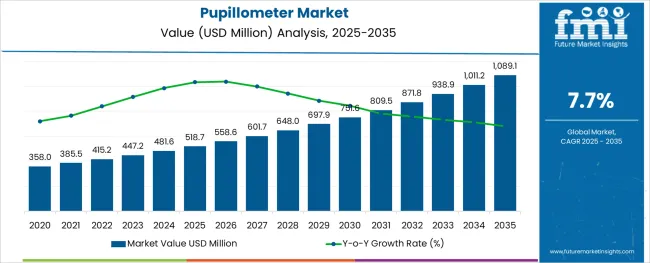

The Pupillometer Market is estimated to be valued at USD 518.7 million in 2025 and is projected to reach USD 1,089.1 million by 2035, registering a compound annual growth rate (CAGR) of 7.7% over the forecast period.

The pupillometer market is being propelled by rising demand for objective, quantifiable neurological assessments and greater integration of noninvasive monitoring tools in clinical workflows. Clinicians in critical care, neurology, and emergency medicine are increasingly relying on pupillometers to track pupillary reflex and size, which are vital in detecting changes in intracranial pressure or brain injury.

Innovations in digital eye tracking, automation, and compact device form factors are enhancing accuracy and usability. The growing trend toward real-time patient monitoring, combined with regulatory approvals for medical device safety, supports wider adoption.

Moreover, hospital and clinic investment in advanced diagnostic equipment is accelerating integration of pupillometry into standard patient evaluation protocols. The outlook remains positive as demand rises for continuous neurological monitoring, improved patient outcomes, and streamlined clinical documentation across healthcare settings.

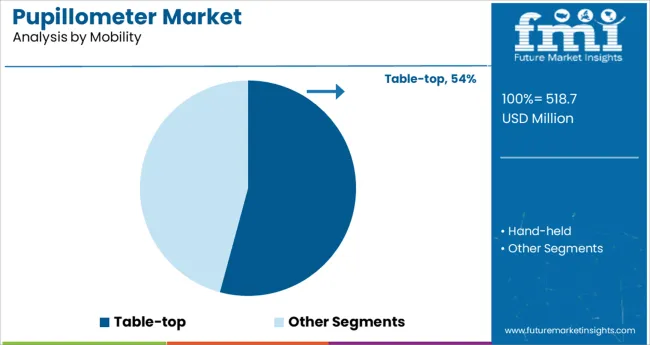

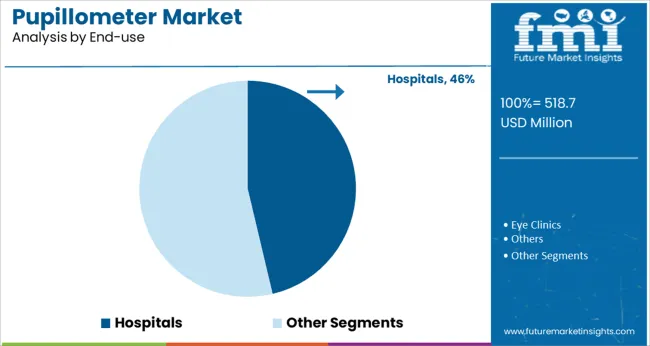

The market is segmented by Mobility, Type, End-use, and Application and region. By Mobility, the market is divided into Table-top and Hand-held. In terms of Type, the market is classified into Video and Digital. Based on End-use, the market is segmented into Hospitals, Eye Clinics, and Others.

By Application, the market is divided into Ophthalmology, Neurology, Oncology, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

It is observed that the table‑top mobility segment holds 54.20% of total pupillometer market revenue, making it the leading mobility category. This dominance is supported by hospital preference for desktop devices that offer enhanced stability, larger display units, and higher throughput during neurological assessments.

The fixed position enables precise calibration and reduced user‑related variability, yielding more reliable data in critical applications such as ICU and ED settings. Its integration with hospital IT systems further enables seamless data recording into electronic medical records.

Consequently, institutions have prioritized table top models due to their operational efficiency, data accuracy, and seamless workflow integration, reinforcing their market leadership.

It is noted that the hospitals end‑use segment accounts for 46.30% of total market share, positioning it as the market leader. This concentration is driven by clinical necessity for accurate neurological monitoring in emergency departments, intensive care units, and neurosurgical wards.

Hospitals have been investing in pupillometry devices to support standardized patient assessments, early detection of brain injury, and enhanced patient safety. Additionally, integration into hospital protocols and staff training budgets has enabled more frequent use and consistent data collection.

With increasing regulatory focus on outcome-based care and diagnostic accuracy, hospital procurement teams have prioritized pupillometers, leading to their dominance within end‑use applications.

When comparing digital and video pupillometers, the latter is clearly superior. To give just one example, these tools can record the full range of pupillary responses. In addition, video pupillometers like Konan Medical USA Inc.'s EyeKinetix pupillometer use infrared high-definition video cameras to record the bilateral pupil responses to monocular visual stimuli.

Additionally, EyeKinetix captures both spontaneous and evoked pupillary light reactions at the same time. Another element contributing to increased interest in video automated pupillometer is their recent regulatory clearance. So, in July 2024, NeurOptics Inc. introduced the NPi-300 Pupillometer to consumers in the United States.

The NPI-300 Pupillometer also contains cutting-edge technologies like an LED light source, a high-precision infrared camera, and a powerful microprocessor. As a result, the market expands as a result of the increased demand brought about by these features.

In addition, video pupillometers like the NPi-300 are faster and more convenient than digital pupillometers. Therefore, automatic pupillometers eliminate the potential for human error that might occur with manual approaches.

Consequently, this causes an increase in demand for video pupillometers, which in turn propels the development of the market. Therefore, because of these benefits, these devices are widely used in clinical practice.

The pupillometer market is expanding as a result of the widespread use of computers and the Internet in the creation of brand-new goods. For instance, in 2020, Essilor Instruments USA introduced the X81705 Pupillometer medical device, which combines precise measurement with user-friendly controls.

Binocular and monocular measures, as well as the X81705's infinite vision distance setting, are both fully manually adjustable. The X81705 also has an automatic off/on functionality and digital readouts that can measure down to 0.5 nm.

The automated pupillometer market is expanding as more people seek alternatives to the traditional method of pupil measurement due to safety concerns.

As an example, a 2020 study published in the American Journal of Critical Care found that neurological nurses and critical care consistently underestimated pupil size and incorrectly measured pupil reactivity, leading the authors to conclude that the use of an automated pupillometer medical device is an essential tool allowing for more effective and timely diagnostics.

The rising global incidence of eye problems is also fuelling demand for pupillometers. The number of people with moderate or severe visual impairment is projected to increase to nearly 358 million by 2050 from the current estimate of 217 million, according to 2020 research by the International Council of Ophthalmology.

The demand for pupillometers is expanding because of the rise in ophthalmic-related illnesses caused by prolonged use of digital electronics such as TVs, smartphones & tablets, laptops, video games, and PCs. While demand for pupilometers continues to rise, the market expansion is being stymied by a dearth of trained personnel to operate cutting-edge devices.

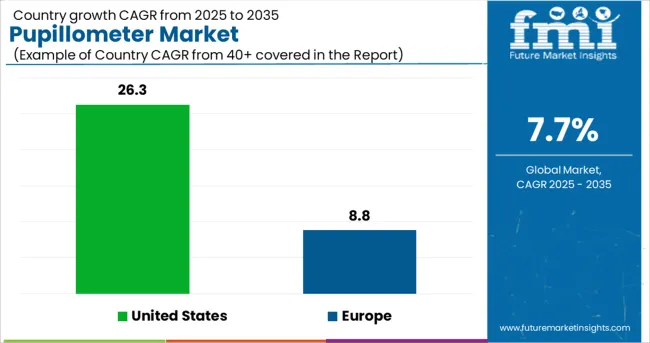

The USA market is expected to hold a market share of 26.3% of the global market.

In 2024, North America accounted for over 26.3% of global revenue, thanks to the region's large population and high incidence of neurological and eye illnesses. Pupillometry's widespread applicability in the United States is another factor that should boost sales.

The United States is home to several market leaders, including NeurOptics, a company that designs and manufactures state-of-the-art pupillometers to improve medical diagnostics. The company is also investigating the application of pupillometers across a range of critical care settings to broaden the scope of its products.

An 8.8 percent compound annual growth rate (CAGR) is predicted for the Europe Pupillometer Market between 2025 and 2035.

As their use in neuropsychological testing becomes increasingly commonplace, pupillometers are enjoying brisk sales growth around the world. When compared to more conventional approaches, the price of the next-generation pupillometer is higher.

Despite the advantages of medical devices, their adoption rate has not changed significantly in industrialized economies.

With the rising prevalence of neurological illnesses, the pupillometer is finding more and more uses. Furthermore, technical development has led to the creation of a pupillometer for the next generation, which is more advanced than the medical devices of the past.

The forecast calls for the fastest growth in Japan for the Asia Pacific region. Pupillometers are becoming more widely available in the region owing to an increase in the number of online retailers and distributors offering them.

Pupillometers are also being offered by the regional branches of multinational corporations like NeurOptics, Johnson & Johnson Vision, and Konan Medical.

NeurOptics' pupillometer is available in India through Hansraj Nayyar Medical India, in Japan from IMI Co., and in South Korea from Neuroplus. The introduction of major corporations like NIDEK has boosted the automated pupillometer's accessibility and popularity in the region.

Pupillometry is a growing industry for many reasons, including the prevalence of neurological illnesses. According to The Lancet Global Health Report 2024, for instance, an aging population is a major contributor to the rising incidence of non-communicable neurological illnesses in India.

Major causes of disability from neurological disorders in India include stroke, headache problems, and epilepsy. Since automated pupillometers are used to measure eye curvature, which can indicate neurological abnormalities, this drives up demand for the devices. Over the next few years, the market in question is likely to expand, thanks to the rising prevalence of neurological illnesses.

New Entrants to Foster Innovation in the Global Market

The startups in the pupillometer market are adding a new edge to the properties of excavators by curating innovations beyond the imagination.

They are continually upgrading the pupillometer with advanced technology, and manufacturers and sellers are continuously attempting to reduce costs for greater accessibility to the market share. Startup firms are triggering the expansion of the pupillometer market with their unique attempts.

The top startups operating in the market are:

| Name | Mind’s Eye |

|---|---|

| Date of Establishment | 2020 |

| Description | When it comes to pupillometry biomarkers for ADHD, Mind'sEye Diagnostics has you covered. The platform relies on our novel scientific biomarkers, which include the use of a mobile phone camera to extract eye parameters, the execution of unique image analysis, and the deployment of a proprietary analysis algorithm, all of which allow for the identification of ADHD and other mental disorders. There's also a smartphone app that keeps tabs on how a patient's ADHD symptoms change throughout the day, allowing for more precise dosing and better overall management of the condition. |

| Name | EYE-COG |

|---|---|

| Mind’s Eye | 2020 |

| Description | EYE-main COG's goal is to aid in the identification of ADHD and other mental problems using pupillometry biomarkers. It has developed a platform that includes an Eye tracker, a short, computerized attention test, a personal questionnaire, and a cloud-based algorithm that analyses eye markers taken from the eye tracker data and automatically sends a full report to EYE-COG software which can be used for the accurate diagnosis of ADHD. Single ADHD analysis tests can be purchased for USD 30 each, and the kit can be purchased for USD 1500. |

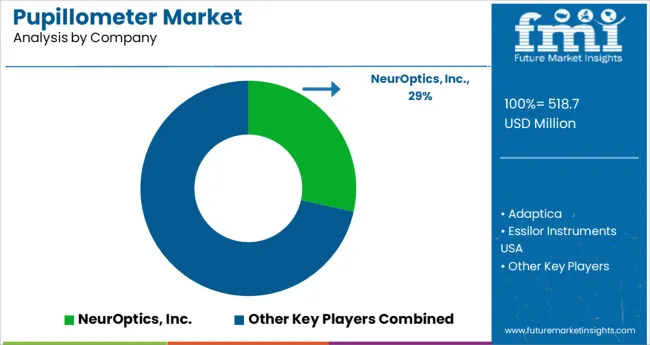

There are several international and domestic players in the pupillometer industry, making for a competitive marketplace. NeurOptics Inc., Essilor Group (Essilor Instruments), Visionix, USA Ophthalmic., NIDEK SA, HAAG-STREIT GROUP, Reichert Inc., Konan Medical USA Inc., Good-Lite Company, Grobet USA are among the top players in the market (Vigor Optical).

In order to maintain their market share and expand their product offerings, many companies are implementing market strategies like the introduction of new, ground-breaking items as well as mergers, collaborations, and acquisitions.

Some of the recent developments in the pupillometer market include the following:

NeurOptics Inc. introduced the NPi-300 pupillometer in 15 countries in May of 2025. The United Kingdom, France, Italy, Germany, Switzerland, Austria, Norway, Sweden, Denmark, Belgium, the Netherlands, Luxembourg, Ireland, Australia, and New Zealand were among the first to introduce the pupillometer.

The VERITAS Vision System, a next-generation phacoemulsification program (phaco) designed to address three critical areas of patient safety, performance during surgery, and comfort, became globally available on July 23, 2024, thanks to Johnson & Johnson Vision, a global leader in eye health and part of Johnson & Johnson Medical Devices Companies.

This weekend at the 2024 American Society of Cataract and Refractive Surgery (ASCRS) and American Society of Ophthalmic Administrators (ASOA) Meeting, the business is expected to provide live demonstrations of the innovative system in the wetland area of Johnson & Johnson.

In the United States, NeurOptics Inc. released the NPi-300 Pupillometer in July 2024. The NPI-300 is an automated pupillometer for use in neurological testing. It is also utilized to detect neurological disorders in both young and old individuals, including stroke, TBI, seizures, and other neurological events.

The global pupillometer market is estimated to be valued at USD 518.7 million in 2025.

It is projected to reach USD 1,089.1 million by 2035.

The market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types are table-top and hand-held.

video segment is expected to dominate with a 58.9% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA