The restaurants and mobile food services segment on a global scale is set to expand at an extensive pace during the period between 2025 and 2035. Consumers are looking for convenience, variety in cuisines, and experiences, which are driving food trucks, casual dining and quick-service restaurants (QSRs) to thrive.

Technological enhancement of the food processes, explosion of digital ordering platforms, and the need for cashless payment methods also contribute crucially for the growth of the market. Sustainability efforts, including environmentally friendly packaging and plant-based menu offerings, also continue to trend the market.

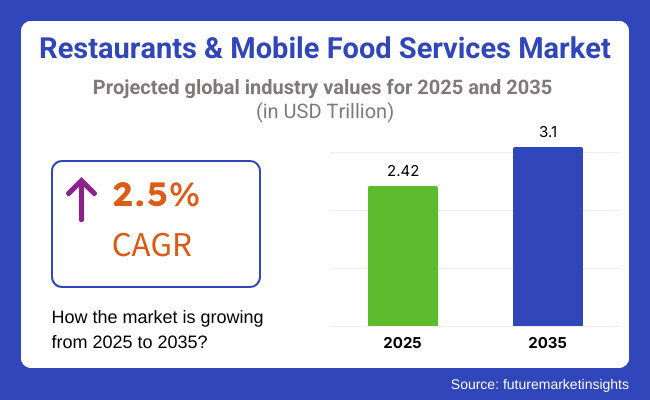

The restaurants and mobile food services had a revenue of around USD 2.42 Trillion by 2025 and are likely to generate more than USD 3.10 Trillion by 2035, around 2.5% CAGR. Most of the growth is attributed to increasing disposable income, growing global footprint of fast food and increasing penetration of online food delivery platforms.

Mobile food services, such as food trucks and street vendors, will be among the fastest-growing segments due to their low overhead costs and capability to respond to shifting consumer tastes.

United States and Canada are pioneers in the North America Restaurants and mobile food service set market. The region has a large international fast-food presence, an emerging food truck culture and a growing appetite for fast-casual dining experiences.

Cities such as New York City, Los Angeles, and Toronto have concentrations of both conventional eateries and mobile food carts. Digital disruptions (for example, app-based food ordering, AI-powered customers) have boosted customer engagement as well as operational efficiency. In North America, trends in sustainability, like the use of biodegradable packaging and local sourcing, are having an impact as well.

The growth of the European restaurant and mobile food service sectors is predicted to be steady as the number of street food festivals, mobile kitchens, and non-formal dining outlets increases. The demand for a variety of food, including organic, and vegan alternatives is growing in countries such as the UK, Germany and France.

Sustainability continues to drive policies, with stricter legislation on single-use plastics and food waste management at the governmental level. The surge in digital ordering platform and contactless payment systems are also kicking growth across Europe. Open-air markets and music festivals are just some of the events that allow mobile food vendors to make extra income.

Asia-Pacific will lead the restaurants and mobile food services market in growth. Well-established street food culture, supported by high urbanization and increasing disposable income of consumers in the region, is further driving the market growth. Countries like China, India, and Thailand long have established cars, which are now supplementing their old-school food vendors with technology and hygiene.

Growing number of food delivery platforms, rising preference for international cuisines and adoption of sustainable food approaches are some other factors bolstering the market growth. Asia-Pacific is set to lead the global market in revenue and innovation in the sector, with a growing middle class and evolving eating habits.

Changing Consumer Behaviour and Expenditure Trends

Consumers increasingly want appropriate culinary options that go from healthier meals and plant-based or globally influenced cuisines. At the same time, increasing food prices, labour shortages and strict regulatory conditions put financial strain on restaurant owners and food service operators.

Licensing regulations, limited cooking space, and availability based on location and seasonality poses challenges for mobile food services. Additionally, businesses must adapt their operational strategies-to meaningfully optimize the sourcing of ingredients, streamline operations and remain flexible.

Expansion in Fast-Casual Dining, Food Innovations, and Kitchen Counter to Regional Cultural Specialties

As consumers increasingly seek out convenient, high-quality food options, both the Restaurants and Mobile Food Services Market are positioned for growth. Consumers crave fast-casual dining experiences that offer value, speed and real food. The proliferation of food trucks, pop-up restaurants, and delivery-only restaurants has widened access to this new way of enjoying food.

In order to offer customers a unique and culturally rich dining experience, many owners of mobile food services bring to their dishes the traditional foods they grew up with. These real, home-grown food concepts usually do well, building loyal followings and growing cultural appreciation.

New menu customization options, technology-driven ordering systems, and sustainable packaging solutions are also improving customer engagement. Innovative businesses that prioritize culinary experimentation, digital ordering platforms, and sustainable ingredient sourcing will thrive as market forces and consumer behaviour shift.

The dining and out-of-home eating trends were evolving at a faster pace between 2020 and 2024 resulting in a lot of changes in restaurants and mobile food services market. Fast-casual and quick-service restaurants outperformed legacy dining establishments, as consumers sought value and ease of use.

However, supply chain disruptions, labour shortages, and inflation affected profitability for restaurants. Businesses adjusted by launching new digital ordering platforms, optimizing takeout and delivery models, and engaging in dynamic pricing on their menus.

As we look further ahead to 2025 to 2035 the market will continue to evolve with advancements in automated kitchens, personalized dining experiences and sustainability-focused food service models. New menus focused on plant-based dishes, localized sourcing and zero-waste food efforts will set new benchmarks for consumer preference.

Implementation of self-service kiosks, streamlined meal prep automation and ghost kitchens will further augment operations and profitability.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Importance of legal requirements: Health and safety, labour law, and food service requirements |

| Dining Trends | Growth in takeout, delivery services, and fast-casual dining |

| Industry Adoption | Increased use of online food delivery platforms and cloud kitchens |

| Supply Chain and Sourcing | Reliance on international food distributors and bulk raw materials |

| Market Competition | Traditional Restaurants, Food Trucks, and Delivery-Only Kitchens |

| Market Growth Drivers | The need for convenience, value and a variety of food options |

| Sustainability and Energy Efficiency | Development of compostable packaging and waste reduction strategies |

| Integration of Smart Ordering | Contactless payments, self-order kiosks and mobile apps have been slow to be adopted. |

| Advancements in Food Service Models | Use of ghost kitchens, mobile ordering, and meal subscription services |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter sustainability policies, eco-friendly packaging mandates and labour automation standards |

| Dining Trends | Expansion of personalized dining, sustainable food options, and experiential restaurant formats. |

| Industry Adoption | Rise of automated food preparation, AI-powered menu recommendations, and sustainable restaurant concepts. |

| Supply Chain and Sourcing | Move to local, organic food and farm-to-table restaurant models. |

| Market Competition | Rise of subscription meal services, hyper-local dining concepts, tech-fuelled food brands |

| Market Growth Drivers | More emphasis on sustainability, innovative culinary offer and personalized meal experience. |

| Sustainability and Energy Efficiency | Publish curation of case studies of implementing zero-waste kitchens, carbon-neutral restaurants, and renewable energy-driven food services at scale |

| Integration of Smart Ordering | Increased AI-powered order customizations, voice ordering, and frictionless digital dining experiences |

| Advancements in Food Service Models | Evolution of fully automated restaurants, interactive dining experiences, and eco-conscious food concepts. |

The USA restaurant and other eating place market has continued to grow due to a national culture of eating out and demand for convenient meal options. The expansion of quick-service restaurants (QSRs), food trucks, and pop-up kitchens with varied cuisines, is to meet the changing preferences of consumers.

Mobile food vendors are cashing in on crowded city centres, sporting grounds and food festivals where hungry customers want to devour high-powered meals on the move. The emphasis on fresh, organic, and locally sourced ingredients is also informing menu after menu. Furthermore, meal delivery services play a critical role in expanding restaurant reach and making food more attainable for consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 2.9% |

Growing urbanization and fast-paced work lives have contributed to the growth of the UK restaurant and mobile food service market due to the increasing need for low-priced and speedy dining options. Fewer fine-dining establishments but food trucks and takeaway restaurants are booming, as are casual dining operations, especially in the major cities like London, Manchester, and Birmingham.

Health-minded dining trends are driving the industry, with vendors increasingly providing vegan, gluten-free and sustainably sourced options. This trend has given rise to weekend food festivals and street food markets, and it has increased demand for innovative and high-quality mobile food solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 2.6% |

The European restaurant and mobile food services market is growing steadily, driven by the food tourism rise and the increasing demand for convenience-based dining. Countries like France, Germany, Italy and Spain are experiencing a boom of mobile and pop-up restaurants and events catering services.

Government schemes promoting small food businesses and relaxed regulation for street food vending are opening up avenues for growth. Trends like sustainability also shape the market as customers prefer fresh, local ingredients and sustainable packaging.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 2.5% |

There is a rapid increase in Japan’s restaurant and mobile food services sector. These bento stalls, ramen carts and specialty dessert vendors draw both locals and tourists, especially in Tokyo, Osaka and Kyoto.

Seasonal and themed food events tend to attract sizeable crowds in search of unique dining experiences. Food trucks are also booming, serving authentic Japanese food, as well as global fusion food, adapted to changing consumer habits.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.4% |

The South Korea restaurant and mobile food services market is growing at a faster pace due to the tremendous street food culture as well as event-based dining services. These revolutionised mobile food vendors just as they had done with funky dishes spanning busier urban centres and even night markets and pop-up festivals - where ligneous Korean BBQ, fried chicken, and traditional desserts remain as resolutely popular as they get.

For tourists and locals alike, the rise of themed food trucks and pop-up restaurants also help spur the industry. There has also been increased consumer demand for healthier, more sustainable meal options from mobile food services, with vendors opting for fresh, local and seasonal ingredients to cater to changing palettes.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 2.7% |

Cafeterias, grill buffets, and buffets continue to be important segments of the restaurants and mobile food services market, thanks in part to consumers' demand for low-cost, high-quality food options, combined with menu variety. This segment has experienced a constant growth owing to the increasing popularity of self-service dining formats, bulk meal offerings, and relaxed food-and-drink experiences.

With rising urban populations and dining habits shifting toward affordable meal solutions, cafeteria and buffet-style restaurant concepts provide a valued alternative to mainstream, full-service dining.

Flexible meal pricing models and option to meet different diets mean that these formats appeal to a broad demographic from families to office workers and budget consumers. Moreover, buffet-type meals gained momentum due to the requirement for quicker hours of service, enabling the diner to manage portion control and what they are eating during the meal, thus ensuring speed and shortened queue times.

Cafeterias - places for institutional dining and common in schools, hospitals, and corporate settings - have changed in the past decade or so. In response to rising consumer demand for healthier meal options, many cafeterias have adopted farm- to-table dining, locally sourced ingredients, and plant-based menus to capture health-conscious diners.

This change reflects shifting consumer demand for information about the sourcing and sustainability of foods.

In contrast, buffet-style dining has gained popularity across hospitality, entertainment, and tourism sectors, where large hotels and high-end resorts have invested in the experience of world-class buffets.

It is no longer just about unlimited plates but has now evolved into international cuisines, live cooking stations and personalized meals to serve varied customers. For buffet operators, the model of high volume service combined with competitive pricing structure translates into profit, with customers still getting value for money.

The rise in interactive dining experience demand has especially increased market penetration for grill buffets. And as for the consumers, they love the idea to pick up fresh ingredients and get dishes cooked and served, with a sense of unique dining experiences. This reinforces that grill buffets are a success with consumers, especially now that the hot trend of all-you-can-eat formats, where customers feel they pay a fixed price to get unlimited servings, are working in the grill buffet's favour.

Cafeterias, grill buffets, and buffets, however, continue to pose challenges, such as fluctuating costs of food, operational inefficiencies, and stringent hygiene and food safety measures. But the challenges of the food service sector are being met with innovations in automated food preparation, AI-assisted meal planning and digital ordering systems that help restaurants operate more efficiently and ultimately offer a better dining experience.

Smart buffet technology, which uses AI-powered sensors to track food levels and predict when replenishments are needed, has decreased food waste while ensuring that fresh food is available during service hours. Also, digital menu customization and online reservation systems make for a more streamlined dining experience that adds convenience for both operators and diners.

Hybridization is another major trend, with some buffet restaurants adding table service elements in order to attract a wider clientele. This concept takes the best of what buffet dining has to offer in terms of variety and price and marries it with full-service, experience-driven dining to appeal to both the casual diner and the consumer who wants an experience.

Though labour shortages and operational complexities remain barriers, the dining sector of buffets is on the verge of a great transformation with the help of robotic food servers and automated grill stations. All these innovations promise to improve food safety, lower costs, and shorten service speed, enabling cafeterias, grill buffets, and buffets to remain competitive in the changing food service world.

The mobile food services segment, which encompasses food trucks, removable container kitchens, and pop-up food vendors, is developing at a fast pace due to changing consumer lifestyles and the demand for convenient, cost-effective and diverse meals. As urban centres grow denser and entrenched tastes favour fast-casual formats, mobile food businesses have found opportunity in their nimbleness and lower overhead costs when compared with more traditional brick-and-mortar restaurants.

Food trucks represent the largest segment of the mobile food services market and have seen some of the best market adoption for their ability to serve high-quality meals at competitive prices. These businesses are mobile, allowing them to track locations that are high foot traffic areas such as business districts, college campuses, festivals, and public events for a guaranteed flow of customers.

Trend of Gourmet and Specialized Foods: The revolution of gourmet and specialized foods is one of the points driving the food truck industry. In contrast to traditional fast-food fare, contemporary food trucks focus on bold flavours, fusion cuisine and even artisanal food concepts, serving an increasingly adventurous consumer base.

More than 70% of mobile food businesses offer niche culinary experiences, including organic, gluten-free, and plant-based options, so offering a mobile food business ensures meeting the needs of every dietary preference.

AI Powered Customer Engagement: The shift in mobile food industry has also been impacted by AI powered customer engagement tools. Real-time GPS tracking, digital menu boards, and app-based systems for taking pre-orders have helped increase operational efficiencies while improving customer convenience.

Moreover, AI-based analytics offer food truck operators critical insights into customer preferences, peak hours, and menu optimization, further streamlining business operations.

The proliferation of sustainable mobile food units is another sector driving innovation in market movement. The trend of sustainability has contributed to the increased use of solar powered kitchen systems, biodegradable packaging, energy-efficient cooking appliances and others. Not only do these eco-friendly alternatives resonate with consumer morals, they also help save costs and maintain positive brand image.

Removable container kitchens also emerged as a scalable solution for mobile food service providers beyond food trucks. These semi-permanent structures allow more kitchen space, increased food production, and operational stability over standard food trucks.

Container-based restaurant setups have proliferated in event-based dining, seasonal pop-ups and urban redevelopment projects, as some cities’ limited space for traditional restaurants has made expansion difficult.

Removable container-based food services have also gained traction due to the increasing demand for ghost kitchens and delivery-only restaurant formats. By locating modular kitchens in areas with high demand, food service providers can quickly prepare and deliver online orders, minimising both delivery time and operational expenses.

Indeed, according to research, more than 40% of mobile food businesses in emerging markets are based on container setups - that's evidence of a strong pivot toward a scalable model.

In the face of intensifying competition, mobile food service operators have embraced smart kitchen technologies ranging from automated cooking stations to IoT-enabled food safety monitoring systems to AI-assisted inventory management. These innovations have smoothed food preparation procedures, reduced waste, and created uniform quality across mobile enterprises.

Despite the rapid growth of this industry, the mobile food services market is also burdened with a lot of obstacles, such as limitations in regulations, location permissions, and increasing fuel prices. Restrictive local zoning laws play a role in operational limitations, including lack of access to lucrative vending locations and additional regulatory expenses for operators of mobile food businesses.

To combat these problems, industry shares things like app-based food truck aggregators, offering real-time location tracking and seamless customer interaction. The integration of cloud kitchens with mobile food services has also proved to be a game-changer that enables

Market growth is further bolstered by the rising popularity of themed food truck parks and collaborative mobile food hubs. Existing examples: These restaurants can offer different dining ambiances and create market pressure to drive revenues with multiple food vendors within a premises or around a location in high traffic public spaces.

The Restaurants and Mobile Food Services Market is expanded through cafeteria, grill banquet & Buffet based low-cost, high-volume restaurant models, while mobile food service continue to succeed through flexibility in food inventive and helped item based innovation.

Nature of both segments may be facing certain operational challenges but they are also adapting through intelligent automations, AI-enabled optimizations and sustainability-focused initiatives. Consumer dining habits are rapidly changing, and the food services industry will continue to thrive as businesses are focusing on expanded options that deliver value, convenience, and experiences.

The future of mobile food services is bright, even with operational challenges to overcome thanks to technology, further innovations, and changing consumer habits. AI-powered business optimization, combined with eco-responsible practices and data-driven menu optimization, break new ground, while a notable shift towards sustainability and technology-driven platforms enhances market expansion and creates new ways for innovation in the mobile food service industry.

Due to the growing demand for ready-to-eat food products, the mobile food services market is turning into a unit with fast growth. The rise of digital ordering platforms, cloud kitchens and mobile food service logistics changed the game.

Market Approach: The characters in the fast food market contain established quick-service coffee chains, autonomous food truck operators, and food delivery merchants using technology-fuelled arrangements to incorporate profits, close the gap, and pay. Digital engagement strategies, AI-driven mobile food truck routing, and sustainability-focused mobile kitchens are at the forefront of the market’s evolution.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| McDonald's (Mobile & Delivery Services) | 14-18% |

| Domino’s Pizza Inc. (Delivery & Mobile Operations) | 12-16% |

| Starbucks (Mobile Coffee Services & Food Trucks) | 9-13% |

| Door Dash (Food Delivery Aggregator) | 7-11% |

| Uber Eats (Restaurant and Mobile Food Service Logistics) | 6-10% |

| Independent Operators & Other Companies (Combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| McDonald's | Operates mobile food trucks, AI-powered delivery systems, and digital ordering integrations. |

| Domino’s Pizza Inc. | Specializes in AI-based food delivery logistics, mobile order customization, and automated delivery solutions. |

| Starbucks | Offers premium mobile coffee services, sustainable mobile cafes, and AI-driven demand forecasting. |

| Door Dash | Aggregates food delivery, partners with independent and chain restaurants, and enhances delivery logistics through AI. |

| Uber Eats | Provides on-demand restaurant delivery, AI-based food truck tracking, and mobile food service optimization tools. |

Key Company Insights

McDonald's (14-18%)

With its ubiquitous Delivery service, AI-enabled food trucks, and mobile payments in use, McDonald's is a leader in the mobile food services space. With its emphasis on efficiency, customer convenience, and global presence, the firm stablish itself as the leader in mobile dining alternatives.

Domino’s Pizza Inc. (12-16%)

Domino’s remains a strong player in mobile food services, utilizing AI-based route optimization, contactless ordering, and automated delivery technology. Its extensive digital engagement strategy ensures seamless customer interactions.

Starbucks (9-13%)

Starbucks continues to redefine mobile coffee experiences with sustainable mobile cafes, demand-based location optimization, and AI-driven inventory forecasting, allowing it to cater to high-traffic urban and event-based locations.

Door Dash (7-11%)

As a medium enhancing the ecosystem between diners and restaurant, Door Dash utilizes AI technology to streamline its logistic quotient and predictive demand analytics to minimize the delivery time between the restaurant and a mobile food service. The Company’s platform allows restaurants to penetrate new markets seamlessly.

Uber Eats (6-10%)

Uber Eats plays a pivotal role in restaurant and mobile food service logistics by integrating AI-based tracking, real-time food truck location updates, and optimized delivery solutions that enhance consumer accessibility to mobile dining options.

The mobile food services market includes numerous independent operators and emerging brands contributing to industry growth through technological innovations and unique offerings. Notable players include:

The overall market size for Restaurants and Mobile Food Services Market was USD 2.42 Trillion in 2025.

The Restaurants and Mobile Food Services Market is expected to reach USD 3.10 Trillion in 2035.

The demand for the restaurants and mobile food services market will grow due to rising urbanization, increasing consumer preference for convenient dining options, expanding food delivery services, growing disposable income, and the surge in culinary tourism, driving innovation in the food service industry.

The top 5 countries which drive the development of Restaurants and Mobile Food Services Market are USA, UK, European Union, and South Korea.

Cafeterias, Grill Buffets, and Buffets to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Ownership, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Ownership, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Ownership, 2018 to 2033

Table 10: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: Europe Market Value (US$ Million) Forecast by Ownership, 2018 to 2033

Table 13: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Asia Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 15: Asia Pacific Market Value (US$ Million) Forecast by Ownership, 2018 to 2033

Table 16: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 18: Middle East and Africa Market Value (US$ Million) Forecast by Ownership, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Ownership, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Ownership, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Ownership, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Ownership, 2023 to 2033

Figure 13: Global Market Attractiveness by Type, 2023 to 2033

Figure 14: Global Market Attractiveness by Ownership, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Ownership, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Ownership, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Ownership, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Ownership, 2023 to 2033

Figure 28: North America Market Attractiveness by Type, 2023 to 2033

Figure 29: North America Market Attractiveness by Ownership, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Ownership, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Ownership, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Ownership, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Ownership, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Ownership, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 47: Europe Market Value (US$ Million) by Ownership, 2023 to 2033

Figure 48: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 53: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) Analysis by Ownership, 2018 to 2033

Figure 56: Europe Market Value Share (%) and BPS Analysis by Ownership, 2023 to 2033

Figure 57: Europe Market Y-o-Y Growth (%) Projections by Ownership, 2023 to 2033

Figure 58: Europe Market Attractiveness by Type, 2023 to 2033

Figure 59: Europe Market Attractiveness by Ownership, 2023 to 2033

Figure 60: Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Asia Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 62: Asia Pacific Market Value (US$ Million) by Ownership, 2023 to 2033

Figure 63: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Asia Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 68: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 69: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 70: Asia Pacific Market Value (US$ Million) Analysis by Ownership, 2018 to 2033

Figure 71: Asia Pacific Market Value Share (%) and BPS Analysis by Ownership, 2023 to 2033

Figure 72: Asia Pacific Market Y-o-Y Growth (%) Projections by Ownership, 2023 to 2033

Figure 73: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 74: Asia Pacific Market Attractiveness by Ownership, 2023 to 2033

Figure 75: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 76: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 77: Middle East and Africa Market Value (US$ Million) by Ownership, 2023 to 2033

Figure 78: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 83: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: Middle East and Africa Market Value (US$ Million) Analysis by Ownership, 2018 to 2033

Figure 86: Middle East and Africa Market Value Share (%) and BPS Analysis by Ownership, 2023 to 2033

Figure 87: Middle East and Africa Market Y-o-Y Growth (%) Projections by Ownership, 2023 to 2033

Figure 88: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 89: Middle East and Africa Market Attractiveness by Ownership, 2023 to 2033

Figure 90: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Evaluating Market Share in Restaurants & Mobile Food Services

Full-Service Restaurants Market Analysis by Model, Service, Location, and Region Through 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Handheld Robotic Navigation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Handheld Mesh Nebulizer Market Size and Share Forecast Outlook 2025 to 2035

Dandruff Control Shampoos Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA