Details | Oracle Corporation entered into an agreement with a major fashion retailer to implement its cloud-based platform. This initiative focuses on optimizing supply chain operations and improving sales forecasting accuracy. |

| Date | June 2024 |

| Contract Value (USD Mn) | Approximately USD 60 - USD 80 |

| Estimated Renewal Period | 4 - 6 years |

| Company | IBM Corporation |

|---|---|

| Contract/Development Details | IBM Corporation was awarded a contract by a prominent e-commerce company to deploy its AI-driven tools. The objective is to enhance customer experience and boost conversion rates through personalized recommendations. |

| Date | September 2024 |

| Contract Value (USD Mn) | Approximately USD 70 - USD 90 |

| Estimated Renewal Period | 3 - 5 years |

In 2024, the industry witnessed significant growth, with major technology firms securing substantial contracts to provide advanced analytics solutions to prominent retailers. SAP SE's collaboration with a global supermarket chain underscores the increasing demand for data-driven inventory and customer management.

Oracle's partnership with a fashion retailer highlights the industry's focus on optimizing supply chains and sales forecasting through cloud-based analytics. IBM's engagement with an e-commerce leader reflects the trend towards utilizing AI-driven tools to personalize customer experiences and improve conversion rates.

These developments indicate a robust expansion of the sector, as retailers increasingly adopt sophisticated technologies to gain competitive advantages in a dynamic industry landscape

During 2020 to 2024, the industry expanded with increased speed as companies embraced AI, machine learning, and real-time analytics to make better-informed decisions. Retailers utilized data-driven insights to manage inventory, monitor store traffic, and enhance customer interaction by means of personalized marketing.

Expansion in e-commerce also created a higher need for analytics platforms, which enable businesses to monitor customer journey and improve digital marketing activities. Privacy regulations such as GDPR and CCPA resulted in safe data management implementation, while cloud analytics solutions thrived on the basis of scalability and compliance prospects.

2025 to 2035 will see the sector revolutionized with AI-powered hyper-personalization, quantum computing, and blockchain. Quantum computing will facilitate supply chain optimization and real-time demand forecasting, whereas blockchain will create more secure data and transparency. AI-based sentiment analysis will aid retailers in a better understanding of consumer behaviour, impacting dynamic marketing and pricing initiatives.

Augmented reality (AR) and virtual reality (VR) analytics will reshape shopping, while AI-facilitated automation will ensure sustainability through supply chain optimization and operational waste minimization.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Retailers adopted secure data practices to comply with GDPR, CCPA, and other privacy regulations. | Blockchain-powered data governance, AI-driven compliance automation, and decentralized customer data ecosystems will redefine data protection. |

| AI and machine learning improved demand forecasting, customer segmentation, and personalized marketing. | Quantum-powered real-time analytics, AI-driven hyper-personalization, and AR/VR-based shopping behaviour analysis will transform retail intelligence. |

| Retail analytics optimized supply chain, customer engagement, and Omni channel marketing strategies. | AI-powered conversational commerce, decentralized data ecosystems, and predictive automation will expand retail analytics applications. |

| Cloud-based analytics solutions enabled real-time monitoring and multi-channel retail optimization. | IoT-connected smart shelves, edge computing-driven analytics, and real-time AI-powered store automation will enhance operational efficiency. |

| Businesses used AI-driven analytics to personalize offers, predict trends, and improve demand planning. | Quantum-enhanced predictive analytics, real-time consumer sentiment analysis, and AI-driven hyper-personalization will shape future customer experiences. |

| Challenges included data silos, integration issues, and rising operational costs in global retail networks. | AI-driven autonomous supply chain management, decentralized retail ecosystems, and blockchain-powered supplier tracking will streamline operations. |

The industry is constantly surrounded by a number of major significant problems, such as data privacy policies, technological vernacular, amalgamation, cybersecurity peril, and industry competition. The most challenging problem is dealing with compliance with international data protection laws such as GDPR, CCPA, and new AI laws.

As the analytics tools are esoteric to customer data, purchasing behavior, and real-time location, retailers have to abide by data governance, and only ethical AI practices can keep them from incurring legal penalties and reputational damage.

Another stark problem we have to face is technological obsolescence. The rapid advancement of technologies such as AI, machine learning, and predictive analytics inflates the pressure on retailers and solution providers to perpetually renew their systems. In the event they fail to acquire essential updates, they can be researching misconstrued findings, pursuing futile schemes, and forfeiting competitive advantage.

Integration challenges are those that are generated when retailers experience problems interlocking new analytics platforms with already-acquired ERP, CRM, and POS systems. The shrouded integration of data many times is the root of analytic-driven decision-making weaknesses in many enterprises. Companies must before all things be right invest in both scalable and interoperable solutions in order to achieve optimality.

Cybersecurity threats are an additional risk to the industry platforms that contain not only sensitive customer data, but also payment details and operational insights. Data breaches, ransomware attacks, and insider threats can result in financial losses, tarnishing of the company's image, and penalties from regulators. High-level encryption, multi-factor authentication, and efficient threat detection systems are vital to formation.

Finally, competition within the industry is very high because players from the cloud, AI, and analytics solutions are already coming in with established companies and newcomers. To enable corporate survival in this domain, companies need to focus on a real technological breakthrough through advanced AI, real-time insights, and Omni channel data analytics.

The largest industry growth will be driven by retail analytics software in 2025. Market dynamics and consumer behaviour have changed, and a round-up of advanced analytics solutions by vendors like SAP, IBM, Oracle, SAS, and Teradata also offers insight into how retailers can best wield AI to their advantage - from optimizing pricing and managing inventory to improving customer engagement.

The growing importance of big data analytics, machine learning, and predictive modelling is driving demand for analytics software that provides insight into consumer behaviour and sales trends in real-time.

Apart from store-based analytics, there is a growing trend for cloud-based platforms, including Google Cloud Retail AI, Microsoft Azure Retail Insights, AWS (Amazon Web Services) Retail, and Snowflake Retail Data Cloud, which provides all three significant cloud-based platforms grow primarily on account of high scalability and cost-effective solutions.

Retail analytics consulting, implementation, support, and managed services consulting, implementation and support related to retail analytics is a core part of helping retailers implement, customize, and enhance their analytics solutions. 360-degree retail analytics service providers like Accenture, Deloitte, Capgemini, Wipro, Infosys, Infor, Cognizant, etc., to support brands in implementing their data-driven agendas.

The trend for increased complexity in Omni channel retailing, supply chain optimization, and demand forecasting is also driving demand for managed services, allowing retailers to stay ahead of the competition by expanding their analytics capabilities.

When done properly, merchandising analytics can pave the way for inventory management, suitable demand prediction, and pricing profitability. Retailers utilize AI-powered merchandising agents provided by firms like IBM, SAS, Blue Yonder, and RELEX Solutions to optimize product placement, dynamic pricing, and promotional efficiency.

Others, like Google Cloud Retail AI, AWS Retail, and Zebra Technologies, also offer robust automated replenishment planogram compliance and shelf-space optimization solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 9.1% |

| UK | 8.8% |

| European Union | 9.0% |

| Japan | 8.9% |

| South Korea | 9.3% |

The USA industry is growing significantly, with organizations adopting AI-powered insights, predictive analytics, and real-time data solutions. Organizations build complex analytics platforms to optimize stock management, enhance customer experiences, and optimize operations. Retailers are making big data choices to enhance Omni channel strategies and segment industries through personalization in increasing numbers.

Using retail analytics in the USA consumer goods, retail, and e-commerce sectors optimizes supply chains and improves sales forecasts. Government laws also push companies to implement secure and compliant data management systems to protect the ethical handling of consumer data. FMI projects that the USA industry will grow at 9.1% CAGR over the forecast period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| AI and Predictive Analytics | Improve customer engagement and inventory decision-making. |

| Omni channel Strategies | Experts facilitate online and offline shopping integration. |

| Government Regulations | Regulations support the safe and compliant use of information.. |

| E-commerce Growth | Virtual stores use sophisticated analytics to optimize the supply chain and forecast demand. |

The UK industry grows as companies adopt AI-driven solutions to enhance customer experience and optimize operational effectiveness. Companies leverage data analytics software to optimize pricing strategies, forecast demand fluctuations, and personalize customer experiences. The trend towards digital transformation and cloud analytics drives industry growth as companies look for more agile and scalable solutions.

Strong regulatory requirements facilitating data security and privacy permit the secure utilization of analytics by the retail sector. For decision-making, machine learning and automatic reporting are also being extensively adopted by retail entities in the fashion, food retailing, and internet retailing industries.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| AI-Driven Analytics | Promotes better demand planning and enhances customer customization. |

| Digital Transformation | Retailers embark on cloud-based analytics to ensure ease of working. |

| Regulatory Compliance | GDPR and other similar regulations motivate investments in secure analytics software. |

| Automated Reporting | Companies utilize next-gen analytics to make timely business decisions. |

The European Union industry grows with the use of AI-driven customer insights, supply chain analytics, and demand forecasting technology by firms. Germany, France, and Italy are some of the top industries utilizing big data analytics for higher retail activity. The European Commission has strong data protection regulations that encourage companies to adopt GDPR-compliant analytics solutions.

Cloud technology and machine learning technology greatly enable retail analytics in all industries. EU retailers use such technologies to optimize pricing models, tailor customer interactions, and attain effective inventory management.

Growth Factors in the European Union

| Key Drivers | Details |

|---|---|

| AI-Driven Insights | Maximizes supply chain and customer engagement plans for retailers. |

| GDPR Compliance | Influences investments in secure analytics platforms. |

| Cloud-Based Analytics | Enables scalability and flexibility in retail business. |

| Retail Innovation | European businesses use data analytics to enhance price models and demand forecasting. |

The Japanese industry for retail analytics is expanding relentlessly as firms embrace AI-based analytics, digitalization, and real-time processing. Companies develop new analytics solutions to manage inventory more effectively, improve demand forecasting, and optimize customer engagement plans.

Japan's emphasis on technology upgradation and precision retailing fosters the adoption of advanced analytics. E-commerce, fashion, and fast-moving consumer goods (FMCG) industries heavily invest in premium analytics solutions to attain a competitive advantage.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| AI-Powered Analytics | Supports precise demand forecasting and inventory management. |

| Digital Transformation | Companies invest in analytics to deliver better customer experience. |

| Competitive Retail Market | Companies invest in analytics to increase customer interaction. |

| Smart Retail Technologies | Intelligent technologies like IoT and AI define the retail sector. |

The South Korean industry is dominated by fast growth as retailers implement AI-based demand forecasting, real-time inventory management, and customer behaviour analysis. Digital transformation initiatives are encouraged actively by the government, which results in implementing retail analytics solutions across industries.

Companies leverage AI-powered business intelligence, cloud-based retail platforms, and automated customer segments for maximum operational efficiency. Advances in predictive analytics and machine learning also drive industry growth, allowing retailers to provide personalized experiences and streamline the supply chain.

Growth Factors in South Korea

| Key Drivers | Details |

|---|---|

| AI-Based Forecasting | Enhances demand planning and inventory monitoring. |

| Government Support | Supports retail analytics digitalization. |

| Cloud Integration | Improves efficiency and scalability of analytics deployment. |

| Customer Behaviour Insights | Retailers apply data analytics to personalization strategy simplification. |

The global industry continues to show great promise as reliance on data alerts pushes retailers to achieve an enriched customer experience, improved operations, and ultimate profitability. Major industry forces include the advent of AI-based analytics, real-time data processing, and cloud-based applications that help businesses optimize pricing, inventory management, and marketing strategies.

Companies such as SAP, IBM, Oracle, SAS, and Microsoft dominate the industry with their advanced platform that uses machine learning, big data, and predictive modelling to enhance decision-making. These companies develop AI-driven solutions designed to meet the changing consumer expectations for demand forecasting, personalized recommendations, and Omni channel customer engagement.

Emerging start-ups and niche providers are changing the face of competition through unique offerings such as foot traffic analysis, dynamic pricing algorithms, and real-time consumer sentiment tracking. Further, growing emphasis on first-party data strategies to comply with privacy-focused analytics alternatives adds to the differentiation in the industry as regulations tighten over the data.

For example, while trying to pool off both online and offline data to create a unified picture of customer behaviour in a post-pandemic world, investing in AI-driven automation, advanced personalization, and seamless Omni channel analytics will really hold the strategic advantage in this changing environment.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| IBM | 20-25% |

| Microsoft | 15-20% |

| SAP SE | 12-17% |

| Oracle Corporation | 8-12% |

| SAS Institute Inc. | 5-9% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| IBM | Provides AI-driven retail analytics, predictive insights, and cloud-based business intelligence solutions. |

| Microsoft | Develops data analytics platforms, AI-powered retail solutions, and customer experience optimization tools. |

| SAP SE | Specializes in enterprise retail analytics, supply chain optimization, and sales forecasting solutions. |

| Oracle Corporation | Focuses on cloud-based retail analytics, AI-powered CRM, and Omni channel commerce solutions. |

| SAS Institute Inc. | Offers advanced customer analytics, real-time data insights, and demand forecasting tools. |

Key Company Insights

IBM (20-25%)

IBM has been pioneering retail analytics by using AI-powered predictive insights, cloud-based analytics, and real-time decision-making.

Microsoft (15-20%)

With data analytics platforms, Microsoft improves retail operations combined with smart customer engagement tools on AI and business intelligence.

SAP SE (12-17%)

Optimizing the supply chain, forecasting, and analytics throughout the business helps increase profitability and efficiency at the SAP enterprise level.

Oracle Corporation (8-12%)

Cloud-based retail analytics lie under the Oracle umbrella, as well as AI-driven CRM and data-rich Omni channel commerce solutions.

SAS Institute Inc. (5-9%)

SAS Institute understands the analytics of customer behaviour, demand forecasting, and AI-enabled decision-making in retail.

Other Key Players (20-30% Combined)

The industry is slated to reach USD 14.9 billion in 2025.

The industry is predicted to reach USD 68.9 billion by 2035.

The key players in the industry include IBM, Microsoft, SAP SE, Oracle Corporation, SAS Institute Inc., Google Cloud, Amazon Web Services (AWS), Teradata, Salesforce, and NielsenIQ.

South Korea, slated to grow at 9.3% CAGR during the study period, is poised for fastest growth.

Retail analytics software is being widely used.

By solution, the industry covers software and service.

By function, the industry includes customer management, merchandising, store operations, supply chain, and strategy & planning.

By enterprise size, the industry covers SMEs and large enterprises.

By deployment model, the industry includes on-premise and cloud.

By field crowdsourcing, this industry is segmented into on-shelf availability, documentation & reporting, promotion campaign management, and customer insights.

By region, the industry spans North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.