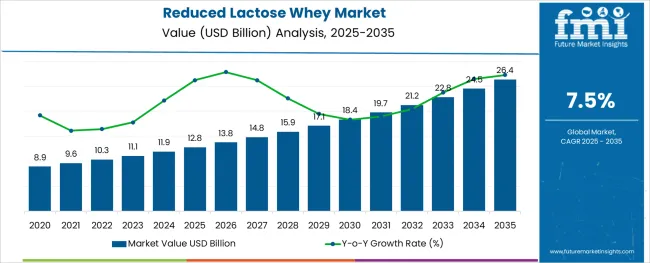

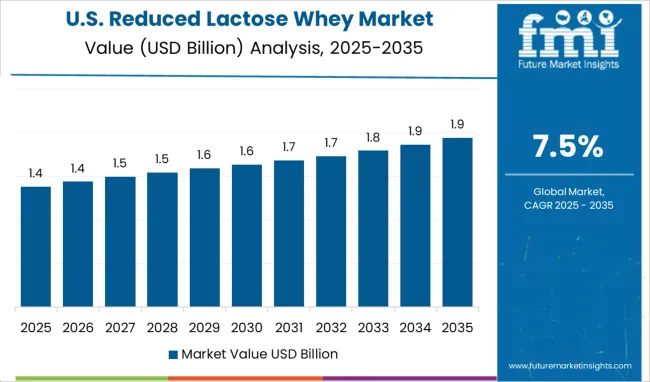

The Reduced Lactose Whey Market is estimated to be valued at USD 12.8 billion in 2025 and is projected to reach USD 26.4 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

The reduced lactose whey market is expanding due to increasing consumer demand for lactose-reduced and lactose-free products driven by rising lactose intolerance awareness and dietary preferences. Nutrition science publications have highlighted the health benefits of reduced lactose products for improving digestive comfort among sensitive populations. Advancements in processing technologies have enabled more efficient lactose removal, improving product quality and taste.

Growing interest in functional foods and clean-label ingredients has also contributed to market growth, as whey is increasingly incorporated into a variety of food and beverage products for its nutritional benefits. The food and beverage sector has adopted reduced lactose whey in dairy alternatives, protein supplements, and bakery applications to meet consumer expectations.

Future market opportunities are expected to arise from innovations in extraction techniques and increased use of whey in sports nutrition and medical nutrition products. Segmental growth is projected to be led by Conventional nature, Filtration extraction method, and the Food and Beverages end-use sector.

The market is segmented by Nature, Extraction, End Use, and Distribution Channel and region. By Nature, the market is divided into Conventional and Organic. In terms of Extraction, the market is classified into Filtration, Precipitation, and Dialysis. Based on End Use, the market is segmented into Food and Beverages, Nutraceuticals, and Household/Retail. By Distribution Channel, the market is divided into Indirect Sales and Direct Sales. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Nature, Extraction, End Use, and Distribution Channel and region. By Nature, the market is divided into Conventional and Organic. In terms of Extraction, the market is classified into Filtration, Precipitation, and Dialysis. Based on End Use, the market is segmented into Food and Beverages, Nutraceuticals, and Household/Retail. By Distribution Channel, the market is divided into Indirect Sales and Direct Sales. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

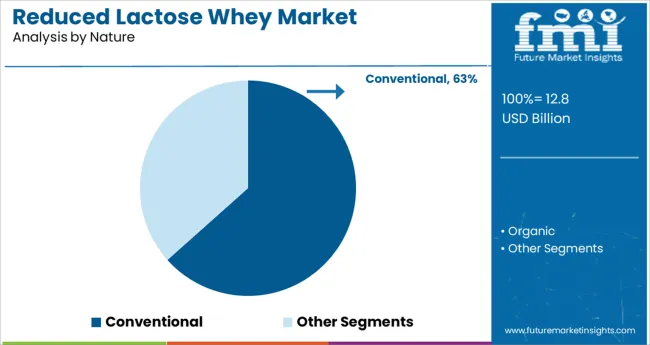

The Conventional segment is anticipated to account for 63.4% of the reduced lactose whey market revenue in 2025, maintaining its position as the leading product nature. This segment’s growth is attributed to the established processing techniques that offer consistent product quality and widespread availability. Conventional whey production methods have been optimized over decades to balance lactose reduction while preserving protein integrity and nutritional value.

Manufacturers and food formulators have favored conventional reduced lactose whey for its reliable functional properties, which support diverse applications in food formulations. Additionally, consumer acceptance has been high due to familiarity and taste profile.

As demand for lactose-reduced ingredients continues to grow in mainstream food products, the conventional segment is expected to sustain its dominant role.

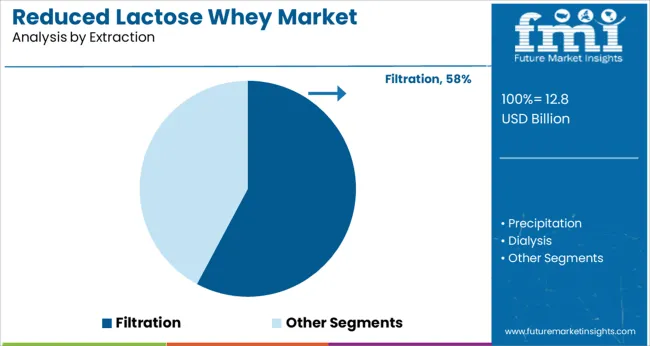

The Filtration segment is projected to contribute 57.8% of the market revenue in 2025, establishing itself as the preferred extraction method. Filtration techniques such as ultrafiltration and microfiltration have been widely adopted for their effectiveness in lactose removal while retaining valuable proteins and peptides. These methods provide efficient processing with minimal impact on flavor and functional properties.

Technological improvements in membrane materials and filtration systems have enhanced process scalability and cost-efficiency. Food industry players have increasingly implemented filtration to meet stringent quality standards and consumer expectations.

With ongoing advancements and cost optimization, filtration is expected to remain the extraction method of choice in reduced lactose whey production.

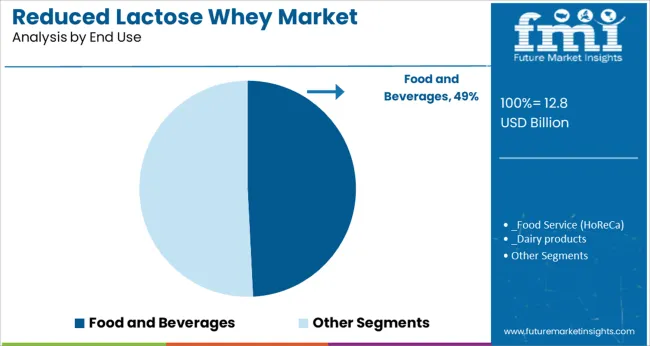

The Food and Beverages segment is projected to hold 49.2% of the reduced lactose whey market revenue in 2025, sustaining its leadership as the primary end-use industry. Growth in this segment has been driven by the incorporation of reduced lactose whey into a wide range of products such as dairy alternatives, nutritional beverages, baked goods, and confectionery.

Consumer trends toward healthier and functional food options have encouraged product innovation using whey ingredients. Manufacturers have leveraged the nutritional benefits of whey proteins along with lactose reduction to cater to sensitive consumer groups.

Additionally, expanding distribution networks and increasing demand for protein-enriched foods have supported the segment’s growth. As clean-label and digestive health become more important to consumers, the Food and Beverages segment is expected to maintain its dominant position.

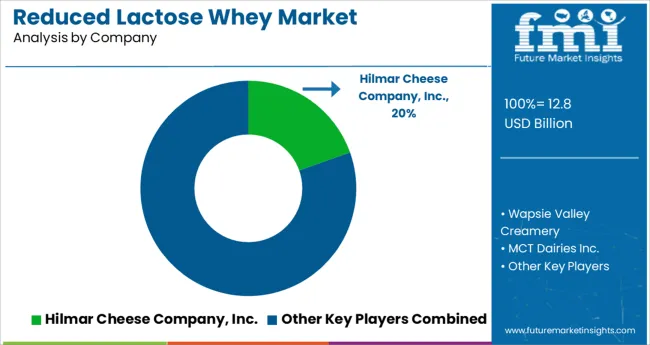

The production of reduced lactose whey is in its early stages, with only a small number of companies producing it. The use of reduced lactose whey in the food industry is increasing because the product is economically viable and also because the lactose content is very low, making it suitable for use in any type of food product, not just dairy products.

Furthermore, the processing of the reduced lactose whey incurs no additional costs, and the lactose is removed using a physical separation technique. As a result, cheese manufacturing companies can produce reduced lactose whey powder at very low production costs, which is in high demand in end-use industries.

The global demand for plant proteins is being driven by rising product demand as consumers become more aware of the importance of eating a healthy diet and leading an active lifestyle.

Furthermore, rising innovations in the manufacturing of proteins that contain a diverse range of amino acids and perform specific functions such as energy balance, weight loss, muscle repair, and satiety by various manufacturers are creating a massive market opportunity for plant proteins. As a result, it directly substitutes animal protein products, slowing the growth of the reduced lactose whey market.

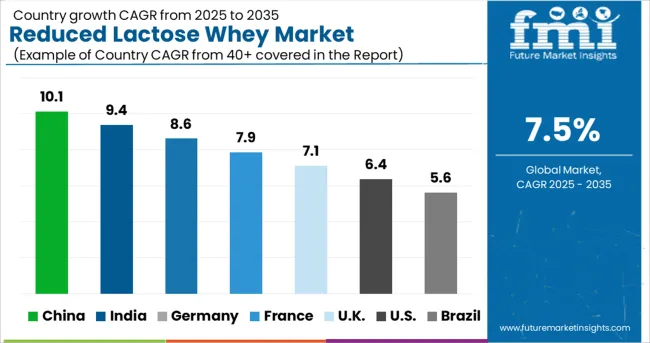

Rising consumer concerns about daily protein intake and rising health awareness are expected to drive demand for reduced lactose whey powders in North America. The convenience and ease of use of reduced lactose whey powders for making protein shakes or blending them with a variety of food products to meet changing consumer tastes and preferences are expected to drive product demand in North America.

The Europe market is expected to grow moderately over the forecast period due to factors such as rising emphasis on healthy living, an increasing trend of preventive health care, and rising demand for reduced lactose whey from the United Kingdom, Germany, and France.

The increased use of protein products in synthetic and naturally derived personal care products is expected to have a positive impact on its market in the coming years. Furthermore, the country's growing number of food processing industries has resulted in large imports of animal proteins, particularly whey protein, in recent years. The trend is expected to continue over the forecast period.

Due to increased exports and domestic demand for dairy-based protein ingredients such as casein and whey, Asia Pacific is expected to grow the fastest. The rising geriatric population and constantly changing climate conditions in emerging countries such as India have raised concerns about skin problems, which are expected to drive personal care product demand and likely augment market growth in the Asia Pacific over the forecast period.

Because of its health benefits, reduced lactose whey is increasingly being used in a variety of food and beverage applications such as dairy, bakery, energy drinks, and confectionery products. Food additives, consumer food, nutraceutical supplements, animal feed, alcoholic drinks, aerated drinks, non-alcoholic drinks, and juices or health drinks are all part of the food industry.

As a result of their various properties of reduced lactose whey, such as their ability to act as a stabilizing agent, flavor enhancer, and emulsifying salt, the food, and beverage sector is expected to drive market demand over the forecast period.

Wapsie Valley Creamery, Inc., Hilmar Cheese Company, Inc., MCT Dairies Inc., G&R Foods Inc., HoogwegtGroep B.V., Grande Cheese Company, Agropur Inc., Graham Chemical Corporation, Fonterra Inc., Interfood Inc., Leprino Foods Company, Dana Foods Inc., and AMCO Proteins are some of the leading players in the global reduced lactose whey market.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 7.5% from 2025 to 2035 |

| Market Value in 2025 | USD 11.07 Billion |

| Market Value in 2035 | USD 22.82 Billion |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Nature, Extraction, End Use, Distribution Channel, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, UK, France, Spain, Italy, Russia, BENELUX, China, Japan, South Korea, GCC, South Africa, Turkey |

| Key Companies Profiled | Wapsie Valley Creamery; Hilmar Cheese Company Inc.; MCT Dairies Inc.; G&R Foods Inc.; HoogwegtGroep B.V.; Grande Cheese Company; Agropur Inc.; Graham Chemical Corporation; Fonterra Inc.; Interfood Inc.; Leprino Foods Company,; Dana Foods Inc.; AMCO Proteins |

| Customization | Available Upon Request |

The global reduced lactose whey market is estimated to be valued at USD 12.8 billion in 2025.

It is projected to reach USD 26.4 billion by 2035.

The market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types are conventional and organic.

filtration segment is expected to dominate with a 57.8% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Reduced Fat Butter Market Size and Share Forecast Outlook 2025 to 2035

Reduced Fat Cheese Market Size, Growth, and Forecast for 2025 to 2035

Reduced Fat Dairy Market Analysis by Ice cream, Yogurt, Skim milk and Others through 2035

Reduced Salt Packaged Foods Market - Health-Conscious Eating Trends 2025 to 2035

Reduced Iron Powder Market Analysis by Product, Application and Distribution Channel Through 2035

Reduced Fat Cheeses Market

Direct Reduced Iron Market Growth – Trends & Forecast 2024-2034

Cholesterol Reduced Butter Market

Lactose-Free Butter Market Size and Share Forecast Outlook 2025 to 2035

Lactose Market Report – Size, Growth & Forecast 2025 to 2035

Lactose Assay Kit Market Size and Share Forecast Outlook 2025 to 2035

Lactose-Free Probiotics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Lactose-free Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Lactose and Derivative Business

Lactose Free Dairy Product Market Outlook – Share, Growth & Forecast 2025 to 2035

Competitive Breakdown of Lactose Providers

Lactose-free Cheese Market Growth - Consumer Trends & Industry Analysis 2025 to 2035

Lactose-Free Probiotic Yogurt Market Trends - Product Type & Sales Insights

Lactose-free Infant Formula Market

Lactose-free Sour Cream Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA