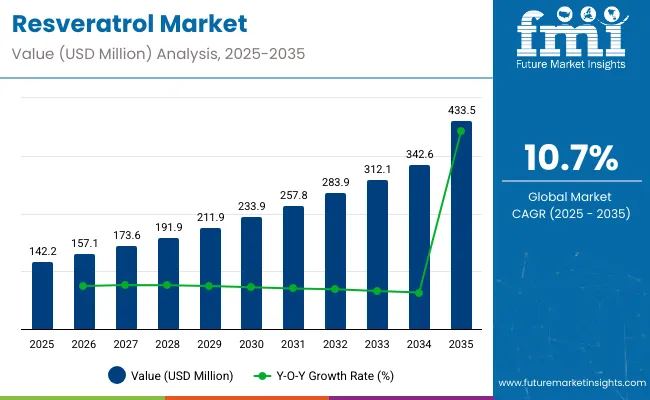

The global resveratrol market is projected to witness significant expansion between 2025 and 2035, with its market value expected to grow from USD 142.2 million in 2025 to USD 433.5 million by 2035. This anticipated growth reflects a strong compound annual growth rate (CAGR) of 10.7%, underscoring increasing consumer interest in natural and health-enhancing products.

A growing focus on health, wellness, and disease prevention is driving demand for resveratrol across key sectors, including nutraceuticals, pharmaceuticals, and cosmetics. Consumers are becoming more proactive about maintaining their health, which is fueling the rise of preventive medicine and the demand for natural, plant-derived ingredients like resveratrol.

| Attributes | Description |

|---|---|

| Estimated Global Resveratrol Market Size (2025E) | USD 142.2 million |

| Projected Global Resveratrol Market Value (2035F) | USD 433.5 million |

| Value-based CAGR (2025 to 2035) | 10.7% |

Resveratrol is a naturally occurring polyphenol found in grapes, red wine, berries, and knotweed. It is widely recognized for its potent antioxidant properties, which help neutralize free radicals and reduce oxidative stress in the body. Scientific research has consistently highlighted resveratrol’s ability to support cardiovascular health, combat signs of aging, and offer neuroprotective benefits. These health-promoting qualities make it a highly attractive ingredient in functional foods, dietary supplements, and wellness products aimed at enhancing longevity and reducing the risk of chronic diseases.

The rising popularity of plant-based and clean-label products is further boosting resveratrol's market appeal. Modern consumers increasingly seek transparency and sustainability in their product choices, favoring ingredients that are both effective and naturally sourced. Resveratrol fits well within these preferences, offering a compelling combination of natural origin and scientifically supported efficacy.

Moreover, increasing disposable incomes, especially in emerging economies, are enabling greater spending on health and wellness products. As a result, manufacturers are ramping up production and innovation to meet the growing demand. Investments in research and development, coupled with strategic marketing efforts, are helping to expand resveratrol’s reach into new markets and applications.

The resveratrol market is set for robust growth over the next decade, supported by strong consumer trends toward preventive healthcare, natural products, and overall wellness. Its wide-ranging benefits and versatile applications position it as a cornerstone ingredient in the future of functional nutrition and health-conscious consumer goods.

The global trade landscape for grapes and blueberries is growing steadily, fueled by rising consumer demand for fresh, healthy fruits and year-round availability. Grapes benefit from established production and export infrastructure, while blueberries are gaining prominence due to their health benefits and expanding cultivation in both hemispheres. Trade flows are supported by advanced cold chain logistics and increasing preference for nutritious diets worldwide. Seasonal production cycles in different regions enable continuous supply to major markets, helping stabilize prices and meet demand.

Maintaining the right temperature throughout the supply chain helps prevent spoilage, extend shelf life, and protect nutritional value. To ensure these standards are met, various internationally recognized certifications guide producers, exporters, and logistics providers in implementing effective cold chain practices. These certifications not only help maintain food safety and quality but also build trust among consumers and trading partners by demonstrating compliance with strict regulatory requirements and best practices. Adhering to these standards is essential for successful global trade in fresh produce.

The following table displays six-month relative change in CAGR from base year (2024) to current year (2025) of global resveratrol market. It allows stakeholders to understand the revenue growth and performance of the market across different periods.

| Particulars | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 10.3% |

| H2 (2024 to 2034) | 10.5% |

| H1 (2025 to 2035) | 10.6% |

| H2 (2025 to 2035) | 10.7% |

Between 2025 to 2035, in the H1 phase, the company will witness a CAGR growth rate of 10.6%, and between the same period H2 phase, the company will witness a growth rate of 10.7%. It is a sustainable growth rate for the resveratrol market because there is growing application in nutraceuticals, pharmaceuticals, and cosmetics. First half of the forecast period (H1) was 30 BPS, and second half (H2) was 20 BPS, capturing composite demand and application development. Conclusion

World market of resveratrol also offers promising potential of growth in the next decade with increased usage in nutraceutical, pharma, and cosmetics sectors. Expansion in the market is fueled by leading drivers of natural antioxidant demand, awareness of disease prevention through a healthy lifestyle, and ongoing clinical trials.

The global resveratrol market can be segmented based on form, product, isomer, end-use, and region. By form, the market is divided into liquid and solid. By product, it includes extract, fermentation, and synthetic. Based on isomer, the market comprises trans-resveratrol and cis-resveratrol. By end-use, the segments are skin care, hair care, makeup, bath care, fragrance, tools, dietary supplements, pharmaceuticals, and others (oral care products, personal hygiene items, and wellness devices that support overall health and beauty).

Regionally, the market is segmented into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, and the Middle East and Africa.

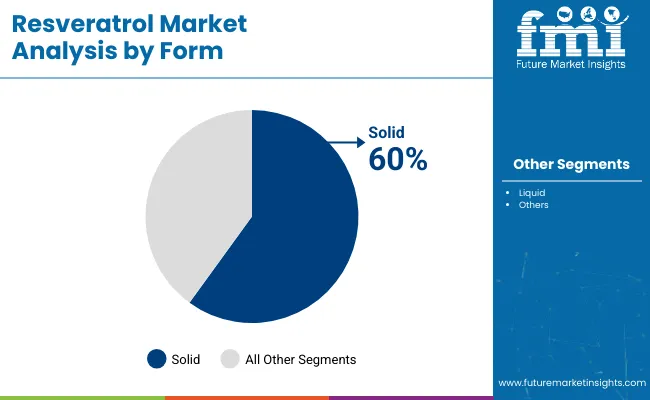

The solid segment of the global resveratrol market is expected to maintain a dominant position throughout the forecast period, accounting for more than 60% of the market share in 2025 and continuing to lead in terms of volume and value by 2035. This dominance is largely due to the versatility, stability, and cost-effectiveness of solid resveratrol in a wide range of applications.

Solid resveratrol is most commonly used in powder and capsule forms, making it an ideal choice for dietary supplements and pharmaceutical products. The powdered form allows for easy blending with other ingredients, making it suitable for tablet compression and encapsulation. These formulations are highly favored by consumers and manufacturers alike for their longer shelf life, precise dosage control, and ease of transport and storage.

On the other hand, the liquid segment, growth is primarily driven by the increasing demand for liquid nutraceutical formulations, beverages, and cosmetic serums, where rapid absorption and ease of consumption are critical. Liquid resveratrol is gaining traction in skincare and cosmetic applications due to its enhanced bioavailability when applied topically, aligning well with the growing consumer preference for functional beauty products and natural skincare solutions. As a result, the liquid segment, though smaller in market share, is expected to expand significantly in the coming years.

| Form | Share (2025) |

|---|---|

| Solid | 60% |

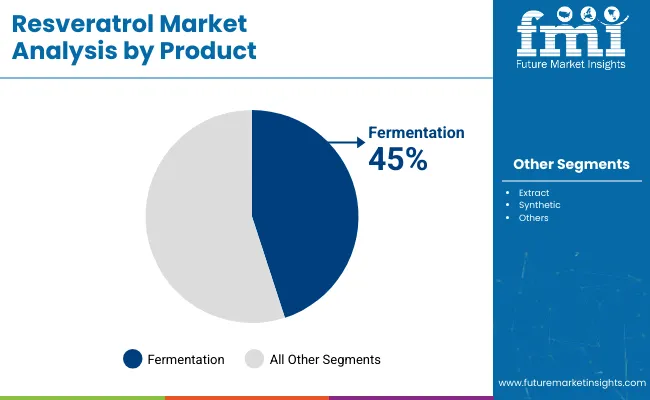

In the global resveratrol market, segmentation by product includes extract, fermentation, and synthetic forms. Among these, the fermentation segment is projected to be the fastest-growing, with a CAGR of 13.4% from 2025 to 2035. This growth is driven by increasing demand for high-purity, bioidentical resveratrol produced through sustainable and natural fermentation processes.

As consumers and manufacturers prioritize clean-label ingredients and environmentally friendly production methods, fermentation-based resveratrol is gaining strong momentum, especially in the nutraceutical and pharmaceutical sectors.

The extract segment currently holds the largest market share, owing to its natural origin and widespread consumer acceptance. Extracted primarily from grapes, berries, and Japanese knotweed, this form of resveratrol is widely used in dietary supplements and cosmetics. Its appeal lies in its direct association with plant-based wellness trends and its perceived authenticity. However, the reliance on agricultural raw materials can lead to supply variability and environmental concerns, which may temper its growth rate over time.

The synthetic segment, while smaller in market share, continues to find niche applications, particularly where cost efficiency and large-scale production are key. Synthetic resveratrol offers consistent quality and purity, making it suitable for mass-market formulations. However, as consumers shift toward natural and bio-based products, synthetic resveratrol faces challenges related to perception and regulatory scrutiny in certain regions.

| Product | CAGR (2025 to 2035) |

|---|---|

| Fermentation | 13.4% |

The global resveratrol market is broadly segmented into two isomer forms, trans-resveratrol and cis-resveratrol. Among these, trans-resveratrol is the fastest-growing segment, with an anticipated CAGR of 11.5% between 2025 and 2035. This impressive growth trajectory is driven primarily by trans-resveratrol’s superior chemical stability and enhanced bioavailability compared to its cis counterpart. These properties make trans-resveratrol the preferred isomer in various sectors, including health supplements, cosmetics, and pharmaceuticals.

Trans-resveratrol has been extensively studied and is widely recognized for its potent antioxidant capacity. It has demonstrated significant benefits in anti-aging, cardiovascular health, and neuroprotection, which have propelled its adoption in a diverse range of products such as dietary supplements, skincare formulations, and therapeutic agents. Its stability ensures that the bioactive properties remain intact through processing, storage, and consumption, further enhancing its market appeal. Moreover, consumer awareness about the health benefits of trans-resveratrol continues to grow, encouraging manufacturers to incorporate it in functional foods and nutraceuticals.

On the other hand, cis-resveratrol holds a relatively smaller share in the market, primarily due to its lower stability and comparatively weaker health benefits. Cis-resveratrol often forms unintentionally as a by-product or through the isomerization of trans-resveratrol when exposed to light or heat during manufacturing or storage. This limits its direct commercial use since its biological efficacy is less studied and understood.

| Isomer | CAGR (2025 to 2035) |

|---|---|

| Trans- resveratrol | 11.5% |

In the global resveratrol market by end-use, the dietary supplements segment is the fastest-growing, with a CAGR of 12.3% from 2025 to 2035. This rapid growth is fueled by increasing consumer awareness about preventive healthcare and the rising popularity of natural, plant-based supplements that support healthy aging, cardiovascular health, and overall wellness. Dietary supplements containing resveratrol are widely favored for their ease of consumption and scientifically backed health benefits, driving strong demand globally.

Other segments, such as skin care, hair care, makeup, bath care, fragrance, tools, pharmaceuticals, and others, also contribute significantly to the market but grow at comparatively moderate rates. The skin care segment holds a substantial share due to resveratrol’s antioxidant and anti-aging properties, which make it a popular ingredient in creams, serums, and lotions aimed at improving skin health and appearance. Hair care and makeup segments are gradually adopting resveratrol for its protective and rejuvenating effects on hair and skin, respectively. Bath care and fragrance applications use resveratrol more selectively, often highlighting its natural origin and wellness benefits.

The pharmaceutical segment, while smaller in volume, is important for its role in research and therapeutic formulations targeting cardiovascular and neuroprotective health. The “others” category includes functional foods, beverages, and niche wellness products that are increasingly incorporating resveratrol due to consumer demand for multifunctional ingredients.

| End Use | CAGR (2025 to 2035) |

|---|---|

| Dietary Supplements | 12.3% |

There is a group of players that is analogous to those with large revenues, leadership, and significant market penetration in Tier 1. They possess robust brand equity and spend a significant amount on product development, advertisement, and research because they don't want to fall behind in the market for resveratrol.

Evolva Holding SA is a market leader for high-purity, nature-identical resveratrol produced using next-generation fermentation technology. One of the market leaders, DSM Nutritional Products, is also a market leader today because it has been offering solutions on resveratrol for dietary supplement, pharmaceutical, and personal care markets. Competition is also reaping benefits from its share in the market by establishing strategic alliances and conducting scientific studies to investigate the health impacts of resveratrol.

Tier 2 consists of players with smaller revenue than those in Tier 1 but with adequate market presence. Sabinsa Corporation has established a widely recognized brand in the nutraceuticals market with natural-source resveratrol, like Polygonum cuspidatum.

Maypro Industries is another established player in the same niche with business in marketing premium resveratrol as a food ingredient, functional food, and dietary supplement. Both firms compete on product differentiation and next-generation formula, targeting customers who need science-supported and natural antioxidant-based treatments. Their focus on quality products and their formulas allows them to establish customer loyalty.

Tier 3 comprises new entrants and niche players that are emerging as key players in the resveratrol market. They may have lean channels, but they employ new and alternative business models to grow rapidly. Resvitale, LLC, is a relatively new company that specializes in resveratrol supplements, selling directly to consumers and online to reach health-conscious individuals.

Biotivia Longevity Bioceuticals is a relatively new company that produces resveratrol supplements for wellness and aging, selling them online and through social networks to reach niche markets. All Tier 3 companies employ e-commerce, brand customization, and marketing strategies that are sustainability-led, aiming to match the giants and carve their own niche in the newly emerging resveratrol market.

Shift: With increasing consumer demand for longevity and healthy aging, resveratrol is experiencing a surge in the nutraceuticals industry. As an antioxidant, resveratrol is best recognized for its role in combating oxidative stress and its cardiovascular benefits. Market demand is greatest in North America, Europe, and Japan, the world that is aging the fastest and nations most aggressively seeking dietary supplements for long-term well-being.

Strategic Response: Companies operating in the market, such as RevGenetics, Biotivia, and Thorne Research, have introduced pure trans-resveratrol supplements in the anti-aging segment. Life Extension introduced a novel longevity supplement made from resveratrol in the United States and recorded sales growth of 15% within six months.

Japan-based Shiseido introduced resveratrol into beauty and health supplements because of the huge need from the elderly population for addressing skin health. Simultaneously, European nutraceutical companies have increased resveratrol supply through pharmacies and e-commerce, prompting further growth.

Shift: Resveratrol is leaking out of capsules and tablets to move into fortified foods and functional beverages. As people seek an easy way to incorporate antioxidants into their lives, companies are adding resveratrol to sports drinks, tea, and even chocolate. Expansion is accelerating for resveratrol-functional foods in the United States, the United Kingdom, and South Korea.

Strategic Response: It countered this trend by introducing America to resveratrol-fortified green tea, which was largely responsible for a 12% increase in sales of antioxidant drinks. Twinings introduced herbal teas to the market that are fortified with resveratrol and are in high demand among consumers seeking healthy beverages in the UK. It did not happen with South Korean firms, however, and the firm Lotte Chilsung brought resveratrol into energy drinks offered to young consumers as a functional health.

Additional Scientific Research and Doctoral Supervision

Shift: Additional scientific research supporting the probable health effects of resveratrol, including cardiovascular effects, neuroprotection, and metabolic homeostasis, is gaining consumers' trust. Resveratrol's ability to enhance cell health and longevity, which researchers are investigating, has generated considerable interest, particularly in the United States, Canada, and Germany.

Strategic Response: Pharmaceutical and supplement companies are utilizing science sponsorships to further establish their brands. Elysium Health invested in collaborations with high-profile scientists on a resveratrol formulation of aging that raised subscriptions 20%. German DSM Nutritional Products collaborated with universities to investigate the mechanism of action of resveratrol for preserving metabolic health, and more effectively for European consumers, as it is not a fantasy.

Shift: The athletes and sports players also take resveratrol in higher doses due to its purported muscle-building and anti-inflammatory effects. The increasing demand for natural, plant-based performance-enhancing activities is driving growth in the United States, Australia, and Canada, making these regions major drivers in the primary geography locations.

Strategic Response: Leading sports nutrition companies, such as Optimum Nutrition and MuscleTech, introduced resveratrol-fortified recovery beverages, which contributed to a 14% growth in the United States market. Sporting businesses in Australia released endurance sport-specific resveratrol-fortified protein products. Resveratrol is now an ingredient for incorporation by Canadian sport nutrition companies into hydrating formulas, in combination with electrolytes for consumption during the muscle-recovery stage.

Shift: The cosmetics and personal care industry is welcoming resveratrol for its age-reversal and anti-aging capabilities. Skin care companies are introducing resveratrol face masks, creams, and serums to capitalize on the growing demand for natural anti-aging products. The trend as a whole is being spearheaded in South Korea, France, and the USA, where consumers greatly value science-driven skincare.

Strategic Response: Premium beauty companies, such as L'Oréal and The Ordinary, have launched resveratrol-infused anti-aging serums to drive 10% of antioxidant facial care sales. Innisfree, a Korean beauty company, introduced resveratrol into its consumers' favorite sleep masks, catering to those who prioritize plant-derived facial care. French beauty company Caudalie launched an expanded line of resveratrol facial care with its collagen-boosting and anti-wrinkle benefits.

Shift: Plant-based and naturally occurring resveratrol is currently trending over synthetic forms. Due to the growth of clean labeling, demand for berry-derived, Japanese knotweed-derived, and grape-derived resveratrol is increasing at least three times. The trend is highly visible in Europe, China, and North America.

Strategic Response: Companies such as Evolva and Sabinsa have invested in synthesizing resveratrol using plant materials under green technology, which has augmented sales by 18% in the natural health segment. Resveratrol, sold as organic or non-GMO, is available at NOW Foods for sale as a way of communicating with clean-label USA consumers. Resveratrol, derived from Japanese knotweed, is being introduced to the market by Chinese medicine companies as an updated product, aiming to capitalize on the demand for plant-based medicine originating in Asia.

Shift: As competition in the resveratrol industry continues to rise, businesses now focus on price optimization, as well as direct-to-consumer (DTC) platforms. Resveratrol supplements have never sold as well as they have on Amazon, iHerb, and Alibaba, with price and convenience driving sales.

Strategic Response: Mass-market resveratrol stores have driven down the prices of inexpensive products, and high-end ones have lost their premium positions. Amazon and iHerb have reported 22% sales growth of resveratrol, driven by price and subscription convenience. Alibaba and JD.com, as leading Chinese e-commerce platforms, have driven the sales of resveratrol products, which account for 19% of the growth in online supplements.

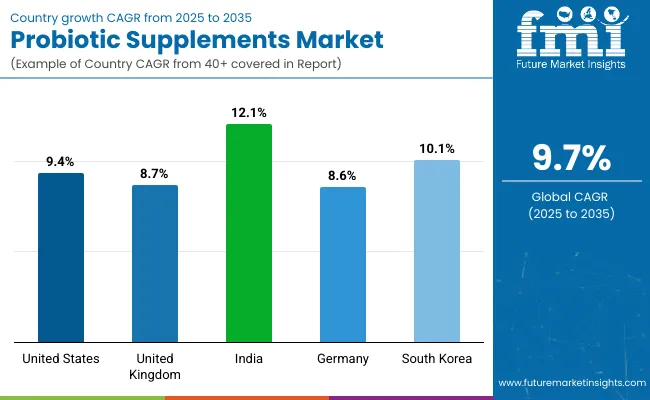

The global resveratrol market is expected to experience significant growth over the next decade, driven by increasing demand from consumers for health supplements and expanding applications in the pharmaceutical and cosmetics industries. Below is an approximation of the Compound Annual Growth Rate (CAGR) from 2025 to 2035 of the large markets:

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

| Germany | 6.5% |

| China | 8.4% |

| Japan | 5.9% |

| India | 9.1% |

Its largest market is the United States, where the culture of health and wellness prevails. The quest for natural antioxidants to enhance cardiovascular function, immunity, and lifespan is leading more consumers to resveratrol-functional foods and supplements in increasingly larger volumes, pushing them further into the mainstream.

The USA nutraceutical market is also experiencing increasing demand for plant-based resveratrol, particularly in anti-aging applications, brain health, and metabolism. Research supporting the supposed mechanism of action by which resveratrol offers protection against oxidative stress, improves cardiovascular function, and treats skin conditions has provided supplement companies with numerous reasons to include it in their product lineups.

In the pharmaceutical industry, ongoing research on the anti-cancer, neuroprotective, and anti-inflammatory actions of resveratrol has led to its increasing application in clinical practice. Access to high-quality pharma companies and R&D facilities investing in novel drug chemicals is also driving the market.

China is experiencing market growth in resveratrol at a very rapid pace, driven by growth in the pharmaceuticals and functional food market. With the support of its rampant incidence of lifestyle diseases like neurodegenerative disease, cardiovascular disease, and diabetes, propelling consumer demand for natural prevention of health products, and hence, that's leading to a rise in demand for functional foods and dietary supplements produced from resveratrol.

Government patronage of traditional Chinese medicine (TCM) and herbal medicines has also led to increased usage and adoption of resveratrol in China. Resveratrol, a bioactive compound with anti-inflammatory and antioxidant properties, is also becoming the subject of research aimed at exploring its potential as an inhibitor of chronic diseases and a promoter of overall wellness.

China's functional beverage market is buzzing with the fast-emerging culture of health-conscious consumers of resveratrol-based beverages. Business-conscious brands are producing herb and plant-based beverages with remarkable amounts of resveratrol, anticipating the burgeoning demand for vegetable-based, age-proof, and wellness-driven products.

India will remain the fastest-growing market for resveratrol due to the immense demand for preventive medicine and research and development in the pharmaceutical and nutraceutical sectors. India has a huge population base, increasing disposable incomes, and growing consumer demand for health and well-being, which is propelling demand for resveratrol supplements, food fortification, and dermaceuticals.

The Indian nutraceutical market is growing at a highly dynamic rate, with resveratrol becoming an important component of anti-aging and antioxidant supplements. Vegetable supplements are also being consumed by Indians at a growing rate to combat age-related disease, inflammation, and oxidative stress, fueling the demand for natural sources of resveratrol.

Indian beverage and food functional food market is also looking at resveratrol opportunities. Resveratrol-rich beverages, herbal teas, and nutri-fortified milks are emerging among the urban health-conscious population. The natural origin, herbal origin, and plant origin product trend is irresistibly biased towards natural and plant origin resveratrol, and resveratrol is used as a branded ingredient in natural wellness products.

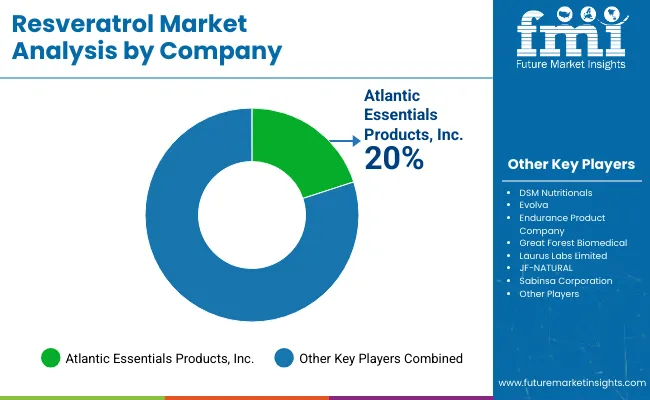

The resveratrol market is dominated by giants such as DSM Nutritionals, Evolva, Endurance Product Company, Great Forest Biomedical, Laurus Labs Limited, and JF-NATURAL. The market is being fueled by new technology of extraction, new ingredients, and increased applications in pharmaceuticals, dietary supplements, and cosmetics by such companies.

As more requests for natural anti-aging substances and antioxidants become available, businesses are looking forward to investing in biotechnological R&D, clinical trials, and green procurement streams. The demand for resveratrol nutraceuticals, which offer life-extending, anti-inflammatory, and cardiovascular benefits, is also increasing in the market.

The global market for resveratrol is evolving with emphasis on natural and synthetic sources such as grape skin extracts, knotweed-resveratrol, and biotech-synthesized resveratrol. Companies are expanding capacity, improving bioavailability, and exploring new forms of delivery, such as liposomal resveratrol, transdermal patches, and enhancing water solubility, in the competition to bring maximum value to consumers.

Scientific discovery and approval procedures also dictate the speed of the market. Companies have spent money scientifically proving the health benefits of resveratrol in an attempt to stimulate consumption in functional foods, drugs, and cosmetic anti-aging products.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 142.2 million |

| Projected Market Size (2035) | USD 433.5 million |

| CAGR (2025 to 2035) | 10.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameter | Revenue in USD million |

| By Form | Liquid, Solid |

| By Product | Extract, Fermentation, Synthetic |

| By Isomer | Trans-resveratrol, Cis-resveratrol |

| By End-use | Skin Care, Hair Care, Makeup, Bath Care, Fragrance, Tools, Dietary Supplements, Pharmaceuticals, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | DSM Nutritionals, Evolva, Endurance Product Company, Great Forest Biomedical, Laurus Labs Limited, JF-NATURAL, Sabinsa Corporation, Resvitale LLC, Shanghai Natural Bio-engineering Co., Ltd., Atlantic Essentials Products, Inc. |

| Additional Attributes | Rising demand for cost-effective dairy alternatives, growing infant nutrition sector, expanding bakery industry |

| Customization and Pricing | Available upon request |

The industry has been categorized into Extract, Fermentation, and Synthetic.

This segment is further categorized into Solid and Liquid.

The market is segmented based on isomers into Trans-resveratrol and Cis-resveratrol.

The market is segmented by end-use into Skin Care, which includes cream & lotion, scrub exfoliator, cleanser & toner, balm & butter, serum & mask, makeup remover, and others. Hair Care comprises shampoo, conditioner, essential oil, hair color, hair stylist products, and hair oil. Makeup is categorized into facial makeup, eye makeup, lip makeup, and nail makeup. Bath Care consists of shower products, liquid bath products, bath additives, and bar soaps. The Fragrance segment includes perfume, deodorant, and cologne. Additionally, the market covers Tools, Dietary Supplements, Pharmaceuticals, and Others

The market is analyzed across North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan & Baltic Countries, Russia & Belarus, and the Middle East & Africa.

