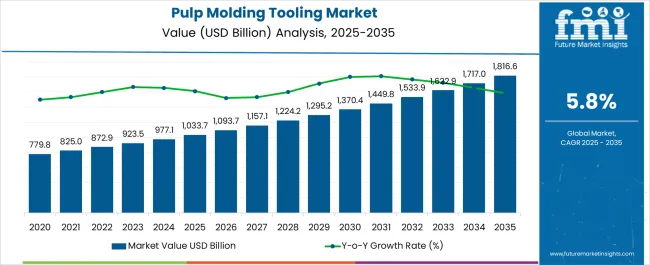

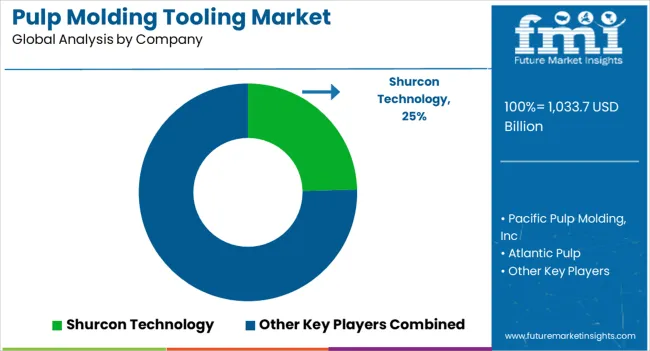

The Pulp Molding Tooling Market is estimated to be valued at USD 1033.7 billion in 2025 and is projected to reach USD 1816.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

| Metric | Value |

|---|---|

| Pulp Molding Tooling Market Estimated Value in (2025 E) | USD 1033.7 billion |

| Pulp Molding Tooling Market Forecast Value in (2035 F) | USD 1816.6 billion |

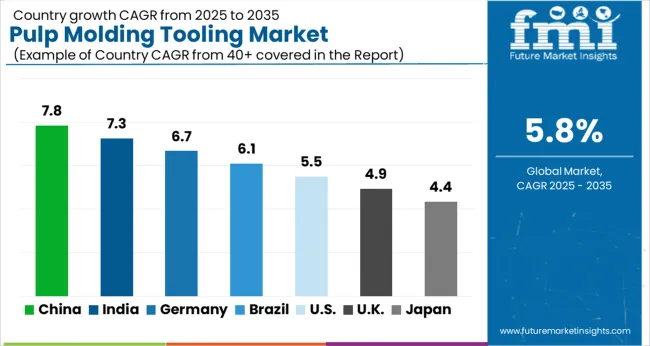

| Forecast CAGR (2025 to 2035) | 5.8% |

The pulp molding tooling market is gaining traction as industries increasingly adopt sustainable and biodegradable packaging alternatives in response to regulatory mandates and consumer demand for eco friendly solutions. Rising restrictions on single use plastics and a global shift toward circular economy practices are driving the need for advanced tooling technologies that support mass production of pulp based packaging.

Manufacturers are focusing on developing durable tooling systems capable of ensuring high precision, lower maintenance, and cost efficiency across diverse applications. Technological advancements such as automated molding machines and enhanced material formulations are further improving productivity and product consistency.

The market outlook remains strong as end use sectors including food and beverages, consumer goods, and electronics emphasize eco friendly packaging, thereby reinforcing the role of efficient pulp molding tooling in supporting large scale sustainable production.

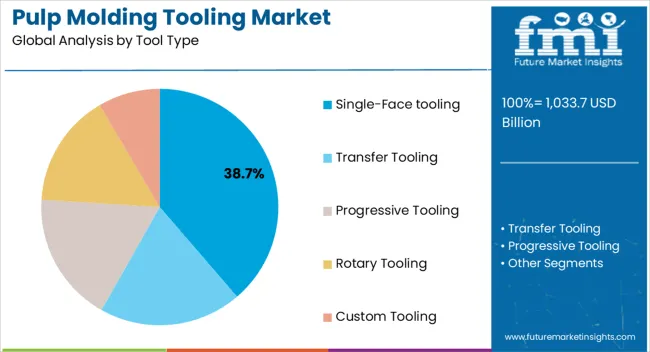

The single face tooling type segment is projected to account for 38.70% of total market revenue by 2025, positioning it as the leading segment. Its dominance can be attributed to its cost effectiveness, operational simplicity, and suitability for mass production of standardized molded fiber products.

The segment’s efficiency in producing lightweight and structurally stable packaging items has encouraged its adoption across diverse industries.

Additionally, reduced maintenance needs and adaptability for varied product designs have strengthened its position as the preferred tooling type in large scale pulp packaging production.

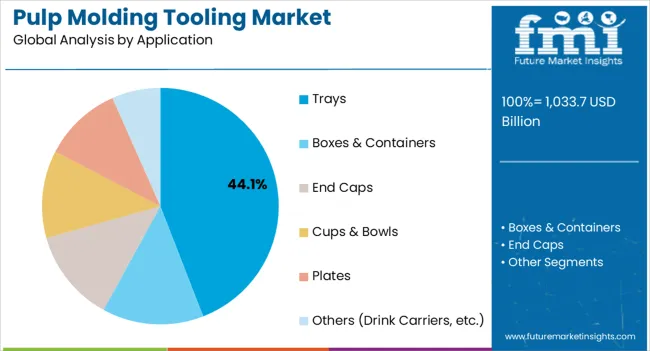

The trays application segment is expected to hold 44.10% of the total revenue share by 2025, making it the dominant application category. This growth is being driven by the rising use of molded fiber trays for food service, agricultural produce, and protective packaging.

Trays offer superior cushioning, biodegradability, and cost efficiency compared to conventional plastic alternatives. Their widespread use in retail and food distribution networks has further reinforced demand.

As sustainable packaging initiatives accelerate globally, trays remain the preferred application due to their versatility, functionality, and eco friendly profile.

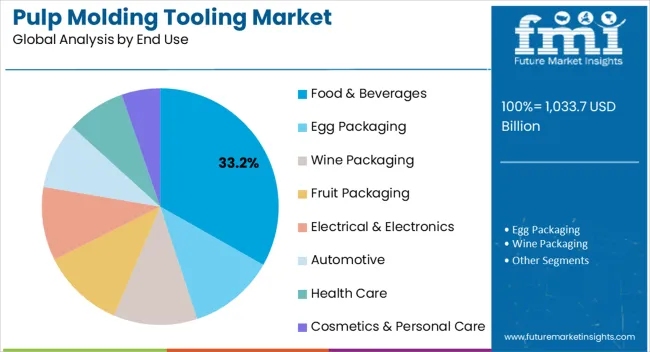

The food and beverages end use segment is projected to account for 33.20% of total market revenue by 2025, positioning it as the leading end use category. The segment’s leadership is supported by heightened demand for sustainable food packaging, regulatory restrictions on single use plastics, and growing consumer preference for eco friendly dining solutions.

Quick service restaurants, catering services, and packaged food producers are increasingly adopting molded pulp packaging for serving and transporting food products.

Its advantages such as compostability, strength, and food safety compliance have further driven adoption, solidifying the food and beverages sector as the largest end use segment in the pulp molding tooling market.

The historical demand for global pulp moulding tooling has shown significant increase, and the market prognosis shows a positive future outlook. The need for pulp moulding tooling has been pushed over the previous decade by a dramatic trend towards sustainable packaging solutions, increased environmental concerns, and stricter plastic consumption rules.

Looking ahead, the need for pulp moulding tools is expected to stay strong. The worldwide market is prepared to benefit from the increasing emphasis on sustainability and circular economy practises. With a growing preference for recyclable, biodegradable, and renewable packaging materials, pulp moulded packaging ideally matches with these environmentally aware goals, placing itself as a preferred solution.

The historical demand for global pulp moulding tooling has been robust, and the prediction predicts a healthy future trajectory. Sustainability initiatives, legislative support, market penetration in new industries, technology breakthroughs, and the expansion of emerging markets all contribute to the creation of one-of-a-kind growth prospects.

The global pulp molding tooling industry's future market growth is quite promising, with various unique aspects impacting its trajectory. Demand for pulp molded products is predicted to skyrocket as sustainability becomes a key aspect of packaging strategy around the world.

Pulp moulding tooling has various environmental benefits, including the fact that it is compostable, biodegradable, and created from recyclable components.

The integration of advanced technology is the market prognosis for the future. This integration improves production efficiency, product uniformity, and reduces labour expenses. Smart technologies also allow for real-time monitoring, predictive maintenance, and quality control, resulting in more efficient operations and increased output rates.

Factors such as the increasing emphasis on advanced technology integration, sustainability, collaborative activities, a focus on product development and adaptation, circular economy initiatives, and the expansion of emerging countries all contribute to the market's favourable trajectory.

| Country | India |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 118.5 million |

| CAGR % 2025 to End of Forecast (2035) | 5.8% |

India's vast population and increasing middle class are important market demand factors. Rising disposable incomes and shifting customer preferences have raised demand for packaged items in a variety of businesses.

Pulp molded packaging is well-liked by Indian consumers due to its versatility, protection, and aesthetic appeal, supporting the demand for pulp molding tooling. India's substantial agricultural presence contributes to the demand for pulp moulding tooling.

The agricultural business generates a significant amount of waste material, such as bagasse and straw, which can be used as raw materials in pulp molded goods. The availability of agricultural waste contributes to the long-term viability and cost-effectiveness of pulp molding in India.

However, India's noteworthy market share in the pulp molding tooling market can be attributed to the country's thriving manufacturing sector, increasing emphasis on sustainability, supportive government initiatives, rising consumer demand for recyclable packaging, and the availability of agricultural waste.

| Country | China |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 219.1 million |

| CAGR % 2025 to End of Forecast (2035) | 6.3% |

China is a market leader in the global pulp molding tooling market. China has a high demand for effective and environmentally friendly packaging solutions, owing to the country's domestic consumption as well as its prominence as a global industrial hub.

The dominance of China in the global paper and pulp industry provides a solid foundation for the growth of the pulp molding tooling market. The availability of sufficient raw materials, such as recycled paper, enables the creation of pulp moulded products to be cost-effective.

China has a competitive advantage in the worldwide pulp moulding tooling market due to its resource advantage and manufacturing competence. Despite the fact that the country is well positioned to meet the demand for sustainable packaging solutions, which strengthens its market position in the pulp moulding tooling business.

With a CAGR of 5.3% from 2025 to 2035, the egg packaging segment is expected to dominate the pulp molding tooling industry. Trays are essential in packaging and transportation in a variety of industries.

The pulp molding tooling market manufactures trays for a variety of applications, including food and beverage packaging, egg packaging, pharmaceutical packaging, cosmetics packaging, and more. Through providing the demand for sustainable and adaptable packaging solutions, the trays segment is driving the growth of the pulp molding tooling market.

Pulp molded trays boxes are popular in a variety of industries, including food and beverage, egg packaging, electronics, cosmetics, and pharmaceuticals, due to their eco-friendliness, protective characteristics, and aesthetic appeal. With a greater emphasis on sustainability, the trays category is projected to continue driving the growth of the pulp molding tooling market.

Eggs are sensitive and must be transported and stored in secure and protective packaging. Because of its superior cushioning, stress absorption, and insulation capabilities, pulp moulded egg packaging is a suitable choice. Individual eggs can be securely held and separated in the moulded trays or cartons, preventing breakage and preserving product integrity.

The egg-packaging category is a prominent driver of the pulp moulding tooling market, owing to rising egg demand and the need for sustainable packaging solutions. The pulp molding tooling market is dominated by wine packaging. The wine industry necessitates packaging solutions that not only protect the bottles but also improve their visual appeal and branding.

Pulp moulded wine packaging can be made with elaborate patterns and textures, resulting in an eye-catching presentation that is consistent with the premium image of wine.

The distinct requirements of egg packaging and wine packaging, together with the advantages of pulp moulding, have positioned these categories as industry leaders in the pulp molding tooling market.

Players in the global pulp molding tooling market use a variety of techniques to maintain their competitive advantage and fulfil changing client expectations.

Market participants in the global pulp molding tooling market distinguish and remain competitive by focusing on constant innovation in product design and technology, a commitment to sustainability and strong customer partnerships.

They position themselves as industry leaders and respond to the different needs of clients by offering creative and advanced solutions, customizing designs, and prioritizing environmental responsibility, eventually driving their success and growth.

Key strategies in pulp molding tooling market:

Product Innovation

Manufacturers are quickly respond to changing market demands and customise their goods with modular tooling systems, eliminating the need for expensive retooling. This innovative approach to product development enables manufacturers to optimise production processes, streamline operations, and efficiently serve to the different needs of clients in the pulp molding business.

Customization:

Customization is crucial in the worldwide pulp molding tooling market because it allows market participants to offer personalized solutions that fit the individual needs of consumers. Customization includes mold size, form, and configuration, allowing producers to make a wide range of pulp molded goods, including as containers, trays and packaging inserts that properly meet the intended uses.

Sustainability:

The pulp molding tooling market is deeply embedded in sustainability, with market participants embracing innovative efforts like as using recycled and renewable resources, establishing energy-efficient production processes, and fostering the circular economy.

They not only address the growing need for eco-friendly solutions by prioritising sustainability, but they also contribute to a greener and more resilient future for the packaging sector as a whole.

The global pulp molding tooling market is estimated to be valued at USD 1,033.7 billion in 2025.

The market size for the pulp molding tooling market is projected to reach USD 1,816.6 billion by 2035.

The pulp molding tooling market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in pulp molding tooling market are single-face tooling, transfer tooling, progressive tooling, rotary tooling and custom tooling.

In terms of application, trays segment to command 44.1% share in the pulp molding tooling market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pulp Roll Cradle Market Forecast and Outlook 2025 to 2035

Pulp Liner Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Pulpwood Market Size and Share Forecast Outlook 2025 to 2035

Pulp Drying Equipment Market Trend Analysis Based on Type, End-Use, Region 2025 to 2035

Pulp Washing Equipment Market

Pulp Cells Market

Pulp Moulding Tooling Market

Pulp Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Repulpable Tape Market Size and Share Forecast Outlook 2025 to 2035

Beet Pulp Market Size and Share Forecast Outlook 2025 to 2035

Hydrapulper Market Size and Share Forecast Outlook 2025 to 2035

Wood Pulp Market Analysis – Demand & Growth Forecast 2024-2034

Drum Pulper Market

Citrus Pulp Fiber Market Size and Share Forecast Outlook 2025 to 2035

Molded Pulp Packaging Market Size and Share Forecast Outlook 2025 to 2035

Molded Pulp Basket Market Size and Share Forecast Outlook 2025 to 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Citrus Pulp Market Analysis - Trends & Growth Forecast 2025 to 2035

Market Share Breakdown of the Molded Pulp Basket Industry

Hardwood Pulp Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA