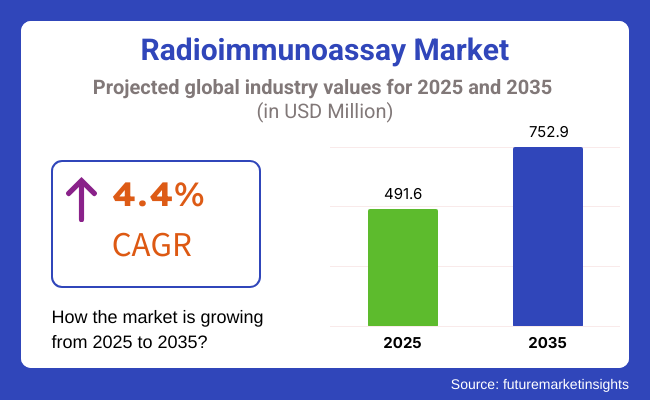

The global market for radioimmunoassay is forecasted to attain USD 491.6 million by 2025, expanding at 4.4% CAGR to reach USD 752.9 million by 2035. In 2024, the revenue of radioimmunoassay was around USD 470.8 million.

Biotechnology shows technological progress and increasing demand for more precise diagnostic devices have spawned a brighter future for the radioimmunoassay (RIA) market. RIA remains an important tool in diagnosing various diseases, including infectious disease along with oncology and infectious diseases.

Advances in radiolabeling methods are improving assay sensitivity and specificity and lowering radiation exposure hazards. Automation and miniaturization are reaping the benefits thereof-the optimized laboratory processing, faster turnaround time, and better results.

With a growing trend toward personalized medicine, RIA aids targeted therapeutic approaches with a diagnosis set to correct biomarker analysis. The great push for the detection of diseases during their early onset adds to an already rocking application in the realm of clinical diagnostics and research.

Even though competition offers non-radioactive techniques, RIA's modest sensitivity puts it in the frontline of specialized testing. Regulatory agencies are increasing compliance standards governing radiopharmaceuticals, further propelling the use of RIA into necessity in the world of developing medical diagnostics and research.

Demographic factor as population size, age, distribution and disease prevalence can influence the RIA market. The aging population is more prone to diseases and needs diagnosis. Technological advancement in kit development can help to provide improved, automated and rapid diagnostic methods. These factors significantly shape the demand, adoption, and growth of the market on a global scale.

Another major health-related issue is diabetes. Somatostatin content in delta-cell number is reduced in type-2 diabetes, claims research published in the International Journal of Molecular Sciences in 2023. Somatostatin levels are measured using a radioimmunoassay (RIA) but require a longer duration for the development of results.

Scientists have undertaken a task to transform the kit into a straightforward handheld gadget that can be mass-produced in a short period. These major applications of radioimmunoassay technology will boost demand for it globally.

Explore FMI!

Book a free demo

North America is the largest radioimmunoassay (RIA) market because of its well-developed healthcare infrastructure, the prevalence of pharmaceutical and diagnostic giants, and high biomedical research investment. The USA is the biggest market among them, and increasing demand for hormone assays, cancer biomarker tests, and infectious disease diagnosis fuel the market.

Strict quality control measures are enforced by regulatory agencies such as the FDA and CDC, and investments in nuclear medicine research continue to increase applications of RIA. In spite of this growth, regulatory limits on radioactive isotopes and competition from chemiluminescent and enzyme immunoassays (ELISA) hinder market expansion.

Yet the growing use of automated RIA platforms and AI-based assay interpretation increases efficiency and drives market growth. Biotech company collaborations with healthcare institutions remain to promote innovation, and government programs that are designed to enhance chronic disease care increase the need for sensitive diagnostic instruments.

Europe accounts for a major percentage of the radioimmunoassay market, fueled by strong government support for medical research, the concentration of top biotech companies, and increasing demand for precise diagnostic methods in clinical as well as research applications. Germany, France, and the UK dominate the region, with intense adoption in endocrinology, immunology, and cancer screening.

But the imposition of strict controls on radioactive materials under European Medicines Agency (EMA) regulations hinders RIA adoption. The move towards non-radioactive immunoassay alternatives and increasing emphasis on precision medicine are redefining market trends.

Healthcare providers and research institutions partner to create sophisticated biomarker-based RIA tests, driving innovation in the region. AI-powered laboratory automation investments are also on the rise, improving diagnostic accuracy and efficiency.

Competition within the Asia Pacific radioimmunoassay market is changing rapidly due to increased spending on healthcare, rising instances of chronic diseases, as well as the development of diagnostic laboratories. China, Japan, and India will likely lead a strong growth of RIA in endocrinology, oncology, and infectious disease testing.

In spite of growth momentum, environmental regulation dissimilarity, high costs of radioactive material, and lack of trained professionals are instant constraints on market expansion. Increase in the number of contract research organizations (CROs) in the region and increasing biopharmaceutical studies are driving adoption of RIA in drug discovery and clinical testing.

AI-facilitated diagnostic platforms and automated RIA analyzers are improving laboratory automation and precision and are driving business growth further. Government-sponsored schemes aimed at upgradation of the healthcare infrastructure as well as stimulation of nuclear medicine research are pushing market growth even further in Asia-Pacific.

Challenges

Alternative Diagnostics Methods Hinders the Market Growth

The market faces competition from alternative diagnostic technologies such as stable free radicals, fluorochromes, chemiluminescence precursors, enzyme inhibitors, and methods. These are easy to handle, can give qualitative and quantitative information and easy to discard post experiment. This competition can limit market penetration and slow down the growth of radioimmunoassay, particularly in regions where other technologies are more established.

It is largely restricted to immunoassays, the need for expensive reagents and equipment and the requirements for licensing and containment. Another important problem is disposal of radioactive waste management, special training and license required and expensive instrumentation.

Opportunities

Development of Precise and Easy to Use Diagnostics Tools has Lucrative Opportunity in the Market

Growing needs for sensitive and specific diagnostic assays are driving sizeable opportunities for the radioimmunoassay (RIA) market. Technologies of automated RIA platforms, microfluidics, and AI-interpretable data are enhancing the accuracy and speed of the test. An increased emphasis on precision medicine and biomarker-directed diagnostics is extending applications of RIA in targeted health care.

Research organizations, pharma, and diagnostic organizations are coming together to create the next generation of RIA kits that are more secure and better performing. Telehealth and home diagnostic services growth is fueling the demand for laboratory tests based on RIA, particularly hormone analysis and cancer diagnostics. The use of low-radiation RIA technologies and eco-friendly diagnostics is emerging, creating new market opportunities for expansion.

Advancements in Automation and AI-Powered RIA Systems: RIA laboratories are enhancing precision, minimizing the workload of human intervention, and optimizing efficiency through the use of robotics and data analysis based on AI. Automated platforms are streamlining reagent use and high-throughput sample processing, reducing laboratory operations to a minimum.

Expansion of Biomarker-Based RIA Tests: The need for early disease detection and customized treatment planning is fueling research in RIA-based biomarker assays in oncology, neurology, and infectious disease therapy. Scientists are investigating new biomarkers to identify cancer at an early stage, with an objective to enhance the survival rate of patients.

Increase of AI and Machine Learning in RIA Data Interpretation: Artificial intelligence-based image processing and pattern recognition technologies are improving the precision of RIA test results, allowing for quicker and more accurate diagnostics of hormone disorders, cancer, and infectious diseases. Clinicians are employing AI-based predictive modeling to better evaluate patient risk profiles.

Low-Radiation and Eco-Friendly RIA Solution Development: Innovators are developing radiation-free or low-radioactive immunoassays that meet regulatory needs without sacrificing the high sensitivity and specificity of classic RIA methodologies. Biopharma firms are investing in hybrid diagnostic platforms blending RIA with non-radioactive detection technologies for improved safety and efficiency.

During the years, the market of radioimmunoassay (RIA) expanded steadily due to advances in immunoassay technologies, research and development expansion, and the rising incidence of infectious and chronic diseases. Clinical centers and laboratories resorted to RIA owing to its wonderful sensitivity for detecting hormones, infectious agents, and tumor markers.

With the growth of the biopharmaceutical and biotech sectors, there was also increased demand for precise biomarker identification, prompting widespread adoption of RIA in drug development and monitoring of therapies. Scientists also highly valued RIA in targeted therapy and precision medicine, particularly in proteomic and endocrinological research.

Labs adapted by adopting automation and high-throughput RIA systems to enhance efficiency and reduce the risk of manual errors. Increased emphasis on personalized medicine only added to the importance of RIA in case-specific diagnostics such as hormone analysis and cancer identification. Healthcare infrastructural and research investments in growth markets provided opportunities for RIA service providers that were not otherwise available.

And while doing all this, the focus on sustainability increased, necessitating the design of safer radiolabels, environment-friendly reagents, and more effective waste disposal for compliance with overall global environmental aims. To remain abreast of changing market needs, firms invested heavily in new technology, enhanced regulatory compliance, and formed strategic alliances-all to accommodate the growing demand for high-quality RIA in research and clinical applications.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Regulatory agencies prioritized safety and effectiveness in RIA procedures, simplifying approvals for diagnostic use of radioactive substances. |

| Technological Advancements | Scientists embraced sophisticated RIA methods with increased sensitivity and specificity, allowing for the detection of diseases at an early stage and monitoring. |

| Consumer Demand | Patients and physicians increasingly demanded accurate and dependable diagnostic testing, especially in oncology and endocrinology. |

| Market Growth Drivers | Increased incidence of chronic disorders and ongoing development in diagnostic assays fueled market expansion, as developed economies invested in healthcare infrastructure. |

| Sustainability | Industry players started making some moves towards safe disposal and treatment of radioactive agents in accordance with ecological regulation. |

| Supply Chain Dynamics | Firms depended on established distribution channels to provide RIA kits and instruments to hospitals and diagnostic laboratories. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Authorities will introduce full guidelines for automated and high-throughput RIA systems to ensure standardized protocols and data protection. |

| Technological Advancements | Producers will incorporate automation and high-throughput features into RIA systems, create non-radioactive immunoassay substitutes, and improve multiplexing technologies for the simultaneous detection of multiple analytes. |

| Consumer Demand | Doctors will prefer individualized medicine strategies, using accurate biomarker measurement to customize therapy, driving the need for point-of-care testing solutions. |

| Market Growth Drivers | Diagnostic companies will enter emerging markets, invest in new immunoassay technologies, and create strategic alliances with healthcare providers to increase market penetration. |

| Sustainability | Companies will completely apply sustainable practices, employing eco-friendly assay components, minimizing hazardous waste, and implementing energy-efficient manufacturing for assay kits and equipment. |

| Supply Chain Dynamics | Industry players will maximize supply chains with digital technologies to improve transparency, efficiency, and on-time delivery of assay components, increasing access in remote and underserved regions. |

Market Outlook

Chronic diseases like obesity, diabetes, and cardiovascular diseases have dropped the United States into a severe issue. All these are conditions that need radioimmunoassay for diagnosis and treatment. Those are some of the essential characteristics that may make it appealing and thus the demand for radioimmunoassays in the United States healthcare system.

The USA is a competitive market for medical devices, wherein there are a number of manufacturers and suppliers which make radioimmunoassay kits and accessories. The demand for radioimmunoassay on the USA market looks for assurance in invasive diagnosis equipment.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 1.6% |

Market Outlook

Germany possesses a strong, well-educated medical system, doctors, researchers, and technicians. The staff easily knows adequately about how to handle and translate radioimmunoassay information, thus ensuring that this kind of technology is acceptable by the research and clinical practice environment. Large immunodiagnostic kit producing industries in Germany are one of the factors that contribute extravagantly to its advantage to own the market.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 2.9% |

Market Outlook

The country's swiftly expanding middle class has boosted expenditure on healthcare and disposable money. The need for better-quality healthcare goods, like radioimmunoassay, has increased as a result of demographic shifts. The rising middle class's increased disposable income has helped the Chinese economy expand.

The Chinese population is second largest in world making it a huge market for disease diagnostics, RIA being able to identify high level of sensitivity is prominently used for diagnosis many china a large market for radioimmunoassay.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 5.3% |

Market Outlook

India's market for radioimmunoassay is expanding because healthcare providers and researchers are responding to the increasing infectious disease burden and emphasis on molecular diagnostics. Growing diagnostic laboratories, expanded access to healthcare, and the strong pharma industry are promoting demand for inexpensive and scalable extraction systems. Government efforts to spur research and encourage local production contribute further to the size of the market.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.0% |

Market Outlook

The radioimmunoassay market of Brazil is observing gradual growth with the nation attempting to tackle growing instances of contagious illnesses such as Zika and dengue. Involvements made by governments for public health facilities and advancement of biotechnology-based research activities are boosting demands for effective diagnostics devices. Advances made in health infrastructures as well as heightening awareness concerning molecular diagnostics are compelling adoption even within clinical as well as research realms.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 1.1% |

Kits & Reagents Drive Radioimmunoassay Market Growth with Enhanced Biomarker Detection and Hormone Testing Applications

Reagents and kits prevail in the market of radioimmunoassay (RIA) owing to the role they provide for effective, sensitive biomarker determination. Radioactively tagged antigens, antibodies, and calibration solutions, such as components used, are pivotal for testing hormone levels, diagnostic screening of disease, and therapeutic drug monitoring. An increased frequency of endocrine conditions, enhancing requests for accuracy of measurements from hormones, as well as boosting uses of RIA for drug therapy monitoring, fuel market advancement.

North America and Europe dominate the segment based on high research investments and approvals for diagnostic assays, whereas Asia-Pacific grows strongly as clinical labs increase and the awareness of disease detection at early stages increases. Trends in the future are projected to include assay automation using AI, development of non-radioactive RIA alternatives, and better reagent stability for extended shelf life.

Advanced RIA Instruments Propel Market Growth with Automation, High-Sensitivity Diagnostics, and AI-Driven Innovations

RIA instruments are dominant in the performance of accurate immunoassays, with automated RIA analyzers and gamma counters used extensively in hospital laboratories, research laboratories, and clinical labs. The instruments enable high-throughput analysis, minimize manual error, and enhance reproducibility. Increased demand for automated RIA systems, expanded usage of high-sensitivity diagnostic instruments, and greater emphasis on cancer and endocrine biomarker studies are driving the market.

North America and Europe are the leaders in RIA instrument adoption, whereas Asia-Pacific is witnessing increased investments in laboratory automation and diagnostic infrastructure. Future developments will introduce AI-integrated RIA analyzers for real-time interpretation of data, benchtop systems that are small and decentralized for testing, and next-generation radiolabeling methods that increase assay sensitivity.

Infectious Disease Diagnostics Lead Radioimmunoassay Market amid Rising Demand for Early and Accurate Pathogen Detection

Infectious disease is the largest application of radioimmunoassay (RIA), fueled by the demand for sensitive and specific diagnostic reagents to identify viral and bacterial pathogens. Expanding global infectious disease burden and need for early and correct diagnosis keep the market growing. North America and Europe lead the segment with well-developed healthcare infrastructure, rich research funding, and extensive implementation of RIA in clinical diagnosis.

In the meantime, the Asia-Pacific is growing at a fast pace aided by increasing disease awareness for management of infectious disease, increased diagnostic facilities, and government programs promoting improvement in the public health systems. The future of this market will involve the convergence of RIA with multiplex assays, improvement in radiolabeling to enable safer diagnosis, and the creation of handheld RIA platforms for point-of-care infectious disease diagnosis.

Oncology Emerges as a Key Growth Driver in Radioimmunoassay Market through Advanced Cancer Biomarker Detection and Personalized Diagnostics

Oncology is one of the most rapidly expanding sectors in the RIA market with increasing healthcare practitioners utilizing the method for the identification of cancer biomarkers and tumor developments tracking. Sensitive detection of certain tumor-associated antigens like alpha-fetoprotein (AFP) for liver cancer and prostate-specific antigen (PSA) for prostate cancer is provided by RIA.

The overall increasing cancer burden demands oncology diagnostics to be specific and personalized. Furthermore, the enhanced use of RIA in clinical studies for developing newer chemotherapeutics is being rendered by researchers.

North America and Europe currently lead RIA-based oncology testing owing to their already advanced healthcare systems and a strong focus on cancer research. Meanwhile, Asia-Pacific is escaping fast with expansion of cancer screening programs and government efforts to encourage early detection.

In upcoming years, RIA's future in oncology is evolving. Recent innovations are forthcoming, like radiolabeled antibody assays providing better detection with the help of biomarkers; AIs that analyze tumor markers more accurately and help the hybrid diagnostics platform that integrates RIA with molecular imaging-providing real-time insights on cancer progression and response to treatment.

The market for radioimmunoassay (RIA) is characterized as highly competitive due to surging demand for sensitive and specific diagnostic methods within endocrinology, oncology, and infection detection. Competitors are venturing into automated processes, high-throughput RIA instruments, and advanced techniques for radiolabeling as they seek to sustain their position in the marketplace.

The established manufacturers of diagnostic assays, specialty biotechnology companies, and evolving laboratory services make up the contours of the growing market for immunoassay diagnostics.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| PerkinElmer Inc. | 23.5% |

| DiaSorin S.p.A. | 18.4% |

| Beckman Coulter (Danaher) | 12.5% |

| Siemens Healthineers | 9.7% |

| Berthold Technologies | 6.7% |

| Other Companies (combined) | 29.3% |

| Company Name | Key Offerigns /Activities |

|---|---|

| PerkinElmer Inc. | Market leader offering high-sensitivity RIA kits and automated immunoassay solutions for clinical diagnostics. |

| DiaSorin S.p.A. | Specializes in RIA-based hormone and infectious disease assays with a focus on precision and reliability. |

| Beckman Coulter (Danaher) | Develops advanced radioimmunoassay kits and automated systems for laboratory use. |

| Siemens Healthineers | Provides RIA solutions integrated with automated laboratory workflow systems. |

| Berthold Technologies | Offers specialized RIA instrumentation and detection systems for research and diagnostic applications. |

Key Company Insights

PerkinElmer Inc. (23.5%): Presently leading the market of the group called radioimmunoassay, PerkinElmer manufactures highly precise assays that are used in the key application of endocrinology, oncology, and infectious disease diagnosis.

DiaSorin S.p.A. (18.4%): DiaSorin is regarded as a leader in immunodiagnostics by developing RIA-based specific solutions to analyze hormones and infectious diseases.

Beckman Coulter (Danaher) (12.5%): Beckman Coulter is reputed for laboratory automation, but with a combination of RIA technology with high-throughput processing platforms, productivity in diagnosis improves.

Siemens Healthineers (9.7%): Currently, Siemens is still at the forefront of diagnosing technologies and providing RIA solutions which help clinical laboratories all over the world provide better patient care.

Berthold Technologies (6.7%): Excelling in precision instruments, Berthold Technologies manufactures sophisticated RIA detection tools for special usage but ensures that accuracy in laboratory analysis does not diminish.

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

The overall market size for radioimmunoassay market was USD 491.6 million in 2025.

The Radioimmunoassay Market is expected to reach USD 752.9 million in 2035.

Advancements in automated RIA systems are streamlining laboratory workflows and boosting market expansion.

The top key players that drives the development of radioimmunoassay market are PerkinElmer Inc., Berthold Technologies GmbH & Co.KG, Siemens Healthineers, Montreal Biotech, DIAsource Abbexa, IBL International GmbH, Creative Biolabs, MP BIOMEDICALS, ALPCO, Padyab Teb Co., Merck KGaA, NovoLytiX GmbH, Beckman Coulter, Inc., DiaSorin S.p.A., DRG INSTRUMENTS GMBH EUROIMMUN Medizinische Labordiagnostika AG.

Kits & Reagents in product type of radioimmunoassay market is expected to command significant share over the assessment period.

Kits & Reagents, Instruments, Consumables, Services

Oncology, Cardiology, Endocrinology, Infectious Disease, Autoimmune Disease, Therapeutic Drug Monitoring, Drug of Abuse and Others

Serum, Plasma, Urine, Saliva, Cell Culture Sample

Research Use Only and Clinical Use

Hospital, Specialty Clinics, Academic and Research Institute, Diagnostics Laboratories, Reference Laboratories, Cancer Research Institutes and Veterinary Hospitals

North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Middle East & Africa

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Analysis by Product, Testing Methods, End User, and Region - Forecast for 2025 to 2035

Cardiovascular Diagnostics Market Report- Trends & Innovations 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.