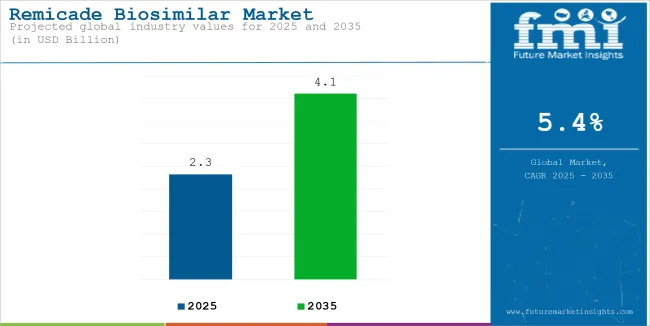

The remicade biosimilar market reached USD 2.32 billion in 2025. It is anticipated to grow at a CAGR of 5.4% during the assessment period 2025 to 2035 and reach a value of USD 4.10 billion by 2035.

| Attributes | Description |

|---|---|

| Estimated Remicade Biosimilar Market Size (2025E) | USD 2.32 billion |

| Projected Remicade Biosimilar Market Value (2035F) | USD 4.10 billion |

| Value-based CAGR (2025 to 2035) | 5.4% |

Infliximab, or remicade, is a medicine used for treating autoimmune disorders such as rheumatoid arthritis, psorisatic arthritis, or Crohn’s disease. In the mentioned disorders, there is a protein named tumor necrosis factor alpha (TNF-aplha), which causes inflammation. Remicade stops the activity of this protein, and hence prevents inflammation.

Moreover, drugs that show activity similar to Remicade are called Remicade biosimilars. These drugs are licensed and approved by the USA FDA and European Medicine Agency (EMA). They show no difference in their activity from the original Remicade. Remicade biosimilars act like a savior for the people who cannot afford the original remicade.

Rising Research on Rheumatoid Arthritis to Increase Product Demand

| Attributes | Details |

|---|---|

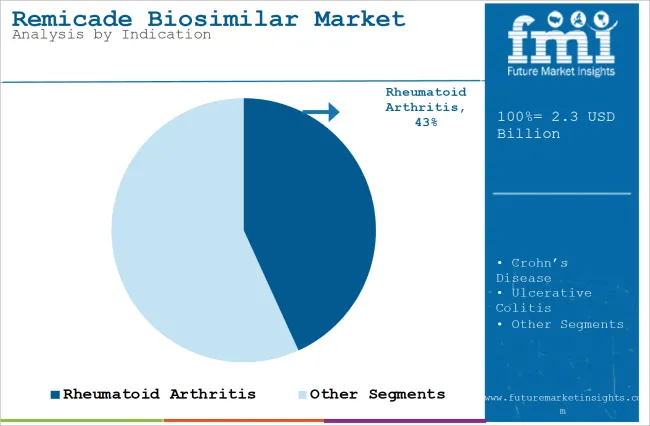

| Top Indication Type | Rheumatoid Arthritis |

| Market Share in 2025 | 43.2% |

In terms of indication, the market is divided into Crohn’s disease, psoriatic arthritis, rheumatoid arthritis, ulcerative colitis, plaque psoriasis, and ankylosing spondylitis. The rheumatoid arthritis segment is likely to capture 43.2% market share in 2025. The rising occurrence of the disease is leading to an increasing need to find better and effective options to treat it.

The orginal remicade, infliximab, is generally the prescribed medicine for rheumatoid arthritis, which requires treatment for a long period of time. In this regard, biosimilars prove cost effective and affordable solutions for a large number of middle-class patients.

Not only for patients, but they are also effective for markets that have lower budgets and are in a developing stage. Moreover, research on rheumatoid arthritis is being conducted since a long time, which has progressed further research on biosimilars.

Availability of Skilled Professionals in Hospital Pharmacies to Propel Product Adoption

| Attributes | Details |

|---|---|

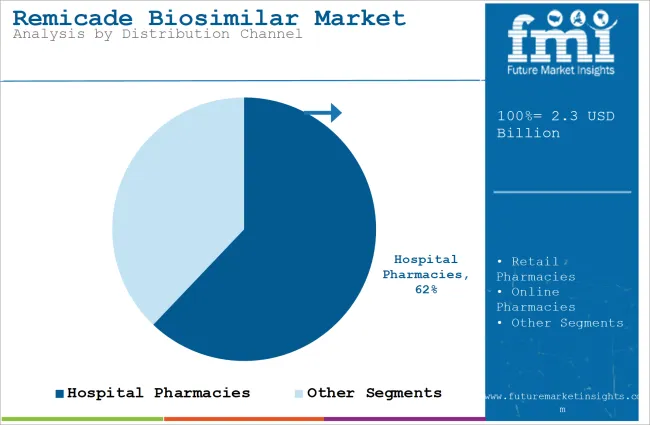

| Top Distribution Channel Type | Hospital Pharmacies |

| Market Share in 2025 | 62.1% |

By distribution channel, the market is divided into online pharmacies, hospital pharmacies, and retail pharmacies. The hospital pharmacies segment held 62.1% share in 2025, driven by availability of skilled healthcare professionals in multispecialty hospitals. In such hospitals, treatment processes such as administration of an IV or facilities to admit the patients are easily accessible.

Storage of medicines can be done easily as well, as hospitals have refrigerators and cold storages of a high quality. Additionally, these facilities have the availability of a highly trained staff for handling and storing the drugs.

The number of patients visiting the hospitals is high in volume, which is further responsible for hospital pharmacies holding a lion’s share. Because hospitals have high demand for medicines, the hospital pharmacies also have tie-ups with manufacturers directly, and can get the biosimilars at lower prices.

Usage in Emerging Markets to Foster Product Sales

Biosimilars have seen widespread adoption in developed economies, including Europe, North America, and others. Now, they are also getting adopted in emerging markets of China, South Korea, Brazil, and India due to uptake by governments in national healthcare programs to decrease costs. Additionally, rising demand for affordable treatment is favouring its bulk adoption in areas where traditional medications were more common.

Huge Therapeutic Applications to Drive Product Demand

Infliximab biosimilars are indicated for autoimmune disorders, including Crohn’s disease, ulcerative colitis, and rheumatoid arthritis. Current research is boosting its applications in other immune-mediated disorders. They are also being prescribed by physicians in off-label settings, where there is a cost constraint.

Switch Toward Subcutaneous Formulations to Expedite Demand

Subcutaneous formulations of infliximab biosimilars are being innovated by market players. Thus, they are offering a substitute to the conventional intravenous infusion. These alternatives are being more patient-friendly and are convenient. Additionally, they ensure adherence and decrease the requirement for infusion centers.

Growing Payer-driven Substitution to Lead to Market Growth

Payers are increasingly replacing branded Remicade with biosimilars such as Avsola, Renflexis, and Inflectra to decrease the cost of treatment. Moreover, biosimilars are also getting adopted due to favourable reimbursement policies. This factor is boosting the market share.

Decrease in Prices of Biosimilars to Create Demand

The market is observing intense competition and many biosimilars are making their entry to the market. Additionally, due to a significant decrease in prices, these medications are becoming widely accessible to cost-sensitive healthcare settings and patients. Moreover, the rising awareness about the benefits of these products is also contributing to their demand.

Quick Regulatory Approvals to Impel Market Revenue

The regulatory clearance process for biosimilars is becoming more efficient and rapid, which is leading to increased market entry. Additionally, harmonized guidelines are being implemented by areas such as the Middle East and Asia to increase the adoption of biosimilars. the rising incidence of autoimmune disorders has compelled governments to take active efforts for the fast approval of medications.

Remicade, or its biosimilars can only be administered through intravenous infusion, or IV. The reason why remicade biosimilars are administered through IV, is that the medicine consists of certain antibodies, which are large protein molecules. On consuming the drug through the oral route, the strong acids in the stomach breakdown the protein molecules that they encounter. Digestion of these antibodies makes them ineffective.

Due to these reasons, direct administration of the drug into the bloodstream is necessary, so that the antibodies do not breakdown, and can effectively target the protein TNF-alpha. However, there are several cases where intravenous infusion method does not seem effective.

One of the main reasons for this is difficulty in finding the blood vessels. Additionally, many times patients are not comfortable with the insertion of needles during intravenous infusions. Hence, it becomes important to come up with other ways of administering the medicine. Thus, the development of biosimilars that can be taken orally is boosting the remicade biosimilar market ahead.

A Trend Toward Affordable Treatments

Autoimmune disorders can be seen prevailing in different countries. However, cost and affordability of medicines create an issue. Not all countries have rich citizens, and if people belonging to the middle class get affected by the mentioned disorders and are left untreated, they end up losing their lives.

Additionally, the original remicade is around 20% more expensive than biosimilars. Thus, even in the developed regions such as the USA and Europe, biosimilars are produced owing to a demand for affordable treatment.

Another factor behind the increased production of biosimilars is the ability of the human body to resist the original remicade with prolonged use. Biosimilars, despite showing similar efficacy as that remicade, can prevent this resistance to the medicine by the body.

Moreover, there is intense competition between different companies, and different biosimilars are entering the market. Increasing competition is leading to price drops and increased affordability. Now, the drugs are being approved faster and entering the market quickly.

Difficult Intake Procedures May Hamper Market Growth

Remicade and its biosimilars need to be inserted only through intravenous infusion. It is not possible to ingest the drugs orally, as the proteins might get digested by gastric juices in the stomach.

By the time oral tablets of remicade biosimilars are not manufactured, treating patients with it is going to be challenging. The reason is that it is difficult to find the blood veins in some patients, and some patients are scared of needles.

High Costs May Hinder Product Adoption

Although remicade biosimilars are lower in price, many times they are just a notch lesser in price than the original remicade. As different companies set prices for their drugs, they also keep high profits in their mind, and a high competition among countries might also lead to prices going up, rather than going down. Profit margins can be affected with pricing pressure.

Profits would also get hampered as more rigorous, time consuming, and expensive clinical trials need to be conducted. Additional costs need to be beared for filing patents, and this would further lead to delayed launch of remicade biosimilars.

With the key patents of remicade getting expired, the USA is working on the production of remicade biosimilars. Some examples of the remicade biosimilars are Inflectra and Renflexis.

They are affordable for ordinary people, and have prices lower than the original product. A rapid growth is seen in the sales of biosimilars in the USA market. Moreover, the USA region is set to grow at a CAGR of 2% during the forecast period. Canada, on the other hand, is expected to grow at a 3.5% CAGR during the forecast period.

Germany

Biosimilar market in Germany, which is set to grow at a CAGR of 2% during the study period, is one of the largest in the Europe. In the country’s healthcare industry, usage of biosimilars is being encouraged. Germany has also made it mandatory to use biosimilars, and hence high expenses incurred in original remicade are being avoided.

Patients and healthcare providers are highly accepting this, and hence the usage of biosimilars is getting promoted. Moreover, a significant population of patients suffers from autoimmune conditions, with rheumatoid arthritis being one of the common ones. Doctors in Germany prescribe biosimilars for such conditions, which reduces the financial burden.

Thus, a rising popularity of remicade biosimilars is driving the remicade biosimilar market ahead. The trust factor is increasing for remicade biosimilars owing to their positive effects, which is further boosting awareness among people.

UK

In the UK, the National Health Service has come up with strategies for increasing biosimilar adoption in the healthcare market. The country is set to show a CAGR of 2.3% during the forecast period. There are several initiatives that are being taken up for saving costs and provide quality healthcare at lower prices.

This is substantially increasing the growth of this market in the UK Physicians are accepting remicade biosimilars increasingly, as positive effects and reviews from the treated patients are being reported.

France

The market in France is set to register a CAGR of 3.3% during the forecast period. This can be credited to a favorable regulatory ecosystem for biosimilars, which is encouraging their usage to manage healthcare expenditures. Additionally, in clinical practices, infliximab biosimilars have witnessed a huge adoption.

India

India is set to observe a CAGR of 7.2% during the forecast period. The prevalence of conditions such as inflammatory bowel disease, Crohn’s disease, or ulcerative colitis is quite high in India. Additionally, there is a large population that lies in the middle-class income group. Due to this, there is a rising need for cheaper medications.

With more population and more diseases, the demand for biosimilars will be ever increasing in India. Government is also coming up with several policies and schemes to provide medicines at lower and affordable prices for lower income groups. Due to this, biosimilars will be available not only in tier-1 cities, but also tier-2 and tier-3 cities.

Japan

Japan has a growing population that is aging. The country also has an increased number of autoimmune diseases. For combating these diseases, there is a need for affordable and pocket-friendly remicade biosimilars. For making them more affordable, government of Japan is implementing policies in order to facilitate the use of biosimilars, fueling market growth.

Considerable innovations are being witnessed in the market as companies focus on differentiating their products while addressing issues. Celltrion Healthcare is leading since it has created subcutaneous formulations of infliximab biosimilars, offering a more patient-friendly option to conventional IV infusions.

Likewise, Samsung Bioepis is emphasizing next-generation biosimilars with improved efficacy and stability. On the other hand, Pfizer deploys digital health solutions to enhance patient monitoring and treatment adherence. Moreover, clinical trials are also being conducted by players to expand therapeutic indications, emphasizing to position their products as versatile substitutes to branded ones.

Several companies are working tirelessly to make remicade biosimilars easily affordable. New innovations are continuously under progress. The main focus of companies is to understand the demand of their customers in order to maximize the profits by delivering biosimilars of the best quality.

So, companies such as Celltrion Healthcare are developing biosimilar tablets that can be consumed orally. They are also developing biosimilars that can be given to the patient through the subcutaneous delivery method, which means the medicine is injected in the fatty tissue below skin.

This is useful for patients who are overweight, or have problems with locating blood vessels for IV. Several other key companies are showing their expertise and advancement in medical science to manufacture biosimilars of the best quality.

| Company | Area of focus |

|---|---|

| Pfizer Inc. | Integrating digital media in healthcare to improve patient monitoring |

| Celltrion Healthcare | Leading in developing biosimilars that can be administered subcutaneously |

| Merck & Co., Inc. | Working on co-developing several oncology compounds |

Based on indication, the remicade biosimilar market is segmented into Crohn’s disease, rheumatoid arthritis, ankylosing spondylitis, psoriatic arthritis, ulcerative colitis, and plaque psoriasis.

By distribution channel, the market is divided into retail pharmacies, online pharmacies, and hospital pharmacies.

The market size is estimated at USD 2.32 billion in 2025.

By distribution channel, the hospital pharmacies segment leads the market.

Some of the major product manufacturers are Pfizer Inc., Celltrion Healthcare, Samsung Bioepis, and others.

The USA, which is set to record 2% CAGR during the assessment period is a key hub for major companies.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biosimilar Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Biosimilar Contract Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Biosimilar and Biologics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Insulin Biosimilar Market Report – Growth & Forecast 2024-2034

Global Psoriasis Biosimilars Market Analysis – Size, Share & Forecast 2024-2034

Interchangeable Biosimilars Market

Middle East & Africa (MEA) Biologics and Biosimilar Market Analysis by Drug, Drug Class, Dosage Form, Indication, Distribution Channel, and Country through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA