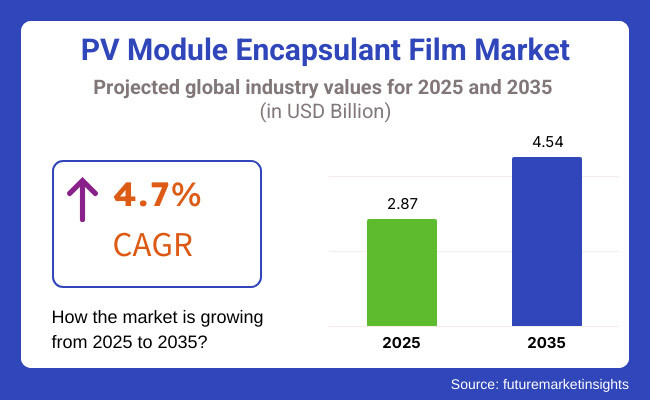

The PV module encapsulant film market is estimated to reach USD 2.87 billion in 2025. It is expected to grow at a CAGR of 4.7% during the forecast period and garner a value of USD 4.54 billion in 2035.

In 2024, the PV module encapsulant film market experienced steady growth, driven by rising solar energy installations worldwide. The incentives and subsidies rolled out by the governments in the important regions of the USA, China, and the EU, in particular, pushed for faster deployments of PV installations.

Supply chain disruptions due to raw material shortages, particularly affecting ethyl vinyl acetate (EVA) and polyolefin elastomer (POE), causing price fluctuations that impacted most module manufacturers. Increased investment in recycling and sustainable encapsulant materials may mitigate some of these risks in the long run. High-performance encapsulants showed improvement in UV resistance and durability.

Furthermore, the development of bifacial and thin-film solar technologies has increased the demand for higher encapsulation efficiency. It is likely that by 2025 and in years to come, there will be continuous growth in the expansion of solar energy due to intensified global net-zero commitments. Falling prices of solar PV modules combined with improving efficiencies of the encapsulant films will drive adoption.

Also, the localization of manufacturing in key regions aims to stabilize the supply chain. Emerging markets, particularly in Southeast Asia and Latin America, are expected to drive additional demand. While regulatory swings and material price volatility are expected to be critical issues, new developments in high performance, green, and sustainable encapsulants will already have implications on future dynamics.

Explore FMI!

Book a free demo

In the recent survey by FMI with the players in the value chain of PV solar module encapsulant films, key insights were revealed concerning trends, challenges, and developmental drivers in the industry.

Supply chain stability was highlighted as the foremost issue, as above 60% of the manufacturers and suppliers responded with pertinent remarks; raw material availability has been able to disrupt production schedules. The stakeholders mentioned that they see increasing significance in regional supply chains to reduce dependency on overseas sourcing, especially for EVA and POE materials.

Over 70% of survey respondents highlighted a growing demand for encapsulant films excelling in durability, UV resistance, and thermal stability. This demand for enhanced product characteristics is partly driven by the advent of bifacial solar modules and thin-film technology, which push manufacturers to develop next-generation encapsulants that improve module efficiency and lifetime.

Also, over 50% of the respondents highlighted an increased interest in sustainable encapsulant solutions that match recyclable and bio-based materials to the worldwide sustainability strategy. Industry players also raise concerns regarding regulatory uncertainty, especially in jurisdictions that enforce stringent environmental regulations on what is permissible in the composition of encapsulant materials.

Virtually all interviewees indicated that government incentives and funding for solar projects have been instrumental in generating demand for high-performance encapsulant films, while the survey further revealed that customized encapsulant solutions geared to specific climatic conditions and module types are emerging as key differentiators in the industry.

Government policies and regulations drive the industry by enforcing quality, safety, and sustainability standards. Tax incentives, recyclability mandates, and certification requirements across regions shape production and adoption. Compliance with these evolving regulations is crucial for manufacturers seeking industry expansion and long-term growth opportunities.

| Countries/Region | Regulations & Certifications |

|---|---|

| United States | The Inflation Reduction Act (IRA) 2022 provides tax credits for solar projects using domestically produced materials, encouraging local encapsulant film production. Encapsulants must meet UL 1703 and IEC 61215 safety and durability standards. |

| European Union | The Eco-design Directive and Waste Electrical and Electronic Equipment (WEEE) Directive enforce recyclability standards for solar components, including encapsulant films. RoHS (Restriction of Hazardous Substances) compliance is mandatory to limit hazardous material use. |

| China | The 14th Five-Year Plan prioritizes solar energy expansion, leading to a high demand for encapsulants. The government enforces CQC (China Quality Certification) and GB/T 9535 to 2021 standards for encapsulant film safety and performance. |

| India | Under the Production Linked Incentive (PLI) Scheme, domestic manufacturers receive financial incentives for producing solar encapsulant films. The Bureau of Indian Standards (BIS) mandates compliance with IS 14286 and IS/IEC 61730 for module encapsulation. |

| Japan | The FIT (Feed-in Tariff) Program supports renewable energy expansion, indirectly driving demand for high-quality encapsulant films. JET (Japan Electrical Safety & Environment Technology Laboratories) certification ensures encapsulants meet safety standards. |

| South Korea | The Renewable Energy 3020 Policy aims to increase solar capacity, prompting strict quality control for encapsulant films. KS C 8565 is the national standard for PV module encapsulant materials. |

| Brazil | Norma ABNT NBR 16274 regulates the quality of encapsulant films used in solar modules. Government incentives under PROGD (Distributed Generation Program) support local production and adoption. |

| Australia | The Small-Scale Renewable Energy Scheme (SRES) promotes the adoption of certified solar components, including encapsulants. Compliance with AS/NZS 5033 and IEC 61730 is required. |

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Government incentives, solar adoption, and initial advancements in encapsulant technology drive moderate growth. | Accelerated growth is expected due to large-scale solar projects, rising bifacial module adoption, and stricter sustainability regulations. |

| Predominantly EVA-based encapsulants; early adoption of POE and advanced EVA variants. | Higher adoption of POE, thermoplastic polyolefin (TPO), and recyclable encapsulants for improved efficiency and sustainability. |

| Government subsidies, declining solar panel costs, and increasing residential solar installations. | Expansion of industrial and commercial solar projects, energy security concerns, and net-zero carbon commitments. |

| Supply chain disruptions due to COVID-19, dependence on imports for raw materials, and fluctuating raw material prices. | Increasing regulatory compliance, higher demand for recyclable materials, and the need for encapsulants with enhanced durability. |

| Dominated by a few key players with a strong industry presence, focusing on cost-effective encapsulants. | Greater competition with new entrants investing in R&D for high-performance and sustainable encapsulant materials. |

| Recyclability has not been a major focus, with traditional encapsulant materials remaining dominant. | Environmental policies drive a strong push for recyclable encapsulants and low-carbon footprint materials. |

| Growth concentrated in China, the USA, and Germany due to strong government backing. | Expansion in emerging regions such as India, Southeast Asia, and Africa, alongside continued dominance of key solar hubs. |

Ethyl Vinyl Acetate (EVA) dominates the industry due to its excellent optical transparency, flexibility, and cost-effectiveness. The segment recorded a CAGR of 5.4% from 2018 to 2022 and is projected to grow at 5.1% from 2023 to 2033. Extrapolating this trend, EVA encapsulant films will continue leading from 2025 to 2035, driven by increasing solar panel installations and the rising demand for high-performance encapsulation materials.

Among EVA variants, Transparent EVA is widely used for its superior light transmittance, ensuring maximum solar energy absorption. White EVA is in demand due to its reflective properties, which enhance module efficiency by improving light utilization. Anti-PID EVA is also experiencing strong adoption as it prevents power losses caused by leakage currents. These advancements in EVA encapsulants will play a crucial role in improving solar module performance and longevity.

The bifacial PV module segment is projected to witness the highest growth from 2025 to 2035, as bifacial technology enhances overall energy generation by capturing sunlight from both sides. This technology requires encapsulants with superior durability, high UV resistance, and excellent optical clarity.

Compared to monofacial modules, bifacial variants demand advanced materials like POE and specialized EVA formulations, increasing the need for high-performance encapsulants in modern solar applications. As solar farms expand their bifacial module installations, encapsulant manufacturers are focusing on developing films that enhance energy yield and extend module lifespan.

The growing emphasis on high-efficiency solar power generation is driving research into encapsulant solutions that improve performance in diverse environmental conditions. The increasing adoption of bifacial technology across residential, commercial, and utility-scale installations is expected to boost demand for next-generation encapsulant films.

Encapsulant films in the 0.40-0.60mm thickness range are experiencing the highest demand due to their optimal balance of flexibility, durability, and cost efficiency. Thinner encapsulants (0.20-0.40mm) are primarily used in lightweight solar applications, while thicker encapsulants (0.60-0.80mm) are gaining traction in high-efficiency modules.

The need for encapsulants capable of withstanding environmental stress is driving growth in the thicker encapsulant category, particularly in extreme-weather installations. The increasing focus on long-lasting solar panel performance is pushing manufacturers to develop encapsulant films with enhanced thermal stability and mechanical strength.

Thicker encapsulant films are particularly favored in installations exposed to harsh environmental conditions, as they provide improved resistance against moisture, temperature fluctuations, and mechanical stress. With rising investments in high-durability solar solutions, demand for 0.60-0.80mm encapsulant films is expected to grow significantly across utility-scale and industrial solar projects.

Encapsulant films weighing between 400-475 g/m² dominate the segment, offering an ideal balance of lightness and mechanical strength. Films below 400 g/m² are used in applications where reducing module weight is a priority, particularly in residential and portable solar solutions.

However, encapsulant films above 475 g/m² are witnessing growing demand in large-scale solar installations, where enhanced structural integrity is crucial for long-term efficiency and performance. As the solar industry advances, manufacturers are focusing on developing encapsulants with improved weight-to-strength ratios to optimize module efficiency.

The demand for encapsulants with superior resistance to harsh weather conditions is driving innovation in encapsulant weight categories. With increasing installations of solar panels in extreme environments, higher-weight encapsulants are expected to gain popularity in the coming years.

The Commercial and Industrial segments remain the largest consumers of PV module encapsulant films, driven by large-scale solar installations and corporate sustainability initiatives. Government policies and incentives are accelerating solar adoption in commercial and industrial sectors.

The Residential sector is also expanding as rooftop solar installations grow, contributing to the overall demand for high-performance encapsulant films. The Industrial segment is expected to witness the fastest growth due to rising investments in high-efficiency solar solutions for manufacturing plants and large-scale operations.

The need for encapsulants with superior durability and longer lifespans is increasing as industrial facilities prioritize energy efficiency. With stricter environmental regulations and sustainability commitments, encapsulant manufacturers are focusing on developing long-lasting, eco-friendly materials to cater to this expanding segment.

| Countries | CAGR |

|---|---|

| USA | 5.1% |

| UK | 4.3% |

| France | 4.5% |

| Germany | 4.8% |

| Italy | 4.6% |

| South Korea | 5.2% |

| Japan | 4.9% |

| China | 5.5% |

| Australia & New Zealand | 4.4% |

Expansion of Solar Manufacturing and Bifacial Module Adoption Driving Industry Growth

The USA is expected to grow at a CAGR of 5.1% from 2025 to 2035, driven by expanding domestic solar manufacturing and strong government incentives. The Inflation Reduction Act (IRA) 2022 promotes local solar production, reducing reliance on imports. The increasing adoption of bifacial and high-efficiency PV modules is further driving demand for advanced encapsulant films that enhance module durability and performance.

Government Incentives and Sustainability Regulations Supporting Encapsulant Film Demand

The UK is projected to expand at a CAGR of 4.3% from 2025 to 2035, supported by government-backed solar incentives and sustainability-driven regulations. The Contracts for Difference (CfD) scheme and tax incentives are boosting solar adoption and increasing encapsulant film demand. A shift toward recyclable encapsulant materials aligns with the UK’s environmental policies, driving innovation in durable and eco-friendly encapsulation solutions.

Eco-Design Policies and Recycling Mandates Boosting Industry Expansion

France is set to grow at a CAGR of 4.5% from 2025 to 2035, fueled by solar expansion initiatives like the PPE (Programmation Pluriannuelle de l’Énergie). The CRE (Energy Regulatory Commission) enforces eco-design and recycling mandates, encouraging the use of sustainable encapsulants. The increasing adoption of thin-film solar technologies also supports industry growth, as these modules require specialized encapsulation materials for long-term stability.

High-Efficiency PV Technologies and Stringent Environmental Compliance Fueling Growth

Germany is expected to register a CAGR of 4.8% from 2025 to 2035, driven by high-efficiency PV technologies and environmental regulations. The Renewable Energy Sources Act (EEG 2023) promotes solar expansion, increasing demand for UV-resistant encapsulant films. Additionally, recycling mandates under the WEEE Directive influence material selection, pushing manufacturers toward sustainable encapsulant alternatives that comply with Germany’s strict environmental policies.

Tax Incentives and Advanced PV Module Technologies Driving Demand

Italy is projected to expand at a CAGR of 4.6% from 2025 to 2035, backed by EU Green Deal policies and national incentives. The Superbonus 110% tax credit has significantly boosted residential and commercial solar adoption. With rising investments in advanced PV technologies, demand for durable encapsulant films is growing. Increasing regulations on recyclability and hazardous materials are also shaping encapsulant material choices.

Renewable Energy Policies and Next-Generation Encapsulant Films Accelerating Growth

South Korea is forecasted to grow at a CAGR of 5.2% from 2025 to 2035, supported by Renewable Energy 3020 Policy and government incentives. Rising demand for high-performance encapsulants tailored for humid and coastal environments is driving growth. Local manufacturers are investing in next-generation encapsulant films that enhance module durability, ensuring longer operational lifespans and better performance in diverse climatic conditions.

High-Performance Encapsulants and Quality Certifications Strengthening Position

Japan is anticipated to expand at a CAGR of 4.9% from 2025 to 2035, driven by carbon neutrality goals and strong government support for solar expansion. Programs like Feed-in Tariff (FIT) and Feed-in Premium (FIP) encourage solar investments. JET certification requirements enforce strict quality standards, pushing demand for weather-resistant encapsulants that ensure module longevity and efficiency in Japan’s variable climate conditions.

Large-Scale Solar Installations and Vertical Integration Enhancing Dominance

China is expected to witness a CAGR of 5.5% from 2025 to 2035, supported by large-scale solar installations and government-backed supply chain integration. The 14th Five-Year Plan prioritizes solar capacity expansion, increasing demand for EVA and POE encapsulants in bifacial solar modules. With leading encapsulant manufacturers based in China, innovation in cost-efficient and high-performance encapsulation is strengthening the country’s global position.

Renewable Energy Targets and Extreme Weather Conditions Shaping Encapsulant Demand

Australia and New Zealand are projected to grow at a CAGR of 4.4% from 2025 to 2035, driven by renewable energy targets and extreme weather conditions. The Australian Renewable Energy Target (RET) and New Zealand’s Zero Carbon Act are fueling solar adoption. High UV exposure necessitates durable encapsulant films, while compliance with AS/NZS 5033 standards ensures product quality and longevity.

As of 2024, the PV module encapsulant film sector has experienced significant expansion, driven by the increasing adoption of solar energy and advancements in photovoltaic (PV) technology. Leading players such as STR Holdings Inc., Mitsui Chemicals, Hanwha Solutions, First Applied Material, Siemens AG, and Bridgestone Corporation have been actively implementing strategies to strengthen their positions and cater to the growing demand for high-performance encapsulant films.

STR Holdings Inc. led with an estimated 20-25% share in 2024 to maintain tense consistency. The company has focused on innovation and sustainability, launching a new line of UV-resistant encapsulant films in early 2024. These products, designed for high-efficiency solar panels, have been well-received for their durability and performance. STR Holdings' strong distribution network and commitment to R&D have further solidified its leadership.

Mitsui Chemicals holds approximately 18-20% of the share in 2024. The company has prioritized technological advancements, introducing a new range of high-transparency encapsulant films with enhanced adhesion properties. These products, launched in mid-2024, have gained traction in the residential and commercial solar sectors due to their superior quality and reliability.

Mitsui Chemicals' focus on innovation and customer satisfaction has helped it maintain a competitive edge. Hanwha Solutions accounts for roughly 15-18% of the share in 2024. The company has invested heavily in R&D, launching a new series of encapsulant films with improved thermal stability and moisture resistance.

These products, designed for harsh environmental conditions, have been well-received for their performance and longevity. Hanwha Solutions' emphasis on innovation and sustainability has enabled it to capture a significant portion of demand.

First Applied Material has seen its presence grow to around 12-15% in 2024. The company has focused on developing sustainable encapsulant solutions and introducing a new line of recyclable encapsulant films in collaboration with industry stakeholders. First Applied Material's commitment to sustainability and its strong R&D capabilities have positioned it as a key player in the industry.

Siemens AG holds an estimated 10-12% share in 2024. The company has expanded its product portfolio by launching a new series of encapsulant films with enhanced electrical insulation properties. These products, designed for use in high-voltage solar panels, have been well-received for their safety and performance. Siemens' focus on specialized solutions has helped it carve out a niche.

Bridgestone Corporation has maintained a presence of approximately 8-10% in 2024. The company has focused on strategic partnerships, collaborating with solar panel manufacturers to develop customized encapsulant solutions for large-scale solar farms. Bridgestone's emphasis on innovation and collaboration has strengthened its reputation as a trusted provider of high-quality encapsulant films.

In 2024, the industry has also witnessed strategic collaborations and partnerships aimed at addressing emerging challenges in performance and sustainability. For instance, STR Holdings Inc. partnered with a leading solar panel manufacturer to develop a new line of encapsulant films for bifacial solar panels. This collaboration has enhanced STR Holdings' credibility and reach.

These six players dominate the sector, collectively holding a significant share of approximately 85%. These companies are leveraging innovation, sustainability, and technology to meet the growing demand for high-performance encapsulant films.

The global shift towards renewable energy is a primary driver for the industry. Governments worldwide are enforcing carbon neutrality targets, incentivizing solar energy adoption, and aiming to reduce reliance on fossil fuels. Policies like the Inflation Reduction Act (USA), the EU Green Deal, and China's 14th Five-Year Plan are boosting investments in solar manufacturing, increasing demand for high-performance encapsulant films.

Supply chain fluctuations, particularly for EVA, POE, and thermoplastic polyolefins, impact stability within the sector. Geopolitical tensions and trade restrictions on solar materials also influence production costs and accessibility. However, technological advancements in bifacial modules, thin-film PV, and recyclable encapsulants are driving innovation, enhancing durability, and improving cost efficiency.

As rising interest rates and inflation impact capital expenditure in solar projects, financial incentives, green bonds, and net-zero commitments help sustain industry growth. The industry's long-term growth aligns with the global energy transition and decarbonization efforts.

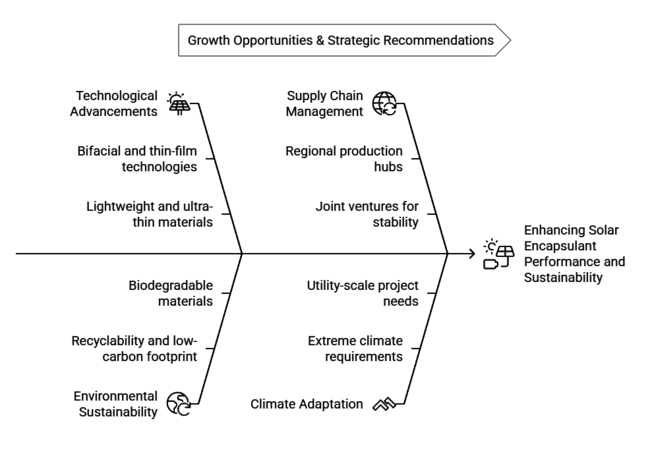

Expansion into bifacial and thin-film PV technologies

Bifacial solar modules are gaining traction due to their higher energy yield. Encapsulant manufacturers should focus on high-performance POE films that offer superior UV resistance and moisture protection. Additionally, thin-film PV modules are becoming popular in urban and space-constrained applications. Companies should develop lightweight, ultra-thin encapsulants tailored for these modules to capture new demand.

Investing in recyclable and sustainable encapsulants

With increasing environmental regulations, encapsulant films must meet recyclability and low-carbon footprint requirements. Stakeholders should prioritize R&D in biodegradable or fully recyclable encapsulants, especially in regions like the EU where circular economy policies are stringent. Partnering with solar panel recyclers to create closed-loop encapsulant solutions can offer a competitive edge.

Localizing production to reduce supply chain risks

Reliance on Chinese suppliers for EVA and POE resins increases supply chain risks. Establishing regional production hubs in the USA, Europe, and India can improve raw material access and mitigate tariff-related challenges. Joint ventures with polymer manufacturers can ensure stable supply and cost efficiency.

Customization for extreme climates and utility-scale projects

As solar adoption increases in deserts, coastal areas, and high-altitude regions, demand for encapsulants with better thermal stability, salt resistance, and UV shielding is rising. Developing climate-specific encapsulants and working with EPC contractors can enhance performance, especially in extreme conditions.

Growing solar energy adoption, technological advancements in module efficiency, and government incentives promoting renewable energy are major drivers.

Ethyl Vinyl Acetate (EVA) dominates the industry, but Polyolefin Elastomer (POE) is growing rapidly due to its superior durability for bifacial solar modules.

Regulations promoting sustainable materials, mandatory recycling policies, and financial incentives for solar energy projects are increasing encapsulant film adoption.

Bifacial modules require encapsulants with high optical clarity and weather resistance, boosting demand for advanced materials like POE and high-performance EVA.

China, the United States, Germany, and Japan are witnessing rapid expansion due to large-scale solar installations and supportive government policies.

By material type, the sector is segmented into ethyl vinyl acetate (EVA), polyolefin elastomer (POE), thermoplastic polyolefin (TPO), and polyvinyl butyral (PVB).

By application, the industry is segmented into monofacial pv module and bifacial pv module.

By thickness, the sector is segmented into 0.20-0.40mm, 0.40-0.60mm, and 0.60-0.80mm.

By weight, the industry is segmented into below 400 g/m², 400-475 g/m², and above 475 g/m².

By end-use, the sector is segmented into commercial, industrial, and residential.

The market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

Polyethylene Terephthalate Glycol (PETG) Market Growth - Innovations, Trends & Forecast 2025 to 2035

Sodium Bicarbonate Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Phenylethyl Market Growth - Innovations, Trends & Forecast 2025 to 2035

PP Homopolymer Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Phenoxycycloposphazene Market Growth - Innovations, Trends & Forecast 2025 to 2035

Drag Reducing Agent Market Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.