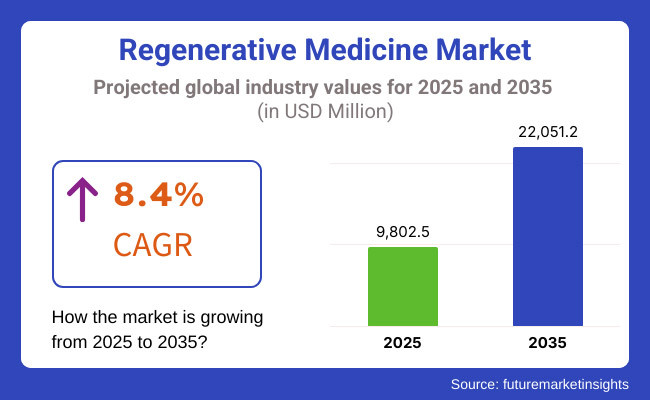

The market is expected to reach approximately USD 9,802.5 million in 2025 and expand to around USD 22,051.2 million by 2035, reflecting a compound annual growth rate (CAGR) of 8.4% over the forecast period. The regenerative medicine market has greatly evolved over the decades and is, therefore, expected to expand between 2025 and 2035.

Pioneering advances in stem cell research, gene therapy, and tissue engineering were the basis of novel treatment approaches that are pushing the industry forward. They have increasingly fueled research and investments into regenerative therapies, while rising incidences of chronic ailments and growing demand for personalized medicine continue being consistent influencers.

In time, the increased scope of clinical trials for cell and gene therapy will have been complemented by progress in scaffolds based on biomaterials for bolstering the market's potential. Major applications in orthopedics, neurology, and cardiovascular disease have also, consequently, spearheaded development in the sector.

Development costs have continued to be high, as have ethical and regulatory hurdles that market players meet. Though, progressive technology has continued to make possible breakthroughs; for instance, 3D bioprinting has made an emergent breakthrough in tissue engineering.

Growing relationships between the public and private sectors have expedited research and commercialization efforts. Advancements in regenerative drug delivery systems have enhanced patient outcomes. As the market enters another phase of development, these historical trends provide a solid basis for future development and make regenerative medicine the change agent in medicine.

From 2020 to 2025, the regenerative medicine market grew rapidly with developments in stem cell research, gene therapy, and tissue engineering. The rising prevalence of chronic diseases and increasing demand for personalized medicine propelled investments in regenerative therapies.

The period also witnessed a vast rise in clinical trials for cell and gene therapies, which resulted in the launch of new products. Advances in biomaterial-based scaffolds have largely improved tissue regeneration applications, especially in orthopedics, neurology, and cardiovascular diseases. However, the current and future market growth faced obstacles of high development costs, ethical issues, and rigid regulatory hurdles. Public-private partnerships, nonetheless, have skyrocketed, speeding up research and commercialization activities.

Further, the coming of 3D bioprinting has transformed tissue engineering, while advancements in regenerative drug delivery systems improved therapeutic success. As the landscape of industry embraced the road to 2025, these achievements set up an architectural framework for sustained market growth wherein more innovations and extensive clinical acceptance of regenerative medicine are anticipated.

Explore FMI!

Book a free demo

Strong research and development investments programs and favorable regulatory frameworks besides the well-established health care infrastructure are driving the regenerative medicine market in North America. The United States is the dominant country in the region with a massive stem cell and gene therapy research funding, personalization of medical applications, and increasing approvals of cell-based therapies on board.

Besides these, the innovation train is being revved by advances in 3D bioprinting and the expansion of regenerative applications in orthopedics and neurology. However, challenges such as the high cost of treatment, complexity of reimbursement issues, and standards concern over stem cell research persist.

Increasing commercialization of regenerative therapies, the emergence of clinical trial networks, and the fusion of AI-powered drug discovery are the major driving forces on the way to more market growth in North America.

Europe happens to be a key market for regenerative medicine, where positive government policies, growing levels of research funding, and widespread academic collaboration draw new investments into the industry. The UK, together with Germany and France, is a considerable share of the market mainly owing to the EMA's attempts at fast-tracking the regulatory pathway for advanced therapies.

Some of the factors that could possibly hinder market expansion are regulatory challenges, high manufacturing costs, and a sparse reimbursement outlook for regenerative therapies. Increasing implementation of cell and gene therapy, newly formed research hubs in regenerative medicine by various institutions, and increasing investments into biopharmaceutical partnerships are changing the European market landscape.

On the other hand, the advent of newer biomaterials, together with increasing emphasis on regenerative therapies for degenerative diseases, is improving service delivery and clinical efficacy.

Basically, the demand for regenerative medicine has been rapidly increasing in the Asia-Pacific region, hash traditional fast growth in the region. It can be due to the heavy investments made in healthcare, the momentum it gave to stem cell research, and an increasing demand for advanced therapies. The market opportunities with regard to these developments in the region would include countries such as China, Japan, and South Korea.

These countries all have an expanding biopharmaceutical industry, supported by governments with strong funding in R&D to promote regenerative medicine and facing increasing approvals for cell-based therapies. Still, entry barriers provided by disparate regulatory frameworks, weak sometimes clinical trial infrastructure, and possibly considerations of affordability might dampen market entry.

An increasing number of international regenerative medicine firms, the developing applicability of regenerative therapy for aging-related diseases, and an integration of AI-driven regenerative diagnostics buoys the market. Moreover, intensive collaboration between global biopharma companies and regional research institutes is speeding up the novel regenerative treatment development.

Challenges

Challenges Hindering the Adoption and Expansion of Regenerative Medicine Market

Regenerative medicine faces several challenges in the market, including high development and manufacturing costs, long regulatory approvals, and ethical issues associated with stem cell research. Moreover, market uncertainty has proliferated because of the large scalable production of cell-based therapies, the absence of standardized clinical protocols, and patient safety.

Reimbursement policies vary greatly across regions in regenerative treatment, thus restricting patient access to advanced therapy. These are some of the height barriers that present obstructing potentials to growth in the market, and clinical trials keeping long-term efficacy and safety data with immune-rejection risk and tumor formation slightly add to such barriers.

Opportunities

Expanding Regenerative Medicine Frontiers: Innovations in Bioprinting, Next-Generation Gene Therapies, and Advanced Stem Cell Applications

It includes increases in the recognition of 3D bioprinting; increasing building and establishing stem cell banks; and increased investments that result from growing private and public excitement in gene editing. Other aspects include the generation of commercial cell therapies that will be available off the shelf, advancements in nanomedicine for regenerative applications, and improved studies in bioengineered tissues for transplantation.

All of these matter in combination to propel growth. The increased push towards regulatory harmonization, improving accessibility of GMP compliance in manufacture plants, and further extending applications of personalized medicine into regenerative therapies will create new innovative avenues for players in the industry. Increased collaboration among biotech companies and academic institutions, joined by government agencies, should also push research forward and into the commercialization of regenerative treatments.

Advancements in Stem Cell and Gene Therapies

The new opportunity of CRISPR gene-editing technology, induced pluripotent stem cells (iPSCs), and autologous stem cell therapies indeed transforms the landscape of regenerative medicine. The new possibilities would likely open up in genetically disordered patients because of precise genetic modifications and thus lead personalized medicine.

iPSCs which can be differentiated mostly into all cell types are expected to advance the areas of disease modeling, drug testing, and also regenerative uses, which in turn are expected to diminish the reliance on stem cells derived from the donors. Nevertheless, autologous stem cell therapies use the patient's own cells and therefore are most likely to result in minimal immune rejection and also improvement in therapeutic effects when it comes to conditions like neurodegeneration, cardiovascular disorders, and musculoskeletal injuries.

Together, they pave new pathways in treating diseases that were thus far non-treatable using innovative therapies. However, regulatory complexities as well as ethical dilemmas and scalability hurdles remain to be tackled. Enhanced methods for differentiating cells and optimizing manufacturing will further refine gene editing so that regenerative medicine will eventually be widely adopted as research intensifies toward better patient care outcomes.

Growth of 3D Bioprinting and Tissue Engineering

The incredible effectiveness of regenerative medicine has been made possible by the developed 3D bioprinting and applications into tissue engineering, building complex tissues and organs for transplantation. 3D bioprinting has been set up to enable biomaterials along with the living cells and growth factors to build a tissue functionally, thus possibly being the answer to organ shortage in the future and decreasing dependence on donor transplant.

Innovations in developing bioinks and scaffold-free approaches have enhanced cell viability and tissue integration and, therefore, increased this likelihood with personalized medicine applications. Innovations in developing bioinks and scaffold-free approaches have enhanced cell viability and tissue integration and, therefore, increased this likelihood with personalized medicine applications.

Tissue engineering has seen incredible advances in regenerative therapies for skin grafts, cartilage repair, and vascular reconstruction according to the patients suffering from severe injuries or degenerative conditions hence creating new avenues. However, advances like these-in fact, like all great potential-tend to face their own challenges in terms of vascularization, functionality over the long term, and regulatory approval.

Thus, more promises are expected to emerge from increased attention to biomaterials, bioreactor technologies, and artificial intelligence interface that can potentially foster faster development towards the clinical translation of yet to be-certified 3D bioprinted tissue solutions-much an important force for the future breakthroughs in regenerative medicine.

Regenerative medicine market is booming, and it will grow between 2020 and 2024 due to the increasing incidence or suspected chronic diseases, progressive disorders, and chronic organ failures demanding more advanced solutions in medicine. Innovations in stem cell therapy, gene editing, and tissue engineering perceived as alternatives for classical approaches have caused demand for regenerative therapies to rise significantly.

Besides, the ongoing expansion of the cell and gene therapy trials, which include CAR-T cell and CRISPR gene editing, in addition to their regulatory approval processes, gives that extra support for widespread acceptance of this market. Development in therapies also led to improvement in the therapeutic efficacy in orthopedics, neurology, and cardiovascular applications. Further on, biomaterials and scaffold-based tissue regeneration applications proliferated.

Also, the compatible reimbursement schemes and capital infusions into the regenerative biopharmaceuticals have gotten stimulated in increased accessibility to novel therapeutic modalities.

The change is fast coming by the years 2025 to 2035, with revolutionary treatment options from precision medicine and next-generation gene therapies being very personalized and effective. The coming of 3D Bioprinting is determining the future of systems for the regeneration of tissues and organs with a much-reduced dependency on donor transplants.

Meanwhile, novel regenerative therapies are quickened by AI-enabled drug discovery and computational modeling as treatment outcomes are optimized. Furthermore, greater affordability by these innovations will come from higher penetration of biosimilars and cheaper regenerative medicines for emerging markets.

Integration of digital health through remote patient monitoring and AI-based diagnostics will render adherence to long-term regenerative treatments smoother. This will position regenerative medicine at the helm of dictating the future of personalized and curative healthcare.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | The regulatory landscape prioritizes very seriously the safety and efficacy of regenerative therapies so that regulatory bodies speed up approvals for therapies targeting unmet medical needs. |

| Technological Advancements | Technological Development The progressiveness in stem cell and gene therapy broadened the specificity and the potency of treatment that could offer better outcomes for patients undergoing those kinds of therapy. |

| Consumer Demand | Consumer Need Further heightened awareness translates into increased demand for effective and easily accessible regenerative treatments-the patients are now opting for therapies that promise better quality of life and disease management. |

| Market Growth Drivers | Market Growth Drivers Increasing incidences of chronic diseases, large investments in research and development, and government backing policies that promote innovation in therapeutics contribute to the overall market growth. |

| Sustainability | Sustainability Pollution prevention initiatives as a start towards eco-friendly manufacturing processes of pharmaceuticals and a reduction in the environmental effects of their production, and some companies are applying green chemistry in their practices. |

| Supply Chain Dynamics | Supply Chain Dynamics They rely on established distribution networks, which theoretically should be able to ensure that therapies are widely available in urban and peri-urban healthcare facilities. This often proves hard to accomplish in reaching remote communities. Digitization of supply chains through e-commerce platforms could make supply chains much more transparent, efficient and accessible in time delivery of therapies to a global patient population, including some living in remote and underserved areas. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Development of general guidelines for personalized medicine and advanced therapeutic modalities should allow for standard protocols as well as patient safety. |

| Technological Advancements | Not only that, but also a major boost is into the application of artificial intelligence and machine learning in the drug discovery and development process, resulting in attaining new therapeutic targets and optimizing treatment regimes. |

| Consumer Demand | Patients would prefer individualized treatment strategies, coming together with healthcare practitioners to customize their therapies using the patient's unique genetic profile and disease characteristics as guiding factors. |

| Market Growth Drivers | Embracing opportunities in the emerging markets with developing health care systems, increasing focus on early diagnosis and intervention, and strategic partnerships between pharmaceutical companies and research institutions foster innovation. |

| Sustainability | Adoption of sustainability practices in all dimensions, from the usage of biodegradable materials and energy-efficient manufacturing processes to initiatives of creating reduced carbon footprints by drug development and distribution. |

| Supply Chain Dynamics | Optimization of supply chains through digital technologies and e-commerce platforms, enhancing transparency, efficiency, and accessibility, ensuring timely delivery of therapies to a global patient population, including those in remote and underserved regions. |

Market Outlook

The regenerative medicine market in the United States has robust growth owing to advances in cell and gene therapies; the enormous burden of chronic diseases such as diabetes and cardiovascular ailments; and colossal investments being made by many research and development organizations into regenerative medicine. Strategic partnerships between pharmaceutical companies and research institutions foster innovation in United States.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 6.9% |

Market Outlook

The regenerative medicine market in India is expected to experience prolific growth due to increased investments in healthcare, greater awareness of advanced therapies, and a rising burden of chronic diseases. The market is further flourish with the innovations and measures towards faster approval of new therapies.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 4.8% |

Market Outlook

In the rapidly developing field of regenerative medicine in China, the major drivers are strong government support, tremendously large patient population, and well progressing biotechnology sector. Numerous policies have been adopted with widespread funding and relaxed regulatory pathways to speed up advances in cell and gene therapies.

Heavy density of population along with high prevalence of chronic diseases creates tremendous demand for the advanced regenerative applications.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 4.8% |

Market Outlook

Market for Germany's regenerative medicine sector is likely to witness a steady growth in future, backed by its strong healthcare system, substantial R&D activities and enabling regulatory frameworks. The increasing population of elderly people in the country would increase the demand for therapies for age-related conditions among others.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 4.8% |

Market Outlook

Increasing resilience in the Nigerian regenerative medicine market is caused by increased government healthcare investments, increased prevalence of chronic diseases, and increased application of advanced stem cell therapies within the country. In this country, developments such as CRISPR-edited allogeneic stem cells, AI-assisted donor matching for precision medicine, and improved cryopreservation technologies for long-term storage of cells taking place as developments.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 4.8% |

Stem Cell Therapy - Allogeneic Stem Cell Therapy Leads In the Regenerative Medicine Market Due To Its Scalability

Allogeneic stem cell therapy has seemed to be one of the most common and rapidly evolving branches of Regenerative Medicine, especially in areas relating to oncology, musculoskeletal disorders, and disorders of the immune system. This kind of therapy has the grafts from a donor who may either match genetically or be completely unrelated to the recipient, thereby enabling certain conditions, such as these examples herein that follow: leukemia, lymphoma, or certain types of genetic disorder-to be cured.

Increases in hematological cancers, the establishment of stem cell banks, and the heightened number of studies into immune tolerance mechanisms are some major growth factors for the market. In North America and Europe, these therapies have found more acceptance than in Asia-Pacific, where investment into stem cell research programs and government-supported stem cell therapy programs is witnessing a rapid growth.

Some of the new avenues include CRISPR-edited allogeneic stem cells, AI-assisted donor matching for precision medicine, and improved cryopreservation technologies for long-term storage of cells.

Gene Therapy Leads Due To Its Potential To Provide Long-Lasting Or Curative Treatments

Gene therapy, in modern times, substitutes faulty genes to treat genetic diseases or cancers and other long-term diseases, is certainly a modern area of regenerative medicine. Gene therapy human clinical trials are designed for spinal muscular atrophy, hemophilia, and inherited retinal diseases and cover various gene-delivery strategies such as viral vectors, CRISPR gene-editing technologies, and RNA interference (RNAi) therapeutics.

The increase in the approval of these therapy products, a lot of money invested in next-generation gene editing tools, and precision medicine's ever-increasing demand propel the gene therapy market. Most large clinical trials and approvals for gene therapies come from North America and Europe, but now the Asia-Pacific region has almost emerged as a major contender with several governments lending support to gene therapies.

Expected trends include: AI-designed gene therapies; next-generation viral vectors designed to direct genes into target cells; and ex vivo gene therapy, considered somewhat more efficient and a safer alternative.

Musculoskeletal Disorders Lead Due To The High Prevalence Of Osteoarthritis

Cell and tissue engineering procedures provide another possibility for the treatment of musculoskeletal disorders, such as degenerative diseases like osteoarthritis, ligament sprains, and fractures, in regenerative medicine.

Success is being seen in stem cell-based therapies and tissue engineering strategies towards regenerating cartilage, bone defect repair, and joint function recovery. Market driving factors are an expanding aging population, rising incidence of sport injuries, and increased acceptance towards orthopedic regenerative treatments.

Musculoskeletal regenerative therapies are available in North America and European markets while Asia-Pacific is commencing with advancing awareness toward orthopaedics and advancement in 3D bioprinting for bone and cartilage regeneration. Future innovations may include AI-powered personalized joint regeneration therapy, biocompatible implants based on 3D printing, and regeneration treatments on exosomes to facilitate quick healing.

Oncology Leads Due To the Success of Gene and Cell Therapies

Regenerative medicine has generated great improvement interest in oncology, especially in cell-based immunotherapy development rather than gene therapy or stem-cell transplants.

Personalized cancer treatment, highly specific both against leukemia and lymphoma patients as well as solid tumors, was opened up by CAR-T-cell therapies. Increasing incidence of cancer, further investments for regenerative cancer immunotherapy, and higher acceptance of these ge-modified immune-cell therapies towards precision oncology will fulfill main demand drivers in this respect.

North America and Europe hold the lead for regenerative oncology treatments, while the rapid establishment of cancer treatment centers and regulatory approvals for novel cell-based therapies are rapidly supporting acceptance in Asia-Pacific. Next-generation CAR-T cell treatments promising better targeting of tumors, AI-based predictive oncology models in treatment selection, and gene-edited immune cell therapy for indications in solid tumors will be some of the anticipated opportunities.

The regenerative medicine market is extremely competitive, fueled by advancements in stem cell therapies, gene editing, and tissue engineering. Firms are increasingly investing in cell-based therapies, biomaterials, and novel regenerative techniques to remain competitive. Established biopharmaceutical companies, pioneering biotechnology firms, and aspiring startups are shaping the regenerative treatment landscape together.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Novartis AG | 23.8% - 24.9% |

| Gilead Sciences (Kite Pharma) | 19.8% - 21.2% |

| Bristol-Myers Squibb | 13.3% - 15.5% |

| Organogenesis Holdings | 11.2% - 12.8% |

| Astellas Pharma Inc. | 8.0% - 9.3% |

| Other Companies (combined) | 23.8% - 26.5% |

| Company Name | Key Offerings/Activities |

|---|---|

| Novartis AG | Market leader in cell and gene therapy, including Kymriah for cancer treatment. |

| Gilead Sciences (Kite Pharma) | Specializes in CAR-T cell therapies, offering Yescarta for hematologic malignancies. |

| Bristol-Myers Squibb | Develops regenerative treatments such as Breyanzi, a CAR-T therapy for lymphoma. |

| Organogenesis Holdings | Focuses on regenerative skin substitutes and wound care solutions. |

| Astellas Pharma Inc. | Invests in stem cell therapies and gene editing for regenerative applications. |

Key Company Insights

These include:

The overall market size for Regenerative Medicine Market was USD 9,802.5 million in 2025.

The Regenerative Medicine Market is expected to reach USD 22,051.2 million in 2035.

Rising Prevalence of Cancer has significantly increased the demand for Regenerative Medicine Market.

The top key players that drives the development of Regenerative Medicine Market are Novartis AG, Gilead Sciences (Kite Pharma), Bristol-Myers Squibb and Organogenesis Holdings Astellas Pharma Inc.

Bisphosphonates is expected to command significant share over the assessment period.

Cell Therapy (Autologous Cell Therapy and Allogenic Cell Therapy), Stem Cell Therapy (Allogeneic Stem Cell Therapy and Autologous Stem Cell Therapy), Tissue-engineering and Gene Therapy

Wound Care, Musculoskeletal Disorders, Oncology, Dental, DMD (Duchenne Muscular Dystrophy), Hepatological Diseases, Inflammatory & Autoimmune Diseases and Other Therapeutic Applications

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The Prurigo Nodularis (PN) Treatment Market is segmented by product, and end user from 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.