The global industry is estimated at a value of USD 142.2 million in 2025.

Sales increased at 9.8% CAGR between 2020 and 2024.

Some of the leaders in this industry include DSM Nutritionals, Evolva, Endurance Product Company, Great Forest Biomedical, Laurus Labs Limited, JF-NATURAL, Sabinsa Corporation, Resvitale LLC, Shanghai Natural Bio-engineering Co., Ltd., Atlantic Essentials Products, Inc., Juvicell, and Others.

The North American region is forecast to lead the resveratrol market in 2024 and is likely to do so throughout the forecast period.

The industry is projected to grow at a forecast CAGR of 10.7% from 2025 to 2035.

Table 1: Global Market Value (US$ million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (MT) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ million) Forecast by Product, 2019 to 2034

Table 4: Global Market Volume (MT) Forecast by Product, 2019 to 2034

Table 5: Global Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 6: Global Market Volume (MT) Forecast by Form, 2019 to 2034

Table 7: Global Market Value (US$ million) Forecast by Isomer, 2019 to 2034

Table 8: Global Market Volume (MT) Forecast by Isomer, 2019 to 2034

Table 9: Global Market Value (US$ million) Forecast by End Use, 2019 to 2034

Table 10: Global Market Volume (MT) Forecast by End Use, 2019 to 2034

Table 11: North America Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 12: North America Market Volume (MT) Forecast by Country, 2019 to 2034

Table 13: North America Market Value (US$ million) Forecast by Product, 2019 to 2034

Table 14: North America Market Volume (MT) Forecast by Product, 2019 to 2034

Table 15: North America Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 16: North America Market Volume (MT) Forecast by Form, 2019 to 2034

Table 17: North America Market Value (US$ million) Forecast by Isomer, 2019 to 2034

Table 18: North America Market Volume (MT) Forecast by Isomer, 2019 to 2034

Table 19: North America Market Value (US$ million) Forecast by End Use, 2019 to 2034

Table 20: North America Market Volume (MT) Forecast by End Use, 2019 to 2034

Table 21: Latin America Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 22: Latin America Market Volume (MT) Forecast by Country, 2019 to 2034

Table 23: Latin America Market Value (US$ million) Forecast by Product, 2019 to 2034

Table 24: Latin America Market Volume (MT) Forecast by Product, 2019 to 2034

Table 25: Latin America Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 26: Latin America Market Volume (MT) Forecast by Form, 2019 to 2034

Table 27: Latin America Market Value (US$ million) Forecast by Isomer, 2019 to 2034

Table 28: Latin America Market Volume (MT) Forecast by Isomer, 2019 to 2034

Table 29: Latin America Market Value (US$ million) Forecast by End Use, 2019 to 2034

Table 30: Latin America Market Volume (MT) Forecast by End Use, 2019 to 2034

Table 31: Europe Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 32: Europe Market Volume (MT) Forecast by Country, 2019 to 2034

Table 33: Europe Market Value (US$ million) Forecast by Product, 2019 to 2034

Table 34: Europe Market Volume (MT) Forecast by Product, 2019 to 2034

Table 35: Europe Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 36: Europe Market Volume (MT) Forecast by Form, 2019 to 2034

Table 37: Europe Market Value (US$ million) Forecast by Isomer, 2019 to 2034

Table 38: Europe Market Volume (MT) Forecast by Isomer, 2019 to 2034

Table 39: Europe Market Value (US$ million) Forecast by End Use, 2019 to 2034

Table 40: Europe Market Volume (MT) Forecast by End Use, 2019 to 2034

Table 41: Asia Pacific Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 42: Asia Pacific Market Volume (MT) Forecast by Country, 2019 to 2034

Table 43: Asia Pacific Market Value (US$ million) Forecast by Product, 2019 to 2034

Table 44: Asia Pacific Market Volume (MT) Forecast by Product, 2019 to 2034

Table 45: Asia Pacific Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 46: Asia Pacific Market Volume (MT) Forecast by Form, 2019 to 2034

Table 47: Asia Pacific Market Value (US$ million) Forecast by Isomer, 2019 to 2034

Table 48: Asia Pacific Market Volume (MT) Forecast by Isomer, 2019 to 2034

Table 49: Asia Pacific Market Value (US$ million) Forecast by End Use, 2019 to 2034

Table 50: Asia Pacific Market Volume (MT) Forecast by End Use, 2019 to 2034

Table 51: Middle East & Africa Market Value (US$ million) Forecast by Country, 2019 to 2034

Table 52: Middle East & Africa Market Volume (MT) Forecast by Country, 2019 to 2034

Table 53: Middle East & Africa Market Value (US$ million) Forecast by Product, 2019 to 2034

Table 54: Middle East & Africa Market Volume (MT) Forecast by Product, 2019 to 2034

Table 55: Middle East & Africa Market Value (US$ million) Forecast by Form, 2019 to 2034

Table 56: Middle East & Africa Market Volume (MT) Forecast by Form, 2019 to 2034

Table 57: Middle East & Africa Market Value (US$ million) Forecast by Isomer, 2019 to 2034

Table 58: Middle East & Africa Market Volume (MT) Forecast by Isomer, 2019 to 2034

Table 59: Middle East & Africa Market Value (US$ million) Forecast by End Use, 2019 to 2034

Table 60: Middle East & Africa Market Volume (MT) Forecast by End Use, 2019 to 2034

Figure 1: Global Market Value (US$ million) by Product, 2024 to 2034

Figure 2: Global Market Value (US$ million) by Form, 2024 to 2034

Figure 3: Global Market Value (US$ million) by Isomer, 2024 to 2034

Figure 4: Global Market Value (US$ million) by End Use, 2024 to 2034

Figure 5: Global Market Value (US$ million) by Region, 2024 to 2034

Figure 6: Global Market Value (US$ million) Analysis by Region, 2019 to 2034

Figure 7: Global Market Volume (MT) Analysis by Region, 2019 to 2034

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 10: Global Market Value (US$ million) Analysis by Product, 2019 to 2034

Figure 11: Global Market Volume (MT) Analysis by Product, 2019 to 2034

Figure 12: Global Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 14: Global Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 15: Global Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 16: Global Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 17: Global Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 18: Global Market Value (US$ million) Analysis by Isomer, 2019 to 2034

Figure 19: Global Market Volume (MT) Analysis by Isomer, 2019 to 2034

Figure 20: Global Market Value Share (%) and BPS Analysis by Isomer, 2024 to 2034

Figure 21: Global Market Y-o-Y Growth (%) Projections by Isomer, 2024 to 2034

Figure 22: Global Market Value (US$ million) Analysis by End Use, 2019 to 2034

Figure 23: Global Market Volume (MT) Analysis by End Use, 2019 to 2034

Figure 24: Global Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 25: Global Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 26: Global Market Attractiveness by Product, 2024 to 2034

Figure 27: Global Market Attractiveness by Form, 2024 to 2034

Figure 28: Global Market Attractiveness by Isomer, 2024 to 2034

Figure 29: Global Market Attractiveness by End Use, 2024 to 2034

Figure 30: Global Market Attractiveness by Region, 2024 to 2034

Figure 31: North America Market Value (US$ million) by Product, 2024 to 2034

Figure 32: North America Market Value (US$ million) by Form, 2024 to 2034

Figure 33: North America Market Value (US$ million) by Isomer, 2024 to 2034

Figure 34: North America Market Value (US$ million) by End Use, 2024 to 2034

Figure 35: North America Market Value (US$ million) by Country, 2024 to 2034

Figure 36: North America Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 37: North America Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 40: North America Market Value (US$ million) Analysis by Product, 2019 to 2034

Figure 41: North America Market Volume (MT) Analysis by Product, 2019 to 2034

Figure 42: North America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 44: North America Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 45: North America Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 46: North America Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 47: North America Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 48: North America Market Value (US$ million) Analysis by Isomer, 2019 to 2034

Figure 49: North America Market Volume (MT) Analysis by Isomer, 2019 to 2034

Figure 50: North America Market Value Share (%) and BPS Analysis by Isomer, 2024 to 2034

Figure 51: North America Market Y-o-Y Growth (%) Projections by Isomer, 2024 to 2034

Figure 52: North America Market Value (US$ million) Analysis by End Use, 2019 to 2034

Figure 53: North America Market Volume (MT) Analysis by End Use, 2019 to 2034

Figure 54: North America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 55: North America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 56: North America Market Attractiveness by Product, 2024 to 2034

Figure 57: North America Market Attractiveness by Form, 2024 to 2034

Figure 58: North America Market Attractiveness by Isomer, 2024 to 2034

Figure 59: North America Market Attractiveness by End Use, 2024 to 2034

Figure 60: North America Market Attractiveness by Country, 2024 to 2034

Figure 61: Latin America Market Value (US$ million) by Product, 2024 to 2034

Figure 62: Latin America Market Value (US$ million) by Form, 2024 to 2034

Figure 63: Latin America Market Value (US$ million) by Isomer, 2024 to 2034

Figure 64: Latin America Market Value (US$ million) by End Use, 2024 to 2034

Figure 65: Latin America Market Value (US$ million) by Country, 2024 to 2034

Figure 66: Latin America Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 70: Latin America Market Value (US$ million) Analysis by Product, 2019 to 2034

Figure 71: Latin America Market Volume (MT) Analysis by Product, 2019 to 2034

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 74: Latin America Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 75: Latin America Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 78: Latin America Market Value (US$ million) Analysis by Isomer, 2019 to 2034

Figure 79: Latin America Market Volume (MT) Analysis by Isomer, 2019 to 2034

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Isomer, 2024 to 2034

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Isomer, 2024 to 2034

Figure 82: Latin America Market Value (US$ million) Analysis by End Use, 2019 to 2034

Figure 83: Latin America Market Volume (MT) Analysis by End Use, 2019 to 2034

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 86: Latin America Market Attractiveness by Product, 2024 to 2034

Figure 87: Latin America Market Attractiveness by Form, 2024 to 2034

Figure 88: Latin America Market Attractiveness by Isomer, 2024 to 2034

Figure 89: Latin America Market Attractiveness by End Use, 2024 to 2034

Figure 90: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 91: Europe Market Value (US$ million) by Product, 2024 to 2034

Figure 92: Europe Market Value (US$ million) by Form, 2024 to 2034

Figure 93: Europe Market Value (US$ million) by Isomer, 2024 to 2034

Figure 94: Europe Market Value (US$ million) by End Use, 2024 to 2034

Figure 95: Europe Market Value (US$ million) by Country, 2024 to 2034

Figure 96: Europe Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 97: Europe Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 100: Europe Market Value (US$ million) Analysis by Product, 2019 to 2034

Figure 101: Europe Market Volume (MT) Analysis by Product, 2019 to 2034

Figure 102: Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 104: Europe Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 105: Europe Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 106: Europe Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 108: Europe Market Value (US$ million) Analysis by Isomer, 2019 to 2034

Figure 109: Europe Market Volume (MT) Analysis by Isomer, 2019 to 2034

Figure 110: Europe Market Value Share (%) and BPS Analysis by Isomer, 2024 to 2034

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Isomer, 2024 to 2034

Figure 112: Europe Market Value (US$ million) Analysis by End Use, 2019 to 2034

Figure 113: Europe Market Volume (MT) Analysis by End Use, 2019 to 2034

Figure 114: Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 115: Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 116: Europe Market Attractiveness by Product, 2024 to 2034

Figure 117: Europe Market Attractiveness by Form, 2024 to 2034

Figure 118: Europe Market Attractiveness by Isomer, 2024 to 2034

Figure 119: Europe Market Attractiveness by End Use, 2024 to 2034

Figure 120: Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: Asia Pacific Market Value (US$ million) by Product, 2024 to 2034

Figure 122: Asia Pacific Market Value (US$ million) by Form, 2024 to 2034

Figure 123: Asia Pacific Market Value (US$ million) by Isomer, 2024 to 2034

Figure 124: Asia Pacific Market Value (US$ million) by End Use, 2024 to 2034

Figure 125: Asia Pacific Market Value (US$ million) by Country, 2024 to 2034

Figure 126: Asia Pacific Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 127: Asia Pacific Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 130: Asia Pacific Market Value (US$ million) Analysis by Product, 2019 to 2034

Figure 131: Asia Pacific Market Volume (MT) Analysis by Product, 2019 to 2034

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 134: Asia Pacific Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 135: Asia Pacific Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 138: Asia Pacific Market Value (US$ million) Analysis by Isomer, 2019 to 2034

Figure 139: Asia Pacific Market Volume (MT) Analysis by Isomer, 2019 to 2034

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Isomer, 2024 to 2034

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Isomer, 2024 to 2034

Figure 142: Asia Pacific Market Value (US$ million) Analysis by End Use, 2019 to 2034

Figure 143: Asia Pacific Market Volume (MT) Analysis by End Use, 2019 to 2034

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 146: Asia Pacific Market Attractiveness by Product, 2024 to 2034

Figure 147: Asia Pacific Market Attractiveness by Form, 2024 to 2034

Figure 148: Asia Pacific Market Attractiveness by Isomer, 2024 to 2034

Figure 149: Asia Pacific Market Attractiveness by End Use, 2024 to 2034

Figure 150: Asia Pacific Market Attractiveness by Country, 2024 to 2034

Figure 151: Middle East & Africa Market Value (US$ million) by Product, 2024 to 2034

Figure 152: Middle East & Africa Market Value (US$ million) by Form, 2024 to 2034

Figure 153: Middle East & Africa Market Value (US$ million) by Isomer, 2024 to 2034

Figure 154: Middle East & Africa Market Value (US$ million) by End Use, 2024 to 2034

Figure 155: Middle East & Africa Market Value (US$ million) by Country, 2024 to 2034

Figure 156: Middle East & Africa Market Value (US$ million) Analysis by Country, 2019 to 2034

Figure 157: Middle East & Africa Market Volume (MT) Analysis by Country, 2019 to 2034

Figure 158: Middle East & Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 159: Middle East & Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 160: Middle East & Africa Market Value (US$ million) Analysis by Product, 2019 to 2034

Figure 161: Middle East & Africa Market Volume (MT) Analysis by Product, 2019 to 2034

Figure 162: Middle East & Africa Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 163: Middle East & Africa Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 164: Middle East & Africa Market Value (US$ million) Analysis by Form, 2019 to 2034

Figure 165: Middle East & Africa Market Volume (MT) Analysis by Form, 2019 to 2034

Figure 166: Middle East & Africa Market Value Share (%) and BPS Analysis by Form, 2024 to 2034

Figure 167: Middle East & Africa Market Y-o-Y Growth (%) Projections by Form, 2024 to 2034

Figure 168: Middle East & Africa Market Value (US$ million) Analysis by Isomer, 2019 to 2034

Figure 169: Middle East & Africa Market Volume (MT) Analysis by Isomer, 2019 to 2034

Figure 170: Middle East & Africa Market Value Share (%) and BPS Analysis by Isomer, 2024 to 2034

Figure 171: Middle East & Africa Market Y-o-Y Growth (%) Projections by Isomer, 2024 to 2034

Figure 172: Middle East & Africa Market Value (US$ million) Analysis by End Use, 2019 to 2034

Figure 173: Middle East & Africa Market Volume (MT) Analysis by End Use, 2019 to 2034

Figure 174: Middle East & Africa Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 175: Middle East & Africa Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 176: Middle East & Africa Market Attractiveness by Product, 2024 to 2034

Figure 177: Middle East & Africa Market Attractiveness by Form, 2024 to 2034

Figure 178: Middle East & Africa Market Attractiveness by Isomer, 2024 to 2034

Figure 179: Middle East & Africa Market Attractiveness by End Use, 2024 to 2034

Figure 180: Middle East & Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Resveratrol Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Resveratrol Enriched Formulas Market Size and Share Forecast Outlook 2025 to 2035

Resveratrol Industry Analysis in Japan Growth, Trends and Forecast from 2025 to 2035

Resveratrol Industry Analysis in Korea Growth, Trends and Forecast from 2025 to 2035

Triacetylresveratrol Market Size and Share Forecast Outlook 2025 to 2035

Demand for Resveratrol in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA