The railway telematics market is estimated to reach USD 7.1 billion in 2024. It is anticipated to grow at a CAGR of 7.3% during the assessment period 2024 to 2034 and reach a value of USD 14.5 billion by 2034.

| Attributes | Description |

|---|---|

| Estimated Railway Telematics Market Size (2024E) | USD 7.1 billion |

| Projected Railway Telematics Market Value (2034F) | USD 14.5 billion |

| Value-based CAGR (2024 to 2034) | 7.3% |

Transportation is becoming more efficient with the deployment of technology. Along with getting advanced and efficient, the safety factor is becoming crucial. Additionally, information technology is playing a vital role in enhancing the safety and efficiency of railway transport. This integration of information technology in railway systems is called railway telematics. Moreover, artificial intelligence is being used for collecting the data and transforming it.

Furthermore, several sensors installed in trains collect data and the data related to trains, cargo, and infrastructure is analyzed. The railway telematics market shows healthy growth due to the surging prioritization of efficiency in transport.

| Attributes | Details |

|---|---|

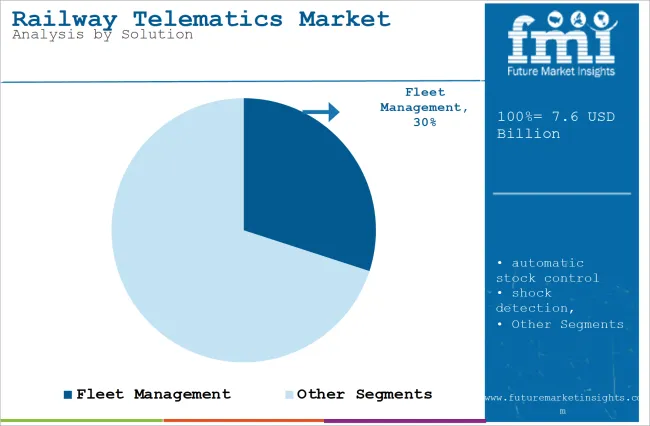

| Top Solution Type | Fleet Management |

| Market Share in 2024 | 30% |

By solution, the market is divided into fleet management, automatic stock control, shock detection, remote data access, railcar tracking and tracing, reefer wagon management, ETA, and others.

Fleet management is extremely important and accounts for 30% of the global market share in 2024. The growing importance of efficient fleet management for transporting cargo and passengers drives the fleet management segment ahead. A fleet means the entire set of wagons that goes as one single train.

To ensure the safe and intact transport of passengers or cargo, it is important to manage the railway fleet properly. The train schedule needs to be updated and prepared properly. Additionally, it needs to be optimized to reduce idle time. Energy or fuel consumption should also be constantly checked. It is also important to reduce operational costs by tracking and analyzing the performance. Moreover, regular maintenance of train wagons also needs to be done to prevent potential accidents.

| Attributes | Details |

|---|---|

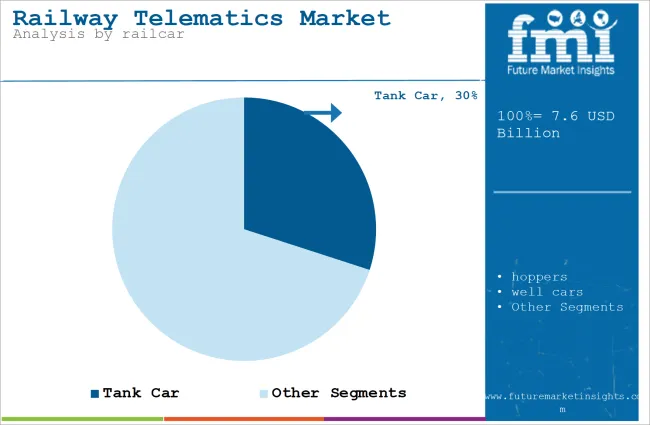

| Top Railcar Type | Tank Car |

| Market Share in 2024 | 30% |

By railcar, the market is divided into tank cars, hoppers, well cars, boxcars, refrigerated boxcars, and others. The tank cars segment accounts for a share of 30% in 2024. There is a growing use of tank cars for transporting perishable items, which is fostering segment growth. Tank cars are large containers in a train that are used for transporting fluids such as liquefied gases, petrol, diesel, and even milk.

A rise in fuel usage is another factor that drives the tank car segment ahead. Certain liquids that are perishable, such as milk, need to be transported on or before time, and no delay in such cases can be afforded. Transport through roadways can be quite delayed as unexpected traffic jams might arise.

Telematics systems help in designing appropriate schedules for trains and hence can ensure that these products are delivered on time. As railway telematics systems also detect if there are any maintenance issues with the train, they can be used even for checking leaks in the tanks. While transporting hazardous materials, tightly regulated conditions can be ensured, the status of which can be tracked by railway telematics systems.

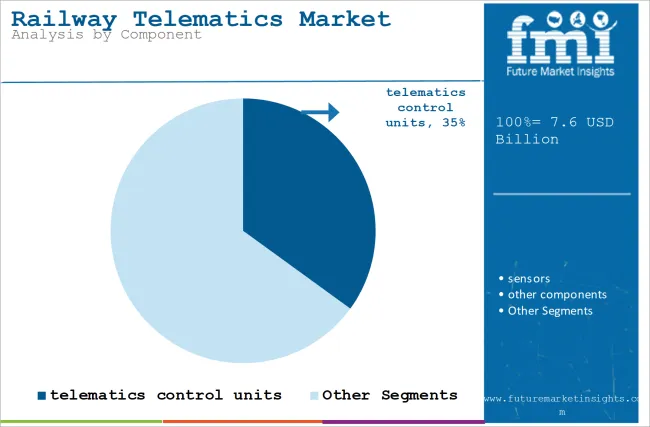

By component, the market is segmented into telematics control units, sensors, and other components. Sensors collect signals that further get processed by the TCUs. Using sensors, information about location can be gained for navigation. Because of sensors, fuel levels, temperature, and load capacities can be monitored to run trains at maximum efficiency.

With the help of TCUs, data from various sensors is collected, analyzed, and transmitted. The main purpose of TCUs and sensors is to enhance the safety of railways by detecting issues in the train to prevent future accidents, use fuels efficiently, save repairing costs, and minimize emissions.

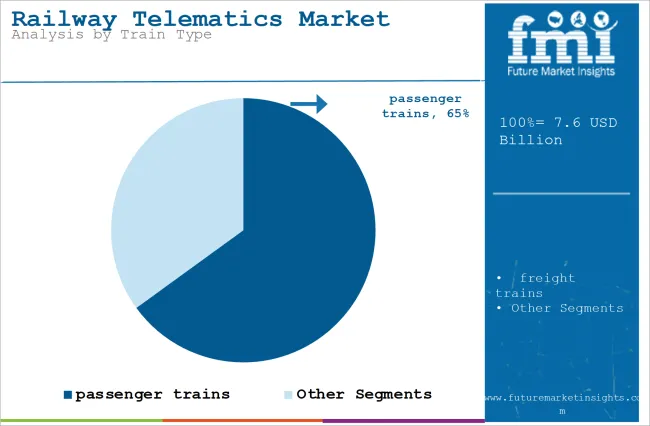

By train type, the market is segmented into passenger trains and freight trains. Prime focus of passenger trains is to ensure safety and comfort of passengers, and freight trains focus on transport cargo efficiently. Railway telematics in passenger trains provides location-updates of the train so that passengers can avoid last minute hassles.

Moreover, arrival and delay information is provided accurately by several train tracking apps. Railway telematics in freight trains help in handling cargo, tracking it, and to ensure proper distribution of weights when the cargo is loaded. Fuel gets used efficiently when load is properly managed and distributed in the freight trains.

Increased Importance of Efficient Freight Management to Boost Telematics Adoption

Railways are an important means of transport for bulk goods. Consequently, the freight sector is seeing growth and expansion. To ensure that goods are delivered at the right time efficiently, it is important to reduce delays, reduce costs, and make the optimum use of time, which means efficient management of freights is required. Telematics solutions are feasible to detect the live location of cargo, leading to improved decision-making. Moreover, heavy government investment in modernizing railway infrastructure can improve efficiency and safety.

Rise in the Focus on Safety and Security to Augment Demand

There have been several railway accidents in the past, which were caused by uncontrolled railway speeds and miscommunication because of poor connectivity issues. Such accidents can be avoided, and railway transport can become safer and more efficient if we can monitor their speed and maintenance status in real-time.

Automatic braking systems can also be installed and with this facility, train accidents can be reduced. Repairing of trains can be done on time and certain AI algorithms can be used for collecting and analyzing large chunks of data in order to ensure smooth operations without any hiccups.

Need for Real-time Fuel Usage Monitoring to Expedite Product Sales

Telematics systems help monitor fuel levels in real time and analyze usage rates. Additionally, predictive analytics leveraged in railway telematics helps detect potential maintenance challenges that may result in surged fuel consumption. Moreover, they also help analyze fuel theft to reduce unauthorized usage. This way, fuel inventory levels can be monitored and operational efficiency can be maintained to streamline the supply chain process.

Smart Railways and Improving 5G Technology to Spur Product Uptake

As phones, trade, and other products keep getting smarter, trains can be made smart too by integrating telematics systems in railways. Additionally, technologies such as blockchain, cloud computing, and autonomous systems can be integrated. Moreover, customer experiences can be enhanced by real-time communication. Data can also be transmitted more efficiently and easily due to improvements in 5G technology. Furthermore, high-speed internet connectivity can also help monitor in real time.

Owing to faster network speeds, accidents caused because of poor maintenance of trains can be reduced. By using smart railway infrastructure, maintenance can be done regularly by scheduling timely maintenance checks. The sensors that can alert about the poor maintenance conditions can also be installed.

Moreover, the transportation of cargo requires proper weather conditions to take it to the destination in the best condition without damage. Before transporting cargo, temperature and external weather conditions are taken into account. By using telematics, fuel consumption can be regulated, leading to a reduction in greenhouse emissions.

Technological Innovations in Railway Telematics

In the prevailing scenario, cutting-edge technologies are being leveraged in railway telematics to ensure enhanced functionality. For instance, the telematics systems are now witnessing the deployment of machine learning and artificial intelligence algorithms to enhance their efficiency. These algorithms are helping improve route optimization and energy management. Moreover, AI-enabled systems are helping decrease manual errors to avoid collision and optimize the performance of railways.

Challenges in the Railway Telematics Market: High Initial Investment and Cyberattack Threats

For setting up railway telematics systems, advanced hardware, software, and high installation costs are required. Bearing these huge expenses is possible for the countries that are already developed, but this is very challenging for the countries that cannot afford these systems, and this can act as a huge barrier for them.

Not all railway stations have these systems installed for data collection and processing. If a train enters these stations, it may not be able to collect and process the data. Additionally, the incidences of cybercrime are increasing with growing advancements in technology. Hence, the security of data has become a matter of utmost importance.

With higher advancements, data breaches must be reduced. Several terrorist organizations can hack security systems, and hence professionals in the field of cybersecurity and railway operations are in high demand to protect the data.

In North America, the USA accounts for 25.5% of the market share in 2024 and is set to observe a CAGR of 6.2% during the study period. North America has a growing and active rail industry, which is boosting the regional growth. Railroads are a key mode of transporting chemicals and oil.

Tank cars are necessary for transporting oil since the USA is one of the leading countries producing oil. Moreover, leakage of oils needs to be avoided to prevent losses. Telematics systems can help with maintenance checks of the train to ensure that the transport of fuels happens safely.

In Europe, Germany is expected to account for a 6.4% CAGR during the forecast period. The country is committed to enhancing the railway infrastructure. Steps are being taken to integrate advanced telematics solutions in railways to make them more efficient and safe, which are fostering regional expansion.

In Asia Pacific, Japan is anticipated to show a CAGR of 6.4% during the study period. The country shows great technological advancements in transportation systems. The Japanese government is spending on improving the railway networks and striving for safer, secure, and efficient railways. These factors are escalating regional growth.

| Company | Area of focus |

|---|---|

| Alstom SA | Advanced signaling technologies such as Communications-Based Train Control (CBTC) and European Train Control System (ETCS). |

| Robert Bosch GmbH | Delivering telematics solutions for safety and efficiency, along with increasing connectivity in rail transport using IoT and AI. |

| Hitachi Ltd | Integrating telematics solutions to improve train operations by providing comprehensive railway signaling and control systems. |

| Siemens AG | Optimizing rail operations by focusing on advanced signaling and train control systems. |

| Wabtec Corporation | Focuses on improving the braking systems for trains. |

| Knorr-Bremse AG | Acquired Alstom’s conventional signaling business, expanding the portfolio beyond braking systems. |

| ORBCOMM | Provides telematics solutions for railcars that can enable train tracking in real-time and improve efficiency. |

| Railnova SA | Offers tools for monitoring fleet health, performance, and maintenance solutions for the railway industry. |

| SAVVY Telematic Systems AG | Focused on providing tools and services for accessing data in real-time, and managing fleets. |

Strategies focusing on maximizing profits are being implemented by the key players in the railway telematics market. To increase profits, companies ensure that the best solutions are provided and maximum efficiency is acquired while implementing telematics solutions. Railways are getting increasingly digital owing to improvements in the 5G network and easy internet access.

The live location of trains can be tracked, to avoid last-minute hassles while traveling. Even governments have launched several phone applications that can help passengers with easy booking, location tracking, lodging complaints, and others. For example, the IRCTC mobile app has been launched by the Indian Railways.

By solution, the market is segmented into fleet management, automatic stock control, shock detection, remote data access, railcar tracking and tracing, reefer wagon management, ETA, and others.

By railcar, the market is segmented into tank cars, hoppers, well cars, boxcars, refrigerated boxcars, and others.

By component, the market is segmented into telematics control units, sensors, and other components.

By train type, the market is segmented into passenger trains and freight trains.

Global adoption is likely to create a market worth USD 14.5 billion by 2034.

The market is anticipated to be valued at USD 7.17 billion in 2024.

By railcar, the tank cars segment occupies 30% of the market share.

The market is predicted to witness a CAGR of 7.3% during the forecast period.

The USA is the most lucrative market for railway telematics.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Railway Communication Equipment Market Size and Share Forecast Outlook 2025 to 2035

Railway Rolling Stock Market Forecast and Outlook 2025 to 2035

Railway System Market Size and Share Forecast Outlook 2025 to 2035

Railway Air Conditioning System Market Size and Share Forecast Outlook 2025 to 2035

Railway Braking System Market Size and Share Forecast Outlook 2025 to 2035

Railway CNC Wheel Lathe Market Size and Share Forecast Outlook 2025 to 2035

Railway Flatcar Market Size and Share Forecast Outlook 2025 to 2035

Railway Roof Switches Market Size and Share Forecast Outlook 2025 to 2035

Railway Window Market Size and Share Forecast Outlook 2025 to 2035

Railway Maintenance Machinery Market Size and Share Forecast Outlook 2025 to 2035

Railway Control Stands Market Size and Share Forecast Outlook 2025 to 2035

Railway Horn Market Size and Share Forecast Outlook 2025 to 2035

Railway Axlebox Housing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Railway After-Cooler Market - Growth & Demand 2025 to 2035

Railway Fishplate Market Growth – Trends & Forecast 2025 to 2035

Railway Coupler Market Growth & Demand 2025 to 2035

Railway Generators Market Growth - Trends & Forecast 2025 to 2035

Railway Draft Gears Market Growth – Trends & Forecast 2025 to 2035

Railway Emergency Valves Market Trends and Forecast 2025 to 2035

Railway Air Filter Market – Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA