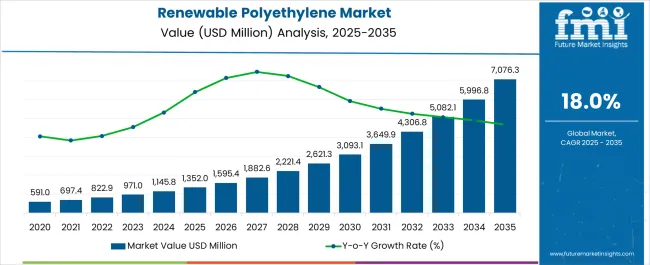

The Renewable Polyethylene Market is estimated to be valued at USD 1352.0 million in 2025 and is projected to reach USD 7076.3 million by 2035, registering a compound annual growth rate (CAGR) of 18.0% over the forecast period.

Production facilities face unique challenges related to feedstock variability and processing complexity. Sugarcane ethanol conversion to ethylene requires specialized catalytic processes that differ from petroleum-based production methods. Quality assurance departments must navigate testing protocols that verify both renewable content certification and traditional polymer specifications, creating dual compliance requirements that affect production scheduling and cost structures.

Supply chain dynamics involve agricultural commodity sourcing where crop yields, seasonal variations, and competing food market demands affect raw material availability and pricing. Procurement teams must coordinate with agricultural suppliers operating under different business cycles than traditional chemical manufacturers, creating inventory management challenges that affect cash flow and production planning.

Biomass processing operations require specialized fermentation and distillation equipment that demands different technical expertise compared to conventional petrochemical processing. Engineering teams must balance process optimization for bio-ethylene yield while maintaining polymer quality specifications that meet customer performance requirements across packaging, automotive, and consumer goods applications.

Manufacturing facilities serving different certification requirements encounter competing operational demands. ISCC Plus certification requires extensive documentation and traceability systems that differ from conventional polymer quality standards. Food-grade applications demand additional safety protocols and testing procedures that increase production complexity and regulatory compliance costs.

Research and development operations coordinate across biotechnology, agricultural science, and polymer engineering disciplines. Product development timelines must account for feedstock variability studies and performance validation that extend beyond traditional polymer development cycles. Innovation teams explore alternative feedstock sources including agricultural waste, algae, and captured carbon while maintaining cost competitiveness with fossil-based alternatives.

The integration of mass balance accounting systems creates operational complexity where renewable content tracking requires sophisticated inventory management and documentation processes. Operations teams must segregate material flows and maintain chain-of-custody documentation that supports sustainability claims while managing conventional production efficiency targets.

Contract manufacturing relationships involve coordination with specialized bio-refineries and conventional polymer processors. Technology transfer processes require extensive validation of renewable feedstock compatibility with existing production equipment while meeting environmental and performance specifications across different application segments.

Technology scaling operations balance pilot plant demonstrations with commercial production requirements. Equipment vendors often lack experience with bio-based feedstock processing, creating technical support challenges that affect production reliability and maintenance scheduling for specialized processing equipment.

Financial operations manage commodity price volatility for agricultural feedstocks alongside traditional petrochemical pricing dynamics. Revenue recognition becomes complex when products carry sustainability premiums that depend on certification maintenance and renewable content verification across supply chain partners.

| Metric | Value |

|---|---|

| Renewable Polyethylene Market Estimated Value in (2025 E) | USD 1352.0 million |

| Renewable Polyethylene Market Forecast Value in (2035 F) | USD 7076.3 million |

| Forecast CAGR (2025 to 2035) | 18.0% |

The renewable polyethylene market is expanding steadily as industries accelerate the transition toward bio based materials to reduce carbon emissions and dependence on fossil fuels. Growing regulatory mandates promoting sustainable packaging, along with rising consumer awareness of eco friendly alternatives, are key drivers shaping this market.

Continuous innovations in feedstock processing, enhanced mechanical properties, and improved recyclability are strengthening adoption across various end use sectors. The ability of renewable polyethylene to provide performance comparable to conventional polyethylene while offering a reduced environmental footprint has made it highly attractive to global brands and manufacturers.

Strategic collaborations among producers, technology developers, and end users are further driving investment and scaling production capacities. With governments and corporations aligning sustainability targets with long term operational strategies, the market outlook remains favorable with packaging, automotive, and consumer goods sectors being primary growth contributors.

The HDPE product type segment is projected to account for 47.60% of the total market revenue by 2025 within the product type category, making it the dominant segment. This growth is being supported by its superior tensile strength, durability, and versatility across high demand applications.

HDPE derived from renewable sources has gained traction in industries seeking sustainable yet high performance alternatives for rigid packaging, industrial components, and consumer products. Its compatibility with existing recycling streams and regulatory support for bio based plastics have further accelerated adoption.

With rising investments in large scale biopolymer production facilities and strong emphasis on reducing lifecycle emissions, HDPE continues to lead within the product type segment.

The packaging application segment is expected to contribute 42.90% of the total market revenue by 2025 under the application category, positioning it as the leading segment. Growth is being driven by increasing demand for sustainable packaging solutions in food and beverages, consumer goods, and e commerce.

Renewable polyethylene provides essential barrier properties, flexibility, and resilience while aligning with global initiatives to replace single use plastics. Leading consumer brands have incorporated renewable polyethylene packaging to meet sustainability commitments and appeal to eco conscious consumers.

Regulatory pressure to reduce plastic waste and the expansion of circular economy practices have also supported the rapid adoption of renewable polyethylene in packaging. These factors collectively reinforce the dominance of packaging as the foremost application segment in the renewable polyethylene market.

Governments in North America, particularly the United States, are implementing policies and regulations to promote the use of renewable and sustainable materials. For instance, several states have passed legislation to ban single-use plastics, which has led to increased demand for renewable plastics like Renewable Polyethylene.

Consumers in North America are becoming more conscious of the impact of plastic pollution on the environment and are seeking out eco-friendly alternatives. This has created a growing demand for Renewable Polyethylene in products ranging from packaging to consumer goods.

The development of new and improved manufacturing processes for Renewable Polyethylene has made it easier and more cost-effective to produce in North America. This has helped to increase supply and reduce the cost of the material, making it more accessible to businesses.

Many businesses in North America are responding to the growing demand for sustainable products by adopting eco-friendlier practices and using renewable materials like Renewable Polyethylene in their products. This has created new opportunities for manufacturers and suppliers in the region.

The development of new and improved manufacturing processes for Renewable Polyethylene has made it easier and more cost-effective to produce. This is expected to increase supply and reduce the cost of the material, making it more accessible to businesses.

There is a growing interest in developing new and innovative products using Renewable Polyethylene. For instance, there is a significant potential for the use of Renewable Polyethylene in packaging, as well as in consumer goods like toys and furniture.

Many companies are partnering with each other to develop new products and technologies using Renewable Polyethylene. These collaborations are expected to drive innovation and accelerate the adoption of Renewable Polyethylene in various industries. Several major companies have already begun investing in renewable polyethylene. For example, in 2020, IKEA announced that it would switch to using renewable polyethylene in its products, while Coca-Cola has also started using renewable polyethylene in some of its bottles.

Overall, as consumers and companies become more environmentally conscious, the demand for renewable polyethylene is likely to continue growing, making it an important part of the transition to a more sustainable future.

Growing environmental concerns in recent times regarding traditional or fossil-derived polyethylene packaging are driving the substitution by renewable polyethylene. Some of the factors including lack of degradation, and drastically depleting natural resources have provided momentum to the adoption of renewable polyethylene compared to fossil-based polyethylene.

Renewable polyethylene (also known as Bio-polyethylene or Green Polyethylene) is synthesized from ethanol, which becomes ethylene after the dehydration process. Worldwide, a variety of feedstocks including sugarcane, sugar beet, and wheat grain are used for renewable polyethylene production.

Renewable polyethylene properties are identical to that of traditional polyethylene, with the added advantage of its environment friendly nature. Compatible physical properties of renewable polyethylene for use in products such as carry bags, bottles, and plastic films and also it's recycling are making it a popular choice of the end-users.

Recyclability is another one of the important properties of renewable polyethylene that increases its applications across various industries. Renewable polyethylene portfolio features nearly 30 grades of LDPE, HDPE and LLDPE families that caters to a wide range of applications such as packaging, agriculture, and automotive parts/components, among others. The huge majority of the aforementioned grades have around 80% to 90% renewable carbon content.

At the global level, increasing harmful environmental consequences of the over-utilization of conventional or fossil-based plastics have led the manufacturers to find alternative solutions and produce plastic by renewable resources or green sources. Concerns over the depletion of the world’s natural resources has also provided traction to bio-based or renewable polyethylene plastic adoption rates across the globe.

Moreover, renewable plastic is biodegradable and can be recycled in the same manner as conventional polyethylene owing to chemically identical. Growing plastic packaging industry is also acting as a key driving factor for renewable polyethylene demand during the foreseen growth of the market.

Increasing demand for flexible packaging across various industries such as food and beverages, automotive parts/components, consumer goods, etc. are projected to positive thrust to renewable polyethylene demand across the globe in the coming years.

One disadvantage associated with the renewable polyethylene is its reliance on the feedstock of agricultural waste. For large scale sourcing of agricultural waste also requires various sources such as fossil fuels, machinery, fertilizers, and pesticides, among many others. Such an aspect is expected to act as a challenging factor for the renewable polyethylene market growth in the near future.

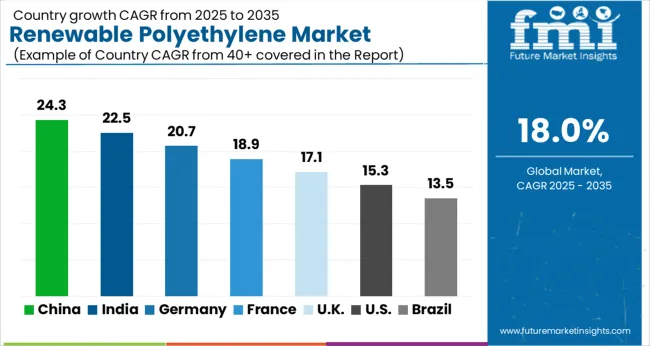

Worldwide, North America followed by Europe is estimated to account for dominating share in global renewable polyethylene. The reason behind this is that the various norms and standards are implemented by the regulatory authorities of those regions over the usage of fossil-based polyethylene.

Such a factor compels manufacturers to develop novel technologies to synthesize plastic by agro-waste or biological/renewable resources. Although, the Asia Pacific region is expected to register prominent growth in the global renewable polyethylene market during the projected timeline of the market.

Owing to the growing investment to tackle challenges of the environmental impact such as GHG emissions, especially in the developing countries (China and India) of the Asia Pacific region, they are likely to pave the path for the robust growth of renewable polyethylene market in the coming years. Moreover, the market in the Middle East & Africa and Latin America regions are projected to witness substantial demand for the global renewable polyethylene market in the near future.

The Renewable Polyethylene Market is expanding rapidly, driven by global efforts to reduce carbon emissions, minimize plastic waste, and promote bio-based material adoption. Renewable polyethylene (bio-PE) is produced from renewable feedstocks such as sugarcane, corn, or other biomass sources and offers the same chemical properties and recyclability as conventional polyethylene while significantly lowering greenhouse gas emissions. Market growth is being fueled by increasing demand from the packaging, automotive, agriculture, and consumer goods industries, along with stricter environmental regulations and corporate sustainability commitments worldwide.

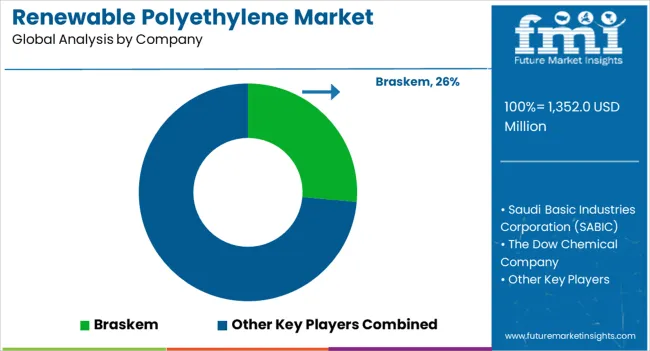

Leading producers such as Braskem S.A., Saudi Basic Industries Corporation (SABIC), and Dow Inc. dominate the renewable polyethylene landscape through large-scale bio-based polymer production and strong collaborations with major packaging and FMCG brands. Braskem, a pioneer in the segment, continues to lead with its I’m green™ Polyethylene, produced from sugarcane ethanol and widely adopted by global packaging companies. SABIC is investing in certified circular and renewable feedstock integration under its TRUCIRCLE™ portfolio, while Dow Inc. focuses on developing low-carbon bio-based PE resins optimized for flexible and rigid packaging.

LyondellBasell Industries N.V. and Mitsui & Co. Ltd. are expanding renewable polymer capacities through joint ventures and partnerships aimed at scaling circular and bio-feedstock operations. Avery Dennison Corporation and Sealed Air Corporation are leveraging renewable PE in sustainable labeling and flexible packaging solutions, aligning with zero-waste and carbon-neutral packaging targets. Plantic Technologies Limited and Total Corbion PLA are driving innovation in bio-based polymer blends, enhancing biodegradability and mechanical performance.

Sojitz Corporation, Toyota Tsusho Corporation, and Respack Manufacturing Sdn. Bhd. are strengthening regional supply chains in Asia by promoting renewable PE adoption in consumer packaging and automotive components.

| Item | Value |

|---|---|

| Quantitative Units | USD 1,352.0 Million |

| Product Type | HDPE (High-Density Polyethylene), LDPE (Low-Density Polyethylene), LLDPE (Linear Low-Density Polyethylene) |

| Application | Packaging, Bags, Bottles, Plastic Films, Sports & Footwear, Agriculture, Non-Woven Fibers, Automotive Parts & Components, Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, India, Japan, Brazil, Saudi Arabia |

| Key Companies Profiled |

Braskem S.A., Saudi Basic Industries Corporation (SABIC), Dow Inc., LyondellBasell Industries N.V., Sojitz Corporation, Avery Dennison Corporation, Sealed Air Corporation, Mitsui & Co. Ltd., Plantic Technologies Limited, Total Corbion PLA, Respack Manufacturing Sdn. Bhd., Toyota Tsusho Corporation |

| Additional Attributes | Dollar sales by product type and end-use application; adoption trends in bio-based polyethylene and circular economy polymers; rising demand for renewable HDPE and LDPE grades in sustainable packaging and automotive applications; sector-specific growth in consumer goods, food & beverage, and agriculture; revenue segmentation between rigid and flexible packaging solutions; integration with bio-ethanol feedstocks (sugarcane, sugar beet, wheat grain) and closed-loop recycling systems; regional growth patterns shaped by regulatory bans on single-use plastics. |

The global renewable polyethylene market is estimated to be valued at USD 1,352.0 million in 2025.

The market size for the renewable polyethylene market is projected to reach USD 7,076.3 million by 2035.

The renewable polyethylene market is expected to grow at a 18.0% CAGR between 2025 and 2035.

The key product types in renewable polyethylene market are hdpe (high-density polyethylene), ldpe (low-density polyethylene) and lldpe (linear low-density polyethylene).

In terms of application, packaging segment to command 42.9% share in the renewable polyethylene market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Renewable Heating Fuels Market Size and Share Forecast Outlook 2025 to 2035

Renewable Isocyanate Market Forecast and Outlook 2025 to 2035

Renewables Energy Consulting Service Market Size and Share Forecast Outlook 2025 to 2035

Renewable Naphtha Market Size and Share Forecast Outlook 2025 to 2035

Renewable Biopolymer Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Renewable Based Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Renewable Energy Certificate Market Size and Share Forecast Outlook 2025 to 2035

Renewable Energy Contactor Market Size and Share Forecast Outlook 2025 to 2035

Renewable Methanol Market Growth - Trends & Forecast 2025 to 2035

Renewable Solvents Market

Polyethylene Terephthalate Catalyst Size and Share Forecast Outlook 2025 to 2035

Polyethylene (PE) Thermoform Packaging Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Naphthalate (PEN) Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Films Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Corrugated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Terephthalate Market Growth - Trends & Forecast 2025 to 2035

Polyethylene Terephthalate Glycol (PETG) Market Growth - Innovations, Trends & Forecast 2025 to 2035

Polyethylene Mailers Market Insights - Growth & Trends Forecast 2025 to 2035

Competitive Breakdown of Polyethylene Corrugated Packaging Manufacturers

Polyethylene Glycol Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA