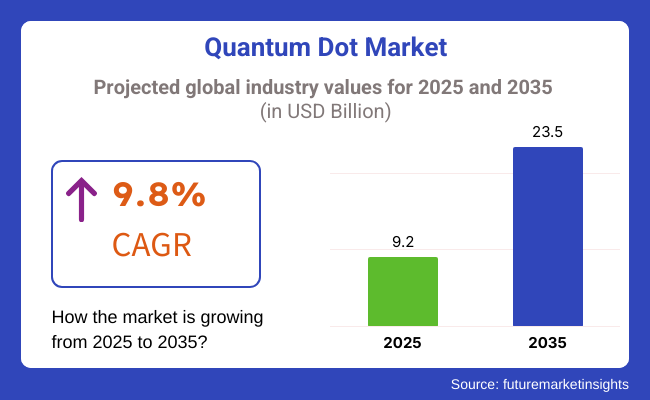

Quantum Dot market size is expected to reach USD 9.2 billion in 2025 and USD 23.5 billion in 2035 at a compound annual growth rate of 9.8% during the forecast period. Rising needs for high-definition displays, improvements in nanotechnology, and expanding applications of quantum dots in consumer electronics, medical imaging, and solar cells are fuelling industry growth.

Improvements in fabrication processes, higher energy efficiency, and color accuracy are further augmenting industry prospects. Moreover, the use of quantum dots in future display panels, quantum computing, and medical applications is widening the horizon. Strategic investments in R&D, regulatory requirements, and cooperation among technology companies, display companies, and research centers are driving industry growth.

Also, the increasing use of cadmium-free quantum dots, AI-based manufacturing, and eco-friendly nanomaterials is accelerating growth. Companies are using quantum dot-enhanced OLED displays, quantum dot-based solar photovoltaics, and advanced bio-imaging products to drive innovation across industries.

The Quantum Dot Market is currently the fastest-growing sector in the electronics industry due to its limited quantum dot light sources and the high-resolution and low-power, more efficient electronic devices. In consumer electronics, QDs improve color reproduction, brightness, and energy, and QLED TVs and displays sell color purity as the main problem.

Moreover, the most important features of healthcare and bio-imaging applications are the biocompatibility, non-toxicity, and stability of quantum dots since they are responsible for precise imaging techniques and the imaging of diseases.

The photovoltaic industry currently involves quantum dots, which are in demand for the new generation of solar cells and offer longer life cycles and better efficiency. Besides, in LED-cum-display technology, the use of quantum dots to enhance brightness and contrast has been a vital factor in making them a preferred choice for premium TVs and monitors.

Furthermore, defense & security applications utilized by advanced sensing, night vision, and surveillance techniques emphasized stability and reliability. The trend in the market is transforming into cadmium-free, environment-friendly quantum dots, which is in line with the worldwide sustainability principle.

| Company | Contract Value (USD Million) |

|---|---|

| Aeluma, Inc. | Approximately USD 50 - 60 |

| Samsung Electronics | Approximately USD 140 - 160 |

| Nanosys, Inc. | Approximately USD 70 - 80 |

Between 2020 and 2024, the quantum dot (QD) market progressed at a high speed, with nanotechnology revolutionizing display technology, medical imaging, and solar efficiency. QLEDs improved color precision and brightness in consumer products, while biomedical applications enabled high-precision imaging and targeted therapeutic drug delivery.

Firms invested in cadmium-free QDs for being environmentally friendly, and artificial intelligence-driven synthesis improved performance and stability. Despite limitations such as high cost and scalability, improved QD formulations lowered toxicity and enhanced commercialization in future tech.

Between 2025 and 2035, material discovery via AI, quantum computing, and flexible display technology will fuel the growth of the QD industry. QD photovoltaics will have higher efficiency than silicon solar, and QD-based biosensors will enable real-time disease diagnosis and customized medicine.

Quantum dots will enable ultra-fast computation in neuromorphic and quantum computing to accelerate AI and cryptography research. AI nanomanufacturing will decrease the cost and size of the technology and find many more uses, enabling unprecedented energy, healthcare, and computing developments.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| QLED displays improved color accuracy and energy efficiency in consumer electronics. | AI-optimized QD displays enhance refresh rates, durability, and adaptive color tuning for AR/VR applications. |

| Research enhanced QD photovoltaics for higher efficiency and durability. | Breakthrough energy conversion efficiencies are achieved in commercial-scale QD solar panels, making them less dependent on silicon-based PV. |

| High-precision medical imaging and targeted drug delivery were made possible through quantum dots. | AI-based biosensors employ quantum dots for real-time disease detection and personalized treatment. |

| Manufacturers designed quantum dots cadmium-free to be regulation and environment-friendly compliant. | Green synthesis technologies by means of AI-based processes reduce toxicity, thus increasing the lifecycle sustainability of quantum dots. |

| The application of quantum information processing was explored through research. | Quantum-dot-based quantum computers provide high-speed cryptographic and AI computation developments. |

| Flexible QD displays appeared at the early stage for wearables and foldable devices. | Rollable, high-resolution QD displays prevail on smart surfaces, automotive dashboards, and immersive media. |

| AI-aided material discovery maximized QD photoluminescence and efficiency. | Autonomous nanomanufacturing platforms simplify large-scale QD production, lowering costs and improving performance. |

| Early applications investigated QD potential for memory and logic devices. | Quantum-dot neuromorphic chips transform AI-based computation to human-like cognitive processing. |

| QDs were incorporated in early research for water filtration and environmental sensing. | AI-driven, QD-based sensors monitor pollution in real-time, facilitating smart city and climate resilience projects. |

| QD technology in AR headsets enhanced resolution and reaction time. | Fully immersive, AI-powered QD displays enable next-generation mixed reality experiences with hyper-realistic images. |

Several threats related to the provision of materials, the regulation compliance, technological development, and the competition with alternative technologies face the industry. One of the serious hazards is the availability and price of raw materials, especially cadmium, indium, and selenium, which are essential for QD production. The procurement of these materials can be affected by chain disruptions, geopolitical conflicts, and environmental regulations, which, in turn, can cause price fluctuations and production delays.

Regulatory challenges are another worry, particularly the concern surrounding carbon-based quantum dot usage. Apart from this, the European Union, for example, has environmentally protective laws (e.g., RoHS) aimed at controlling the use of substances harmful to human health and the environment. Companies falling behind on adherence to the new laws on dynamic standards for waste reduction may find themselves in an unfair market with compensations and/or substitutions of expensive materials.

Also, the rapid innovation trajectory of display technologies followed by the arrival of such products as Mini-LED, Micro-LED, and OLED leads us to the question of whether QD would be implemented or not, and that must be a first threat to it/that is a main challenge before question whether QD directs to their application or not.

Even though it is true that quantum dot technology involves addition of quantum dots into QLED TV displays to make them brighter and more colourful, they are expected to remain in the competitive field against other kinds which are more efficient and probably cheaper to manufacture.

QD industry has high production costs and scalability issues. These are some drawbacks. The invention of low-priced, massively producible quantum dots is still very difficult for the company. Finding scalable synthesis methods and ensuring proportionate production costs through investment in the appropriate strategies of implementation are the ways that industries should apply.

| Country | CAGR (2025 to 2035) |

|---|---|

| The USA | 12.3% |

| The UK | 12.0% |

| European Union (EU) | 12.1% |

| Japan | 12.2% |

| South Korea | 12.4% |

The USA quantum dot market develops at a fast pace as industries increasingly utilize quantum dot technology to improve display performance, increase solar energy conversion, and develop biomedical imaging. Firms constantly innovate to create materials that provide greater color accuracy, energy efficiency, and brightness in consumer devices.

High-definition televisions, quantum dot-based LEDs, and emerging nanotechnology applications drive the growth. Technology innovators embed quantum dots in OLED and MicroLED screens, significantly enhancing color saturation and reducing power consumption. Advances in AI-driven material science accelerate the development of highly efficient and long-lasting formulations.

USA healthcare, electronics, and renewable energy industries use quantum dots to optimize performance and efficiency. Governmental initiatives prompt companies to invest in environmentally friendly nanotechnology solutions at a rapid pace towards converting to non-toxic cadmium-free quantum dots.

Increasing uses of mini-LED and micro-LED technologies further drive demand. At the same time, quantum dots are being synthesized by research centers for future-generation imaging in cancer diagnosis and photovoltaic cells for greater solar energy conversion efficiency.

FMI is of the opinion that the USA is slated to grow at 12.3% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Consumer Electronics | Companies incorporate quantum dots into OLED and MicroLED panels to produce improved color rendition and efficiency. |

| Renewable Energy | Quantum dot-aided photovoltaic cells enhance solar panel efficiency, fueling greater adoption. |

| Healthcare | Biomedical imaging is transformed with fluorescence methods mediated by quantum dots for earlier disease detection. |

| Government Policies | Incentives encourage environmentally friendly, cadmium-free quantum dot manufacturing. |

The UK quantum dot market grows as companies and research institutions adopt quantum dot technologies in the fields of health diagnostics, display technology, and optoelectronics. Organizations aim to enhance light output, increase energy efficiency, and develop applications in nanomaterials. The growth is experienced as the demand for quantum dot-enhanced biosensors and accurate imaging picks up pace.

Applications of medical imaging, quantum computing, and solar panels enabled by quantum dots are growing exponentially. Incentives by governments in the form of supporting development in nanotechnology are encouraging, thus accelerating the introduction of quantum dots into smart lighting and digital signage applications. Artificial intelligence-based synthesis strategies increase material scalability with reduced production costs, bringing quantum dot technologies within budget.

FMI is of the opinion that the UK is slated to grow at 12.0% CAGR during the study period.

Growth Drivers in the UK

| Key Drivers | Details |

|---|---|

| Healthcare | Quantum dots enhance precise imaging and biosensors for quicker diagnosis. |

| Quantum Computing | Companies use quantum dots in quantum processors to enhance efficiency. |

| Renewable Energy | Quantum dot-based solar cells increase energy conversion. |

| Government Support | Policies encourage investments in nanotechnology research. |

The EU quantum dot market expands as companies use this technology in high-definition screens, solar power systems, and biomedical processes. Germany, France, and Italy are leading in using quantum dots in television screens, solar panels, and bio-sensing devices. Demand for sustainable, environmentally friendly solutions fuels investment in cadmium-free solutions.

Strict environmental protection policies prompt manufacturers to come up with recyclable and non-toxic quantum dots. Energy-efficient lighting and nanophotonics propel technology infusion across sectors. The rise in demand for semiconductors from quantum dots supports next-generation computing prospects, with firms looking into their use in future battery technology for more efficiency in energy storage.

FMI is of the opinion that the EU is slated to grow at 12.1% CAGR during the study period.

Growth Drivers in the EU

| Key Drivers | Details |

|---|---|

| Consumer Electronics | Europe is a leader in utilizing quantum dots for ultra-HD display. |

| Renewable Energy | Quantum dot-powered solar panels increase efficiency. |

| Biomedical Applications | Bio-sensing devices use quantum dots to detect disease. |

| Regulations | EU requirements drive quantum dots that are sustainable and cadmium-free. |

Japan's quantum dot market grows as business entities integrate quantum dot materials in high-performance display panels, semiconductor uses, and medical imaging solutions. Businesses engineer next-generation technologies for increased brightness, energy efficiency, and optical performance. Placing quantum dots into OLED and MicroLED displays is driving industry expansion.

Japan's leadership in display technology, quantum computing, and energy-saving technology drives the adoption of quantum dot-based technologies. Automotive, electronic, and healthcare sectors invest in nanomaterial-based quantum dots to achieve extra functionality. Quantum dots are designed to be extremely stable and long-lived, enabling applications in flexible and transparent displays, wearable electronics, and smart textiles.

FMI is of the opinion that the Japan Quantum Dot Market is slated to grow at 12.2% CAGR during the study period.

Growth Drivers in Japan

| Key Drivers | Details |

|---|---|

| Display Technology | OLED and MicroLED manufacturers incorporate quantum dots to deliver high performance. |

| Semiconductors | Quantum dots enhance the efficiency of high-performance computing chips. |

| Healthcare | Quantum dot bioimaging facilitated medical diagnosis and targeted treatment. |

| Wearable Tech | Firms look for quantum dots in flexible, transparent displays. |

South Korea's quantum dot industry expands exponentially as the display industry, semiconductor companies, and emerging energy industries invest in cutting-edge technologies. The government actively promotes research and development on nanotechnology that drives the advancement of quantum dots in next-generation display technology and energy-efficient applications. Businesses are increasingly utilizing quantum dots to improve AR and VR display performance.

Firms use high-purity quantum dots to infuse QLED TVs, flexible OLED screens, and solar cells with performance enhancement and color accuracy. Quantum computing and nanostructured materials innovation fuel growth. The healthcare industry is aided by the growing need for quantum dot-driven high-performance bioimaging methods, which spur investments. Studies on perovskite quantum dots enhance solar cell efficiency, bolstering the nation's renewable energy base.

FMI is of the opinion that South Korea is slated to grow at 12.4% CAGR during the study period.

Growth Drivers in South Korea

| Key Drivers | Details |

|---|---|

| Display Technology | Quantum dots improve QLED TVs, OLEDs, and flexible displays. |

| Renewable Energy | Perovskite quantum dots enhance the efficiency of solar cells. |

| AR/VR Applications | Quantum dots improve color purity in immersive technology. |

| Government Support | Policies encourage nanotechnology research and the use of quantum dots. |

By 2025, the solar cell segment is projected to account for a 33.8% share. Therefore, the application of quantum dots (QDs) that can significantly increase light absorption, charge carrier separation, and energy conversion efficiency has been a key driver for the development of high-efficiency photovoltaic cells. The QDs also show reasonably sized optoelectronic bandgaps, allowing efficient and improved photon harvesting across a broad light spectrum.

Consequently, they can be used in state-of-the-art photovoltaic devices like QD-sensitized solar cells (QDSSCs) and perovskite-QD tandem solar cells. However, it has been found that perovskite-QD-based solar cells can offer up to 30% greater efficiency than conventional silicon-based solar cells. The officials at First Solar and Nanosys are also betting on these developments to result in cheap, high-efficiency solar panels that can surpass what is out there today.

The lasers segment is expected to constitute 24.5% of the industry share by 2025. The potential for quantum dot lasers (QDLs) is significant due to their narrow emission linewidth, high color purity, and tunability, which form the pillar of fiber-optic communications, medical imaging, and high-precision industrial manufacturing.

QDLs offer lower threshold currents and improved temperature tolerance than conventional semiconductor lasers, making them ideal for high-speed fiber-optic communication and compact, high-efficiency laser modules[2,3]. Compared to traditional GaAs-based systems, QD Laser Inc. and Sony are at the forefront of developing wavelength-stable, long-lifetime QD-based semiconductor laser diodes.

By 2025, the sensors segment is expected to account for the largest share of 28.2% of the overall market. There is a growing interest in using quantum dot-based sensors in next-generation healthcare diagnostic applications, environmental monitoring applications, and security applications because of their ultrahigh sensitivity and specificity. QD-augmented biosensors enable single-molecule detection by means of FRET or plasmonic effect.

For bioimaging inspections, real-time pathogen detection, and early cancer diagnosis, medical diagnostic companies such as Thermo Fisher Scientific have developed QD-based fluorescence sensors. In environmental sensing, QDs are used to detect various analytes for wearable biosensors, monitor all contaminants, and identify heavy metals.

In 2025, approximately 13.5% of the share will be held by the transistor segment. Quantum dot field-effect transistors (QD-FETs) are the next-generation devices for nanoelectronics, high-speed computing, and flexible electronics.

These features have concrete improvements in electron mobility, low power consumption, and high-temperature stability and could have future applications in flexible displays, neuromorphic computing, and quantum computing architectures. With leading companies like Samsung and IBM striving to manufacture much smaller, ultra-low-power transistors that would use less energy.

The market for quantum dots is massively revolutionizing due to industries adopting nanotechnology-influenced advances in display technology, the energy efficiency of products, and biomedical applications. High-resolution displays with improved color and ecologically better alternatives to traditional materials are driving investments in quantum-dot-enabled displays, their solar cells, and applications in medical imaging.

Some of the key players dominating the market offer quantum-dot-based display panels, high-efficiency solar solutions, and bio-imaging applications. The major names in the space are Samsung Electronics, Nanosys, Nanoco Group, Sony Corporation, and Quantum Materials Corp. Startups and niche providers are focusing on the development of cadmium-free quantum dots, next-generation material synthesis, and printable quantum dot technology, making the competitive landscape very intense.

The nascent phase of the market rests on the growing penetration of QD-OLED and MicroLED display technologies, the development of low-toxicity quantum dots, and a burgeoning field in life sciences applications. Advancements in innovative ink formulation, printable electronics, and AI-material optimization will keep pushing the industry boundaries further.

Strategic sustainability factors associated with the competition are development in production scalability of quantum dots, changes in luminary structures incorporating cadmium-free materials, and soon incorporation into integrated display and energy technologies. Companies with lower-cost, longer-lasting, and superior-quality solutions are destined to grow in the future.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Samsung Electronics (QD Vision) | 20-25% |

| Nanosys Inc. | 15-20% |

| Nanoco Group Plc | 12-17% |

| Sony Corporation | 8-12% |

| Quantum Materials Corp. | 5-9% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Samsung Electronics (QD Vision) | Develops QLED display technology, quantum dot-enhanced screens, and high-efficiency nanomaterials. |

| Nanosys Inc. | Provides AI-driven quantum dot production, energy-efficient displays, and next-gen display technology. |

| Nanoco Group Plc | Specializes in cadmium-free quantum dots, sustainable nanomaterials, and biomedical imaging applications. |

| Sony Corporation | Focuses on high-resolution quantum dot displays, advanced LED technology, and color-enhancement solutions. |

| Quantum Materials Corp. | Offers quantum dot-based solar panels, medical imaging applications, and high-performance nano-optics. |

Key Company Insights

Samsung Electronics (QD Vision) (20-25%)

Samsung holds the lead in the quantum dot domain through the development of QLED display technologies, AI-enhanced quantum dot manufacture, and nanomaterials that have high efficiency.

Nanosys Inc. (15-20%)

The company enhances the display performance using quantum dots manufactured by artificial intelligence and energy-efficient materials and applications of next-gen quantum dots.

Nanoco Group Plc (12-17%)

Nanoco Group specializes in cadmium-free quantum dots, sustainable nanomaterials, and innovative solutions in advanced biomedical imaging.

Sony Corporation (8-12%)

Sony is working on improving display technology with high-resolution quantum dot displays, new applications based on LEDs, and solutions for the enhancement of hue.

Quantum Materials Corp. (5-9%)

Quantum Materials Corp. offers quantum dot solar panels, AI-enhanced medical imaging technology, and ultra-performing nano-optics.

Other Key Players (20-30% Combined)

The quantum dot industry will continue to grow as industries integrate AI, nanotechnology, and high-efficiency quantum materials to enhance display performance, renewable energy solutions, and biomedical advancements.

The market includes solar cells, lasers & display devices, solid-state LED lighting, Optical switches, logic gates, and memory devices.

The market covers medical devices, consumer electronic devices, the defense industry, and others.

The market comprises Cadmium Sulfide, Cadmium Telluride, Cadmium Selenide, Silicon, and Indium Arsenide.

The market is segmented into colloidal synthesis, fabrication, viral assembly, bulk manufacturing, and cadmium-free quantum dots.

The market spans North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and the Middle East & Africa.

The industry is slated to reach USD 9.2 billion in 2025.

The industry is predicted to reach a size of USD 23.5 billion by 2035.

Key companies include Samsung Electronics (QD Vision), Nanosys Inc., Nanoco Group Plc, Sony Corporation, Quantum Materials Corp., G Display, 3M Company, Osram Opto Semiconductors, Merck Group, and UbiQD Inc.

South Korea, driven by the increasing adoption of display technology, medical imaging, and optoelectronics, is expected to record the highest CAGR of 12.4% during the forecast period.

Solar cells, lasers & display devices, and solid-state LED lighting are among the most widely used applications in the industry.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Quantum Detector Market Size and Share Forecast Outlook 2025 to 2035

Quantum Cascade Laser Market Size and Share Forecast Outlook 2025 to 2035

Quantum Imaging Devices Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Quantum Sensors Market Size and Share Forecast Outlook 2025 to 2035

Quantum Cascade Lasers Market Growth - Trends & Forecast 2025 to 2035

Quantum Cryptography Market Insights - Growth & Forecast 2025 to 2035

Quantum Computing Market Growth – Trends & Forecast 2025 to 2035

Quantum Photonics Market Analysis – Growth & Forecast 2024-2034

Post-Quantum Cryptography (PQC) Migration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automotive Quantum Computing Market Size and Share Forecast Outlook 2025 to 2035

Integrated Quantum Optical Circuits Market Size and Share Forecast Outlook 2025 to 2035

ADC & DAC In Quantum Computing Market Size and Share Forecast Outlook 2025 to 2035

Superconducting Quantum Chip Market Size and Share Forecast Outlook 2025 to 2035

Photonic Integrated Circuit & Quantum Computing Market - Trends & Forecast 2025 to 2035

Dot Peen Marking Machines Market Size and Share Forecast Outlook 2025 to 2035

Endotracheal Tube Market - Growth & Demand Outlook 2025 to 2035

Endotracheal Tube Cuffs Market

Ga 68 DOTATOC Market

Fuchs Endothelial Corneal Dystrophy (FECD) Market Size and Share Forecast Outlook 2025 to 2035

Vascular Endothelial Growth Factor Inhibitor Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA