The focus of cancer treatment centres and hospitals for ensuring the safety of patients along with growing security concerns of workers working in radiation centres is encouraging end users such as hospitals to deploy radiation dose optimization software.

Owing to this, vendors offering radiation dose optimisation software are continuously upgrading their product portfolios to meet the demands of the competitive radiation dose optimisation software market. The global radiation dose optimisation software market is expected to register significant growth in the coming years.

Don't pay for what you don't need

Customize your report by selecting specific countries or regions and save 30%!

| Market Statistics | Details |

|---|---|

| H1,2021 (A) | 27.1% |

| H1,2022 Projected (P) | 27.4% |

| H1,2022 Outlook (O) | 28.0% |

| BPS Change : H1,2022 (O) - H1,2022 (P) | (+) 60 ↑ |

| BPS Change : H1,2022 (O) - H1,2021 (A) | (+) 90 ↑ |

The concentration of cancer cure hospitals for making sure the security of patients together with increasing the security of workers working in radiotherapy centres is promoting hospitals to set up radiation dose optimization software. Many vendors are providing radiation dose optimization software and are constantly improving their product offerings to become competitive in the radiation dose optimization software market.

According to the Future Market Insights analysis, the BPS values interpreted in the radiation dose optimization software market in H1,2022-(O) (Outlook) over H1,2022 (P) are projected to show a growth of +60 units. The reason for the growth of BPS values is the high focus on research and development in the healthcare sector, leading to higher adoption of modern technologies by healthcare providers is the major factor driving the market growth.

The BPS change: H1, 2022 (O) over H1,2021 (A) shows a growth of +90 units. The crucial reason for this growth of BPS values is a rise in the need for radiation dose optimization software in hospitals because of the growing number of medical X-ray imaging, computed tomography scans, and other diagnosis carried out in hospitals is the major factor driving the market growth.

Radiation dose optimisation software is available in automatic as well as manual operating modes. The automatic mode is extensively favoured by end users such as diagnostic centres, hospitals, cancer research institutes, and others as it decreases errors that are likely to occur from human interference.

The software solution automatically measures, examines, gathers, and reports a patient’s radiation exposure data in groups as well as on an individual basis, and also allows real-time staff exposure measurements.

Doctors are using radiation dose optimisation software for the purpose of observing and governing radiation doses in patients. Also, radiation dose optimisation software is used for controlling multiple aspects related to the dose. The radiation dose quantity varies as per the patient and the disease.

Given the humungous number of hospitals present in the world, the market for radiation dose optimisation software is expected to increase shortly. Moreover, the healthcare sector comprises a significant amount of market share in the global industry. Further, there is a high focus on research and development in the healthcare sector, leading to heavy adoption of the latest technologies by healthcare providers, which is expected to significantly impact the market growth of radiation dose optimisation software.

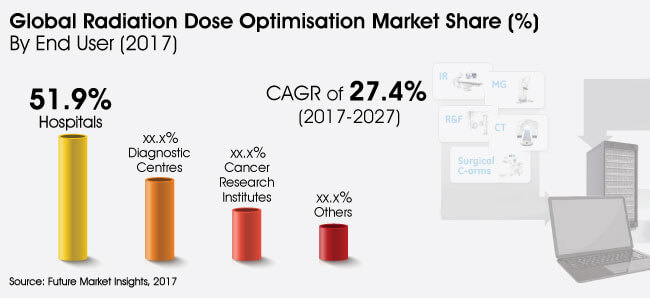

Hospitals are a key target area for radiation dose optimisation software vendors, accounting for over half the overall radiation dose optimisation software market. An increase in the demand for radiation dose optimisation software in hospitals is due to the increasing number of X-ray examinations, CT scans, and other examinations conducted in hospitals.

Diagnostic centres occupied a share of 22.0% in 2017 and are expected to witness a downfall in market share by the end of 2027. Despite witnessing a downfall, diagnostic centres will remain the second leading end user in terms of deployment of radiation dose optimisation software as the need to diagnose chronic diseases will trigger demand for the software. Cancer diagnosis will play a crucial role in the development of this sector in particular with radiation monitoring being the need of the hour.

Get the data you need at a Fraction of the cost

Personalize your report by choosing insights you need

and save 40%!

Explore Technology Insights

View Reports