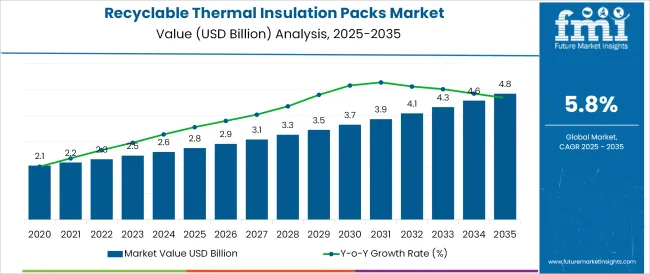

The Recyclable Thermal Insulation Packs Market is estimated to be valued at USD 2.8 billion in 2025 and is projected to reach USD 4.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

The recyclable thermal insulation packs market is witnessing growing demand, driven by increased environmental regulations and the need for efficient cold chain logistics solutions. Industry journals and sustainability reports have emphasized the rising focus on reducing packaging waste in temperature sensitive shipments.

Companies across pharmaceuticals and food industries are increasingly adopting recyclable insulation solutions to align with corporate sustainability goals and regulatory compliance. Technological advancements have improved the thermal performance of eco friendly materials, making them viable alternatives to traditional, non recyclable insulations. Additionally, investor presentations from key packaging companies have highlighted expanding production capacities and collaborative R&D efforts aimed at developing next generation recyclable insulation packs.

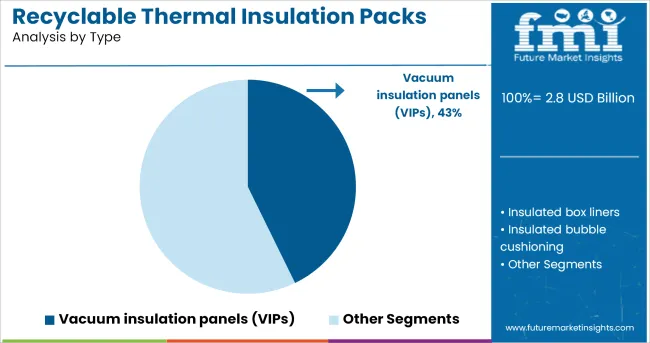

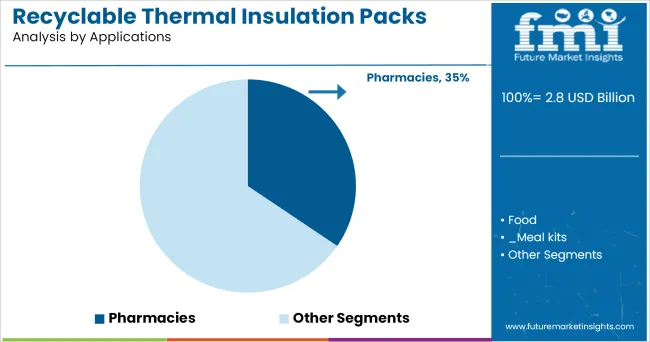

The market outlook remains optimistic as cold chain networks expand globally, supported by the rapid growth of pharmaceutical distribution and e commerce grocery services. Segmental momentum is being led by Vacuum Insulation Panels (VIPs) in the type category, due to their superior thermal resistance, and Pharmacies in the applications segment, driven by stringent temperature control requirements in medication storage and delivery.

The market is segmented by Type and Applications and region. By Type, the market is divided into Vacuum insulation panels (VIPs), Insulated box liners, and Insulated bubble cushioning. In terms of Applications, the market is classified into Pharmacies, Food, Meal kits, Ready to eat packaging, Premium eats, Online grocery packaging, Flower packaging solutions, Pharmaceutical distribution, Diagnostics, Cosmetics, and Animal health.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Vacuum Insulation Panels (VIPs) segment is projected to account for 42.8% of the recyclable thermal insulation packs market revenue in 2025, positioning it as the dominant product type. Growth of this segment has been driven by the high thermal insulation efficiency of VIPs, which has enabled thinner pack designs while maintaining temperature stability over extended periods. Logistics and packaging companies have increasingly favored VIPs for their space saving properties and superior energy retention particularly in long distance cold chain shipments.

Technological advancements in vacuum panel construction and recyclable core materials have addressed earlier concerns regarding environmental impact, enhancing their adoption. Additionally, the pharmaceutical and food industries have adopted VIP based solutions for critical temperature sensitive products where performance reliability is paramount.

As global regulatory frameworks evolve to promote sustainable packaging solutions, the Vacuum Insulation Panels segment is expected to maintain its market leadership, supported by continuous product innovation and expanded application across high value cold chain logistics.

The Pharmacies segment is projected to hold 34.5% of the recyclable thermal insulation packs market revenue in 2025, sustaining its position as the largest application category. Growth in this segment has been driven by the increasing need for reliable thermal packaging in the storage and delivery of temperature sensitive medications, vaccines, and biologics.

Community and retail pharmacies have faced growing demand for home delivery services, prompting the adoption of insulation solutions that ensure product integrity during last mile transit. Industry press releases and pharmacy operations reports have highlighted efforts to comply with Good Distribution Practices (GDP), further accelerating the use of advanced recyclable thermal packs. Moreover, the expansion of cold chain pharmaceutical distribution, particularly for specialty drugs and temperature critical therapies, has strengthened segment demand.

As pharmacies continue to diversify their service offerings and expand home healthcare delivery, the Pharmacies segment is expected to remain a critical application area for recyclable thermal insulation packs, driven by patient safety considerations and regulatory compliance.

The growth of the pharmaceuticals and food & beverages industries has led to an increased demand for transportation, storage and handling of temperature-sensitive goods.

Challenges pertaining to transportation of these temperature sensible products in industries like pharmaceutical, healthcare, food and beverages, cosmetics and chemicals which are subjected to pressure, shocks and extreme conditions during transportation are some of the major factors driving the demand of recyclable thermal insulation packs. As, this packaging not only prevents spoilage but also keeps the products refrigerated, frozen, and warm, and reduces the effects of variable temperature.

Furthermore, pandemic-driven consumer behavioural shift resulting in packages being kept outside for an extended period of time, growing urbanization, expansion of the e-commerce sector and meal kit deliveries and an increase in people's disposable income are boosting the recyclable insulated packaging market as a whole.

Other factors like eco-friendly appeal of recyclable packaging, compact size with a greater load space and thinner liners reducing the carbon footprint which makes these packaging solutions not only sustainable but effective too.

As a result of the pandemic, there has been a substantial rise in the orders for groceries online and even food deliverables at home. Given the rise in e-commerce, insulated packaging is also likely to experience significant sales across meal kits and other perishable food and beverage goods via smaller e-commerce and food delivery forms.

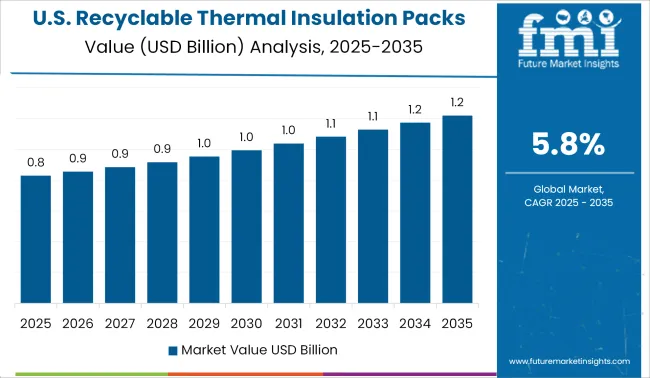

United States is anticipated to lead the recyclable thermal insulation packs market owing to the increasing number of food retail chains and their development, as well as the developing e-commerce industry.

Additionally, noticeable presence in several high-growth industries in the country like healthcare, food, and beverage, etc. is expected to drive the market in the forecast period.

Moreover, stringent government regulations in the country, for instance, the food-contact packaging sector of the USA is highly regulated by the Food and Drug Administration (FDA) are expected to promote adoption of Recyclable Thermal Insulation Packs.

In the Asia Pacific region, factors such as the rapid rise in use of insulated packaging in the food and beverage and pharmaceutical sectors in countries such as China, Japan, and India have contributed to increased demand for insulated packaging.

Furthermore, large supply of raw materials, with the rising usage of packaging across numerous food items (notably meat, fish, and poultry products) and strong economic growth across the manufacturing sectors in countries like India and China are also some of the key factors for the steady growth of the market.

Some of the leading manufacturers and suppliers of recyclable thermal insulation packs include

Key players are emphasizing on lightweight designs to minimize freight costs, to optimize box compression strength coupled with greater load space and also to improve the eco-designs through continuous material optimization.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

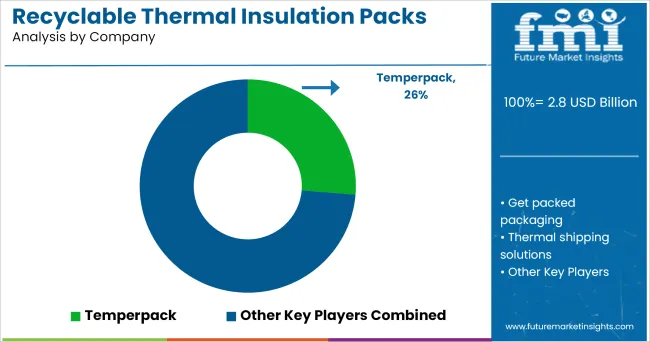

The global recyclable thermal insulation packs market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the recyclable thermal insulation packs market is projected to reach USD 4.8 billion by 2035.

The recyclable thermal insulation packs market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in recyclable thermal insulation packs market are vacuum insulation panels (vips), insulated box liners and insulated bubble cushioning.

In terms of applications, pharmacies segment to command 34.5% share in the recyclable thermal insulation packs market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Recyclable Thermal Insulation Packs Industry

Recyclable Packaging Market Forecast and Outlook 2025 to 2035

Recyclable PE Pouch Market Size and Share Forecast Outlook 2025 to 2035

Recyclable Barrier Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recyclable Ovenable Trays Market Size and Share Forecast Outlook 2025 to 2035

Recyclable Plastic Films Market Analysis - Size, Share, and Forecast 2025 to 2035

Industry Share Analysis for Recyclable Cups Companies

Market Share Distribution Among Recyclable Packaging Providers

Market Share Distribution Among Recyclable Ovenable Tray Providers

Recyclable Cups Market by PE & PP Materials Through 2034

Curbside Recyclable Packaging Market Size and Share Forecast Outlook 2025 to 2035

Leading Providers & Market Share in Curbside Recyclable Packaging

Thermal Interface Material Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Market Forecast and Outlook 2025 to 2035

Thermal Impulse Sealers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Inkjet Printer Market Size and Share Forecast Outlook 2025 to 2035

Thermal-Wet Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Thermal Spray Service Market Size and Share Forecast Outlook 2025 to 2035

Thermal Management Materials for EV Batteries Market Size and Share Forecast Outlook 2025 to 2035

Thermal Barrier Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA