Railroad ties are used in the manufacture of rail sleepers and for the formulation of railway sleepers for placement on the rails and stabilize and support the rails. Wood, concrete, steel, and composite railroad ties allowed only differ in terms of their durability, prices, and environmental impact.

Its growth is supported by increasing investments in railways, expanding high-speed railway projects, and developing environmentally friendly composite railroad ties. Moreover, government schemes for the modernization of railway systems and sustainable solutions for rail transport are supporting growth in the market.

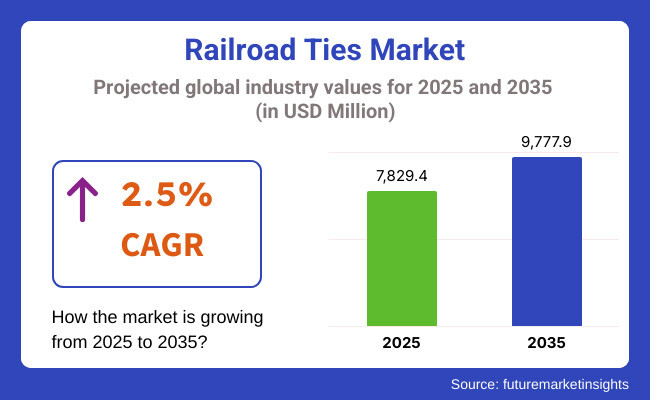

In 2025, the global railroad ties market is projected to reach approximately USD 7,829.4 million, with expectations to grow to around USD 9,777.9 million by 2035, reflecting a Compound Annual Growth Rate (CAGR) of 2.5% during the forecast period.

The predicted CAGR indicates a rising demand for robust and cost-effective rail track systems, increased adoption of composite and recycled plastic ties, along with the continuous expansion of urban and freight railway networks. The progress in corrosion-resistant and maintenance-free railway ties is also expected to drive innovations across the market.

Railroad ties market is holding a strong share in North America due to constantly enhancing railway infrastructure, the demand for more eco-friendly rail materials, and the government allocating more funds for freight rail development.

The introduction of further stringent environmental regulations surrounding old creosote-treated wood ties, along with sustainability issues in general, has led the USA and Canada to dominate composite and wooden tie manufacturing. In addition, market demand is also driven by development of intermodal freight transport as well as investment in high-speed rail.

Market development involvement in Europe: Germany, France, and the United Kingdom are the leading nations in projects specializing in high-speed trains, the development of metros, and green rail infrastructure. The EU's investment drive in low-carbon transport technologies will be translated into an increasing demand for recyclable and durable railway ties, including concrete and composite railway ties. Moreover, improvement in cross-border rail connectivity is supporting the growth of the market.

The railroad ties market in the Asia-Pacific region is anticipated to grow at fastest CAGR over the forecast period, owing to rapid development of railroads, government-backed infrastructure development, and high demand from Australia, China, India, and Japan for efficient mass transit solutions.

With its expanding freight and passenger rail networks and large aqueducts-high-speed rail & metro project investments, demand for cost effective, long-lasting railway ties is on the rise in the region. Moreover, the growing urbanization coupled with smart rail projects will contribute to the growth of the market.

Challenges

Rising Material Costs and Environmental Regulations

Increase in the raw material price such as wood, concrete, and composites. Increasing demand, particularly for sustainable railway infrastructure, has led to stricter environmental regulations on wood preservatives (creosote, borates) and deforestation problems. Additionally, the cost of durable alternatives such as composite and concrete ties can deter adoption in low-cost rail projects.

Opportunities

Growth in High-Speed Rail and Sustainable Rail Infrastructure

Demand for durable low-maintenance railway ties is being driven by expansion of railway networks, particularly high-speed rail (HSR) and urban transport networks. As such, the use of recycled plastic-composite ties, fiber-reinforced concrete ties, and AI-based predictive maintenance technologies is improving durability and sustainability. In addition, investments by governments in green transport and railway electrification are accelerating the shift to eco-friendly materials for railroad ties.

Demand for wooden and concrete railroad ties remained robust as railway renewal projects and increasing freight transport demand continued from 2020 to 2024. Raw material costs were high, and environmental concerns over creosote-treated wooden ties supported the interest in composite and alternative solutions.

From 2025 to 2035, the market will shift into greener, long-lasting railroad tie alternatives like recycled plastic composite ties, fiber reinforced concrete rails and bio-material based wood treatments. Increasing adoption of ai-enabled technologies for railway track monitoring, 12.5X faster and simpler lifecycle management, use of obsolete data will optimise maintenance and thus demand elastic roadbed will increase the demand for high-performance railroad ties.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with timber treatment regulations (creosote bans, EPA guidelines) |

| Technology Innovations | Growth in pre-stressed concrete and improved wood preservatives |

| Market Adoption | Demand for wood and concrete railroad ties in freight and passenger rail |

| Sustainability Trends | Shift towards longer-lasting, treated wood and concrete solutions |

| Market Competition | Dominated by railroad tie manufacturers (Koppers, Stella-Jones, Vossloh, TieTek, L.B. Foster, Nisus Corporation) |

| Consumer Trends | Demand for cost-effective, high-durability railroad ties |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter mandates on carbon-neutral materials, sustainable wood sourcing, and emission reductions |

| Technology Innovations | Advancements in fiber-reinforced composites, bio-based wood treatments, and AI-driven track monitoring |

| Market Adoption | Expansion into composite ties, recycled plastic ties, and smart railroad infrastructure |

| Sustainability Trends | Large-scale adoption of eco-friendly composite ties, biodegradable wood treatments, and circular economy models |

| Market Competition | Rise of sustainable railway material startups, AI-driven railway maintenance firms, and bio-based treatment innovators |

| Consumer Trends | Growth in low-maintenance, recyclable, and smart railway track solutions |

Robust investments in railway infrastructure/facilitation and modernization schemes are expected to drive the growth of United States Railroad Ties market. Constant expansion of railroads and freight transportation has led to increased demand for wooden, concrete, and composite railroad ties.

Trend towards the use of sustainable and long term materials such as composite and plastic railroad ties. Furthermore, the demand impetus comes from government initiatives to improve the rail connectivity and freight efficiency.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 2.7% |

The Industrial development international of UK railroad ties is expanding step-by-step, supported by steady investments for the sector such as arise in railroad electrification and high-speed railroad developments. The increasing focus on decreasing carbon footprint in transport is driving demand for durable and sustainable railroad ties.

In addition, the market growth today is being aided by railroad refurbishment and maintenance projects, particularly those related to passenger and freight networks. The market growth is also contributed by the rising adoption of composite and concrete railroad tracks for long life and sustainability.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 2.3% |

Growing investments in railway modernization and expansion initiatives throughout the region are slightly expanding the European Union (EU) Railroad Ties market. Unanimous approval by the EU for sustainable transport policies is driving the use of eco-friendly, long-lasting materials for the manufacture of railway ties.

Germany, France and Italy are the major markets, with large railway infrastructure construction projects underway and freight network expansion taking place. The increasing usage of composite railroad ties in order to enhance durability and reduce maintenance coststhis is one of the factors driving the long-term growth for the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 2.2% |

Japan railroad ties market is flourishing due to the constant development of new high-speed rail lines along with preservation of existing rail networks. The advanced rail systems in Japan, like bullet trains and urban transit networks, are also generating demand for higher-durability concrete and composite railroad ties.

Rail-Infrastructure-Smart and the use of new emerging materials are the trends of the market. Moreover, the Japan's focus on railway safety and future durability are driving investments in new materials for the railroad tie.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.5% |

The South Korea railroad ties market can help freight transportation companies in the country boost the economy by ensuring that goods are easily transported from one region to another. Railroad ties that can withstand environmental conditions and long-lasting are witnessing growing demand owing to the country’s endeavors to enhance public transport and address rising traffic congestion.

Market growth is driven by the increasing use of composite and concrete railway ties for better performance and sustainability. In addition, the development of advanced railway technology, with a major focus on high-tech automation, is supporting the continuous construction of infrastructure systems in South Korea.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 2.4% |

Wooden railroad ties remain a common track component in low-density railroads, freight routes, and vintage railways. This is the reason they are used in some of the railway installations because they are easy to install and cost-effective and they can also be famous in railway installations as well.

The wood has excellent shock-absorbing properties running toments of a train and deformation of rails is very less as compared to steel. The majority of railroads like oak, pine, and eucalyptus which are hardwoods, and these woods are already damped naturally, reducing stress on the rail and increasing the life of the track.

Moreover, wooden ties are also more lightweight and easier to replace as compared to concrete and steel counterparts, thus, ensuring lower installation and maintenance costs. Many short-line railroads, industrial rail lines, and rural rail lines continue to use wooden ties for efficiency and cost-effectiveness of operation.

Although they have their pros, wooden ties have to contend with rot, insect attack, and environmental issues. While regulations on using chemically treated wooden ties were delayed in most countries, governments and railway bodies are gradually making a shift and opting for stronger and environmentally friendly replacements. To counter these problems, manufacturers have invested in pressure-treated wood, composite enhancement, and renewable timber forested areas to add years of life and lessen natural effect.

Concrete rail ties have gained considerable market share, particularly on high-speed rail corridors, heavy-haul freight lines, and city transit railroads. They offer exceptional strength, long service life and low maintenance so they are the first choice in heavily used rail corridors.

The durability of concrete ties against weathering, decay, and excessive axle loads is one of the main drivers behind their adoption. Unlike wooden ties which decay with time, concrete sleepers provide stable track stability, reduced lateral wandering, and even weight distribution, resulting in safer trains and an extended life of the track.

Furthermore, concrete sleepers can withstand fire and insects, ensuring them a lower life-cycle cost and lesser replacement. The vast majority of high-speed rail, subways and intercity passenger rail systems utilize concrete as their sleeper material due to its resilience to dynamic loading and temperature stresses.

While there are advantages to concrete ties, they tend to be specialized to install, which leads to higher upfront costs and greater logistical complexity. To overcome these drawbacks, manufacturers are developing lightweight concrete mix designs, precast modular sleeper systems and hybrid sleeper system that offers increased flexibility and cost effective deployment across a wide range of railway applications.

The national and international railway networks of secure, efficient and high-capacity rail transport rely on railroad ties. Multiple passenger and freight railroads invest in initiatives related to track modernization and capacity augmentation, providing sustainable mobility solutions to growing urban populations and worldwide trade.

High-speed and electrified rail: One motivating factor for enhancing railroad tie demand in train networks is the focus on high-activity rail and electrified rail. Most countries, including China, Japan, France and the United States, are building high-speed rail corridors, offering faster travel and lower carbon emissions than road and air travel. At high-speed railway tracks, usage of concrete ties is widespread, which offers track stability and accurate alignment along with better vibration control.

Moreover, freight rail infrastructure relies upon robust ties to accommodate high axle weights and long-haul freight traffic. Most freight railroads use concrete or steel ties in high tonnage corridors that yield low track wear and long service life. In contrast, wooden ties continue to serve in low-density freight lines, where maintenance costs and simple replacements in rural and industrial environments are desired.

Although positive, train network growth plans come under large investment and regulatory approvals, causing delays in the deployment of infrastructure. To address these problems, governments are implementing public-private partnerships (PPPs), rail infrastructure funds, and technology-driven maintenance solutions, which enable faster and cheaper upgrades to their railways.

Railroad ties being repurposed is subway systems, which depend on railroad ties to provide safe, dependable urban transit service in most large cities. Concrete and steel ties are popular among subway operators because they are durable and impervious to moisture, and can bear up under frequent passage of trains.

Subway tie uptake is driven primarily by the need to control vibration and noise in underground rail systems. Typically, rubber pads or composite materials reinforce these concrete ties for shock absorption and diminishing structural vibrations, which increase passenger comfort and tunnel stability.

Furthermore, subway expansion projects around the global, particularly in NYC, London, Beijing and Dubai, are also creating demand for high-performance track components. Many subway systems also have automated track monitoring, real-time maintenance diagnostics, and predictive analysis that better manage infrastructure and reduce downtime.

As useful as subway railroad ties are, they come with the challenges of limited space, ventilation in tunnels and access for maintenance. Railway engineers are designing modular track systems, prefabricated sleeper installations, and hybrid materials to mitigate these issues and enable cost-effective and sustainable subway infrastructure developments.

The demand for acceleration in investment on tracks, urban transit, as well as on railway infrastructure are contributing to the consistent growth of the railroad ties market. Railroad ties or sleepers are also important components for the effect of the track stability, load support, and vibration dampening, etc. Demand for long-lasting products, green products, and government initiatives to build rail networks are driving the market. Material types are wood, concrete, steel, and composite ties.

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Vossloh AG | 18-22% |

| Stella-Jones Inc. | 14-18% |

| Koppers Inc. | 12-16% |

| L.B. Foster Company | 10-14% |

| TieTek LLC (Axion International) | 8-12% |

| Others | 26-32% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Vossloh AG | Provides prestressed concrete ties and synthetic composite sleepers for heavy-haul and high-speed rail. |

| Stella-Jones Inc. | Specializes in pressure-treated wooden railroad ties for freight and passenger rail networks. |

| Koppers Inc. | Manufactures engineered wood and creosote-treated railroad ties with a focus on durability and environmental compliance. |

| L.B. Foster Company | Develops concrete and steel-reinforced railroad ties for urban transit and industrial rail applications. |

| TieTek LLC (Axion International) | Produces recycled plastic composite railroad ties, offering sustainability and long-lasting performance. |

Key Market Insights

Vossloh AG (18-22%)

Vossloh leads the railroad ties market with prestressed concrete and composite ties, ensuring high performance for freight and high-speed rail projects.

Stella-Jones Inc. (14-18%)

Stella-Jones is a major supplier of wooden railroad ties, catering to North American railroads with pressure-treated, durable wooden sleepers.

Koppers Inc. (12-16%)

Koppers manufactures engineered wood railroad ties, focusing on environmentally friendly preservation methods and long-term performance.

L.B. Foster Company (10-14%)

L.B. Foster provides steel-reinforced and concrete sleepers, supporting urban transit and industrial railway networks.

TieTek LLC (Axion International) (8-12%)

TieTek specializes in recycled composite railroad ties, offering sustainable and corrosion-resistant alternatives to traditional materials.

Other Key Players (26-32% Combined)

Several emerging and regional players are expanding the railroad ties market with innovative materials and cost-effective solutions, including:

The overall market size for railroad ties market was USD 7,829.4 million in 2025.

The railroad ties market is expected to reach USD 9,777.9 million in 2035.

Expanding railway infrastructure projects, increasing demand for durable and sustainable track materials, and rising investments in high-speed rail networks will drive market growth.

The top 5 countries which drives the development of Railroad ties market are USA, European Union, Japan, South Korea and UK.

Wooden ties expected to grow to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Railroad Market Size and Share Forecast Outlook 2025 to 2035

Period Panties Market Analysis – Size, Growth & Forecast 2025 to 2035

IoT in Utilities Market Size and Share Forecast Outlook 2025 to 2035

Bathroom Vanities Market Analysis - Growth, Trends and Forecast from 2025 to 2035

Laundry Facilities and Dry Cleaning Services Market analysis in United States Growth - Trends & Forecast 2025 to 2035

A Detailed Industry Analysis of Laundry Facilities and Dry Cleaning Services in the United States

USA Period Panties Market Report – Trends, Demand & Outlook 2025-2035

India Period Panties Market Insights – Demand, Growth & Forecast 2025-2035

France Period Panties Market Report – Size, Trends & Outlook 2025-2035

Organic Seed Varieties Market Size and Share Forecast Outlook 2025 to 2035

Reusable Period Panties Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

A Detailed Global Analysis of Brand Share for the Reusable Period Panties Market

eVTOL Charging Facilities Market Size and Share Forecast Outlook 2025 to 2035

Cover Crop Seed Varieties Market Size and Share Forecast Outlook 2025 to 2035

United States Hispanic Novelties Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA