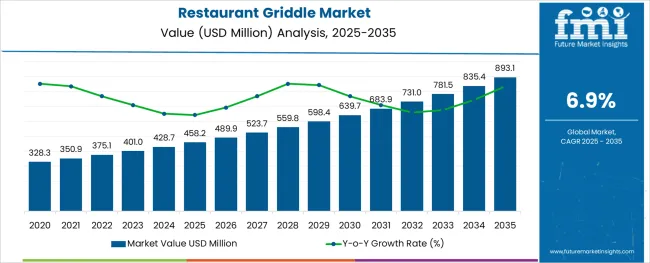

The Restaurant Griddle Market is estimated to be valued at USD 458.2 million in 2025 and is projected to reach USD 893.1 million by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period.

The alginic acid market is undergoing consistent growth, propelled by rising demand from food processing, pharmaceutical formulations, and cosmetic applications. A growing focus on natural and sustainable ingredients in manufacturing processes has positioned alginic acid as a preferred biopolymer across industries.

The market is further supported by its diverse functional benefits, including water retention, gelling, and stabilizing properties, which make it indispensable in high-performance formulations. Increased regulatory acceptance of alginates as safe additives and the push towards cleaner labeling in food and personal care products have reinforced their adoption.

Ongoing innovation in extraction technologies and the utilization of algae as a renewable resource are paving the way for cost-effective production and expanded applications, ensuring sustained market expansion in the coming years.

The market is segmented by Type, Power Type, and Sales Channel and region. By Type, the market is divided into Double Sided and Single Sided. In terms of Power Type, the market is classified into Electric Griddles and Gas Griddles. Based on Sales Channel, the market is segmented into Food Equipment Specialty Retailers, Brand Franchised Stores, Modern Trade, eCommerce Platforms, and Other Channels. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Type, Power Type, and Sales Channel and region. By Type, the market is divided into Double Sided and Single Sided. In terms of Power Type, the market is classified into Electric Griddles and Gas Griddles. Based on Sales Channel, the market is segmented into Food Equipment Specialty Retailers, Brand Franchised Stores, Modern Trade, eCommerce Platforms, and Other Channels. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by salts, sodium alginate is expected to command 27.5% of the market revenue in 2025, marking it as the leading subsegment in this category. This leadership has been driven by its superior solubility, ease of incorporation into formulations, and versatility in a wide range of applications.

Its ability to form stable gels and maintain viscosity under varying conditions has made it highly sought after in both food and pharmaceutical sectors. Manufacturers have prioritized sodium alginate due to its consistent performance, cost-effectiveness, and regulatory acceptance, which have collectively strengthened its position.

The segment’s prominence has also been enhanced by its adaptability to evolving consumer preferences for plant-derived and sustainable ingredients, reinforcing its market share.

Segmented by end user industry, the food industry is projected to hold 33.0% of the market revenue in 2025, positioning it as the most prominent sector. This dominance has been shaped by the industry’s increasing reliance on alginic acid and its derivatives to deliver desirable textures, stabilize emulsions, and improve shelf life of processed foods.

As consumer demand for clean label and natural additives has intensified, the food sector has responded by integrating alginates into bakery, dairy, and confectionery products. Enhanced production efficiency and compliance with food safety standards have further encouraged widespread use.

The segment’s leadership has also been supported by product differentiation strategies where alginates contribute to premium quality and innovation, securing their role in modern food formulations.

When analyzed by functionality, thickening agents are forecast to account for 29.0% of the market revenue in 2025, establishing themselves as the dominant functional category. This preeminence has been underpinned by the growing need for consistent texture and viscosity in a wide array of end products.

Alginic acid’s natural origin and high efficiency in creating uniform, stable thickness without altering taste or color have solidified its appeal. The demand for thickeners in both edible and topical applications has expanded, with manufacturers leveraging its rheological properties to meet performance and regulatory requirements.

The functionality’s leading share has also been reinforced by the ability to deliver cost savings through lower dosages and its compatibility with other ingredients, securing its position as an indispensable component in formulation strategies.

One of the key driving factors for the global restaurant griddle market is consumers' increasing desire for energy-efficient cooking appliances. Restaurant griddle with energy-efficient features is being introduced by manufacturers in response to the growing need for cooking equipment for commercial kitchens that function more efficiently in terms of energy use, capacity, and cost.

Demand for restaurant griddle is high, as they are used mostly in food service organizations due to increased production efficiency while having low operating expenses. The adoption of these goods would be further aided by the increase in demand for food products made with restaurant griddle, and the release of restaurant griddle with ENERGY STAR certification.

Restaurant griddle manufacturers employ a variety of techniques to meet the strict specifications of the ENERGY STAR criteria for griddles, including

Due to the availability of double-sided cooking choices, energy-efficient restaurant griddles cut cooking time by over 50% when compared to other regular types of restaurant griddles. Welbit subsidiary Garland Group has already introduced a double-sided griddle with cutting-edge temperature features.

| Attributes | Details |

|---|---|

| Restaurant Griddle Market CAGR (2025 to 2035) | 6.9% |

| Restaurant Griddle Market Size (2025) | USD 401 million |

| Restaurant Griddle Market Size (2035) | USD 785 million |

Sales revenue in the restaurant griddle industry expanded at a 4.9% CAGR from 2020 to 2025. According to FMI, by 2035, demand for restaurant griddle would rise by 6.9%. The approximate market growth is expected to be USD 384 million.

Weak same-store sales and traffic continue to be a problem for the restaurant business. In February 2020 and January 2020, the number of people walking decreased by 3.1% and 3.2%, respectively. The rising number of new restaurants, alongside constrained growth in dining-out budgets, is essentially one of the main causes of such a decline in same-store sales.

Although there are more restaurants than ever, which drives up the sales of restaurant griddle even more. This is demonstrated by the anticipated higher CAGR of 6.9% between 2025 and 2035 compared to historical growth.

Restaurant griddle with infrared burners is becoming more popular as consumer preferences for griddle change. Over the projection period, it is expected that the worldwide restaurant griddle market would be very consolidated. The firms that are active in the market are concentrating on technology, Research, and Development (R&D) department operations, and brand image.

Along with the lightweight, safe, and multipurpose usage, the manufacturers are also concentrating on differentiating their products based on price, quality, and regulatory compliance, which boosts the market for global restaurant griddle throughout the projection period.

Restaurant griddle with thermostat controls is highly preferred by customers, as they offer the functionality to regulate the temperature appropriately and let the user choose the perfect cooking temperature for a variety of food items based on their needs.

With a CAGR of 7.1% during the forecast period, the gas griddle dominates the restaurant griddle market.

For frying huge quantities of pancakes, eggs, burgers, and other foods, gas griddles are commonly used in restaurants, hotels, cafes, and other commercial locations. The market is expanding as a result of the growing demand from fast food restaurants to prepare quick meals for their staff.

Double-sided gliders dominate the restaurant griddle market, with a CAGR of 6.7% from 2025 to 2035 compared to a CAGR of 4.7% from 2020 to 2025.

Cooking time is reduced by half when an item is grilled on both sides. With this novel, streamlined process, restaurants may effectively double their yield capacity.

Although there isn't a foolproof quick method, the kitchen staff may simply produce greater batches of menu items effectively. The double-sided construction provides consistent temperatures that guarantee unmistakable product consistency.

Africa and the Middle East are likely to continue to have a steady growth. The Latin American market grows since there are more firms operating there. The key players in the restaurant griddle market are inclined to grow in Europe due to the region's advanced manufacturing and industrial sector. But poor demand in developed nations has caused the market in the region to grow slowly.

Due to rising investments, particularly from the end-use industries, the USA restaurant griddle market is anticipated to reach USD 328.3 million, growing from 5.7% CAGR (2020 to 2025) to 7.4%. (2025 to 2035). This is attributable to the creation and production of sophisticated and high-end items and machines.

The Asia Pacific area benefits greatly from increased demand, as significant projects are currently underway in nations like China, India, Australia, and Indonesia. A major manufacturing hub has arisen in the Asia Pacific. China is projected to have a CAGR of 8.5%, with a market size of USD 117.75 million. The region is continuing to benefit from a growing population, which is advantageous for the demand for restaurant griddle.

Significant Projects in Asia Pacific Restaurant Griddle Market

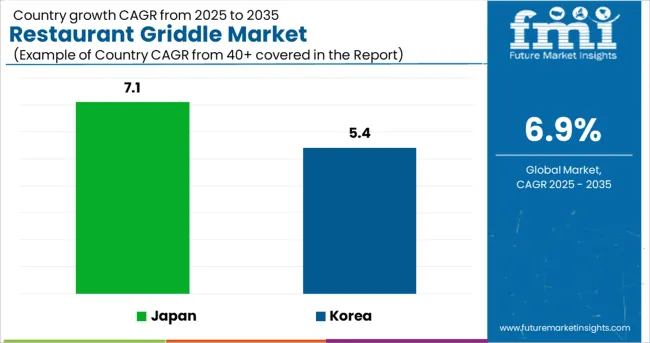

| Country | Japan |

|---|---|

| Market Size | By 2035, Japan is projected to expand at a CAGR of 7.1%, with a market size of USD 49.45 million. |

| Projects | K2S, a Japanese firm, has the expertise and vision to assist in developing the ideal restaurant and is made within the customer’s budget due to the design and construction of more than 800 restaurants globally. They offer the 8200 BTU gas inlet rate, which provides strong heating that rapidly and efficiently cooks the meat. In comparison to other restaurants' griddle, it also reduces the time it takes for customers to return. |

| Country | Korea |

|---|---|

| Market Size | Previously, Korea's restaurant griddle market was growing at 5.4% CAGR. The market is expected to reach a valuation of USD 893.1 million by 2035, with a CAGR of 5.4%. |

| Projects | Samsung BBQ Grills offer the Ultimate Korean BBQ Grills. SamSung's KHood-100 BBQ hood is made specifically to remove all smoke and grease from the cooking pan. For a long lifespan, it is made of 304 stainless steel, which is rust-free. |

Businesses like Blackstone Products, Chipotle, and Yum Brands make significant investments in start-ups to identify technology solutions and establish a presence in the industry.

Established businesses are already funding startups, as ambitious expansion objectives are accelerated by investing in forward-thinking businesses that aim to bring about real change at scale.

The decision was made at a time when restaurant businesses are looking for tech solutions to cut down on their daily labor needs and boost operational efficiency more urgently than in past years due to increased demand and a challenging labor market. As a result, manufacturers find new opportunities in the restaurant griddle market.

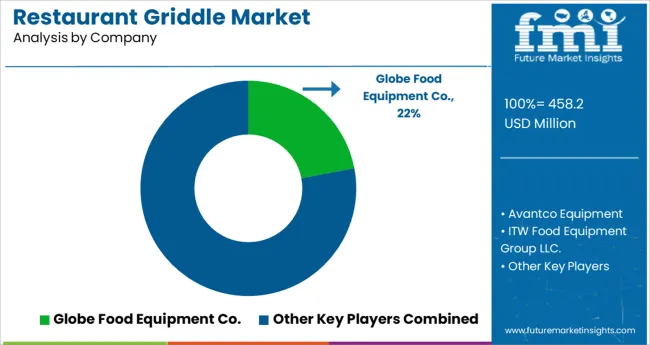

The dominant firms place a strong emphasis on product innovation as a consequence of new product development that assisted in gaining a larger restaurant griddle market share globally. Due to customers' rising preference for healthy food across most areas, the introduction of new products helps maintain consumer interest.

For instance, Weber-Stephen Products LLC introduced the flexible Q1400 in March 2020. The product can be used for roasting, convection cooking, baking, and grilling. TTK Prestige Ltd. unveiled a product with temperature control and non-stick heating plates in December 2020.

Key players

The global restaurant griddle market is estimated to be valued at USD 458.2 million in 2025.

It is projected to reach USD 893.1 million by 2035.

The market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types are double sided and single sided.

electric griddles segment is expected to dominate with a 61.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Restaurant POS Terminals Market Size and Share Forecast Outlook 2025 to 2035

Restaurant Fryers Market Size and Share Forecast Outlook 2025 to 2035

Restaurant Equipment Market Size and Share Forecast Outlook 2025 to 2035

Restaurant Glassware Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Market Share in Restaurants & Mobile Food Services

Restaurants & Mobile Food Services Market Trends – Forecast 2025 to 2035

Analysis and Growth Projections for Restaurant Takeout Business

Griddles Market

POS Restaurant Management System Market Size and Share Forecast Outlook 2025 to 2035

Used Restaurant Equipment Market Size and Share Forecast Outlook 2025 to 2035

Electric Griddle Market Size and Share Forecast Outlook 2025 to 2035

Commercial Griddle Market Size and Share Forecast Outlook 2025 to 2035

Countertop Griddle Market Size and Share Forecast Outlook 2025 to 2035

Commercial Griddles & Flat-Top Grills Market - Industry Scope & Demand 2024 to 2034

Commercial Restaurant Rangers Market

Full-Service Restaurants Market Analysis by Model, Service, Location, and Region Through 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Electric Countertop Griddles Market

Airport Quick Service Restaurant Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA