Technological developments and sector changes in 2024 propelled the radial piston motor industry. In the industrial machinery industry, radial piston motors saw increased adoption due to their superior torque and efficiency compared to conventional motors. In particular, there was a major investment in hydraulic solutions in the mining and construction sectors, boosting demand even more. Energy-efficient radial piston motors were also developed as a result of a growing emphasis on sustainability, especially in North America and Europe.

From 2025 onwards, the industry will benefit from an undeterred influx of capital investments in robotics and automation in various application sectors, most notably logistics and manufacturing. Industry 4.0 is also predicted to have a character-defining impact on the market, with companies integrating smart sensors and IoT-based monitoring systems into these motors. In addition, the Asia-Pacific region will witness the highest growth owing to the rise in industrial and infrastructure development projects.

Volatility in raw material prices and high initial investment costs may remain challenges, but incremental technological advancements and growing use cases in sectors will drive the industry to grow through 2035. The radial pistol market is anticipated to be valued at USD 367.7 million in 2025. It is expected to grow at a CAGR of 3.10% during the forecast period and reach a value of USD 498.98 million in 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 367.7 Million |

| Industry Value (2035F) | USD 498.98 Million |

| CAGR (2025 to 2035) | 3.10% |

Explore FMI!

Book a free demo

Introduction

The global radial piston motor industry has multiple dynamic factors that shape its evolution and transformation in 2023. A comprehensive FMI survey of 450 industry participants in Q4 2024 provides invaluable insights into industry trends.

Adherence to Safety Rules

The safety score was assessed, showing significant interest in occupational safety standards. According to 85% of surveyed stakeholders, safety compliance is a key priority.

Reliability and Efficiency

78% emphasized high-durability and energy-efficient motors, particularly for industrial and construction applications.

Regional Variances

Technological Integration

Divergent ROI Perspectives

73% of USA stakeholders view automation as an investment, in comparison to 35% of Japanese stakeholders who remain skeptical of it due to initial costs.

Global Consensus

62% of stakeholders prefer polycarbonate motor enclosures for their durability and resistance to the weather and environmental conditions.

Regional Variations

Increasing Costs

86% of users cited rising semiconductor and material prices as a major challenge.

Price Sensitivity by Region

Manufacturing Challenges

Issues Related to Distributors and End Users

Consensus on Innovation

72% of makers plan to invest in IoT-enabled motors for predictive analytics.

Regional Priorities

Different Regulatory Impacts

Global Commonalities

Safety, durability, and cost control are common problems.

Key Regional Variations

Strategic Implications

To successfully penetrate these heterogeneous markets, firms need to tailor their strategy geographically-IoT in the USA, sustainability in Europe, and affordability inAsia.

| Countries | Regulations & Certifications Impacting the Market |

|---|---|

| United States (USA) |

|

| United Kingdom (UK) |

|

| France |

|

| Germany |

|

| Italy |

|

| South Korea |

|

| Japan |

|

| China |

|

| India |

|

The USA radial piston motor industry will grow at a 3.5% CAGR in 2025 to 2035, which is slightly higher than the global average of 3.1%. The growth is fueled by increasing investments in industrial automation, oil and gas, construction, and aerospace industries. The use of IoT-enabled hydraulic motors is gaining traction, as 72% of USA industrial stakeholders value smart factory solutions.

Regulatory pressures from the government in the form of OSHA safety regulations and EPA environmental regulations are forcing manufacturers to produce effective, long-lasting motors. The USA is also a world leader in terms of R&D spending, and companies are embedding AI-based predictive maintenance for industrial motors to optimize operational efficiency. Supply chain disruption and semiconductor shortage are challenges.

The UK radial piston motor industry is forecast to advance at a 3.0% CAGR, in step with worldwide trends. The post-Brexit regulatory landscape has brought new compliance rules, such as UKCA marking. Construction, mining, and renewable energy industries are major drivers of demand. 88% of UK stakeholders focus on energy-efficient motors in accordance with rigorous sustainability policies.

The Industrial Strategy Challenge Fund is driving automation and intelligent hydraulic solutions. Yet, economic volatility and the high cost of production in the UK made it a moderately profitable industry relative to Germany and the USA.

The French industry is expected to expand at a 2.9% CAGR due to strong government support for green energy and automation. The Energy Transition Law is also a prominent driver for the use of low-energy-consuming industrial motors. Moreover, ATEX certification is required for motors applied in dangerous conditions like oil refineries and chemical plants.

The agriculture and marine industries also significantly contribute to demand. Nevertheless, high regulatory fees and strict labour laws can hinder industry growth. France is behind Germany in adopting industrial automation but is still a dominant industry owing to its emphasis on green manufacturing.

Germany will experience a robust 3.7% CAGR owing to its dominance in industrial automation, robotics, and precision engineering. The Industry 4.0 initiative has prompted 53% of German manufacturers to incorporate AI-based motor diagnostics and automation. BAFA subsidies for energy-efficient machinery further prompt enterprises to adopt next-gen hydraulic motors.

The DIN standards and CE marking render compliance high, but they also guarantee quality industry entrants. Industries like automotive manufacturing, mining, and industrial equipment largely depend upon high-torque motors, keeping Germany a world-class industry for these motors.

Italy's industry will have a growth of 2.8% CAGR, being marginally lesser than the overall average. Its strong focus on heavy equipment, construction, and the textile industry continues to hold the demand stable. But there is slower growth due to excessive dependency on conventional mechanical systems instead of new automation.

Safety regulations by INAIL are influencing the design standards of motors, and the Eco-Design Directive is encouraging energy-efficient industrial machinery. Furthermore, Italy's emphasis on exporting hydraulic systems in the EU and worldwide guarantees consistent industry growth. However, the regulatory issues and changing economic conditions affect industrial investment.

South Korea is forecasted to register a 3.4% CAGR, spearheaded by smart manufacturing, automation, and miniaturized industrial solutions. 67% of South Korean manufacturers prioritize space-efficient motor design due to urban space limitations. Publicly supported efforts such as Smart Factory Korea are propelling IoT-enabled hydraulic motors adoption.

Further, KC certification and KOSHA safety requirements guarantee product excellence. Shipbuilding, automotive, and semiconductor are key industries that drive demand. But supply chain difficulties and rivalry from Chinese makers subject domestic producers to pricing pressures, necessitating strategic technology differentiation.

Japan’s industry will develop at a 2.6% CAGR, which is below the global average. Despite being a technology leader, Japan’s manufacturing sector continues to favour conventional mechanical systems over digital automation due to cost concerns. Just 25% of Japanese industrial players have implemented smart alarms and IoT-integrated hydraulic motors.

Yet, JIS standards and METI regulations guarantee that motors have high safety and durability standards. Industries such as automotive, robotics, and heavy industry maintain demand, but low digital penetration and old industrial infrastructure constrain rapid industry growth. The trend toward hybrid material constructions for motors is a new trend.

China is expected to have the highest CAGR among large markets, at 4.2%. The nation's fast-paced industrialization, infrastructure development, and government-supported automation drive fuel demand. MIIT policies require energy-saving motors, and CCC certification is a requirement for industry access.

China is the leading producer in the mining, construction, and heavy machinery sectors. The government's Made in China 2025 also promotes local manufacturing, adding to the competition among local and foreign producers. However, pricing competition and intellectual property concerns remain key challenges for foreign market entrants.

The industry in India will be growing at a 4.0% CAGR and will be one of the fastest-growing markets. Government-sponsored infrastructure initiatives, the Make in India movement, and manufacturing sector growth stimulate demand. BIS certification and CPCB environment standards govern industrial motors.

Major consumers are the textile, automobile and heavy machinery industries with growing investments in automation and energy-efficient technologies. Challenges include high import reliance on major motor components and raw material price volatilities. The use of smart hydraulic motors is increasing, especially in automotive and industrial automation.

The medium-speed radial piston motor (2,000-500 RPM) segment holds the highest industry share due to its versatility across various industries, including manufacturing, mining, and construction. Motors in this category offer an ideal balance of torque and speed, making them preferred for heavy-duty applications where controlled power output is required. The low-speed industry(less than 500 rpm) is expanding continually as it applies to marine, power generation, and hydraulic press applications where low-speed high-torque is critical.

The fast-moving industry segment (above 2,000 rpm) is expanding in industries such as aerospace and defence, where precise motion control is required. Increasing demand for energy-saving and small hydraulic motors will boost all categories; however, medium-speed motors will lead in the front due to wide application in industrial and mobile equipment.

Rugu and Small SMA are leading automation types, providing a significant advantage with their compatibility with IoT and Industry 4.0 solutions. This kind of automation is widespread in industrial and mobile machinery applications where predictive maintenance, real-time monitoring, and energy efficiency are critical. MH Motors account for a major share in power transmission, oil & gas, and mining, where durable, high-performance motors are essential.

However, XJ and XF automation types are the fastest-growing segments, particularly in precision-heavy sectors like aerospace and high-performance manufacturing. As technologies move towards automation, smart monitoring, and energy-saving options, the need for automated intelligent radial piston motors is likely to grow in regions like North America, Germany, and South Korea that have a lot of advanced technology.

The presence of radial piston motors in construction equipment, agriculture equipment, and mining trucks makes mobile machinery the biggest end-user segment. The industrial machinery sector is a significant source of income in nations with advanced manufacturing plants such as Germany, Japan, and the US. The fastest-growing application sector is power generation and transmission due to increased investments in renewable energy and hydropower projects, with radial piston motors playing an important role in converting hydraulic energy.

Oil & gas remain a vibrant market, but regulations and environmental concerns are gradually shifting demand toward electric and hybrid versions. Its utilization in aerospace and defence is increasing, especially for high-speed, high-precision motors used in flight control systems, hydraulic actuators, and high-end robotics applications.

Meanwhile, farm and forestry equipment will grow, and demand for high-torque, efficient motors in mechanized agricultural equipment is soaring. Adoption rates in transportation and mining are also seeing increased but growth will be determined by regional factors such as infrastructure spending and trends in the mining industry.

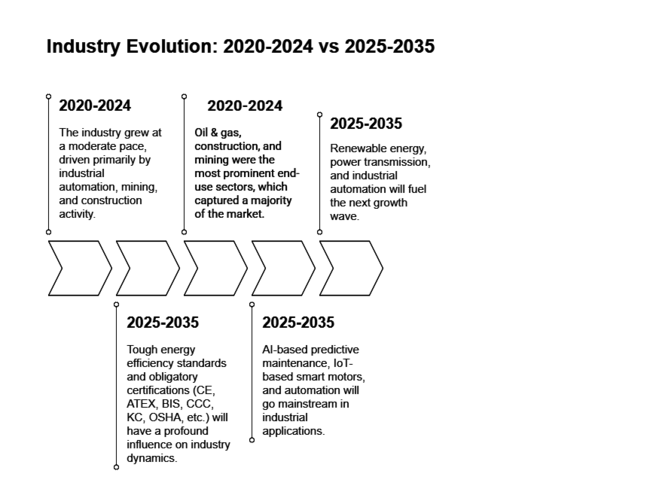

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The industry grew at a moderate pace, driven primarily by industrial automation, mining, and construction activity. | Industry growth is projected to pick up pace with greater uptake of energy-efficient motors, IoT-enabled automation, and smart hydraulic systems. |

| The COVID-19 pandemic disrupted supply chains and raw material prices, which impacted production. | Efforts to strengthen supply chains and localize component production are expected to improve industry stability. |

| Growing demand for medium-speed radial piston motors in heavy-duty use maintained industry pace. | Demand for high-speed motors will increase, especially in aerospace, defense, and precision automation. |

| Oil & gas, construction, and mining were the most prominent end-use sectors, which captured a majority of the market. | Renewable energy, power transmission, and industrial automation will fuel the next growth wave. |

| Regulatory compliance and efficiency requirements were increasing, but enforcement remained lenient. | Tough energy efficiency standards and obligatory certifications (CE, ATEX, BIS, CCC, KC, OSHA, etc.) will have a profound influence on industry dynamics. |

| Many industries favored conventional mechanical hydraulic systems, which constrained the uptake of smart motors. | AI-based predictive maintenance, IoT-based smart motors, and automation will go mainstream in industrial applications. |

| The Asia-Pacific region (China, India, and South Korea) experienced the highest growth, driven by industrial growth. | China and India will continue to be high-growth areas, while North America and Europe will concentrate on high-tech and green solutions. |

Key companies in the radial piston motor industry contend based on pricing strategies, technological innovations, strategic collaborations, and regional expansion. While many companies focus on cost-cutting and modular product designs to serve a broad range of industries, high-end players prioritize energy-efficient motors with IoT connectivity and predictive maintenance capabilities.

Companies are expanding their global presence through acquisitions, mergers, and joint ventures, with a strong focus on Asia-Pacific and Europe. OEM collaboration with mobile and industrial equipment producers drives industry penetration. Moreover, companies are investing in research & development (R&D) for hybrid as well as electric alternatives, complying with sustainability regulations & Industry 4.0 innovation that will ensure long-term growth.

Parker Hannifin Corporation

Industry share: ~25-30%

Parker Hannifin is known as a global leader in motion and control technologies, along with being the leader in radial piston motors via advanced hydraulic products and robust R&D capabilities. Its broad product line serves the construction, agricultural, and marine industries.

Bosch Rexroth AG

Market Share: ~20-25%

Bosch Rexroth has a solid industry share with its advanced hydraulic systems and radial piston motors. It is a major player in the industry, as the company specializes in energy-efficient and automated systems.

Eaton Corporation

Industry share: ~15-20%

Hydraulic Radial Piston Motor - Top Best-in-Class Hydraulic Solutions from Eaton. It has focused heavily on sustainability and electrification, accumulating a significant share in markets, particularly in North America and Europe.

Kawasaki Heavy Industries

Industry Share: ~10-15%

The technical strength of Kawasaki Heavy Industries in heavy machinery and hydraulics enables it to retain a strong share of the radial piston motor industry. The company has built up a customer base of loyalists thanks to its precision engineering and reliability.

Danfoss Power Solutions

Industry Share: ~10-15%

Danfoss is an industry leader in radial piston motor technology, recognized for innovative, energy-efficient hydraulic solutions. A strong distribution channel and customer orientation have helped in increasing its industry share.

Linde Hydraulics

Industry share: ~5-10%

One of them is Linde Hydraulics, a leading manufacturer of high-performance radial piston motors for mobile and industrial applications. Thanks to its technical competence and ability to customize products, it managed to build its own niche in the market.

Similarly, radial piston motors find extensive use in construction, mining, industrial automation, power transmission, aerospace, and agriculture.

Advancements in IoT, predictive maintenance, energy-efficient technologies, and advanced materials are enhancing performance and reliability.

Asia-Pacific, especially China and India, is developing rapidly due to infrastructure expansion and automation in the industry.

Disruptions in supply chains, fluctuations in raw material prices, and stringent environmental regulations are the chief challenges.

High-efficiency hydraulic motors benefit from the realizations of governments and industries regarding emissions demand, sustainability, and cost-effective reduction.

The industry is segmented into low speed (up to 500 rpm), medium speed (500 to 2,000 rpm) and high speed (over 2,000 rpm)

It is fragmented into MH, XJ, XF, Small SMA and SMA

It is segmented among mobile machinery, industrial machinery, power generation and transmission, oil and gas industry, aerospace and defence, transportation, agriculture and forestry, manufacturing, construction and mining

It segmented into North America, Europe, Asia Pacific, Latin America and The Middle East & Africa

Power System Simulator Market Growth - Trends & Forecast 2025 to 2035

United States Plastic-to-fuel Market Growth - Trends & Forecast 2025 to 2035

Power Generator for Military Market Growth – Trends & Forecast 2025 to 2035

Immersion Heater Market Growth - Trends & Forecast 2025 to 2035

Tire Curing Press Market Growth - Trends & Forecast 2025 to 2035

Turbidimeter Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.