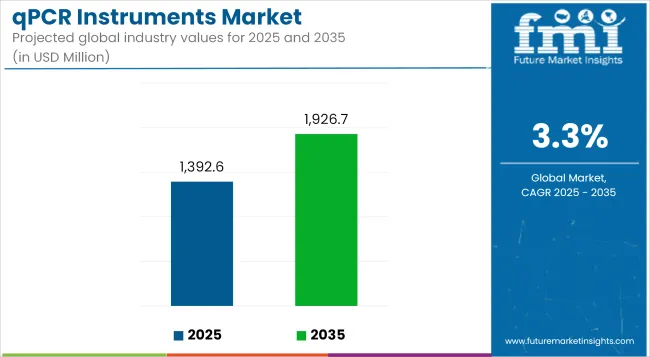

The qPCR instruments market is expected to grow steadily between 2025 and 2035, driven by increasing adoption of molecular diagnostics, rising demand for precision medicine, and advancements in automated, high-throughput real-time PCR technologies. The market is projected to be valued at USD 1,392.6 million in 2025 and is anticipated to reach USD 1,926.7 million by 2035, reflecting a CAGR of 3.3% over the forecast period.

Quantitative polymerase chain reaction (qPCR) instruments find widespread applications in clinical diagnostics, genomics research, infectious disease detection, oncology, agriculture, and biopharma R&D. Multiplexing capabilities, integrated microfluidic chip applications, and portable qPCR platforms are driving demand across decentralized laboratories and point-of-care settings. However, cost of instrumentation, technical complexity and reagent compatibility issues act as a barrier to market growth.

Market Metrics

| Metric | Value (USD) |

|---|---|

| Industry Size (2025E) | USD 1,392.6 million |

| Industry Value (2035F) | USD 1,926.7 million |

| CAGR (2025 to 2035) | 3.3% |

Some of the key trends include the integration of digital PCR, automation of conventional thermal cyclers, cloud-connected instruments, and the application of AI-enabled assay interpretation for in vivo decision making.

North America dominates the global qPCR instruments market and is supported by a strong ecosystem of clinical genomics labs, favourable research funding, and acceptance of molecular diagnostics in personalized medicine.

Demand is strong in oncology testing, infectious disease surveillance and companion diagnostics in the United States. These include partnerships with public health to develop genomics infrastructure across the country and precision agriculture testing programs.

Centralized healthcare systems, EU-funded genomic research grants, and the increasing automation of qPCR platforms in diagnostic laboratories support the European market. Learn more about Workflows for qPCR in Clinical Applications from companies like Germany, UK, France, Italy, Netherlands, integrating qPCR technologies for clinical trial pipelines, point-of-care diagnostics, and pharmacogenomics testing. IVDR, an abbreviation for In Vitro Diagnostic Regulation drives manufacturers towards the highest data validation and automation standards.

Asia-Pacific represents the fastest-growing region, owing to government spending on public health laboratories, infectious disease control, and biotech innovation ecosystems. China is expanding its domestic qPCR manufacturing capacity and is scaling lab automation in hospitals.

For instance, India is implementing qPCR for tuberculosis, dengue, and cancer screening, while Japan and South Korea are prioritizing multiplexed genetic testing, liquid biopsy platforms, and the integration of point-of-care qPCR into smart hospitals.

High Equipment Costs, Reagent Standardization, and Skill Gaps

The qPCR instrumentation has high upfront costs, especially with automated multiplex systems, which can prevent its adoption among small labs and emerging markets. Ongoing barriers include reagent compatibility, cross-platform assay standardization, and need for skilled operators. Furthermore, storage-sensitive consumables and infrastructure constraints may complicate their deployment in the field.

Decentralized Testing, Multiplexing, and AI Integration

Shifts in professional laboratory tests from centralized to decentralized are sure to pay dividends for the market, with portable qPCR, field-ready instruments, or mobile lab integration all presenting opportunities.

Clinical efficiencies will be driven by innovations in sample-to-answer platforms, high-throughput multiplex assays, and machine-learning-based result analysis. Liquid biopsy qPCR, pharmacogenomics, and environmental bio surveillance will further broaden applications within the market.

Based on technology, qPCR (quantitative Polymerase Chain Reaction) Instruments Market showed a remarkable growth between the period of 2020 to 2024 due to COVID-19 testing requirements, technological advancements in pathogen detection and increasing adoption of molecular diagnostics in oncology, genetic testing and agriculture.

These had made instruments faster, smaller, and multiplexed. Hospitals, academic laboratories and biotech companies invested in high-throughput systems and automation. However, saturation in COVID-related diagnostics, consumable cost, and technical complexity restricted use in smaller labs and resource-limited settings.

In 2025 to 2035, the market will undergo a transformation with the introduction of AI-assisted data interpretation algorithm, miniaturized point-of-care (POC) qPCR instrument platform, and cloud incorporated bioinformatics integration.

Innovation in qPCR design and deployment will be spurred on by the growth of precision medicine, decentralized diagnostics, and real-time environmental bio surveillance. Instruments will include plug-and-play cartridges, digital connectivity, and compatibility with multi-omic workflows. Sustainability, automation, and affordability will be the primary drivers, especially in making high-quality molecular diagnostics available worldwide.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Emergency use authorizations (EUAs) for infectious disease diagnostics; established FDA and CE-IVD approvals. |

| Technological Innovation | High-throughput platforms, multiplex detection, and faster thermo cycling protocols. |

| Industry Adoption | Broad adoption in clinical diagnostics, food safety, and academic research during the pandemic. |

| Smart & AI-Enabled Solutions | Semi-automated software for threshold cycle (Ct) analysis and quantification. |

| Market Competition | Dominated by Thermo Fisher, Bio-Rad, Roche, Qiagen, and Agilent. |

| Market Growth Drivers | COVID-19 testing surge, molecular oncology, and genetic disorder diagnostics. |

| Sustainability and Environmental Impact | Limited focus during pandemic peak; reliance on single-use plastics. |

| Integration of AI & Digitalization | Cloud-based data storage and basic LIMS integration. |

| Advancements in Product Design | Bench-top thermal cyclers with fluorescence-based detection and manual setup. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Standardization of AI-augmented diagnostics, global harmonization of decentralized molecular testing standards, and sustainability compliance. |

| Technological Innovation | AI-assisted primer design, portable POC qPCR devices, integrated cloud analytics, and qPCR-CRISPR hybrid platforms. |

| Industry Adoption | Expansion into primary care settings, veterinary diagnostics, environmental biosensing, and synthetic biology workflows. |

| Smart & AI-Enabled Solutions | AI-native systems for automated result interpretation, anomaly detection, and real-time epidemiological mapping. |

| Market Competition | Increased competition from cloud-connected device startups, mobile diagnostic platform providers, and AI-integrated biotech OEMs. |

| Market Growth Drivers | Growth driven by global disease surveillance, personalized medicine, rapid antimicrobial resistance detection, and home molecular testing. |

| Sustainability and Environmental Impact | Development of reusable consumables, low-energy thermo cyclers, and eco-friendly reagent packaging. |

| Integration of AI & Digitalization | Full digital ecosystems with remote device management, blockchain-based result verification, and patient-linked genomic databases. |

| Advancements in Product Design | Compact cartridge-based instruments, microfluidic qPCR chips, voice-guided user interfaces, and rapid deployment kits for field use. |

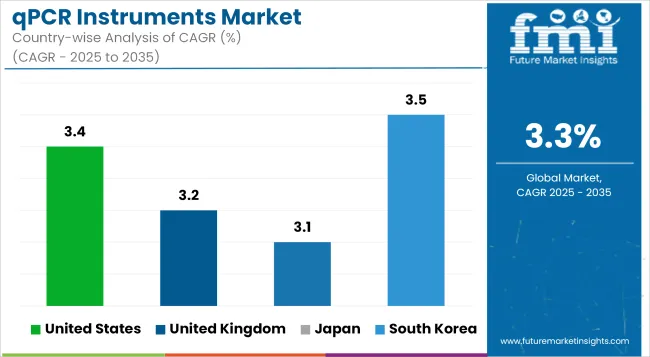

In the USA qPCR instruments market, construction growth IS driven by continuing investments in molecular diagnostics & life sciences research as well as infectious disease surveillance. The report categorizes the global market into key end users including academic labs, biotech companies, and clinical diagnostic centers; highlights the demand for multiplexing capabilities and high-throughput platforms.

The growth of clinical quantitative PCR in areas such as oncology, pharmacogenomics, and precision medicine is supporting broader applications in translational sciences as well as clinical path. Cloud connectivity and real-time data analytics are also key focuses for USA-based manufacturers planning next-gen qPCR platforms.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.4% |

Strong academic research institutions, NHS-based diagnostic expansion, and a growing biotech sector underpin the UK qPCR instruments market. The surge in interest in rapid molecular diagnostics post-pandemic is still propelling demand for multi-use, small-footprint, and easy-to-use qPCR systems.

The tunnelling validation facilitated transparent strategy application of all clinical data usages by deep learning-specific instances in the next sections, as the domains of respiratory infections, cancer screening, and antimicrobial resistance monitoring all benefit from its logistical utility.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.2% |

High pharmaceutical R&D activity in Germany, centralized healthcare system, and EU-wide public health initiatives driving qPCR instruments market in western Europe. qPCR is a well-established method in microbiology, environmental testing, and veterinary diagnostics.

Regulatory requirements for pathogen surveillance and food safety testing are further widening applications in public and private labs. Genomics is big in Europe and manufacturers are positioning themselves around compact benchtop designs, open-system flexibility, and compatibility with a range of reagent kits.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.3% |

Japan qPCR instrument market is gradually expanding and is supported by the need for innovations in precision medicine, the demands of the aging population, and advances in diagnostic workflows. In Japan, research institutes and clinical labs prioritize high-sensitivity instruments with long-term reliability and low failure rates.

Continued infectious disease surveillance initiatives particularly in the respiratory and zoonotic arenas lend additional support to the market. Point of care diagnostics with compact, all-in-one qPCR systems, are gaining acceptance in rural and community health settings.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.1% |

The market for qPCR instruments is growing in South Korea, supported by government-funded genomics initiatives, ever-growing biotech clusters, and increased demand for fast-turnaround diagnostics. In this context, as qPCR systems advance towards real-time remote monitoring, AI-driven assay optimization and automated sample prep modules, the country’s digital integration process is fuelling this innovation.

The demand for molecular tests is driving investments in a number of established and developing markets, including infectious disease testing, rare disease testing, and companion diagnostics, and in hospital labs and reference centers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.5% |

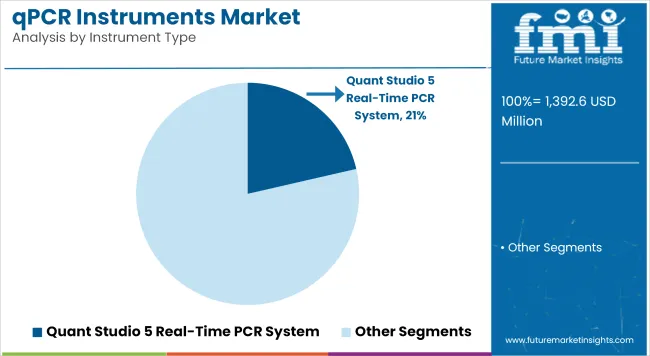

Instrument Type Market Share (2025)

| Instrument Type | Value Share (%) |

|---|---|

| Quant Studio 5 Real-Time PCR System | 21.4% |

The Quant Studio 5 Real-time PCR System is forecasted to dominate the qPCR instruments market by 2025, with 21.4% share in terms of value of the global market. This system, notable for its low barrier to entry, cloud-based connectivity, and quantitative performance, is widely utilized in research and clinical diagnostics. This allows for high-throughput multiplex gene expression, and can be used with a wide range of assays.

With the flexibility of supporting both 96 and 384-well formats, the system is an ideal high through-put solution for medium to large laboratories looking for speed, accuracy, and scalability. The data reproducibility and analysis efficiency are further enhanced by integration with Thermo Fisher’s software platforms.

With increasing demand for real-time PCR in areas of infectious disease monitoring, oncology and genetic research, the cost-efficient performance of the QuantStudio 5 provides the flagship reagent here to the changing blood of molecular diagnostics.

Regional Market Share (2025)

| Region | Value Share (%) |

|---|---|

| North America | 39.6% |

The qPCR instruments market in North America accounted for an estimated 39.6% share of the global value in 2025. Strong healthcare infrastructure, early adoption of technology, and significant investments in genomics and personalized medicine fuel the region's leadership. The USA provides the lion share of this, helped by huge public health spend, high R&D spending, and the fact that many of the world's leading biotech and pharma companies are based in the United States.

Support from regulatory agencies like the FDA and the CDC has supported this high patient-volume growth by providing support for deployment of qPCR platforms in clinical diagnostics and infectious disease surveillance. COVID-19 pandemic generated a substantial boost to regional instrument implementation, and the trend extended to the fields of pathogen detection, oncology, and pharmacogenomics.

Additionally, Canada is playing an increasing role in qPCR based research, led by public-private research institutions and academic laboratories. The ongoing federal investments and partnerships in precision medicine are likely to help North America in retaining the market leader ship and innovation edge in qPCR instrumentation.

The qPCR Instruments Market (quantitative Polymerase Chain Reaction) is expanding consistently as they are used in a variety of applications including, molecular diagnostics, gene expression analysis, pathogen detection, pharmacogenomics, and others.

Such data are critical to real-time nucleic acid quantification systems offering fast, sensitive, and specific diagnostics for research, clinical, and industrial labs. A few of the key market drivers include the increasing demand for infectious disease testing, increasing investments in genomics research, developing oncology biomarkers, and automation in diagnostic workflows.

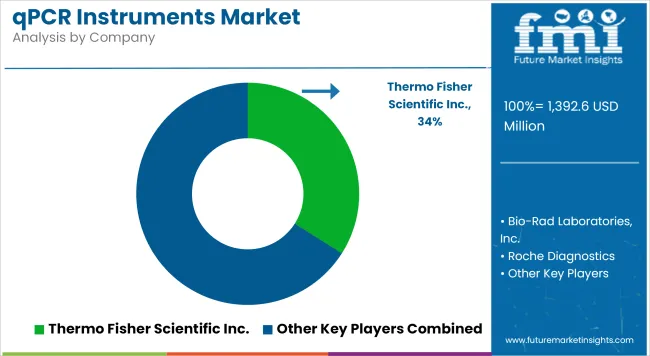

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Thermo Fisher Scientific Inc. | 30-34% |

| Bio-Rad Laboratories, Inc. | 18-22% |

| Roche Diagnostics (F. Hoffmann-La Roche) | 14-18% |

| Agilent Technologies Inc. | 9-13% |

| Qiagen N.V. | 6-9% |

| Others | 14-20% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Thermo Fisher Scientific Inc. | In 2024, Thermo Fisher expanded its QuantStudio™ platform with AI-assisted analysis features and cloud-based connectivity for high-throughput clinical and research labs. |

| Bio-Rad Laboratories, Inc. | As of 2023, Bio-Rad launched the CFX Opus 96 Deep Well qPCR System, providing expanded multiplexing capabilities and intuitive thermal uniformity for complex assay workflows. |

| Roche Diagnostics | In 2025, Roche introduced the LightCycler® 96 Next-Gen system, integrating enhanced fluorescence optics and rapid cycling protocols for time-sensitive diagnostic labs. |

| Agilent Technologies Inc. | In 2023, Agilent upgraded its AriaMx Real-Time PCR platform with enhanced dye flexibility and customizable workflows for research institutions and CROs. |

| Qiagen N.V. | As of 2024, Qiagen expanded its Rotor-Gene Q series, adding modular automation and advanced software integration for infectious disease detection and translational research. |

Key Market Insights

Thermo Fisher Scientific Inc. (30-34%)

Market leader with an expansive qPCR instrument portfolio offering robust scalability, cloud integration, and compatibility with FDA-cleared diagnostics and RUO applications.

Bio-Rad Laboratories, Inc. (18-22%)

Known for innovation in multiplexing and thermal uniformity, Bio-Rad serves both high-throughput clinical diagnostics and life sciences research segments globally.

Roche Diagnostics (14-18%)

Strong in clinical-grade qPCR instruments with CE-IVD and FDA-approved platforms, Roche supports routine diagnostics and high-sensitivity testing across pathology labs.

Agilent Technologies Inc. (9-13%)

Offers user-friendly, research-focused systems with integrated dye calibration and modular design, catering to academic and pharma labs.

Qiagen N.V. (6-9%)

Specializes in flexible benchtop qPCR solutions integrated with RNA/DNA prep workflows and diagnostic assays, especially in molecular infectious disease testing.

Other Key Players (Combined Share: 14-20%)

A growing group of regional suppliers and emerging innovators are contributing to the market through miniaturized systems, AI-enhanced data analytics, and POC-ready qPCR technologies, including:

Table 1: Global Market Value (US$ Million), By Instrument Type, 2018 to 2022

Table 2: Global Market Value (US$ Million), By Instrument Type, 2023 to 2033

Table 3: Global Market, By Region, 2018 to 2022

Table 4: Global Market, By Region, 2023 to 2033

Table 5: North America Market Value (US$ Million), By Instrument Type, 2018 to 2022

Table 6: North America Market Value (US$ Million), By Instrument Type, 2023 to 2033

Table 7: North America Market, By Country, 2018 to 2022

Table 8: North America Market, By Country, 2023 to 2033

Table 9: Latin America Market Value (US$ Million), By Instrument Type, 2018 to 2022

Table 10: Latin America Market Value (US$ Million), By Instrument Type, 2023 to 2033

Table 11: Latin America Market, By Country, 2018 to 2022

Table 12: Latin America Market, By Country, 2023 to 2033

Table 13: Europe Market Value (US$ Million), By Instrument Type, 2018 to 2022

Table 14: Europe Market Value (US$ Million), By Instrument Type, 2023 to 2033

Table 15: Europe Market, By Country, 2018 to 2022

Table 16: Europe Market, By Country, 2023 to 2033

Table 17: Asia Pacific Market Value (US$ Million), By Instrument Type, 2018 to 2022

Table 18: Asia Pacific Market Value (US$ Million), By Instrument Type, 2023 to 2033

Table 19: Asia Pacific Market, By Country, 2018 to 2022

Table 20: Asia Pacific Market, By Country, 2023 to 2033

Table 21: MEA Market Value (US$ Million), By Instrument Type, 2018 to 2022

Table 22: MEA Market Value (US$ Million), By Instrument Type, 2023 to 2033

Table 23: MEA Market, By Country, 2018 to 2022

Table 24: MEA Market, By Country, 2023 to 2033

Table 25: Global Market Incremental $ Opportunity, By Instrument Type, 2018 to 2022

Table 26: Global Market Incremental $ Opportunity, By Region, 2023 to 2033

Table 27: North America Market Incremental $ Opportunity, By Instrument Type, 2018 to 2022

Table 28: North America Market Incremental $ Opportunity, By Country, 2023 to 2033

Table 29: Latin America Market Incremental $ Opportunity, By Instrument Type, 2018 to 2022

Table 30: Latin America Market Incremental $ Opportunity, By Country, 2023 to 2033

Table 31: Europe Market Incremental $ Opportunity, By Instrument Type, 2018 to 2022

Table 32: Europe Market Incremental $ Opportunity, By Country, 2023 to 2033

Table 33: Asia Pacific Market Incremental $ Opportunity, By Instrument Type, 2018 to 2022

Table 34: Asia Pacific Market Incremental $ Opportunity, By Country, 2023 to 2033

Table 35: MEA Market Incremental $ Opportunity, By Instrument Type, 2018 to 2022

Table 36: MEA Market Incremental $ Opportunity, By Country, 2023 to 2033

Figure 1: Global Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 2: Global Market Absolute $ Historical Gain (2018 to 2022) and Opportunity (2023 to 2033), US$ Million

Figure 3: Global Market Share, By Instrument Type, 2023 & 2033

Figure 4: Global Market Y-o-Y Growth Projections, By Instrument Type – 2023 to 2033

Figure 5: Global Market Attractiveness Index, By Instrument Type – 2023 to 2033

Figure 6: Global Market Share, By Region, 2023 & 2033

Figure 7: Global Market Y-o-Y Growth Projections, By Region – 2023 to 2033

Figure 8: Global Market Attractiveness Index, By Region – 2023 to 2033

Figure 9: North America Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 10: North America Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ Million

Figure 11: North America Market Share, By Instrument Type, 2023 & 2033

Figure 12: North America Market Y-o-Y Growth Projections, By Instrument Type – 2023 to 2033

Figure 13: North America Market Attractiveness Index, By Instrument Type – 2023 to 2033

Figure 14: North America Market Share, By Country, 2023 & 2033

Figure 15: North America Market Y-o-Y Growth Projections, By Country – 2023 to 2033

Figure 16: North America Market Attractiveness Index, By Country – 2023 to 2033

Figure 17: Latin America Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 18: Latin America Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ Million

Figure 19: Latin America Market Share, By Instrument Type, 2023 & 2033

Figure 20: Latin America Market Y-o-Y Growth Projections, By Instrument Type – 2023 to 2033

Figure 21: Latin America Market Attractiveness Index, By Instrument Type – 2023 to 2033

Figure 22: Latin America Market Share, By Country, 2023 & 2033

Figure 23: Latin America Market Y-o-Y Growth Projections, By Country – 2023 to 2033

Figure 24: Latin America Market Attractiveness Index, By Country – 2023 to 2033

Figure 25: Europe Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 26: Europe Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ Million

Figure 27: Europe Market Share, By Instrument Type, 2023 & 2033

Figure 28: Europe Market Y-o-Y Growth Projections, By Instrument Type – 2023 to 2033

Figure 29: Europe Market Attractiveness Index, By Instrument Type – 2023 to 2033

Figure 30: Europe Market Share, By Country, 2023 & 2033

Figure 31: Europe Market Y-o-Y Growth Projections, By Country – 2023 to 2033

Figure 32: Europe Market Attractiveness Index, By Country – 2023 to 2033

Figure 33: MEA Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 34: MEA Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ Million

Figure 35: MEA Market Share, By Instrument Type, 2023 & 2033

Figure 36: MEA Market Y-o-Y Growth Projections, By Instrument Type – 2023 to 2033

Figure 37: MEA Market Attractiveness Index, By Instrument Type – 2023 to 2033

Figure 38: MEA Market Share, By Country, 2023 & 2033

Figure 39: MEA Market Y-o-Y Growth Projections, By Country – 2023 to 2033

Figure 40: MEA Market Attractiveness Index, By Country – 2023 to 2033

Figure 41: Asia Pacific Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 42: Asia Pacific Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ Million

Figure 43: Asia Pacific Market Share, By Instrument Type, 2023 & 2033

Figure 44: Asia Pacific Market Y-o-Y Growth Projections, By Instrument Type – 2023 to 2033

Figure 45: Asia Pacific Market Attractiveness Index, By Instrument Type – 2023 to 2033

Figure 46: Asia Pacific Market Share, By Country, 2023 & 2033

Figure 47: Asia Pacific Market Y-o-Y Growth Projections, By Country – 2023 to 2033

Figure 48: Asia Pacific Market Attractiveness Index, By Country – 2023 to 2033

Figure 49: US Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 50: US Market Share, By Instrument Type, 2022

Figure 51: Canada Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 52: Canada Market Share, By Instrument Type, 2022

Figure 53: Brazil Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 54: Brazil Market Share, By Instrument Type, 2022

Figure 55: Mexico Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 56: Mexico Market Share, By Instrument Type, 2022

Figure 57: Germany Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 58: Germany Market Share, By Instrument Type, 2022

Figure 59: United kingdom Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 60: United kingdom Market Share, By Instrument Type, 2022

Figure 61: France Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 62: France Market Share, By Instrument Type, 2022

Figure 63: Italy Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 64: Italy Market Share, By Instrument Type, 2022

Figure 65: BENELUX Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 66: BENELUX Market Share, By Instrument Type, 2022

Figure 67: Nordic Countries Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 68: Nordic Countries Market Share, By Instrument Type, 2022

Figure 69: China Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 70: China Market Share, By Instrument Type, 2022

Figure 71: Japan Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 72: Japan Market Share, By Instrument Type, 2022

Figure 73: South Korea Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 74: South Korea Market Share, By Instrument Type, 2022

Figure 75: GCC Countries Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 76: GCC Countries Market Share, By Instrument Type, 2022

Figure 77: South Africa Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 78: South Africa Market Share, By Instrument Type, 2022

Figure 79: Turkey Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 80: Turkey Market Share, By Instrument Type, 2022

The overall market size for the qPCR instruments market was USD 1,392.6 million in 2025.

The qPCR instruments market is expected to reach USD 1,926.7 million in 2035.

The demand for qPCR instruments will be driven by rising applications in clinical diagnostics and infectious disease detection, growing demand for precision in gene expression and biomarker analysis, expanding use in pharmaceutical and biotech research, and advancements in high-throughput and portable qPCR systems.

The top 5 countries driving the development of the qPCR instruments market are the USA, China, Germany, Japan, and the UK.

The real-time qPCR systems segment is expected to command a significant share over the assessment period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.