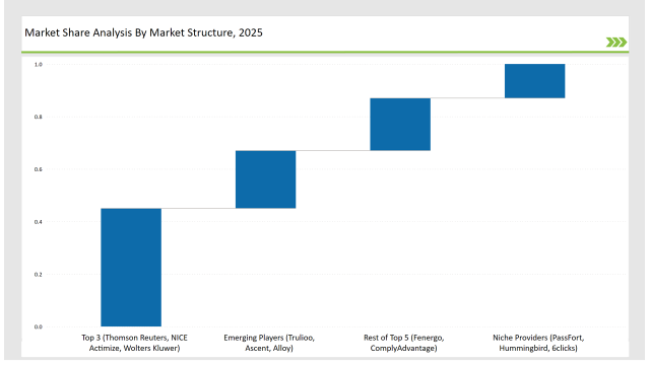

The regulatory technology (regtech) market is growing rapidly, while an increasing amount of organizations embrace digital solutions to improve compliance with regulations, decrease the risk to finances, and heightened data security. In fact, the market share of the top 3 vendors - Thomson Reuters, NICE Actimize, and Wolters Kluwer - accounts for about 45% of the overall market, providing AI-powered compliance management, risk assessment solutions, and fraud prevention tools.

Fenergo and ComplyAdvantage, among the others in that top 5, own the other 20%, targeting customer due diligence (CDD), anti-money laundering (AML) compliance, and real-time transaction monitoring. For instance, emerging players like Trulioo, Ascent, and Alloy, who focus on AI-driven regulatory reporting, automated KYC, and identity verification solutions together constitute 22% of the market.

This only tells half the story, as 13% is taken by niche providers such as PassFort, Hummingbird, and 6clicks which cover highly specific use cases around regulatory reporting automation, fraud detection, and GRC (Governance, Risk, and Compliance) solutions powered by AI.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

| Category | Industry Share (%) |

|---|---|

| Top 3 (Thomson Reuters, NICE Actimize, Wolters Kluwer) | 45% |

| Rest of Top 5 (Fenergo, ComplyAdvantage) | 20% |

| Emerging Players (Trulioo, Ascent, Alloy) | 22% |

| Niche Providers (PassFort, Hummingbird, 6clicks) | 13% |

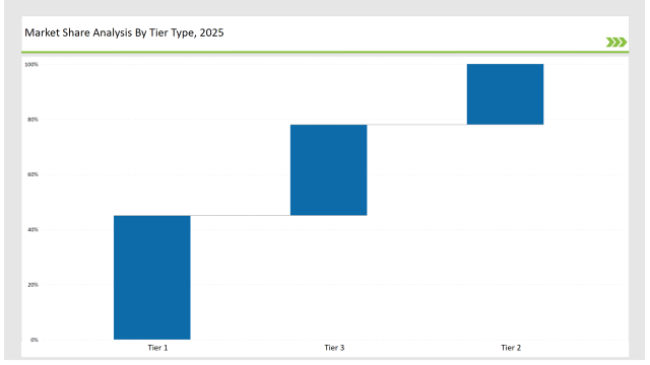

The RegTech market is moderately consolidated, with top players controlling 45-65% of the industry. While Thomson Reuters and NICE Actimize lead the market, mid-sized vendors introduce cutting-edge innovations tailored for startups and financial institutions.

The Software segment leads the market with a 65% share, driven by increasing automation in compliance management and risk assessment. NICE Actimize and Thomson Reuters dominate this segment with AI-powered compliance monitoring and fraud detection solutions.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

AI-Driven Compliance Automation

RegTech solutions utilize AI to offer real-time tracking of financial transactions, automated risk assessments, and regulatory reporting. Machine learning techniques enable AI-powered fraud detection algorithms to learn from historical data, identifying sophisticated fraud patterns while minimizing false positives.

Blockchain-Based Regulatory Reporting

Blockchain technology is utilized by financial institutions to maintain immutable records of regulatory filings, enhancing transparency and accuracy in audits. Blockchain is being utilized in industries including banking, insurance, and healthcare for automating compliance monitoring and fraud detection.

Cloud-Based Risk Assessment Solutions

cloud-based infrastructure to delivery real-time analytical insights, automated alerts, and AI-driven risk analytics, regulatory compliance platforms are honing down and editing their approach to fit. This move increases scalability, security, and ability to adapt to evolving regulations.

Biometric & Digital Identity Verification

Biometric authentication, AI-led KYC solutions are embedded by RegTech companies to make identity verification and fraud detection seamless. Such compliance solutions are beneficial for customers as they enhance customer trust and help prevent financial fraud.

Regulatory Sandboxes & Real-Time Compliance

Regulatory authorities and governments partner with RegTech companies, creating regulatory sandboxes where FinTech startups can run compliance operations in a controlled setting. These tools also help businesses stay compliant with rapidly evolving regulations.

| Tier | Tier 1 |

|---|---|

| Vendors | Thomson Reuters, NICE Actimize, Wolters Kluwer |

| Consolidated Market Share (%) | 45% |

| Tier | Tier 2 |

|---|---|

| Vendors | Fenergo, ComplyAdvantage, Trulioo |

| Consolidated Market Share (%) | 22% |

| Tier | Tier 3 |

|---|---|

| Vendors | Ascent, Alloy, PassFort, Hummingbird, 6clicks |

| Consolidated Market Share (%) | 33% |

| Vendor | Key Focus |

|---|---|

| Thomson Reuters | AI-powered compliance automation and predictive risk analytics. |

| NICE Actimize | Machine learning-driven fraud detection and AML solutions. |

| Wolters Kluwer | Blockchain-integrated regulatory reporting and compliance tools. |

| Fenergo | AI-driven customer due diligence and financial crime risk assessment. |

| ComplyAdvantage | Real-time transaction monitoring with AI-powered alerts. |

| Trulioo | Digital identity verification and biometric authentication. |

| Ascent | AI-powered regulatory compliance automation. |

| Alloy | Risk-based fraud prevention and compliance screening. |

RegTech vendors focus on refining AI-driven risk assessment models to help proactively flag regulatory breaches. For example, automating compliance workflows - including AI-enhanced AML alert systems and real-time fraud detection - will make it easier to operate a financial institution.

RegTech platforms on the cloud will continue to lead and you will see several of them connect with CRM, ERP and even banking systems links and help in mitigating threats in real-time. As for the emerging market segment, they have immense opportunities to expand into emerging markets, while the vendors are already at the centre of multilingual compliance monitoring and jurisdiction-specific enforcement tools.

Leading vendors Thomson Reuters, NICE Actimize, and Wolters Kluwer hold 45% of the market.

Emerging players such as Trulioo, Ascent, and Alloy account for 22%.

Market concentration is categorized as medium, with the top 10 players controlling 45-65% of the market.

Cloud-based platforms dominate the market, offering real-time risk assessment, automated fraud detection, and seamless integration with enterprise systems.

Banking, fintech, insurance, healthcare, and retail industries heavily rely on RegTech solutions for regulatory compliance and fraud prevention.

Vendors must focus on AI-driven compliance automation, expand cloud-based solutions, ensure regulatory adherence, and leverage partnerships with regulatory authorities.

Explore Vertical Solution Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.