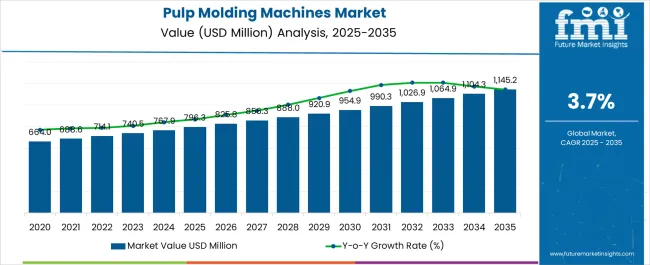

The pulp molding machines market is estimated to be valued at USD 796.3 million in 2025 and is projected to reach USD 1145.2 million by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

The market demonstrates steady expansion driven by escalating demand for sustainable packaging alternatives and mounting regulatory pressure against single-use plastics across food service, electronics, and consumer goods industries. Manufacturing facilities implement automated pulp molding systems that transform recycled paper waste into biodegradable packaging products including egg cartons, food containers, and protective cushioning materials that decompose naturally without environmental contamination. The technology's ability to process various fiber sources including newspapers, cardboard waste, and agricultural residues enables manufacturers to optimize raw material costs while achieving consistent product quality and dimensional accuracy.

Food packaging applications represent the dominant consumption segment where pulp molding machines produce disposable containers, trays, and protective packaging for fresh produce, prepared foods, and retail consumer products requiring grease resistance and moisture barrier properties. Restaurant operators adopt pulp-molded takeout containers that satisfy consumer preferences for environmentally responsible packaging while maintaining food safety standards and thermal insulation characteristics necessary for hot food delivery services. Quality control departments emphasize consistent wall thickness distribution and surface texture uniformity that affects container strength and visual appearance across high-volume production runs.

Electronics packaging markets demonstrate growing adoption of pulp molding technology for protective cushioning systems that replace expanded polystyrene foam in shipping containers for fragile consumer electronics, automotive components, and medical devices. Manufacturing engineers specify custom mold designs that create precise cavities matching product contours while providing impact protection during transportation and storage operations. Cost analysis reveals favorable economics compared to injection-molded plastic alternatives when factoring disposal costs and environmental compliance requirements imposed by extended producer responsibility regulations.

Technology advancement trajectories concentrate on process automation and energy efficiency improvements that reduce operating costs while maintaining product consistency across extended production cycles. Heated mold systems enable faster moisture removal and shorter cycle times that increase throughput capacity without compromising product strength or dimensional stability. Multi-station molding machines provide continuous operation capabilities that eliminate manual handling between process steps while reducing contamination risks and improving worker safety conditions.

Raw material processing considerations highlight fiber preparation systems that optimize pulp consistency and remove contaminants that could affect product performance or appearance characteristics. De-inking equipment removes printing inks and adhesives from recycled paper inputs while maintaining fiber length and bonding properties essential for molded product strength. Water treatment systems enable closed-loop processing that minimizes environmental discharge while recovering process water for reuse throughout production operations.

| Metric | Value |

|---|---|

| Pulp Molding Machines Market Estimated Value in (2025E) | USD 796.3 million |

| Pulp Molding Machines Market Forecast Value in (2035F) | USD 1145.2 million |

| Forecast CAGR (2025 to 2035) | 3.7% |

The pulp molding machines market is witnessing sustained expansion supported by the global push toward sustainable packaging and the replacement of single use plastics with biodegradable alternatives. Increasing demand for molded fiber packaging in food service, electronics, and consumer goods sectors is fueling adoption of efficient pulp molding machinery.

Governments and regulatory authorities advocating eco friendly solutions are further accelerating this trend. Advances in automation, energy efficiency, and integration of digital monitoring systems have enhanced productivity and reduced operational costs, encouraging wider adoption across manufacturing units.

The market outlook remains optimistic as companies prioritize investments in equipment that supports circular economy models, minimizes waste, and enables large scale production of high quality molded fiber products for diverse applications.

The less than 1,500 units per hour capacity type segment is projected to account for 38.60% of total revenue by 2025, positioning it as a significant contributor. Its adoption is favored by small and medium scale manufacturers seeking cost effective solutions with manageable production volumes.

This segment is particularly suited for businesses focusing on niche markets and specialized packaging needs where flexibility and lower operational expenditure are critical. Demand is also reinforced by enterprises in emerging economies where initial investment constraints encourage selection of lower capacity machines.

The balance between affordability, ease of maintenance, and sufficient output capacity has ensured its sustained market presence.

The automatic machine type segment is expected to represent 56.30% of overall revenue by 2025, making it the dominant machine category. This leadership is driven by the advantages of reduced labor dependency, higher consistency, and scalability in high volume production environments.

Automatic machines enable precise process control, improved product quality, and reduced operational downtime, aligning with industry trends of smart manufacturing. Their integration with energy saving systems and advanced automation technologies has further strengthened adoption.

Large scale manufacturers are increasingly opting for automatic machines to maximize efficiency, reduce error rates, and meet growing demand for molded fiber packaging.

The rotary product type segment is projected to capture 47.90% of total market revenue by 2025 within the product category. This growth is attributed to its capability of delivering higher productivity, efficient drying, and uniform product quality compared to other machine configurations.

Rotary systems are widely utilized for large scale packaging production as they offer continuous operation and reduced cycle times. Their operational efficiency and suitability for producing diverse molded fiber products such as trays, containers, and disposable food packaging have supported strong market penetration.

The ability of rotary pulp molding machines to handle large volumes with reliability and lower energy consumption has established them as the preferred product type across industries seeking high throughput and cost optimization.

Initiatives to eliminate the use of plastics and protect the environment have increased the demand for paper-based packaging solutions in recent years. In addition, increasing demand for disposable storage containers has boosted the pulp molding machine market sales.

In its recent report, FMI has estimated that the pulp molding machines market may record a CAGR of 3.7% from 2025 to 2035. Increasing single-use and biodegradable containers may fuel growth in the coming years.

Improved product offerings and services by pulp molding machine manufacturers, along with capacity expansion, can boost the pulp molding machine market growth.

For instance, in 2024, Brodrene Hartmann A/S announced that the company is planning to invest approximately USD 64 million to expand its production capacity and upgrade its machinery at its factory in Europe and the United States.

In May 2024, Huhtamaki announced a new manufacturing facility in KwaZulu-Natal in South Africa, to cater to the growing needs of existing and new egg packaging customers in the area. In addition, the company plans to offer a broad range of locally produced packaging solutions to enter East Africa.

Short Term (2025 to 2025): The short-term growth prospects of the market seem favorable. This could increase the adoption of sustainable packaging solutions among businesses and consumers.

Medium Term (2025 to 2035): During this period, the market is likely to show a slight uptake as it could involve investing in research and development to create new and innovative designs that are more energy-efficient, faster, and capable of producing higher-quality products. By improving the efficiency of pulp molding machines, manufacturers can reduce costs and increase production capacity, making them more competitive in the market.

Long Term (2035 to 2035): As per FMI’s analysis, the market is likely to grow, driven by increasing demand for sustainable packaging solutions and the need for efficient and cost-effective production processes. This could involve investing in research and development to create machines capable of producing more complex shapes and designs. These machines can have quicker production times and significant levels of accuracy.

Adoption of Sustainable Packaging by QSR & CPG Companies

The expanding food industry is fueling the development of related industries, such as the food service packaging sector. The demand for food service disposables has been fueled by the rise in quick-service restaurants (QSR) around the world. Some eateries make minimal steps to keep and clean the used containers.

The need for single-use, low-cost disposable containers has gained traction over the years. Most food service outlets in Western European countries prefer molded pulp packaging. Packaging manufacturers are eager to stand out by developing new products. Using sustainable materials in packaging products is one of the key efforts to stand out in the competition.

In July 2020, Be Green Packaging LLC, a molded fiber packaging manufacturer, developed molded fiber trays for Consumer-Packaged Goods (CPG) packaging.

Government Initiatives Towards Sustainable Packaging

Cost-effective Production Process

Advancements in Technology

Technological advancements in pulp molding machines are driving the growth of the market by increasing their efficiency, productivity, and capacity. For instance, the development of high-speed machines that can produce large volumes of products in a short time has made pulp molding machines more attractive to businesses.

The latest technology, such as automated feeding systems, has enabled faster production processes requiring fewer workers and reduced energy consumption.

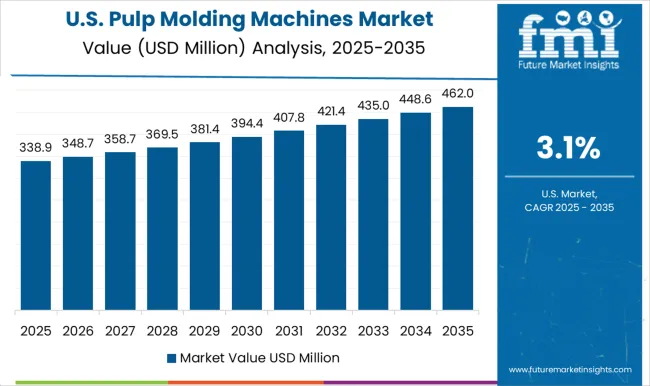

The market in the United States is estimated to reach USD 796.3 million in 2025 and is projected to capture a global market share of 19.2% from 2025 to 2035. The United States pulp molding machines market is estimated to create several market opportunities during the forecast period.

Due to the highly developed technology industry in the United States, its skilled workforce, expanding Research and Development initiatives, and advanced processing capabilities, the United States is among the most prominent markets for pulp molding machines. Over the forecast period, molded fiber packaging is expected to be in high demand in the food and beverage, electronics, and healthcare industries in the United States.

The regional economy is expected to increase due to a growing focus on reducing plastic usage, especially in the food and beverage industry. Pulp-molded trays are likely to be in high demand because of the increasing consumption of eggs, especially in the United States and Mexico.

| Regions | North America |

|---|---|

| Countries | United States |

| Market Share | 19.2% |

| Market Value (2025) | USD 796.3 million |

| Regions | Europe |

|---|---|

| Countries | Germany |

| Market Share | 6.1% |

| Market Value (2025) | USD 796.3 million |

| Regions | Asia Pacific |

|---|---|

| Countries | Japan |

| Market Share | 2.9% |

| Market Value (2025) | USD 20.7 million |

| Countries | Australia |

|---|---|

| Market Share | 10.7% |

| Market Value (2025) | USD 13.2 million |

Different companies from the market in China are offering pulp molding machines at competitive prices, which is beneficial for East & South Asian end users, particularly SMEs. Therefore, this is expected to affect the growth of the pulp molding machines market in Europe in the coming years.

Despite the promising prognosis, a decline in profitability margins is caused by increased competitors in pulp molding machines and the volatility of component pricing. The arrival of new competitors, particularly in Asia Pacific, the expansion of established players' production capabilities, and distributor demands for greater margins continue to impact the profitability margin. Thus, pulp molding machine manufacturers may need to establish strong relationships with customers & distributors to strategically position their products in terms of price to hold up in the competition.

| Countries | United Kingdom |

|---|---|

| CAGR | 2.3% |

| Market Value (2025) | USD 33.5 million |

| Market Value (F) | USD 41.0 million |

| Countries | China |

|---|---|

| CAGR | 4% |

| Market Value (2025) | USD 129.9 million |

| Market Value (F) | USD 184.6 million |

| Countries | India |

|---|---|

| CAGR | 4.2% |

| Market Value (2025) | USD 39.7 million |

| Market Value (F) | USD 57.3 million |

The pulp molding machine market is an emerging industry experiencing significant growth in recent years due to the increasing demand for eco-friendly packaging solutions. Several startups currently operating in this market, offering innovative and sustainable solutions to meet the growing demand for environmentally friendly packaging. Here are a few startups operating in the pulp molding machine market.

Eco-products - Eco-Products is a Colorado-based startup offering a wide range of sustainable food service packaging solutions, including plates, cups, and other renewable and compostable materials.

GreenPak - GreenPak is an Indian startup that offers a range of sustainable packaging solutions, including molded pulp trays and containers made from recycled paper and other sustainable materials.

PulpWorks - PulpWorks is a California-based startup that produces eco-friendly packaging using recycled paper and plant-based materials. The company's products include trays, bowls, and other containers made from sustainable materials.

SPM - SPM is a Swedish startup that produces high-quality pulp molding machines for the packaging industry. The company's machines are designed to produce high-quality, environmentally friendly packaging products.

PulPac - PulPac is a Swedish startup with a unique technology for producing high-quality molded pulp packaging products. The company's technology uses less water and energy than traditional methods and can produce products at a lower cost.

These startups are just a few examples of innovative and sustainable solutions developed in the pulp molding machine market. As demand for eco-friendly packaging continues to grow, we expect to see more startups emerging in this space in the coming years.

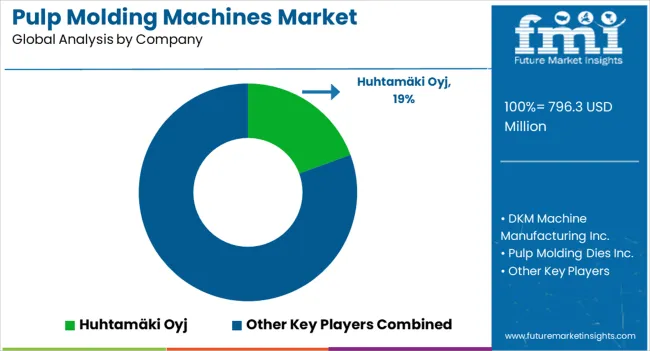

The pulp molding machines market is driven by sustainability trends and rising demand for eco-friendly packaging solutions across food service, consumer goods, and industrial sectors. Huhtamäki Oyj leads globally with advanced pulp molding systems integrated into its packaging operations, focusing on automation, high-speed production, and recyclable molded fiber products for food and beverage applications. Beston (Henan) Machinery Co., Ltd. and Guangzhou Nanya Pulp Molding Equipment Co., Ltd. dominate the Asian market with cost-effective and scalable pulp molding equipment designed for egg trays, fruit packaging, and biodegradable tableware.

HGHY Pulp Molding Pack Co., Ltd. and BeSure Technology Co., Ltd. emphasize smart manufacturing solutions with high-precision molds, energy-efficient drying systems, and automated process control, catering to global clients seeking sustainable alternatives to plastic packaging. Maspack Limited and Inmaco Solutions B.V. provide European-engineered pulp molding systems with strong R&D focus on reducing energy consumption, improving mold accuracy, and optimizing production cycles. Southern Pulp Machinery (Pty) Ltd. specializes in fully integrated pulp molding lines for egg packaging and industrial molded fiber products, particularly in African and Latin American markets. Longkou City Hongrun Packing Machinery Co., Ltd. and Taiwan Pulp Molding Co., Ltd. strengthen regional capacity by offering modular equipment and customization options suited to small and mid-scale manufacturers.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD billion for Value and MT for Volume |

| Key Regions Covered | North America; Latin America; Europe; The Middle East and Africa; East Asia |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Chile, Peru, Germany, United Kingdom, Spain, Italy, France, Russia, Poland, China, India, Japan, Australia, New Zealand, GCC Countries, North Africa, South Africa, and Türkiye |

| Key Segments Covered | Type, Distribution channel, Region |

| Key Companies Profiled | Huhtamäki Oyj, Beston (Henan) Machinery Co., Ltd., Guangzhou Nanya Pulp Molding Equipment Co., Ltd., HGHY Pulp Molding Pack Co., Ltd., Maspack Limited, Inmaco Solutions B.V., Southern Pulp Machinery (Pty) Ltd., BeSure Technology Co., Ltd., Longkou City Hongrun Packing Machinery Co., Ltd., and Taiwan Pulp Molding Co., Ltd. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global pulp molding machines market is estimated to be valued at USD 796.3 million in 2025.

The market size for the pulp molding machines market is projected to reach USD 1,145.2 million by 2035.

The pulp molding machines market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in pulp molding machines market are < 1,500 units/hr., 1,501-3,500 units/hr., 3,501-5,500 units/hr. and above 5,500 units/hr..

In terms of machine type, automatic segment to command 56.3% share in the pulp molding machines market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pulp Roll Cradle Market Forecast and Outlook 2025 to 2035

Pulp Liner Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Pulpwood Market Size and Share Forecast Outlook 2025 to 2035

Pulp Drying Equipment Market Trend Analysis Based on Type, End-Use, Region 2025 to 2035

Pulp Moulding Tooling Market

Pulp Washing Equipment Market

Pulp Cells Market

Pulp Molding Tooling Market Size and Share Forecast Outlook 2025 to 2035

Repulpable Tape Market Size and Share Forecast Outlook 2025 to 2035

Beet Pulp Market Size and Share Forecast Outlook 2025 to 2035

Hydrapulper Market Size and Share Forecast Outlook 2025 to 2035

Wood Pulp Market Analysis – Demand & Growth Forecast 2024-2034

Drum Pulper Market

Citrus Pulp Fiber Market Size and Share Forecast Outlook 2025 to 2035

Molded Pulp Packaging Market Size and Share Forecast Outlook 2025 to 2035

Molded Pulp Basket Market Size and Share Forecast Outlook 2025 to 2035

Citrus Pulp Market Analysis - Trends & Growth Forecast 2025 to 2035

Market Share Breakdown of the Molded Pulp Basket Industry

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Hardwood Pulp Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA